61% Of Restaurants Can’t Pay December Rent, Up 19% From November, Many Other Industries Are Hurting, Too

Q3 2020 hedge fund letters, conferences and more

The Alignable Rent Poll has just been released for December, showing that it’s becoming increasingly difficult for small businesses everywhere to pay their rent in full and on time, given the latest COVID resurgences. The need for more federal funding is also becoming more pronounced for many of these businesses.

Here are some highlights:

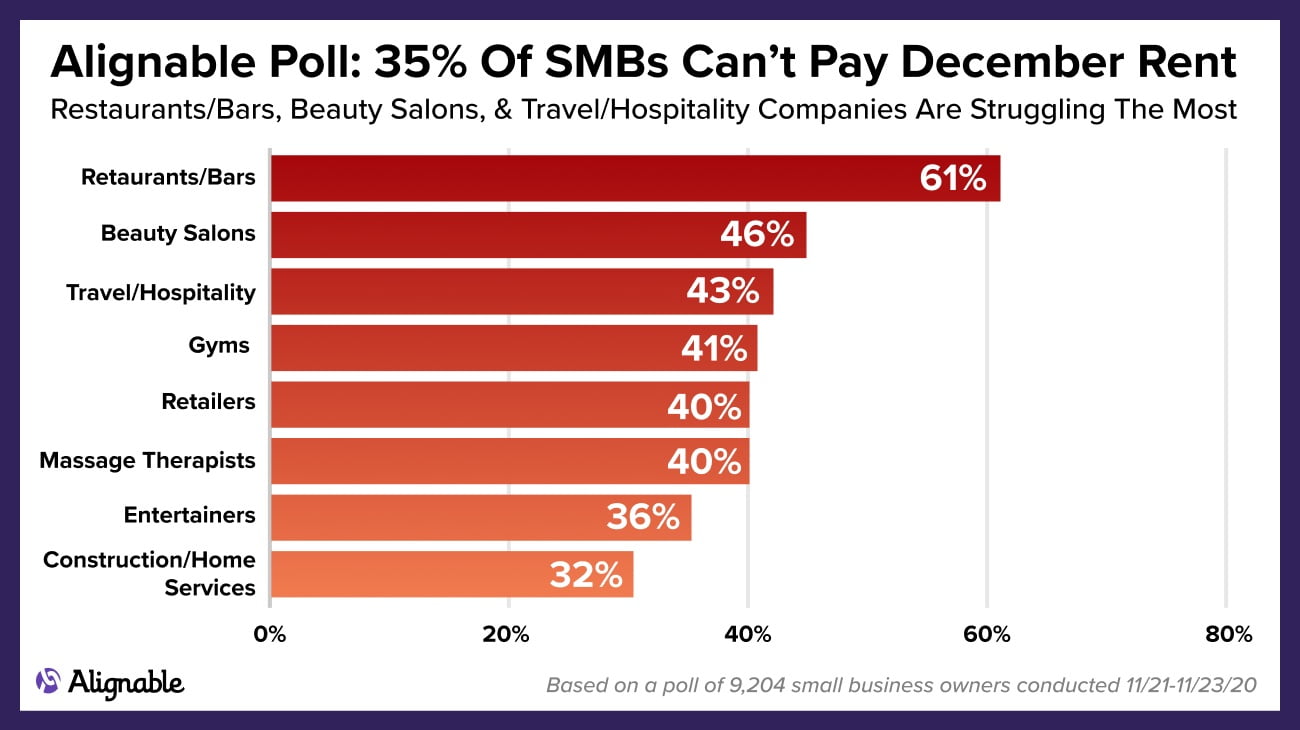

- 35% of U.S. small businesses couldn’t pay their rent this month, up 3% from 32% in November.

- Several B2C industries are devastated – 61% of restaurants can’t pay their rent this month. That’s up 19% from 42% in November.

- Beauty salons (46%) and travel/hospitality businesses (43%) round out the Top 3 most-affected businesses, but many others are in trouble.

