Argosy Investors commentary for the first quarter ended March 31, 2021, discussing their new position in Grocery Outlet Holding Corp (NASDAQ:GO).

Q1 2021 hedge fund letters, conferences and more

Dear Investors,

First quarter 2021 performance was 8.2% in select accounts. The S&P 500 by comparison returned 7.0%. Market returns continued to be strong during the first quarter, as the market’s rally back from the depths of the pandemic-induced recession continues, despite historically high valuations. There seems to be a shift, however temporary it may be, towards “value”, evidenced by the Nasdaq technology index only returning 3.6% during the quarter vs. 8.9% for the more mature, value-tilted Dow Jones Industrials. Companies and sectors most exposed to the worst effects of the pandemic (airlines, restaurants, theme parks, cruise lines, etc.) saw their stocks climb while companies and sectors that benefited most from people working from home (Peloton, Docusign, Zoom, etc.) have seen their shares decline as the country (and world) begins to re-open.

I believe the portfolio is reasonably balanced between growth and value, though tilted towards growth companies. If value stocks do in fact go on an extended run, the portfolio may experience underperformance because some of the companies I own have appreciated significantly but are leading companies which I intend to own long-term.

The most important message you should take away is that Argosy intends to purchase companies capable of generating double-digit returns over long time periods at a fair price. Sometimes these companies may go out of favor, but I intend to still hold them as long as their combined business results and valuation suggest good returns can be expected long-term.

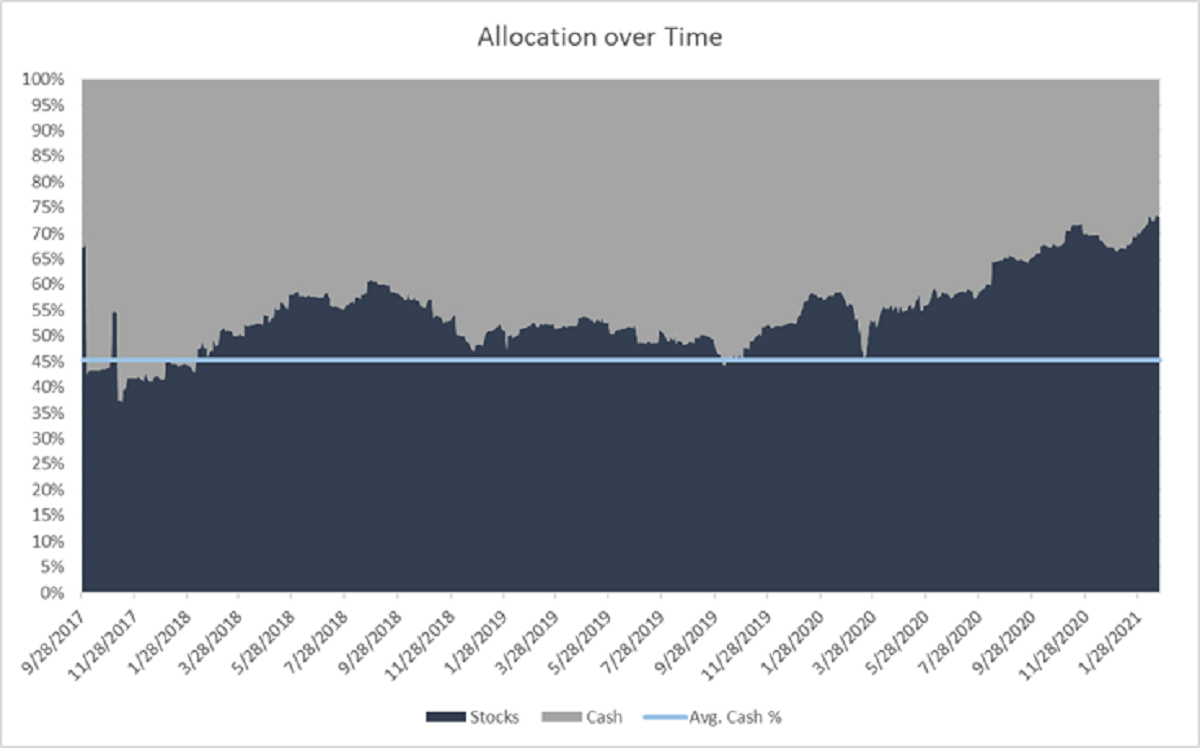

I have talked about the significant cash holding over time in the past, but I wanted to share some long-term history on how the allocation to cash has evolved over time.

