On My Radar: Minus 43.8% Correction To Fair Value by Stephen Blumenthal

“Rule #3: There are no new eras – excesses are never permanent.” – Bob Farrell, Former Chief Stock Market Analyst and Sr. Investment Advisor, Merrill Lynch – Bob Farrell’s 10 Rules for Investing

Q3 2020 hedge fund letters, conferences and more

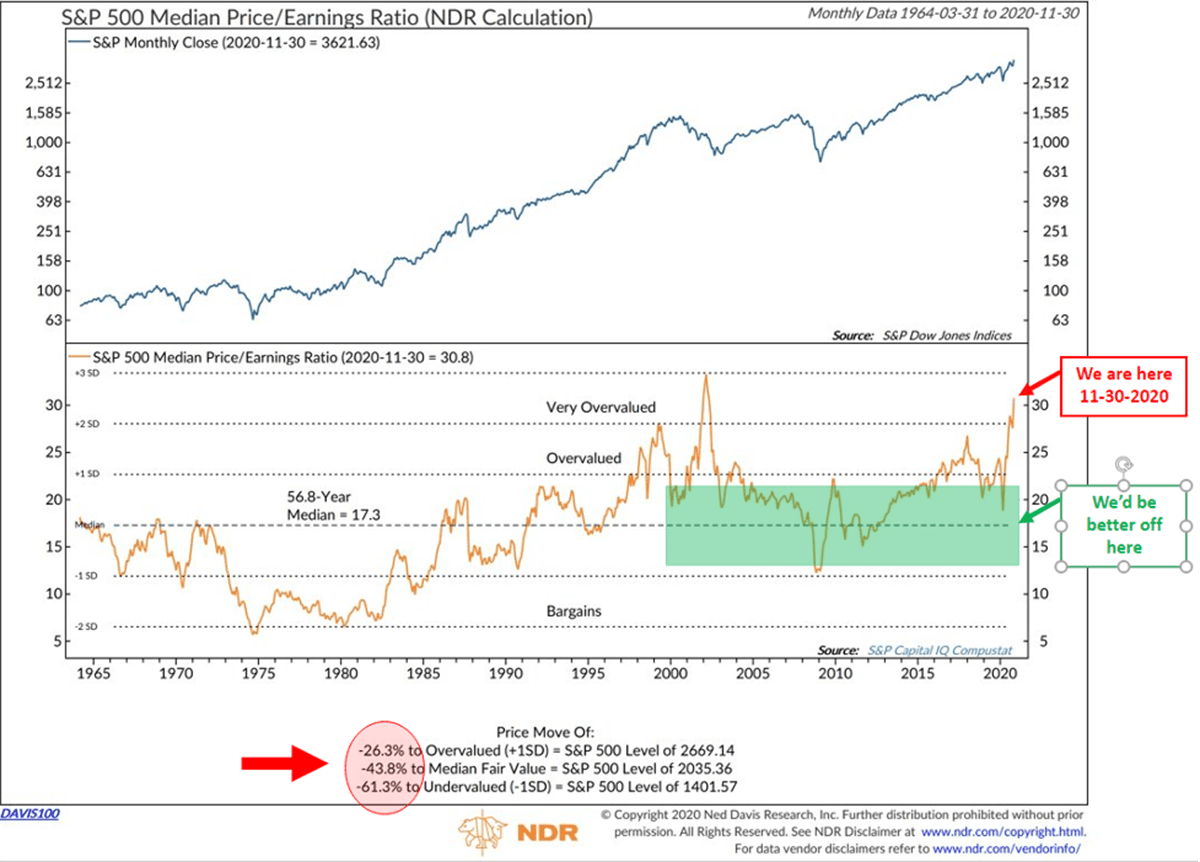

Today, I share my favorite stock market valuation chart with you. It bluntly suggests that a 43.8% correction is required to get us back to what is considered “fair value.” Will it happen? Don’t know.

A 26.3% correction gets us back to what is considered “overvalued.” The S&P 500 Index was at 3,621.63 on November 30, 2020. Minus 26.3% puts the market at 2,669.14. Consider that a higher probability. A shock that would send the Fed to the rescue.

