Qualivian Investment Partners letter for the third quarter ended September 30, 2020, discussinf their investment thesis on Watsco Inc (NYSE:WSO).

Q3 2020 hedge fund letters, conferences and more

“If you want above average returns, then stop thinking like everyone else. Turn off the news, the financial pundits, and think for yourself” -- Ian Cassell

Executive Summary

Readers of investment letters fall into several categories:

- Those who read the entire letter in detail,

- Those who skim, and

- Those who are only interested in the twitter version. For this category here is the tweet:

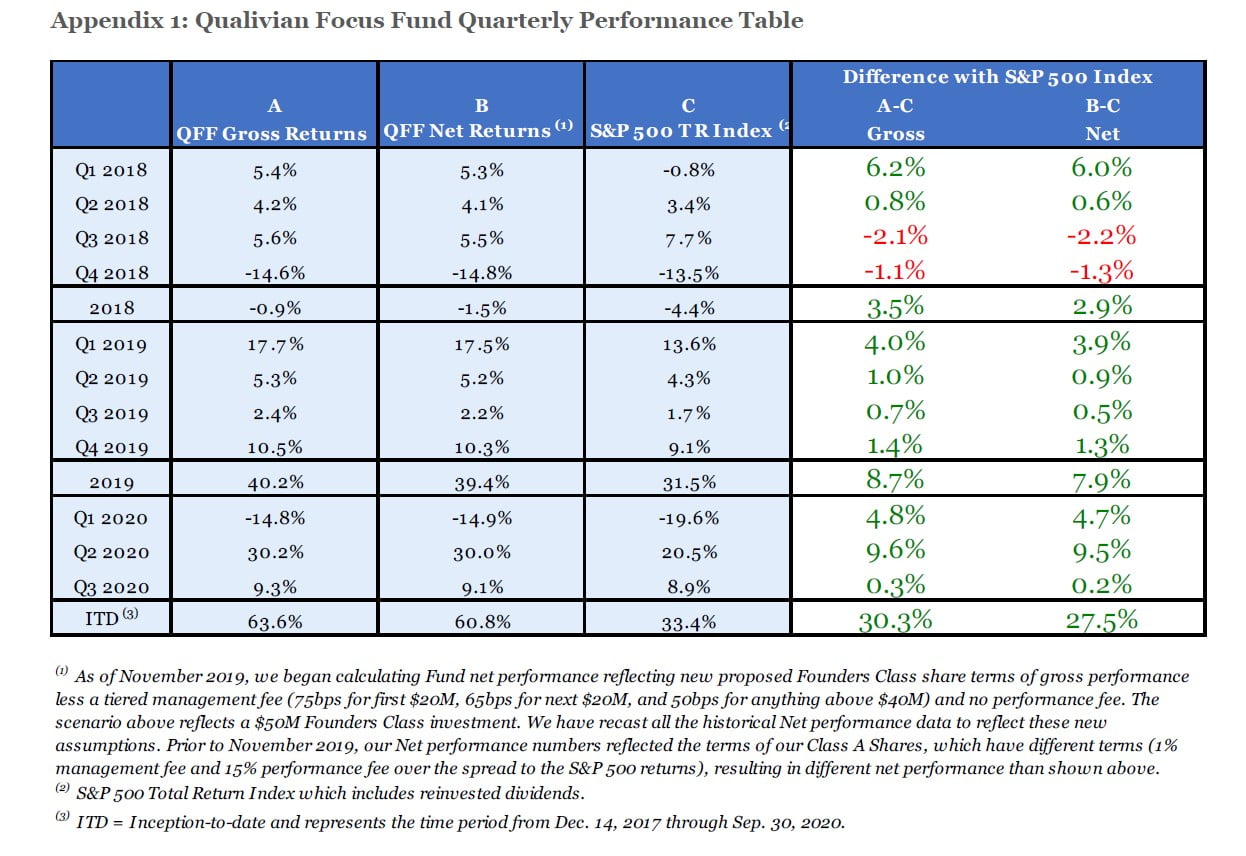

“Our performance in Q3 was ahead of the S&P 500 by 0.3% and 0.2% on a gross and net basis. Since inception through Q3 2020, we have outperformed by 30.2% and 27.5% on a gross and net basis. For the year-to-date period through September 30, 2020, we outperformed the S&P500 by 15.6% and 15.1% on a gross and net basis. We made one trade in Q3.”

Section 1 shares some reflections. We thought this would be a good complement to the usual flaying of facts and figures that occurs in an investment letter and would help investors better understand our approach. Section 2 discusses a quality compounder whose business model we admire. Section 3 discusses our Q3 2020 performance and recaps our core beliefs and thinking.

Section 1: Personal Vantage Points

When writing an investor letter there is pressure to say something that has not been said before. That won’t happen here. Even assuming we were gifted enough, we were born too late (alas!) to independently come up with the investment insights that have fueled the careers of Warren Buffett, Charlie Munger, Nick Sleep, Chuck Akre, Lawrence Cunningham, Nicolai Tangen, Henrik Bessembinder, Terry Smith, Francois Rochon, Ole Peters and others, but which we were happy to assimilate and apply. However, each investment life is distinct, so we have vantage points that may be of interest. We relate a few here so investors can understand us better.