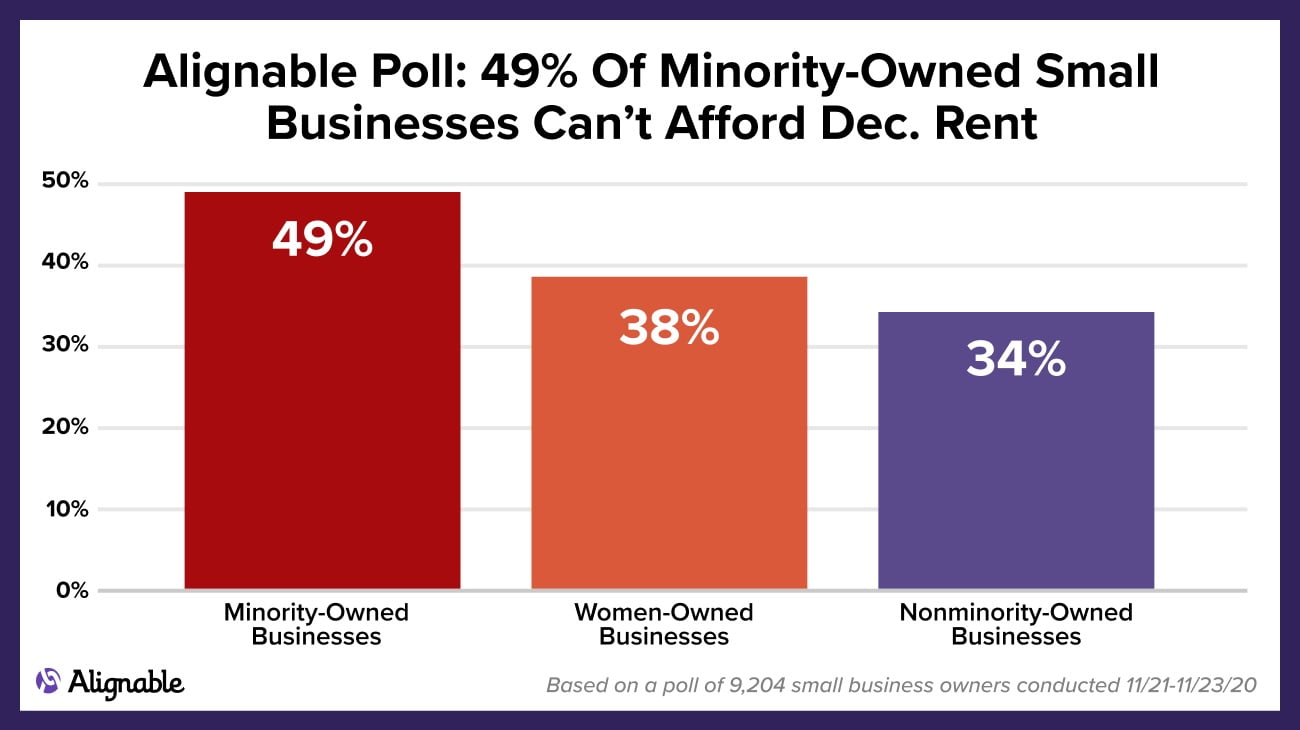

- Looking at demographics, minority-owned businesses are suffering the most, as 49% of them reported that they could not afford their rent in December. That figure is 5% higher than it was in November.

- Women-owned businesses are also struggling (38% of those have not paid their rent, up 3% from 35% last month).

In terms of funding needs, rent topped the list, as evidenced in Alignable’s SMB Funding Needs Report, released last week.

Alignable: 49% Of Minority SMBs Can't Pay December Rent

BOSTON, MA, December 14, 2020: Based on the latest Alignable Rent Poll, the ability of small businesses to pay their full rent in December continues to decline, as more COVID-related shutdowns occur.

Overall, 35% of small business owners reported that they couldn't make rent this month (up 3% from 32% in November). And for minority-owned businesses, the struggle is even more pronounced: nearly half (49%) report being unable to cover their rent in December. That figure jumped 5% from 44% in November.

And for women-owned businesses, 35% couldn't make rent in November and now that percentage is up to 38% in December. These findings are based on the most recent Alignable Rent Poll conducted among 9,204 small business owners from 11/21-11/23/2020.

SMBs Want Federal Rent Help

Covering rent has been a struggle for about one-third of all small businesses since April, given the ongoing COVID issues they face.

Not surprisingly, in another survey, the Alignable SMB Funding Needs Poll, paying rent was the second-most popular answer to a question asking how they would spend more federal funding if they receive it. That poll was conducted among 7,151 small business owners from 12/5-12/7/20.

While 19% of the polltakers answered "paying rent," the top answer by just one percentage point was "paying my employees," chosen by 20% of small business owners.

But when asked what additional help they'd like to receive beyond a potential new round of PPP funding, the No. 1 answer was "rent assistance" -- chosen by 28% of those surveyed.

Major Issue For Many Industries In December

Looking at different sectors, it's clear that money is growing even tighter in many B2C industries, and paying rent is becoming increasingly more challenging.

Restaurants/bars top the list in December with 61% unable to cover their rent. (And that's up 19% since November).

Nearly half of beauty salons (46%) had trouble paying the rent, as did 43% of travel/hospitality businesses.

High percentages of small business owners in other industries also couldn't pay their rent in full, on time:

- 41% of gyms

- 40% of retailers

- 40% of massage therapists

- 36% of entertainers

- 32% of construction/home services firms.

Most noted that increasing restrictions based on COVID resurgences are causing more problems for them -- and limiting the kind of revenue they can make for the rest of the year, and perhaps, beyond.

Rent Woes Across The U.S. & Canada

While 35% of U.S.-based small businesses are unable to pay December rent, small businesses in a variety of states are even more cash-strapped.

In Canada, the rate is even higher -- 37% of Canadian small business owners said they couldn't make December rent, 1% higher than in November.

Here's the breakdown by state for those matching or exceeding the overall, national U.S. average:

- NY -- 43%

- AZ -- 43%

- IL -- 42%

- OR -- 42%

- WA -- 40%

- MD -- 40%

- NJ -- 39%

- PA -- 39%

- CA -- 37%

- VA -- 36%

- GA -- 36%

- MN -- 36%

- FL -- 35%

- SC -- 35%

The following states are still struggling, but not as much as those listed above:

- TX -- 34%

- MI -- 34%

- OH -- 32%

- MA -- 31%

- CO -- 29%

- NC -- 27%

- MO -- 20%

Shifting from the U.S. to Canada, we also witnessed quite a range of rent payment rates across the provinces.

On one extreme, small businesses in British Columbia appear to be weathering the COVID storm a bit better, with only 30% of them reporting that they couldn't afford to pay rent in full and on time.

However, the situation is more severe in other parts of Canada: 43% of small businesses in Alberta, and 42% in Ontario reported not making December rent.

For more details on this most recent Alignable Rent Poll and others, including the methodology behind them, please contact Chuck Casto at [email protected].

To see all Alignable polls since March, go to the Alignable Research Center.

About The Alignable Research Center

Alignable is the largest online referral network for small businesses with over 6 million members across North America.

We established our research center in early March 2020, to track and report the impact of the Coronavirus on small businesses, and to monitor recovery efforts, informing the media, policymakers, and our members.