As this chart shows, cash allocation (which includes short-term bond funds and cash) for mature accounts has been very conservative (~50%) over time. Over the course of 2020, the stock allocation increased as some holdings increased in value. When you view 2020's 29.8% performance (as an example) through the lens of the allocation to stocks to begin the year, the allocation to stocks was about 60%. The low allocation to risk assets makes clear that the underlying holdings performed particularly well last year. With that said, I still hold many of the same stocks I owned last year, so I would not be surprised if this year were a bit disappointing given the performance last year. I certainly am working to identify new ideas to power the portfolio in the future, and trimming existing positions where I believe upside is limited. I ask again that you orient yourself to the long term and that you allow the portfolio to perform well in some years and not as well in others, but hopefully satisfactorily overall.

Existing Portfolio Activity: Stoneco, Endava, And Pinterest

I trimmed stakes in STNE, DAVA, and PINS during the first quarter, and before the downdraft in markets that started in March. I won’t spend much time on these companies here because there have not been any changes to the long-term trajectories of these businesses, but I sold a portion of each of these primarily in recognition of their very high multiples which limit near-term upside in their shares (though I continue to like them long-term). Each of these stocks have provided the portfolio very good returns over a short period of time, so the positions are still significant, but I marginally reduced exposure to these companies.

Kar Auction Services

KAR’s primary business is engaged in the auction process between dealers and owners of used vehicles (corporate fleets, auto rental companies, dealers’ trade-in vehicles, etc.). Its other business acts as a floorplan lender (they finance the cars on dealer lots until they are sold) to independent dealers, many of whom are purchasing vehicles from KAR’s auction business. I have owned a small position at around $22 per share since January 2020, right before the pandemic started.

I purchased more after the stock price recently fell into the mid-$14 range. KAR reported disappointing earnings and guidance, but I ultimately believe the company’s strong cash flows make it very cheap. I expect this company to generate about $1.40 per share in free cash flow, and that represents a 10% yield on my recent purchase price for a company that earns returns on capital approaching 20%.

There are headwinds to both businesses, mainly due to exposure to the same phenomenon. People are increasingly purchasing cars online via companies like Carvana or through sophisticated dealers such as CarMax which have their own wholesale auction functions. These companies are increasingly placing pressure on mom-and-pop dealers who cannot keep up with the pace of technological innovation occurring in the industry. While I acknowledge this risk, I do not believe this dynamic will prevent KAR from generating lots of cash flow for investors. This is more squarely in the camp of a value investment, and the “hair” on an investment like this does not prevent it from being a successful investment, though I am less likely to hold onto an investment like this for a lengthy period of time.

New Portfolio Activity: Grocery Outlet

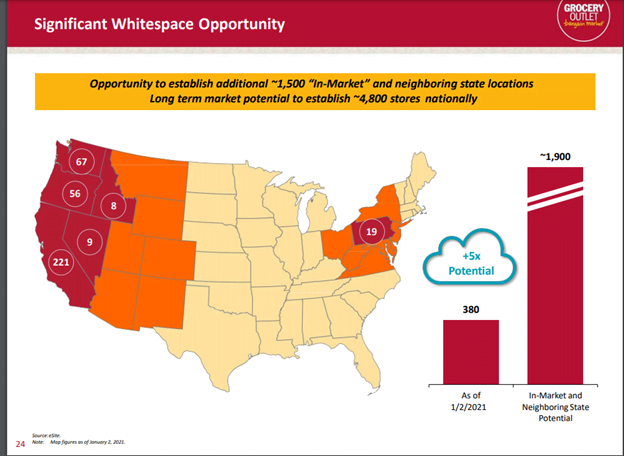

When you think of high-growth businesses, groceries is not the top of the list. With that said, I believe Grocery Outlet Holdings (GO) has a good business model and a significant opportunity for expansion. Grocery Outlet operates a deep-discount grocery model where about half of their selection is priced at 40-70% off traditional grocers. They offer other goods that don’t typically sell at discounts to provide a full selection. The other key to their model is that it is somewhat of a franchise model. Grocery Outlet selects individuals with grocery retail experience to run the stores like owners (operators), and they pay them a commission based on the store’s profitability. This offers a significantly higher earnings opportunity for the operator than as a store manager at another chain, and this arrangement significantly aligns the operators with Grocery Outlet, which I love. The last piece of the puzzle is that Grocery Outlet currently only has 380 stores on the West Coast and in parts of Pennsylvania. It might come as no surprise that customers love low prices, and with an average square footage of 14,000, I believe that continued growth is reasonable to expect.