Investment Authenticity and Boutique Heaven

Most people attempt to live two simultaneous lives: The first is their actual life. The second is the life they want others to think they are living. Authenticity is simply letting go of the second life. The divergence between the two lives surfaces sometimes when we hear something out of character or shocking about someone who we thought we knew well. We then realize their life was not all it was dressed up to be.

How does this apply to investing? Well, let’s start with Sachin Tendulkar, perhaps the greatest living batsman in the game of cricket: “I focused on the ball, not the bowler, not the scoreboard and certainly not the crowd that cheered. That explains my technique.” Many investors focus not on the underlying businesses of their portfolio, but on how the portfolio looks versus the competition or the index it is measured against, the size of their fund, and how many appearances they have had on CNBC. They manage to the mirror. Most investors, like corporate employees, are just satisficing1. They go to work. They manage their boss. They deal with office politics and watercooler talk. They feel the pressure to look productive and “busy.” Inactivity is frowned upon.

This is where a boutique with a concentrated portfolio and a long-term focus has an advantage. We can play the ball and ignore the cheers (or jeers) of the peanut gallery. We can wear our favorite jeans, put our feet up on the desk, chill out, and patiently go through annual filings, industry research, relevant books, and interviews with companies, customers, and competitors. We can disagree and engage in sustained debates without either of us taking umbrage. We can take the time to let our heads clear and our thoughts develop naturally rather than be pressured to produce a new idea or trade every few weeks. Cloudy water becomes clear when it settles.

The industrialization of investing has killed something elemental to the investment soul. Successful investing relies on insights. Insights, like love, happen on their own time and are often counterintuitive. They come when they come, but reading, thinking, and robust debates prepare the ground. It is not a coincidence that some of the influential thinkers over the last two centuries, such as David Hume, Charles Darwin, David Ricardo, and Maynard Keynes did their best work independently and not in conformist university environments. In the investment context, Buffet/Munger, Sleep/Zakaria, Soros, Gayner, Rochon, Akre, Taleb and other investors operated not in investment factories but in boutique-like settings. The leisured aristocrats of ancient Rome, with the freedom to spend the whole day conversing, thinking, reading, writing, or simply following their muse, would have made good investors. Toga anyone?

We Have a Mascot...

With a concentrated, low turnover strategy, we trade only when the investment thesis changes, not when our trading finger gets itchy. This “punch card” strategy2 (Buffet’s phrase) has virtues. Besides the aesthetic pleasure of watching trees grow, it forces hard thinking before the purchase, avoiding, in many cases, hard feelings afterwards. “Hard on the training ground, easy on the battlefield” goes the Prussian maxim. A commitment to low turnover saves investors from their baser urges and emotional imbalances since 99% of information that investors are fed is noise, not signal. What is often missed is that not doing a trade is as much of an intentional decision as a trade. Investors examine their portfolio regularly and continually make decisions to buy, sell, or do nothing. Doing nothing is easier said than done, when the markets are boiling, the emotions of greed and fear are raging, and fellow investors are boasting (you generally only hear about their successful trades!).

Our analogue in the animal kingdom is a python, which lies coiled, cold-blooded, and inert for extended periods, waiting for the deer to wander close. It then strikes. It does not eat again for a long while. Contrast this with the behavior of mammals. They are warm blooded, highly active, eat regularly, and undeniably cuter. But reptiles have lasted one hundred million years longer on earth…and they may yet win the long game. Over time the ruthless logic of evolution weeds out all but the most enduring models, whether in the natural world, or the financial world.

“But not in the South”…. Why we Like the Adversarial System

Too many investors subsist on fully amortized intellectual capital. Their investment views congeal early in their careers and are not reexamined as conditions change. They rely on outdated frameworks, inaccurate heuristics, and tired platitudes as a substitute for fresh thinking. They often work in environments where authority flows from long tenure, and where their investment approach is not challenged. The pretense of expertise can often be displayed by mouthing “generic wisdom”. This happens at cocktail parties. For example, if your conversation partner mentions some characteristic of a country you are unfamiliar with, you can mask your ignorance by blurting “But that is not true in the south”. Well most countries have a north south divide, so your statement might be generically true much of the time. Your interlocutor might even have thought you knew something about the country. But you did not. You were posturing.

One of us remembers an analyst colleague from our buy-side days who followed railroads…only he did not. He had made his mind up about them by about 1992, shortly after he started following them. He was fixated on the idea that railroads were capital heavy, cyclical, and had mediocre returns on capital so were trading stocks and not investments. He was right until the year 2002 when a new operating philosophy, two decades of consolidation, and the rise of a new cadre of CEOs in the industry focused on returns on capital versus the traditional obsession with market share reconfigured the industry structure. But this happened incrementally so detecting the change was difficult unless the situation was examined with a fresh set of eyes. Over the next six years railroads proceeded to triple but this analyst did not rethink his views. Any internal challenge (which seldom occurred) was met with platitudes about high capital intensity of railroads, their sensitivity to the economic cycle, the shrinkage of the rust belt economy, the volatility of fuel prices, et al. This is typical in firms where one person has been designated to arrive at the investment truth. It is reminiscent of the inquisitorial system of justice where a court investigates the facts of the case, applies the law, and comes up with a conclusion. At Qualivian, we much prefer the adversarial system, where the role of the court is that of a referee between the prosecution and defense. When investment bulls interact with investment bears, sparks fly, complacency and lazy thinking are challenged, and insights are more likely to occur.