What is clear is that we sit at one of the most overvalued levels in history. I find valuation data useful in terms of asset allocation (targets for opportunity) and by process, I like to review various valuation metrics each month. Before we take a look at what they’re telling us, recall that debt is a drag on growth and thus a drag on future earnings. “There are no new eras.” I wrote last week about William White (check it out here). Bill was the chief economist at the Bank for International Settlements. Think of the BIS as the central banks’ central banker. “The elephant in the room is debt,” he said. Bill sees four possible scenarios:

- Households, corporations, and governments try to save more to repay their debt. But we know that this gets you into the Keynesian Paradox of Thrift, where the economy collapses. This way leads to disaster.

- You can try to grow your way out of a debt overhang through stronger real economic growth. But we know that a debt overhang impedes real economic growth. Of course, we should try to increase potential growth through structural reforms, but this is unlikely to be the silver bullet that saves us.

- This leaves the two remaining ways: Higher nominal growth – i.e., higher inflation – or

- Get rid of the bad debt by restructuring and writing it off.

Bill advises a combination of three and four, adding, “Approach the problem, try to identify the bad debts, and restructure them in as orderly a fashion that you can.”

On the surface, that “restructure” and “orderly” sound easy to do. But restructuring the mortgage debt mess in 2009 was not so orderly. We now call it “The Great Financial Crisis.” Expect the same sort of impact to hit the corporations who have binged on debt and the investors who own that debt. “Excesses are never permanent.”

You’re not going to be happy if your bond fund drops 40%—an all-too-real risk.

Creditable academic research suggests debt affects growth when it crosses 90% debt-to-GDP. Note the right-hand column in the following chart and factor the information into your deflationary calculator. This is the elephant in the room! (Data through June 30, 2020.):

Source: Ned Davis Research

Getting rid of the bad debt by restructuring and writing it off means that in our immediate future, deflation persists. Excess global production capacity and aging demographics also mean deflationary pressures persist. But do keep one eye on future policy response. If we get what I think is coming, in the U.S. and globally, inflation will become front-page news. That will create an entirely different investment regime. My best guess is that it will happen two years from now.

November was an exceptionally great month for U.S. equities. The year was not looking so good. According to data from Morningstar, going into November, the Invesco S&P 500 equal-weight ETF (ticker symbol “RSP”) was down 3.58% for the year. On November 30th, the year-to-date gain was 10.17%. Tack on another 2.56% in December and all is well with just a few weeks to go before we put 2020 behind us. I believe the equal-weight index is a good proxy for most large-cap equity funds, “the market” as they say.

I hope you will indulge me for a brief, exciting commercial message. My first book, On My Radar: Navigating Stock Market Cycles, is now available for Kindle on Amazon. The hardcover is also available for pre-order (and price guarantee) and will be released in January. The book is about investment process and how to navigate the massive debt restructuring we face ahead of us. I share a road map of sorts, important charts, and how to think about when to play defense and when to seize on the opportunities that will present. The book concludes with a discussion about how wealthy investors think about defending their CORE wealth and how carefully selected, asymmetric return opportunities, which I call “EXPLORE type investment opportunities,” may accelerate wealth. Ultimately, I hope you gain some beneficial insights into how to put in place an investment game plan that is best for you and your family.

Grab that coffee and find your favorite chair. This week I share with you my favorite valuation chart, which helps me set some opportunity targets. We’ll look at the latest market valuation data including Warren Buffett’s reported favorite valuation indicator. I hope you find the information helpful. You’ll also see that the weight-of-trend evidence continues to lean bullish (see this week’s Trade Signals below). Be ever mindful that the whispers of 1999 are growing louder.

If a friend forwarded this email to you and you’d like to be on the weekly list, you can sign up to receive my free On My Radar letter here.

Follow me on Twitter @SBlumenthalCMG

Included in this week’s On My Radar:

- Median P/E – Minus 43.8% to Fair Value

- Trade Signals – Markets Await Additional COVID-19 Stimulus, Vaccine Deployment

- Personal Note – 60 and Sunny

Median P/E - Minus 43.8% to Fair Value

As we look at median price-to-earnings ratios, remember Bob Farrell’s investment rule #3: There are no new eras - excesses are never permanent.

Here is how to read the following chart:

- Note the red “we are here” arrow. We sit in the “very overvalued” zone.

- Note the green highlighted area and the “we’d be better off here” arrow.

- The dotted line shows the 56.8-year median P/E = 17.3. The latest reading is 30.8. That’s higher than the secular bull market peaks in 2000 and 1966.

- Lastly, take a look at the red circle toward the lower left. I think this is a pretty good way to set some targets as to where you may want to get more aggressive with your equity exposure. Target one: 2,669.14 (though still overvalued, that is likely where the Fed steps back in should the market correct that much. Likely sooner in my view but just a guess). Target two: fair value at 2,035.36.