Grocery Outlet’s goal has been to grow store count by 10% annually, and over the last 15 years they have growth same-store sales (SSS) by over 5% annually. SSS may slow over time as the store base matures, but GO could see sales growth in the 12-15% range for several years. Because of Grocery Outlet’s model, I think they will be able to effectively leverage their expenses, so there is a decent argument to be made that profits can grow in the 15-17% range for another 10 years or more.

Constellation Software / Topicus

I have observed Constellation Software from afar as it created an impressive track record of acquiring truly dizzying numbers of software businesses. Constellation’s Mark Leonard could very well be considered among the investment greats of this generation based on his track record and communication about his thought process. Along the way, Constellation generated very strong returns despite my skepticism that they could continue to scale their acquisition pace by purchasing dozens of small companies per year. They avoided the issue of how they could deploy their increasing amounts of capital by paying regular as well as occasional special dividends.

Not that I take much solace in being correct in this case, but Mark Leonard now agrees that they cannot continue to deploy capital in the same small acquisitions they have historically. Leonard recently announced that he would be willing to make larger acquisitions even if it caused Constellation to reduce their internal return targets. Given Leonard’s team’s historically strong price discipline, I feel comfortable that any large acquisitions they pursue will be consummated at decent prices. Further, Constellation also showed a willingness to deconsolidate. In other words, they agreed to become smaller by spinning off Topicus earlier this year. Topicus is the result of a merger between Constellation’s TSS division and Topicus, resulting in Topicus as a larger Europe-focused software conglomerate. Based on what I know about Topicus, they have historically achieved greater organic growth than Constellation historically has. The addition of Topicus into the Constellation orbit may generate positive benefits for Constellation as well by sharing best practices on how to accelerate growth.

I paid a high price for these assets, ~30x FCF, or a 3.3% initial yield on this investment. With that as a disclaimer, I believe the growth rates for Constellation and Topicus can continue at mid-teens rates or better over time. My optically high purchase price can become a bargain in just a few years time.

Roadrunner Transportation Systems

You may remember my introduction to XPO in prior letters, and my explanation for why the LTL shipping industry is attractive. Certainly scale matters in the business, which is why XPO and ODFL are in a good position to continue to grow. With that said, I believe the industry at large is attractive, and smaller players can make decent profits as well, although they will struggle to achieve the best in class performance of players like ODFL.

Roadrunner Transportation Systems (RRTS) is an interesting story because over the last couple of years they have systematically dismantled a hodge-podge of transportation assets purchased with lots of debt, and they now sit in a position of being focused on a top-20 LTL shipping business with net cash on their balance sheet.

They have focused on improving customer service in the short-term which will pressure profits in the short-term but will ultimately drive additional growth across their network of warehouses, and increase profits. With over $400 million in LTL revenue, if RRTS can generate a 95% operating ratio (equivalent to 5% operating margin), then they can generate $20 million of operating profit (which will likely not be taxable due to $236 million of accumulated operating losses). Keep in mind that best-in-class operating ratios are between 80-85% so 95% is ambitious but not unrealistic. Based on a current market capitalization of about $170 million, this business would be trading at approximately 8x earnings if my hopes for 95% operating ratio materialize.

The difficult part is two-fold: 1) the company is 90%-owned by a very successful but also very aggressive hedge fund which could conceivably push remaining public shareholders out of future gains by acquiring the 10% it does not own at a fire sale price; 2) the company has delisted and stopped reporting financial results publicly as of earlier this year to avoid the compliance costs of staying listed, which are typically $3-5 million annually.

This is probably the right decision for the business as it executes its turnaround, but I will be in the dark for a period of time. The best-case scenario involves the company fixing its LTL business, relisting on a stock exchange, and then the 90% owner selling down its stake at much higher prices, bringing even greater liquidity to the stock, which could attract additional owners.

I have not committed significant capital to this idea, but it is a set-up that I like and am willing to bet lightly on given the explosive returns possible if things go my way.

