A new study from savings platform Raisin UK reveals that almost half of Brits don’t have a savings account, which means that they’re not investing in their future.

We’re Not Interested In Interest

For those that DO have a savings account, over a third of people say that they NEVER check interest rates to compare against other savings accounts. This means they might not be getting the best bang for their buck by neglecting to shop around for a better deal.

Q1 2022 hedge fund letters, conferences and more

While interest rates have been less-than-impressive for some time, there are still some savings accounts with better interest than others. Raisin UK reports that over half of Brits don’t check interest rates before opening a bank account.

We Stick With What We Know

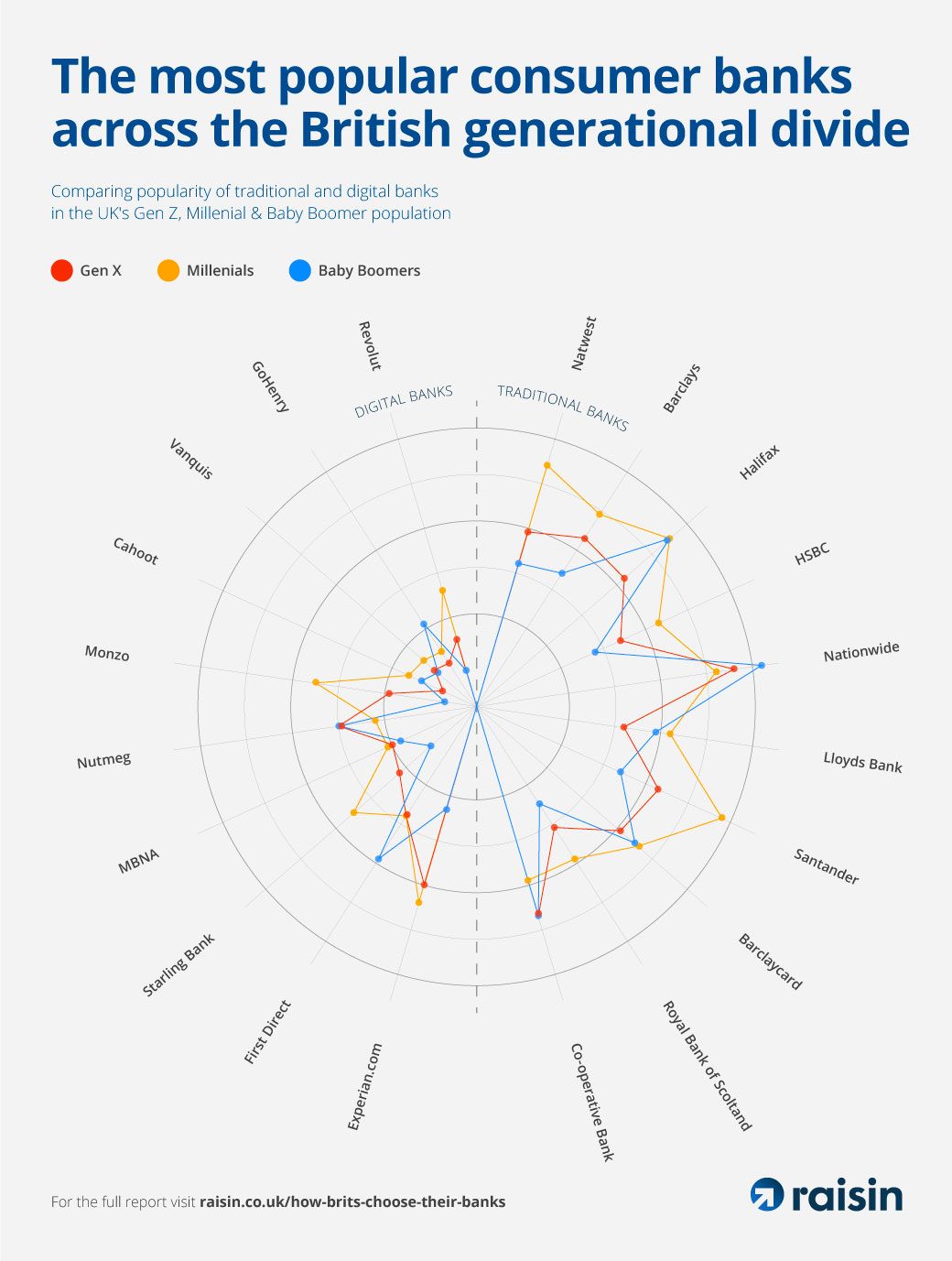

The study also shows that 35% of people have stayed with the same bank account they opened with their parents when they were still a child - that’s a third of all people in the UK.

What’s even more shocking, is that for those under the age of 35, that figure becomes more than half!