Source: Ned Davis Research

Stock Market Capitalization as a Percent of Gross Domestic Income

I like this next chart, as I feel it is informative in terms of coming returns.

Here’s how to read the chart:

- I’ve noted the prior secular bull market peaks: 1929, 1966, 2000, 2008, and 2020.

- 2020’s jury remains out as the market is currently at an all-time high.

- Note the red “we are here” arrow. This shows the value of the stock market as a percent of GDI. The lower section plots the amount over and under the blue dotted long-term trendline that appears in the middle section of the chart.

- The data box is in the upper left. It shows the 1, 3, 5, 7, 9, and 11-year subsequent returns achieved when the market was in the top quintile—overvalued zone (red highlight in the data box) and when the market was in the bottom quintile—undervalued zone (green highlight in the data box).

We sit in the red zone. Expect negative annualized returns over the coming 11 years.

Source: Ned Davis Research

Stock Market Capitalization-to-GDP - The Buffett Indicator

From Advisor Perspectives: “Market Cap to GDP is a long-term valuation indicator that has become popular in recent years, thanks to Warren Buffett. Back in 2001, he remarked in a Fortune Magazine interview that ‘it is probably the best single measure of where valuations stand at any given moment.’”

Compared to the previous two secular bull market peaks and all of the data from 1950 to present, stock market cap (the total value of the U.S. stock market) to GDP (gross domestic product—what we collectively produce as a country) has never been higher.

Source: Advisor Perspectives

Keep one last great Bob Farrell rule in mind — Rule #4: Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

My two cents: Don’t expect sideways… there has rarely been a better time to hedge.

One last thought: There are opportunities in disruptive technologies, such as biotech, etc. There is so much to be optimistic about. It’s just not in cap-weighted passive index funds or low yielding bonds.

Trade Signals - Markets Await Additional COVID-19 Stimulus, Vaccine Deployment

December 9, 2020

S&P 500 Index — 3,705 (open)

Notable this week:

This week, there are a couple changes to the trade signals we monitor. The Don’t Fight the Tape or the Fed indicator moved to a “0” reading, improving from a “-1” reading. This updated reading is a bullish signal for equities. The investor sentiment indicators, calculated by Ned Davis Research (NDR), continue to rise, demonstrating excessive optimism, which is short-term bearish for equities. No changes to the fixed income indicators this week.

For your reading pleasure, Deloitte published its quarterly CFO Signals™ this morning. According to Deloitte’s survey of Fortune 500 executives, 80% of CFOs say equities are overvalued, but nearly 60% expect the S&P 500 to be higher at the end of 2021. In short, CFOs are concerned about economic growth prospects for the first half of 2021 and are optimistic for prospects in the second half.

Source: Deloitte CFO Signals: Q4 2020

Not a recommendation for you to buy or sell any security. For information purposes only. Please talk with your advisor about needs, goals, time horizon and risk tolerances.

Click here for this week’s Trade Signals.

Personal Note - 60 and Sunny

"True hopefulness and optimism is what leads one to dare. It is also what lifts one back up to dare again after a failed attempt." - Brian May, Musician

COVID-19 is raging, and states are shutting things down. A very dear friend and his wife just closed their yoga business. It was doing very well… until. There are thousands of stories like theirs. Indeed, this is a very hard time. With love, I told my friend, “Get back up and dare.”

I imagine you are hearing more and more stories about friends who have or recently have had COVID. One of the girls on the soccer team that my wife, Susan, coaches recently recovered from COVID, but lost her grandfather to the disease. Another lost a father and grandfather.

Last night, Susan got a text from the mother of yet another player—both have the virus. The season is on hold. Much of the country is on hold. Many argue it’s no worse than the flu. I see stats that it’s 3x worse but that is not comforting if it’s a loved one. This is all too real and very close to home. Unfortunately, our legislators appear to be on hold as well. Support for many businesses and families is needed. I’m not sure $900 billion is enough. More on that in another post.

The good news is that vaccines are arriving in the near future. Stay strong! Stay well! Ever forward…

The weekend weather is looking promising… 60 and sunny. Golf is planned.

I hope you have something fun planned as well. And if you need to bonding time with the ones you love most, check out The Queen’s Gambit and Schitt’s Creek (it’s a happy pill) on Netflix.

Optimistic and happy! Wishing you a wonderful week!

Subscribe to OMR

Warm regards,

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.