“I Don’t Know” and the Pretense of Knowledge

At Qualivian we like hearing the answer “I don’t know” in response to an investment question. This is not because we are naturally agnostic or even solipsistic but because it signifies straight shooting in an industry riven with agency conflicts, cognitive biases, and posturing. Most so-called investment “knowledge” is an equilibrium point between competing social considerations, half-baked ideas, and institutional imperatives, rather than the result of serious engagement with the underlying investment considerations. When it comes to investing (and not just investing), we know much less than we think we do. Many poorly thought through answers are given to look informed (few portfolio managers like to say “I don’t know”) and because investing is permeated with unproven theories, folk wisdom, and ideology. Science has a rigorous process for checking assertions - falsifiable hypotheses, peer review, experimental testing, etc. No such process exists in investing. Many professional investors today, much like medical practitioners in the nineteenth century, have high confidence in views for which there is no objective basis. Remember nineteenth century doctors who bled their patients? To realize how uncertain investment “knowledge” is perform a simple test: read what an investment “guru” confidently asserted five years ago and see if it panned out.

Thinking Clearly About Platform Companies

Platforms and Reversing the Wisdom of Crowds

Several of our holdings are platform companies, which are double-sided networks with critical mass on both sides, market dominance, high returns on capital, and a long growth runway. They are more likely to be mispriced because the “wisdom of crowds” is less applicable to these business models.

Remember the story about the crowd in a farmer’s market estimating the weight of the prize bull? The average of the individual estimates was closer to the true value than 97% of the individual estimates. Only 3% of the individual estimates beat the crowd. Nick Sleep points out that investing is the reverse of the wisdom of crowds. We start with the estimate that the crowd gives (the stock price) and we have to determine if our estimate is part of the 3% that beats the crowd.

When is the crowd likely to be wrong? The wisdom of crowds phenomenon relies on the law of large numbers, which implies that the average of the results from many independent estimates should be close to the true value. It will tend to get closer as the number of independent estimates increases. However, the law of large numbers only works when the sample observations follow a well-behaved probability distribution like the normal distribution. It does not work when the underlying distribution is fat tailed. Guess what? The growth of networks on platforms have scaling effects which follow power laws, and which leads to fat tails. So, the wisdom of crowds phenomenon breaks down here and crowd-based equity pricing may be inefficient for platform firms. That is why we feel that platforms are a target rich environment to search for inefficiently priced stocks.

“We are here from the government and we are here to hurt you.” Really?

Our holdings include some of the large platform companies (FB, GOOGL, AMZN) which are under investigation by the government and under the threat of greater regulation. How should we think about this? Is this necessarily bad? We will not comment on the legal aspects, which are yet to be finalized, but we can share some relevant thoughts.

Recall the phrase, “We are here from the government and we are trying to help?”3 That is often perceived as a negative. Suppose we hear its opposite: “We are here from the government and we are trying to hurt you?” Is that also a negative? Not necessarily. It may even be a positive. Consider what happened when the government started regulating the tobacco companies. Entrance into the tobacco industry ceased, helping the existing players. Next, the government banned advertising. This entrenched the existing players even more since each firm could reduce marketing spend without the threat of losing share to competitors. The major players gained market share and increased prices. The government did not intervene to reduce market power since higher prices reduced cigarette demand, a positive for public health. However, returns on capital and distributions to shareholders increased. The net result was that shareholders did well despite increased regulation. Talk of the law of unintended consequence!

Could this happen again with the big tech platform companies if the government imposed more regulation? New entrants would be discouraged from entering and the existing behemoths may be locked into their dominant competitive positions. Even if the government mandates a breakup, this may also prove positive for shareholders since they may be cheaper on a sum of parts basis (see our note on Alphabet in an earlier investor letter). The one form of government regulation that may hurt is the restrictions on the type of consumer data these platforms can amass and use to generate advertising. That would be a more serious hit to their business models, but for now we can only speculate. Stay tuned.

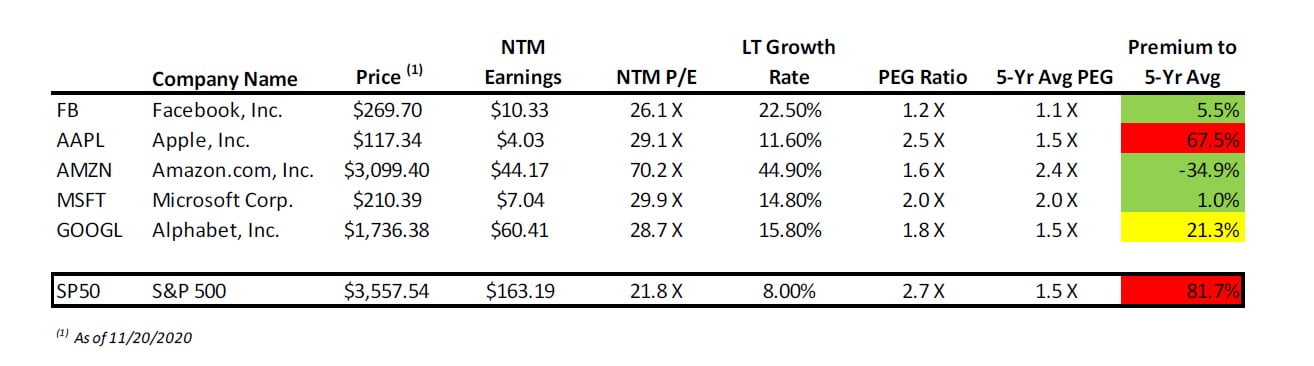

A Note on FAAMG Valuation

FAAMG (the top 5 market capitalization companies in the S&P500) this year have had a spectacular run in 2020. This is partly because of the rotation to secular growers for much of the second and third quarters in 2020 due to the COVID crisis. However, they do not appear to be overpriced versus the S&P500 index for the premium growth they have over the index.