As a bit of premature post-script, since I began writing this letter, RRTS announced a private placement investment that will enable them to continue to invest in their strategy. At the same time, RRTS announced encouraging operational results that they claim will enable them to offer guaranteed shipping in some lanes very soon. Offering guaranteed times should increase demand for their offering as customers begin to gain confidence their goods will be shipped in a timely manner. Shares are up over 70% since my purchase because of the recent news but I think there is additional upside.

Dream Finders Homes

In the few years I have been writing about my investment decisions, and at one point I discussed NVR and why it represented a model for homebuilding that I would invest in. Little did I know that Dream Finders Homes (DFH) would come public just a few short years later. Dream Finders is a smaller, faster-growing version of NVR and they are exhibiting a similar trajectory in profitability and returns on capital that NVR did at this point in their journey. They have some opportunities to improve profitability as they scale, so I hope to hang on to this one for a while. DFH currently trades for about 14x 2021 earnings, which is a good valuation at which to own the shares.

If we’re lucky, DFH will grow revenues at 15% per year for at least the next 5 years and perhaps longer. Profits could grow at 19% annually if margins expand to levels consistent with NVR. On top of that, DFH can generate $1.25 billion in profits over the next 5 years, and if they use those profits to repurchase $1 billion in shares, they can repurchase 20 million shares, or ~20% of shares outstanding. If all of this came to pass, DFH earnings per share can grow by 25% annually. This is undoubtedly the glass-half-full view of DFH’s prospects, but my analysis of less sanguine results leaves me feeling that DFH can create wealth on our behalf under a wide variety of scenarios.

Royal Gold

Gold royalties business achieve 2 objectives for us: 1) It’s a good business model with strong returns through the gold price cycle; and 2) it provides some protection from inflation, should it materialize due to the increasingly loose fiscal and monetary policy decisions the United States (and other developed market economies) is making.

I don’t want to stay on my soapbox for too long, but this is the first time in history that I’m aware of politicians openly stating that debt levels don’t matter, even in the long term. In 2019, the government spent $4.4 trillion. Of those expenditures, $0.4 trillion was spent making interest payments on existing debt at the time of $16.9 trillion. The interest rate on that debt was 2.4%. Debt for 2021 is projected to increase to $22.5 trillion, and then to $33 trillion by the end of the decade.

I don’t have a crystal ball, but if interest rates increased to previously “normal” levels of only 5%, U.S. interest payments would be over $1.1 billion in 2021, 25% of U.S. total expenditures in 2019. In the event that happens, there are a few choices: 1) run a larger deficit which could lead to accelerating debt levels; 2) reduce government spending on things like the military, Medicare, Social Security, pensions, and other programs; or 3) the government allows or encourages inflation to reduce the value of its debt obligations.

To be clear, this spiraling debt outcome currently seems and likely is not happening within the next several years, but the probability of it occurring is not zero and things have changed rapidly before. For that reason, I think an investment in Royal Gold provides some minor insulation against inflation.

Conclusion

The environment I am investing in continues to throw curveballs and head-scratching questions to ponder. Will inflation catch up and impact stock valuations? How will the post-pandemic world materialize? What happens if we go to war? I attempt to sidestep many of these questions by focusing on owning good businesses, at decent prices, and maintain some flexibility to take advantage of the inevitable disruptions that happen in any market environment.

The performance the market achieved in the first quarter is an average result for an entire year. Let’s not get accustomed to quarters like this, especially on the backs of a year in which the market was up close to 20%. Remain ever vigilant that these are unusual times in the market, and prepare yourself now for how you’re going to react when the market doesn’t provide such swift recoveries in the face of crisis. Those times will come and you will help yourself tremendously in the financial realm if you respond with equanimity to the good and the bad periods in the market, inevitable during the course of any investing lifetime.

If what you read seems sensible and you think that Argosy Investors might be a good steward of your hard-earned capital, please contact me at (828) 999-2033. I would love to hear about your financial goals and understand if I can be partners toward your goals.

Until July,

Argosy Investors

Appendix

Note that the above chart shows the concentration of all assets managed in all accounts. The performance reflected within the body of the letter only includes a subset of all accounts, but should be representative of investor experience over time. Many investors still hold high levels of cash because they are relatively new clients to Argosy.