The Broad Market Index was down 0.96% last week and 54% of stocks out-performed the index.

Q3 2020 hedge fund letters, conferences and more

The Real Recession Is Just Beginning

For now, investors stand on the edge of an amazing precipice with many companies recording dramatic drops in revenue thereby executing crisis decisions. Many insolvent companies (negative operating cash flow) and those with steeply negative sales growth are laying off production labor (producing a higher gross profit margin) and white-collar labor (lower SG&A expenses).

These and other measures taken since the appearance of the virus such as the $trillions in stimulus spending and the $trillions in pre-emptive financing by companies have severe time limits which have now been reached. The real recession is just beginning at a time when traditional policy tools such as lower interest rates and higher deficit spending are extended.

Fiscal & Monetary Policy Limitations

Monetary policy is exhausted with interest rates at historical lows. Direct market purchases of securities by the federal reserve has flushed up the financial system and expanded the asset price bubble. That is the easy part since capital markets a very receptive to vast infusions of new money.

The difficult first part is execution of expanded fiscal policy (the Green New Deal, Build Back Better First) is the timing. The likelihood that any real capital-investment-style infrastructure-focused expenditure will be made in the next year is very low. The transition of the administration being delayed questions any consensus on how to proceed among politicians or policy makers. Second part is the sheer magnitude; it will be a challenge for already impaired federal agencies to expand at a fast enough rate to have big enough impact.

More stimulus and the Asset Bubble

More likely, we will see another round of direct stimulus payments that will further expand the asset price bubble, further diminish the efficacy of monetary policy and further expand the revenue of the companies benefiting from the changes associated with the virus.

That is why it is important to maintain stock portfolios in exceptional attributes companies. Look for high sales growth with rising or steady and sustainable gross profit margins. Expense management while lower costs and a good financial condition will be important attributes over the next two years as we navigate the highly uncertain post-virus world.

And now, many of the superior attribute companies are trading at depressed shares prices.

Retailors Growth Gap

Since the election and the good news on the vaccine, share prices of the more destressed companies where the virus has had a negative impact have staged strong advances and are more commonly extended. This provides a good opportunity to improve the attributes of your portfolio by selling poor attributes companies at premium share prices.

This is particularly evident in the retailers where the growth gap between virus beneficiaries and virus victims is stark.

We have collected recent quarter sales data for the Retailers Industry representing 99% of the capital value. The industry capital weighted average sales growth rate is 4.5% and slightly up. A broad improvement since the proportion of industry market-capital accounted for by rising sales growth companies is up to 76.6%, compared to 66.3% last quarter.

Retailing industry is recording a falling gross margin but inventories are down thereby improving the chance of a future increase in the gross margin. SG&A expenses are high in the record of the industry and falling. That implies that the industry has further capability to accelerate EBITDA relative to sales with lower costs. The gross margin is falling at a more rapid rate than SG&A expenses, producing a deceleration in EBITDA relative to sales.

Share prices are depressed with better attribute companies and mostly extended for the poor attribute companies. The strong rally since the vaccine news provides a great opportunity to improve portfolio attributes in the retailers group and in the broader portfolio.

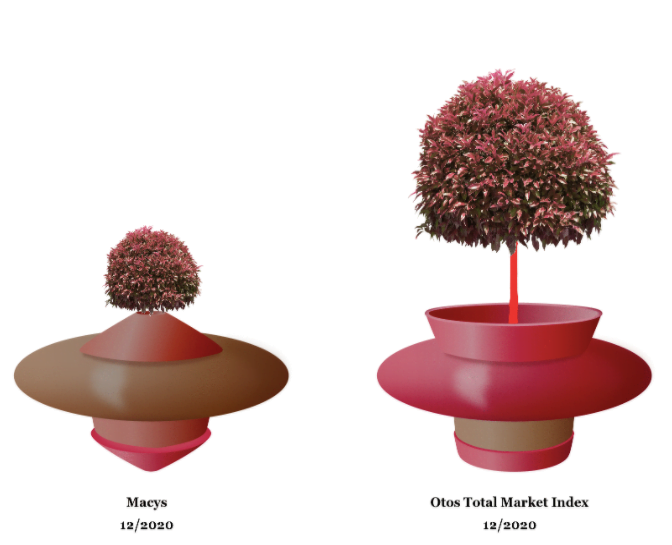

Look at Overstock (NASDAQ:OSTK) vs Macys (NYSE:M) or Big Lots (NYSE:BIG) vs Kohls (NYSE:KSS):

- Overstock.com $55.480 BUY this poor company getting better

- Macys $11.080 SELL this poor company getting worse

- Big Lots Inc. (BIG) $45.060 BUY this rich company getting better

- Kohls Corporation (KSS) $38.240 SELL this rich company getting worse

The more stable the pot appears, the better the attributes.

Green and gold are good. Red is bad! and the more intense the red the more urgent the call to action.

Join our Free December 16th Online Seminar

A special invitation to experience your financial reality as FREEDOM AND EMPOWERMENT.

OTOS will host a free year-end recap this Wednesday, December 16, 2020 at 6:00pm CDT.

These quarterly reviews focus on the ‘Big Picture’, trends and projections as provided by the most recent financial statement update and its influence on portfolio strategy.

Register here: https://www.thefeng.org/chapters/rsvp.php?tid=13440

Hope to see you there!