- The average of the current P/E to growth of FAAMG is 1.8. This is lower than the current P/E to growth ratio of the S&P500 which is 2.7.

- The S&P500 P/E to growth of 2.7 is trading at a steep premium to its own 5-year historical average of 1.5. The current FAAMG P/E to growth of 1.8 is only a slight premium to its 5-year historical average of 1.7.

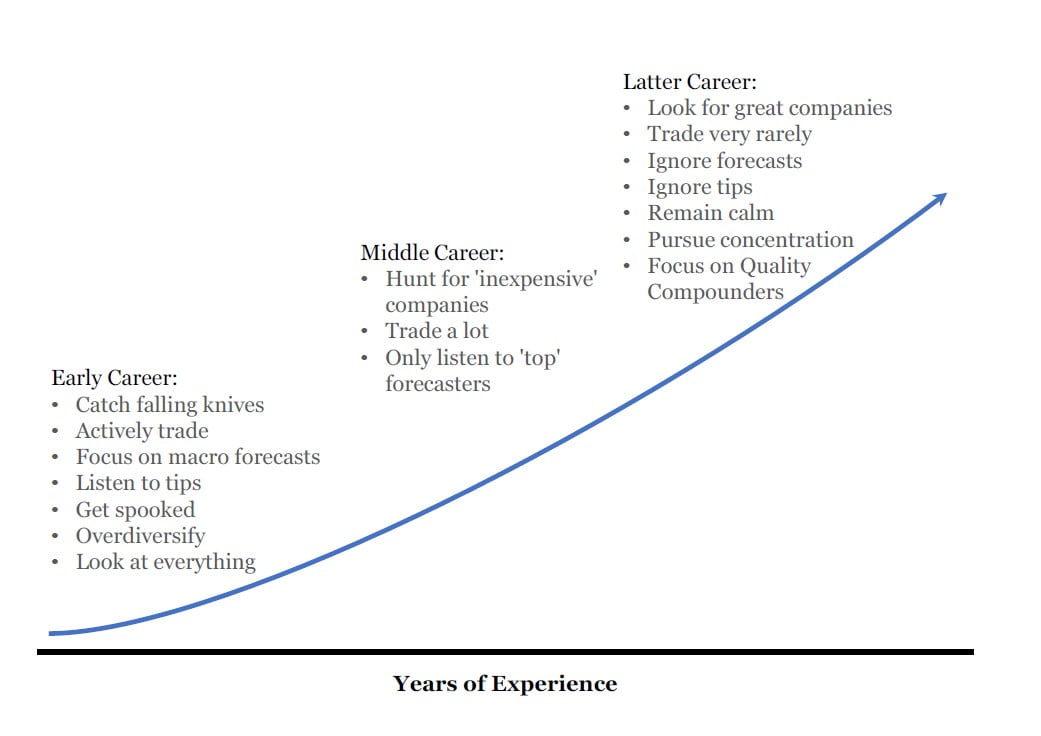

Our Investor Learning Curve

Like many investors, we periodically reflect and see how our investing frameworks have evolved, assessing what worked for us and others and what didn’t. The following learning curve (from Brian Feroldi) tracks how we have seen many of our talented peers in investing (and maybe ourselves!) develop. Note that the activity level for experienced investors decreases over time, as does the stress level. They rely less on what they hear, more on what they see, and even more on what they think. More experienced investors also tend to wait for investment opportunities to occur in their comfort zone rather than aggressively search for them in areas with which they are less familiar. They also realize that a few investment decisions will determine most of their investment results.

Section 2: Watsco (WSO) – A Quality Compounder with Improving Fundamentals

We would like to revisit Watsco (briefly discussed in our Q2 2019 letter). Watsco is the largest HVAC distributor in North America. We like the HVAC distribution business because it is a steady, predictable, and recession-proof business with predictable demand for HVAC equipment driven largely by a replacement cycle. This typically accounts for greater than 80% of shipments, with another 10-15% driven by new house construction. The remainder is accounted for by demand for refrigeration in specific commercial markets.

