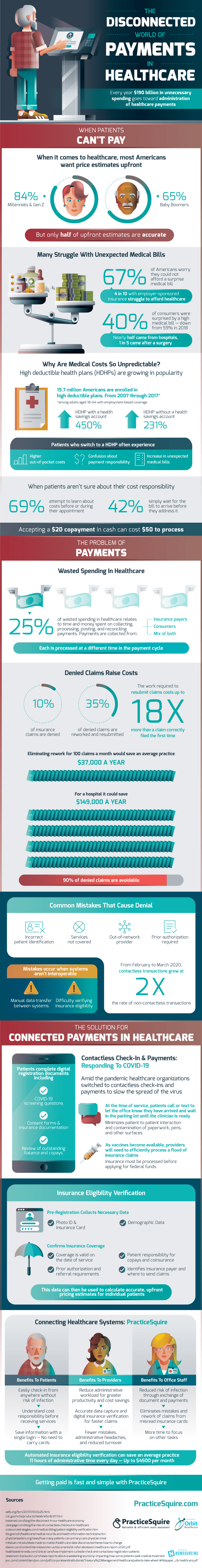

The disconnected world of payments in healthcare has become increasingly complex during COVID-19. The majority of Americans want price estimates upfront when it comes to healthcare, but even with high demand, these estimates fall short, and only half of them are accurate. On top of payment confusion, many Americans struggle with unexpected medical bills. 67% of Americans worry they could not afford a surprise medical bill, and even with employer-sponsored insurance, 4 in 10 struggle to afford healthcare.

Q4 2020 hedge fund letters, conferences and more

The Unpredictability Of Medical Costs

The rise in high deductible health plans is contributing to the growing unpredictability of medical costs. From 2007-2017, 19.7 million Americans were enrolled in high deductible health plans among adults with employment-based coverage. Patients who switch to these plans often experience higher out-of-pocket costs, confusion about payment responsibility, and an increase in unexpected medical bills. When patients aren’t sure about their cost responsibility, 69% attempt to learn before or during their appointment, and 42% simply wait for the bill to arrive before they address it.

The problem of payments in healthcare is processing. 25% of wasted spending relates to the time and money spent on collecting, processing, posting, and reconciling payments. Payments are collected from insurance payers, consumers, and a mix of both, which are all processed at a different time in the payment cycle, contributing to payment disconnection. For example, accepting a $20 cash payment as a healthcare company can cost up to $50 to process.

Denied claims raise costs for healthcare providers. 10% of insurance claims are denied, and the work required to resubmit claims costs up to 18 times more than a claim correctly filed the first time. Common mistakes that cause denial are incorrect patient identification, services not covered, prior authorization required, or out-of-network provider. That being said, 90% of denied claims are avoidable, and eliminating rework for 100 claims a month could save a hospital $149,000 a year and would save an average practice $37,000 annually.

Contactless Check-In: The Solution For Connected Payments In Healthcare

The solution for connected payments in healthcare is contactless check-in and payments. Amid the pandemic, most healthcare organizations have switched to contactless check-ins and payments to slow the spread of the virus. In this process, patients complete digital registration documents including COVID-19 screening questions, consent forms, and insurance documentation, and review of outstanding balance and copays. Additionally, they go through insurance eligibility verification, which colleges necessary data and confirms insurance coverage.

PracticeSquire connects healthcare systems, benefiting patients, providers, and office staff. Office staff get reduced risk of infection, eliminate mistakes and rework claims from misread insurance cards, and are given more time to focus on other tasks. Providers encounter fewer mistakes, administrative headaches, and experience greater productivity and cost savings. Customers can easily check-in from anywhere without the risk of infection, understand cost responsibility before receiving services, and save their information with a single login. Getting paid is fast and simple with PracticeSquire.

Source: PracticeSquire