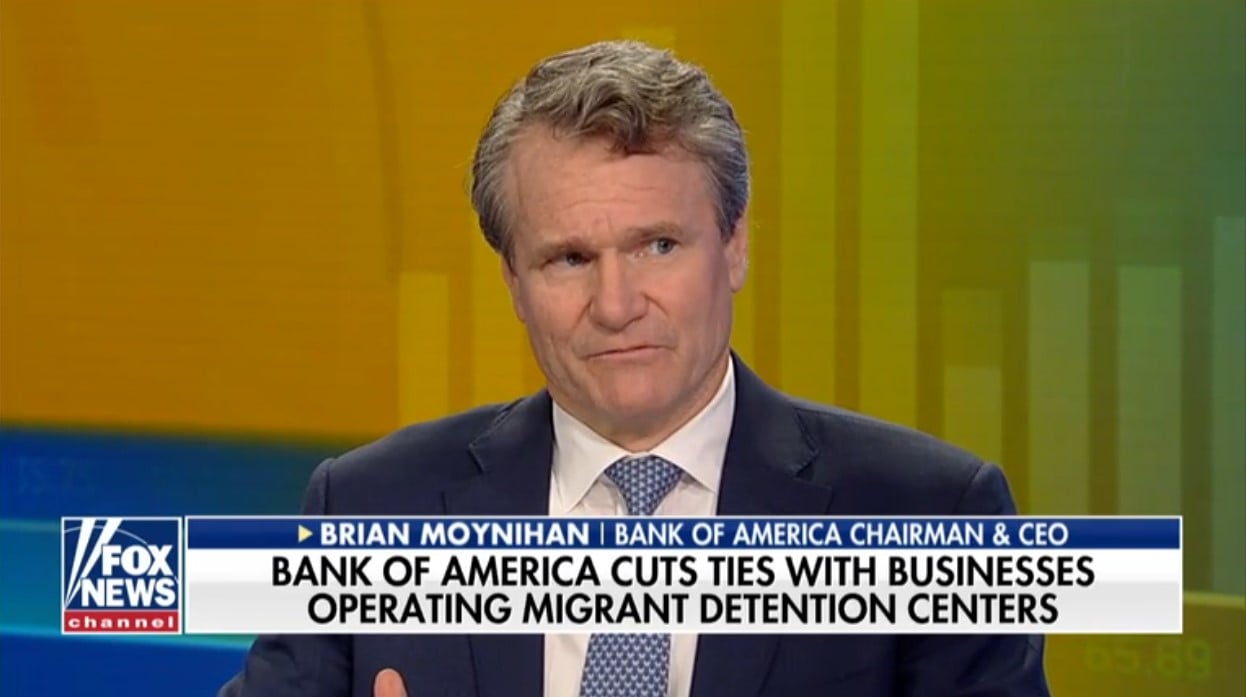

Bank of America CEO Brian Moynihan tells Fox Business Network’s Maria Bartiromo “the issue is if it blows up it could be a detriment” when discussing potential trade agreements

In an interview with FOX Business Network (FBN) anchor Maria Bartiromo, Bank of America CEO Brian Moynihan discussed the debt ceiling, the Federal Reserve, international trade negotiations, and his outlook on the U.S economy. When discussing USMCA and other potential trade agreements, Moynihan said, “the issue is if it blows up it could be a detriment” and “they need to keep it going along towards a positive result. I think both countries interests are there.”

Q2 hedge fund letters, conference, scoops etc

Bank of America CEO: Anonymous currencies are not good

Watch the latest video at foxnews.com

Bank of America CEO: American economy is driving our earnings

Watch the latest video at foxnews.com

On the debt ceiling and a possible government shutdown:

“Well, I think first, I think everybody agrees it shouldn't happen. The problem is 18 months ago everybody agreed it shouldn't happen in the fall of ‘17 and it happened. And so I think we have to be careful that the unintended consequence can happen, in the environment at which it might happen this time is not quite as strong as remember come in the early ‘18 we had tax reform get passed and nobody thought it would happen there was tremendous enthusiasm in the business community. It's a little different now. And so I think that's why you know Secretary Mnuchin and Speaker Pelosi are working hard on it. I think the best intentions are not to have an issue but it affected the economy in the first quarter of ‘18 and the debate is it could affect it again and I think that along with three or four things are needed to get resolved the correct way in order to keep this expansion going in the United States, and I think all of them are eminently solvable and they’ve just got to get done.”