Our Thesis on Watsco…

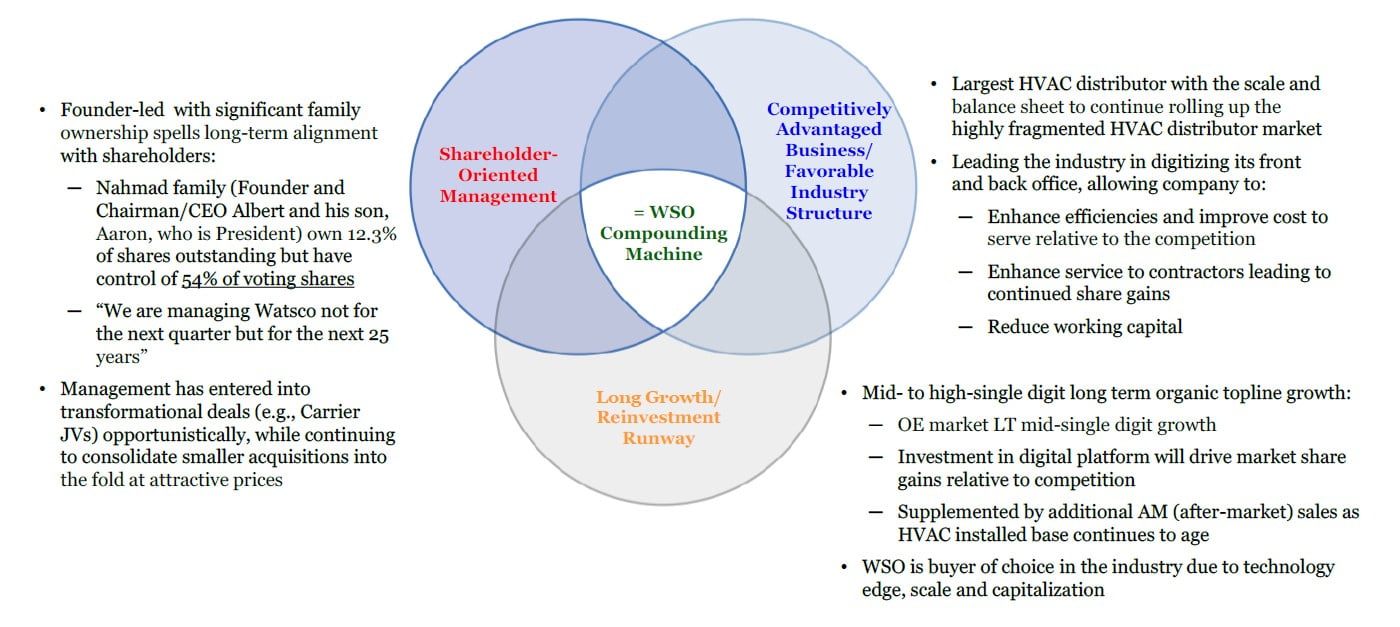

Within the HVAC markets, we like Watsco as a candidate for the fund because:

1) It is the #1 HVAC distributor with 15% market share. It is two and a half times larger than the next largest player.

2) It has high returns on invested capital and is relatively asset light.

3) It benefits from a long growth runway arising from its predictable end market demand as well as its consolidator role in the HVAC market.

4) Is extending and widening its already formidable competitive advantage due to a) its scale and b) its investments in its technology infrastructure. This leads to our differentiated view that Watsco will have higher EPS growth than consensus due to higher revenue growth and better EBIT margins.

5) Has a founder-led management which ignores short term earnings swings and is focused on long-term value creation and allocates capital accordingly, engaging in economically accretive consolidation.

#1. Dominant Competitor in HVAC Distribution…

In the US, HVAC distribution is a $35bn industry. $25bn of revenue is spread among 1300 local independent distributors. There are 50 distributors which do between $100mm and $1bn in sales. Another $5bn in revenue is accounted for by OEM-owned distribution. The remaining $5bn is Watsco, the largest independent HVAC distributor in the country. Watsco has almost 2.5X the market share of the next largest competitor. It serves 90K+ contractors in its key markets and with 600+ locations across the US, Canada, and Latin America. Watsco has concentrated its locations in the sunbelt states, where the need for cooling is omnipresent throughout the year. Florida represents its largest market and Texas its second largest market.

#2. High Return on Capital and Cash-Generative Business…

Watsco’s distribution model and scale have created a lucrative cash-generative model with low reinvestment needs. This leads to impressive returns on assets and invested capital. Watsco had about $673 million of capital invested in the business ten years ago. Currently, there is about $1.6 billion invested (we are defining invested capital as net working capital plus net fixed assets). During this decade, operating income grew from $166 million in 2010 to $372 million in 2019. This implies solid cash on cash returns in the low 20% range. Mid-teen ROIC and low-20% Cash Return on Invested Capital (CROIC) on a steadily growing revenue and capital base have allowed this management team to make the necessary investments in the business to expand organically and via a very disciplined acquisition strategy, discussed below.

#3. Recession-Proof Durable Business with Long Growth Runway…

The installed base of HVAC units has grown at a 3.6% CAGR since 1980. The US has ~115 million installed A/Cs and furnaces, 92 million of which are over 10 years old. Systems last 10-204 years suggesting a solid replacement runway. The primary replacement markets are in less weather-sensitive geographies where HVAC use is more frequent and consistent, which is why Watsco focuses on the Sun Belt (~60% of North America).

In addition to its durable and predictable end-market demand, Watsco’s growth runway is further enhanced by its role as the natural consolidator in the fragmented HVAC distribution market. This is enabled by its scale and its superior technology infrastructure. This is widening its competitive lead with smaller, less well-capitalized competitors who end up selling to Watsco to access its superior technology and its purchasing leverage with the Original Equipment Manufacturers (OEMs). Of the 1,300 independent HVAC distributors in North America, 99% are family owned. On average, these businesses are doing maybe $30-$50mm in revenue per year. This is Watsco’s target for acquisitions.

