B2B sellers pivot with 61% shifting their focus to investing in ecommerce in 2021

Q4 2020 hedge fund letters, conferences and more

Digital Commerce 360 reveals the findings from its first-annual survey of 110 B2B sellers. This is the first in a series of research surveys that will be conducted over the course of 2021.

61% Of Sellers To Focus On Investing In Ecommerce

CHICAGO, February 8th, 2021—When asked about the one thing you learned that will most impact your 2021 ecommerce efforts, sellers focused on inventory and the supply chain along with agility and adaptability. A vigilant focus on customer behavior would allow them to pivot and best take advantage of opportunities as they arise while internal alignment would ensure best-in-class execution.

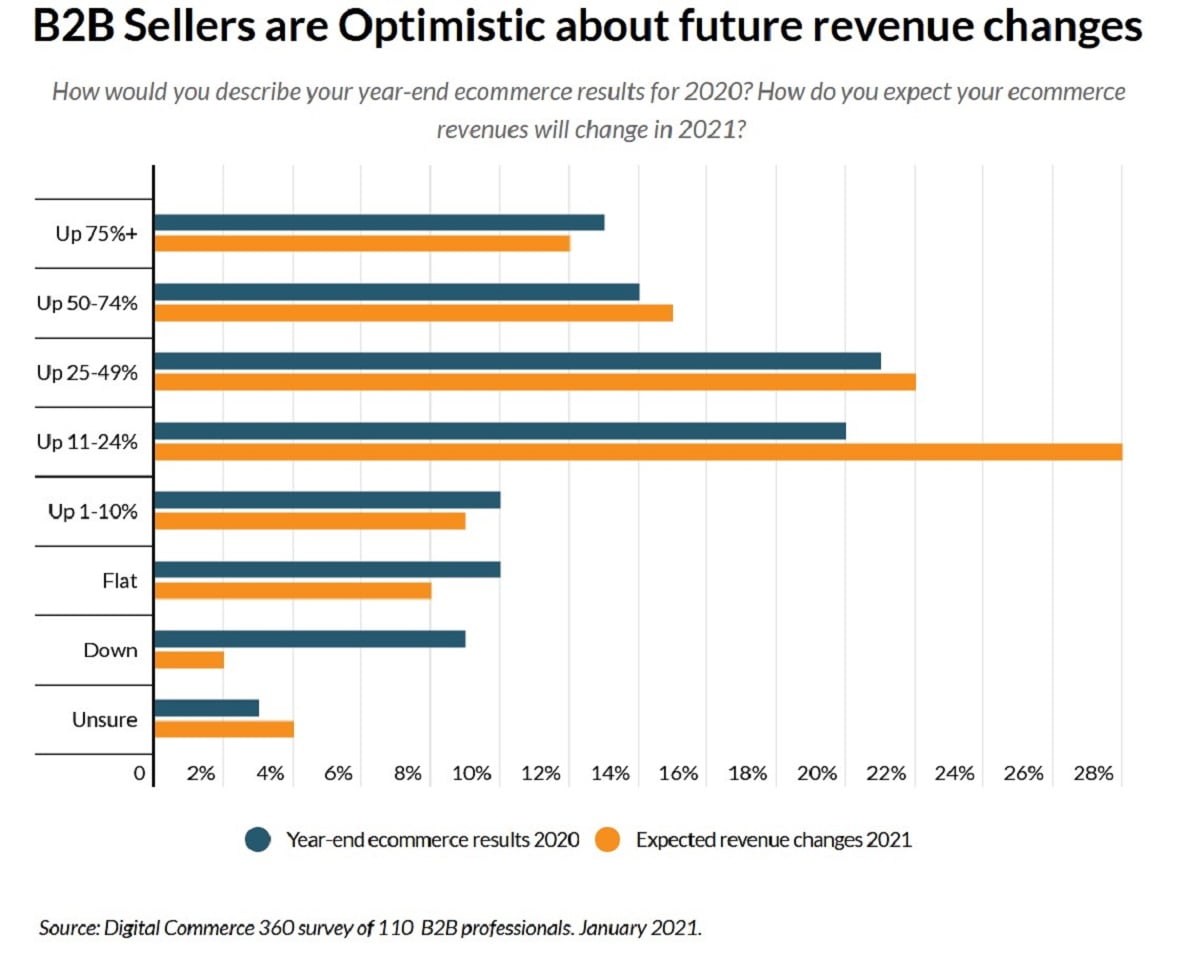

B2B sellers delivered strong results in 2020 with 78% showing increases in 2020 where 48% were up at least 25%. Post-COVID-19, B2B sellers are pivoting with 61% shifting their focus to investing in ecommerce. When looking ahead, B2B sellers project ecommerce revenues will accelerate in 2021 and once again 86% are forecasting an upward trend.

Challenges Faced By Sellers

Sellers face a myriad of challenges from budget to building more sophisticated sites with requisite systems and support. The top challenge is securing enough budget to make the necessary investments that are truly needed. Rounding out the top five are creating a more sophisticated website to better meet customer 2needs, integrating systems, finding staff with the right skill sets and convincing more B2B customers to buy online.

Sellers are planning significant investments across many aspects of their business to meet these challenges head on. Digital marketing leads the charge followed closely by technology infrastructure.

About Digital Commerce 360 Research

At Digital Commerce 360 Research our goal is to provide data and information about ecommerce that helps retail companies, investors and technology providers prosper. The team tracks hundreds of metrics on roughly 6,000 online retail companies around the world, including such sought-after data points as web sales and traffic, conversion rates, average order value and key technology partners used to power their ecommerce businesses. We sell this data in its raw format in our multiple online databases, and we dig deeply into these numbers in our custom research division, and to help inform our 30+ exclusive analysis reports we publish each year on key ecommerce topics, including online marketplaces, cross-border ecommerce and omnichannel retailing.