On possibly passing USMCA and other trade deals:

“Well because that brings you, so you have that you have the debt ceiling that's kind of the fall issues to make sure get done. Because I think that will send a signal to the world that that the United States is pushing forward with agreements on trade. And I think then the next couple of issues are one we've got to get through the Brexit resolution in the general economy, ultimately make sure it doesn't disrupt too much. And then we've got China to keep it from blowing up. You know there's very difficult issues there. And the business community around the world knows that this has to be resolved and it is with the administration and others clearly saying you know these are difficult issues. But the issue is if it blows up it could be a detriment. And so they need to keep it going along towards a positive result. I think both countries interests are there. But if you take those three or four things basically USMCA, the debt ceiling, Brexit, China if we can keep those in the right place I think the economy in the US will continue to progress well.”

On his outlook of the United States’ economy:

“Well if you look at what drives our earnings it's all… it's American economy and our great teammates work in that so our consumer business made $3 billion. Our global banking business which is company, corporate banking made $2 billion and then we made a billion in wealth management, a billion in markets. So it's very spread around, all good performance. But the consumer business everybody is talking about because in that you're seeing a consumer who is very strong in United States spending money, borrowing responsibly. They're employed. Their wages are growing faster than people thought. You see 3 percent handles on that. Their expectations are high. Their confidence although not quite as high at the highest point is still very high. All that's very good because at the end of the day two thirds the U.S. economy is by people like yourself spending money. And if you spend money businesses will be successful small business will be successful. And then we'll go on. We look on the business side our small business loans outstanding are up from 35 to 37 billion year over year about 6 percent. The small business of borrowing again, their conference ticked down a little bit but that's because the world got more complex and if you look at mid-sized companies they're spending a little less on CapEx largely because the incentives are sort of through the system now. But they're very solid. Everybody's fine and sort of brace for please, please remove uncertainty and we can be more aggressive.”

On capital expenditures:

“It's slowed down about half the rate but it’s still there. But the real question, it could be faster with that certainty. But people of sort of adjusted to the issues of the moment. If you look at companies you talk to a company anybody in China has seen a slowdown effect. It's usually 20 percent of their business, 30 percent their business is slowed down at 20 percent. So it's not the impact across the whole platform but it's the reverberation of that impact they're worried about but generally businesses are very sanguine about what's going on, what's going to come. It's amazing to me how efficient businesses have become in terms of the ability to deploy a modest amount of expense and get a lot of pop out like we do. We put three billion dollars in technology. We basically have flat expenses in our company for four years in a row. And think about that with multiple transaction growth 6, 7, 8, 10 percent with sales force growth you know 3, 4, 5 percent a year in terms of new people, we’re able to pay for all that by investing in technology and both for the customer and for ourselves to keep improving the company and our efficiency ratio has gone down. That's what businesses are doing around the world. You know, they're just they're learning how to become incrementally more efficient through all this wonderful technology and capabilities that they have.”

On cryptocurrency:

“I think you have to separate cryptocurrency and the component parts and you hear a lot of people talk about this but there is there is anonymous currency and then there's block chain and enablement of transactions and messaging with verified records. We hold a 50 yard block chain patents today. We are trying to apply a lot of places towards having payments especially payments which have both information and money moving in across border. That's the real application we see when you go to when you go to digital money. As I said 53 percent is digital already. And that does include when you stick your plastic in an A.T.M. vendor it thinks have a point of sale credit card. If you added that the number would actually be like 60, 70 percent. 75 percent of our transactions a check deposit are A.T.M. or phones now. So you're seeing digital digitization activity anonymous currencies are not good because they don't allow the verification. So it's like it's equivalent to a ten dollar bill. You know if you drop it and somebody picks it up.”

On the Federal Reserve cutting rates:

“Well, we’ll see on that. But I think that you know they've got other tools and techniques and there's a lot to talk about but if you really think about it the current rate structure irrespective of Fed cuts coming or not coming is very accommodative to activity. And you've seen that, you've seen the you know the issuance of corporate debt have gone up largely because the carry cost is cheaper. And you know if the rate of they're paying is cheaper so they can incur more debt. You know things like that. So I think they have to worry about the excesses and stuff and they do and they you know share power and many others talk about it. But the reality is they’re really worried about the global economy which has flown from say 3.8 to predicted to be like 3-3.4 this year with more risk around all the issues we talk about say what's going on in the Middle East in terms of disruptive what's going on in China and trade and all these issues I think are on their mind and they're trying to say we're here to make sure this economy grows and you can't complain about the technical aspects the U.S. economy are fine.”