Watsco has benefited from value enhancing M&A, acquiring a little over 60 HVAC distribution businesses since 1989 without ever hiring a banker. Watsco buys smaller distributors for 5-9x trailing EBIT and improves their EBIT margins over the next few years. Watsco trades around 17x EBIT5 so the acquisitions create economic value. It is interesting to note that private equity has not been active in consolidating the fragmented HVAC distribution business and as a result, transaction multiples have not been bid up by financial buyers. This is because OEMs typically have a clause with their distributors giving them a veto power over whether the distributor can continue to sell their product if the distributor is sold. OEMs typically do not like private equity players because they feel that their focus on cost cutting negatively impacts customer service. This has a negative effect on how the OEM brand is perceived.6

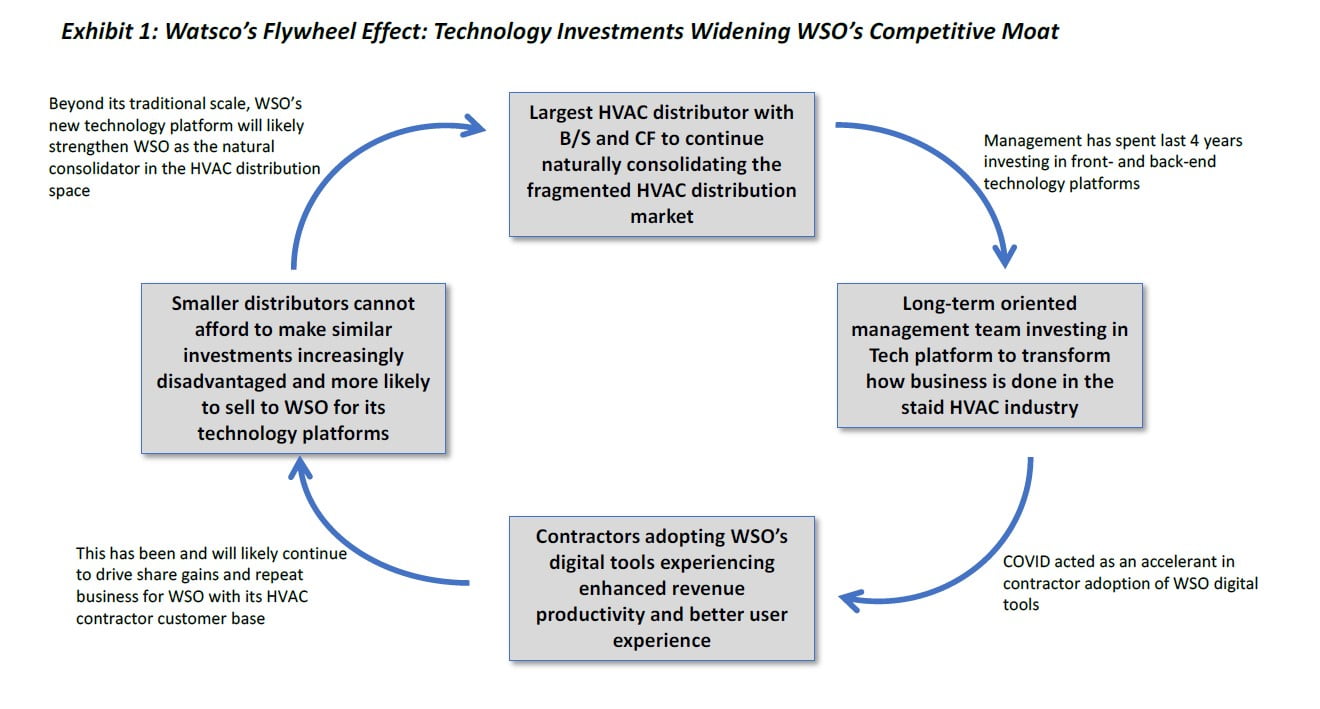

#4. The Case of the Ever-Widening Competitive Moat…

Watsco’s size has enabled it to invest in its technology infrastructure that its small, fragmented competition cannot afford. The company has been expensing roughly $35-$40 million a year for the last four years in building out its eCommerce platform, on-line sales tools, inventory management and warehouse management systems to transform antiquated industry practices.

Traditionally, it might have taken a contractor hours to diagnose a customer’s repair, call the local Watsco distribution center (DC) to see if they had the needed equipment/parts, drive to the DC and often wait for the parts to be picked and loaded on to his truck. If not available, he would go back in 1-2 days to get the needed parts, before returning to the customer’s home to finalize the repair. Today, the process is seamless. The contractor is able to access online tools to diagnose the problem at a customer’s site, look up parts availability, order and pay for the needed parts/equipment in a manner of minutes, and drive up to the Watsco DC for contactless delivery of the order, and be back at the customer’s site same day to finish the job. This allows contractors to materially improve their revenue productivity with Watsco product versus the competition.