Kevin Mountford, Co-founder of Raisin UK discusses the shocking statistics revealed by the study:

“It's amazing to see how little emphasis people put on such important factors, like interest rates. Shopping around and putting the effort into finding the best deals for your prospective bank accounts really makes your money go further.

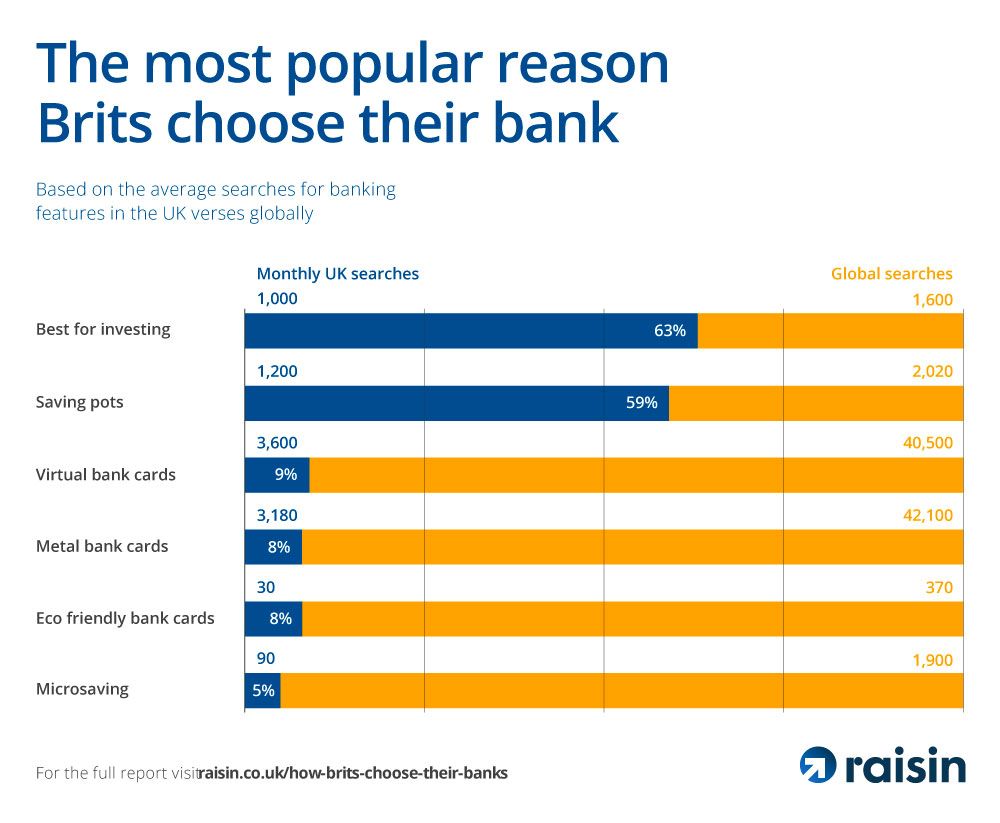

At times like this, it is really helpful for people to passively increase what they have sitting in bank accounts. Data leads us to believe that people are being influenced by certain aesthetic attractions like metal cards, but it is important to make sure you are looking at the important features that will really make a difference.

Saving accounts as a whole are a really good asset to have in your financial arsenal. One of their biggest benefits is how they help you prepare for emergencies. No matter how much you earn a ‘rainy day fund’ is crucial because as we know we can never predict what will happen next, and a savings account is the perfect place to keep it, as it is protected. Savings accounts also help you spend less money, by reducing temptation and removing the ease of just tapping a card. ”

About Raisin UK

We are the UK savings marketplace for Raisin, one of Europe’s most successful technology-led financial services companies.

We connect you with a range of banks offering deposit-protected savings accounts with competitive interest rates, making it easier for you to grow your money.

About Kevin

An experienced FS professional with GM, Sales & Marketing expertise, Kevin has operated in a range of Senior Management & Executive roles over the past 20 years.

Kevin has been employed by a number of large UK brands including Bank of Scotland, Halifax and Birmingham Midshires, where he was Head of Sales and Marketing for their Savings business. Kevin’s early days were focused on Business Banking and in 2001 he was appointed as ‘Head of Affinities’ for HBOS, where he was responsible for a broad range of 3rd party relationships providing credit cards, loans and savings products to the likes of AA, Aviva, Sony and British Gas. In total, he managed a portfolio of 70 brands with a team of 50 and held directorships in a couple of JV’s and was responsible for a multi-million pound P&L.

Since then Kevin led negotiations with Raisin GmbH and a deal was announced Sept 2017 where he co-founded the Raisin UK business which is now part of one of Europe's leading Fintech businesses.