For Watsco, the benefits are clear. Contractors who use the new digital tools tend to be repeat customers, driving market share gains for the company. Furthermore, Watsco is able to better forecast demand for different SKUs, deliver better fill rates to its customers, and ultimately it will be able to reduce overall inventory levels and warehouse square footage as it fine tunes its systems. This has the potential to deliver accelerating revenue, lower costs, and reduced working capital. This is in turn will likely improve its FCF generation and further enhance its ability to pull away from the competition and consolidate the industry. The flywheel effect is illustrated below:

We think COVID has been an accelerant of contractors’ adoption of WSO’s digital tools, and in Q2 and Q3 of this year, Watsco posted 0% and 8% organic growth rates, when industry shipments were down 10% and flat respectively. Watsco reported that 20K of its 90K+ contractors are now using its digital tools, up from the 12K at the end of 2019. We believe that Watsco’s fundamentals are on the verge of improving.

#5. Founder-Led Management Team with Focus Firmly Planted on Long-Term Value Creation…

Finally, we are big fans of Watsco’s founder-led management team. While the founder and CEO, Al Nahmad, and the President, his son AJ (in charge of the technology investments), own 12% of the company, they control 54% of the voting shares, allowing them to run the company much like a private company. They are squarely focused on generating long-term value creation by growing organic market share and consolidating the industry. They are not swayed by short-term earnings results. “We care about the next quarter century not the next quarter.”

Valuation

Optically, it may look like Watsco is trading expensively at 32.5X forward earnings. However, its NTM P/E7 relative to the S&P is currently 1.5X, which is in-line with its 10-year historical average. Furthermore, we believe that the company’s fundamentals are in the early stages of inflecting upwards. Its revenue growth rates are likely to rise from mid-single digits to 6%-8%. Operating margins should increase from the current ~8-9% level closer to 10%, because of the cost efficiencies that their technology investments will begin to deliver over the coming years. All-in, we think Watsco will be able to deliver annualized mid-teens+ EPS growth over the coming years, up from the 9% level the company has achieved over the past 5 years.

Section 3: Fund Strategy Recap and Performance

The Qualivian Focus Fund is an investment partnership focused on long-only public equities. We own a concentrated portfolio (15 -25) of understandable companies with wide moats, long reinvestment runways, and outstanding capital allocation. We expect them to compound capital at a mid-teens rate and hold them for an extended period. We have a private equity approach to public equities. We are seeking investors that are aligned with our long-term horizon. We do not short securities. We do not use leverage. We do not use derivatives. We are not macro investors. We believe that only a relatively small number of exceptional companies are worth investing in over the long term. Our investment process seeks to find and hold those companies. The fund primarily focuses on US companies of all sizes but can have 20% of its portfolio outside the US.

We buy carefully. We sell infrequently. We believe the stock market is a mechanism to transfer wealth from the impatient to the patient. High quality businesses with durable and growing cash flows are rare in a world awash in low and negative interest rates. When they are run by able management teams with excellent capital allocation, they are scarcer still. We are quite comfortable sitting back, holding on, and watching the power of compounding work. The big money is made in the waiting, not in scratching the itch to “do something”. We do not mind watching trees grow.

Our formula:

Long-Term Orientation + Long-Term Investors + Focused Portfolio + Quality Compounders = Maximizing Chance for Outperformance.

Our investors should understand how we invest so they make the right decision (both for them and us). We are not right for all investors. We would encourage investors aligned with our long-term horizon and philosophy to contact Aamer Khan ([email protected]) at 617-970-9583 or Cyril Malak ([email protected]) at 617-977-6101.

Performance of the Fund in Q3 2020

In Q3 2020, we were up 9.3% and 9.1% on a gross and net basis versus the S&P’s 8.93% increase, outperforming by 0.3% and 0.2%. For the year-to-date period through September 30, 2020, we outperformed the S&P 500 by 15.6% and 15.1% on a gross and net basis. In 2019 we finished up 40.2% and 39.4% on a gross and net basis respectively, versus the S&P 500’s performance of 31.5%, or an outperformance of 8.7% and 7.9% respectively.

Since the inception of our fund in December 2017 through September 30, 2020, we have returned 63.6% and 60.8% on a gross and net basis versus the S&P 500’s 33.4% return in the same period, outperforming by 30.3% and 27.5% respectively. Appendix 1 contains a detailed quarter by quarter performance table.

As a long-only strategy that does not short (or employ leverage, options, other derivatives, or financial exotica), we were not immune from the record-setting drop in the markets in the back half of February and throughout March resulting from the COVID virus. However, the returns from our quality compounders with secular growth, high gross and operating margins, strong balance sheets and strong cash flow generation translated into a more muted pull back for our portfolio in Q1 2020 and a superior bounce back in Q2 and Q3 2020.

Our top three contributors in Q3 2020 were Apple (AAPL), Amazon (AMZN), and Mastercard (MA). Our bottom three contributors were American Tower (AMT), Brookfield Asset Management (BAM), and Visa (V), with V and BAM mildly positive in terms of contribution.

Apple: From a product standpoint, iPhone sales in AAPL’s fiscal Q4 quarter (calendar Q3) missed consensus estimates as customers deferred iPhone 11 purchases in anticipation of the launch of the 5G-enabled iPhone 12 in October, however, iPad and Mac sales continued to benefit from COVID-related work/learn from home trends, with each posting the fastest top line growth rates in the last 5 years. This in combination with continued long-term strength in wearables and services revenue, more than made up for the weakness in iPhone sales, allowing AAPL to beat on the top and bottom lines when they reported the quarter in late October. While the market was somewhat disappointed in AAPL’s lack of iPhone 12 guidance for the upcoming fiscal Q1 2021 quarter, we are optimistic that the iPhone 12 will represent a strong upcoming iPhone sales cycle for AAPL, and that the continued strength in its non-iPhone product and service revenue categories (which represented 47% of revenue in the quarter, the highest it has ever been) supports the stock’s rerating and its continued outperformance in the coming years.

Amazon: AMZN shares, along with many other eCommerce participants, have been on a strong run this year, outperforming the S&P 500 materially since February. COVID is pulling forward years of eCommerce migration and AMZN is one of the big winners. Alongside this, cloud migration continues to accelerate as the cost-benefit of migrating from on-premise to the cloud dominates especially in the work/learn from home COVID era. AMZN handily beat topline consensus estimates across its 1P/3P online sales, subscription, and other revenues, while meeting AWS sales estimates (which disappointed market observers). Operating income and cash flow handily beat consensus, increasing 96% and 52% last quarter, despite spending an incremental $2.5bn in Q2 and Q3 on COVID-related expenses.

The management team continues to invest in Prime One-Day shipping, AWS, international, video content, positioning the company for continued market share gains, new revenue growth vectors, and margin expansion once the company laps this investment cycle, further strengthening its long-term competitive advantage. The key risks that we continue to monitor are regulatory/political in nature.

Mastercard: MA continued to see significant headwinds in its higher margin cross-border transaction volumes/revenues because of the drastic drop in cross-border travel (both personal and corporate) due to COVID-related lockdowns. We do not see this portion of MA’s business recuperating before the wide-scale global distribution and adoption of a COVID vaccine in the back half of 2021 going into 2022. The flipside to this is that COVID has accelerated the digitization of cash payments, especially as card not present eCommerce transactions continue to accelerate in the COVID era, and likely permanently shifting consumer shopping and payments behavior in favor of digitized transactions. The other offset to the weakness in cross-border volumes we saw is better expense control on the part of the management team, which will likely continue in the coming quarters. While MA’s cross-border revenues and earnings will continue to be impacted in the next 9-12 months, we expect the continued share gain of digital cash payments at the expense of paper transactions to accelerate. Furthermore, MA continues to invest in value-added services (marketing, fraud detection, etc…) as well as supporting more digital payment modalities on their payment rails, supporting our long-term thesis on this digital payment stalwart.

American Tower: AMT was the only slightly negative contributor to the fund’s performance in the third quarter. However, when it reported Q3 results in October, AMT bested revenue, EBITDA, and AFFO estimates in the quarter, while seeing an improving revenue growth trajectory in its international business, which has been one of the key tenets of our investment thesis in AMT. As key international markets continue to mature and densify their networks, the company should see accelerating revenue, EBITDA and operating cash growth from its portfolio of international towers. The company offered limited color on 2021 expectations, but management did say it expects T-Mobile (TMUS) to drive higher U.S. activity y/y predominantly from its 2.5GHz overlay, and that the timing of its Sprint site decommissioning might be more back-end weighted. We will monitor how much of an impact the Sprint tower sites churn might impact US revenues in the 2022-2024 timeframe, however, we expect the underlying growth in wireless data at 30%+ per year, plus the improving contribution from AMT’s international portfolio of towers in key growth emerging markets, will allow the company to continue to put up low to mid-teens growth over our investment horizon.

Brookfield Asset Management: BAM was neutral this quarter to our performance with the stock largely range -bound. BAM is a premier investor in alternative assets, including real estate, infrastructure assets, fixed income, and private equity. The stock underperformed together with much of the credit sensitive financial sector as the uncertainty regarding the length and depth of the COVID slowdown increased in the first and second quarters. Some of BAM’s subsidiary companies (BPY for instance) have substantial exposure to real estate and have higher than average levels of leverage. We reduced our holding in BAM in the second quarter as it became harder to forecast its economic earnings over the next five years. The stock remains under review.

Visa: was a positive contributor in the quarter, just less so than our other holdings. Visa’s fiscal Q4 quarter (calendar Q3) results were better-than-expected as revenue and EPS beat street expectations driven by stabilizing domestic transaction volumes and good expense control. Although results showed continued pressures from depressed cross-border volumes, which may continue for the foreseeable future as with MA, we believe the worst is behind us and our long-term thesis of V’s structural positioning on the other side of the pandemic remains intact. Looking to the back half of 2021 and going into 2022, we see a recovery in cross-border activity, which together with traditional spending improvements at the POS, leaves considerable room for upside upon reopening. Further, once the macro normalizes (medium term), we believe V (and MA) will continue to benefit from structural drivers including increased contactless payments, more eCommerce transactions, as well as a lift in the value-added services like fraud/gateway/marketing services, and demand for other flows such as B2B, G2C and use of Visa Direct. There is no credible competition on the horizon for the Visa/Mastercard payment networks.

Changes to the portfolio in Q3 2020

We only made one change to the portfolio during the quarter, adding to our position in ADBE, taking advantage of some weakness in ADBE’s stock price to add to our position which we initiated in Q2 2020.

Ending Thoughts

We look forward to continuing to share our thoughts on our investment approach, and to keep you abreast of our performance and changes to the portfolio. In the meantime, if you have any questions, please feel free to reach out to us at the links below.

With best wishes,

Aamer Khan

Co-Founder

Cyril Malak

Co-Founder