Investors Scammed Out Of More Than $80 Billion In Largest Ponzi Schemes Of All Time

Q3 2020 hedge fund letters, conferences and more

It might be the most un-celebrated centennial you’ve never heard of – the year that the Ponzi Scheme turns 100.

Since the term was ‘coined’ in 1920 when Charles Ponzi defrauded thousands of Americans, billions of dollars have been scammed from innocent people through the fraudulent investment scheme. By promising large returns, the schemer gathers money from new investors to pay old ones, thus creating a cycle of large gains for the main perpetrator.

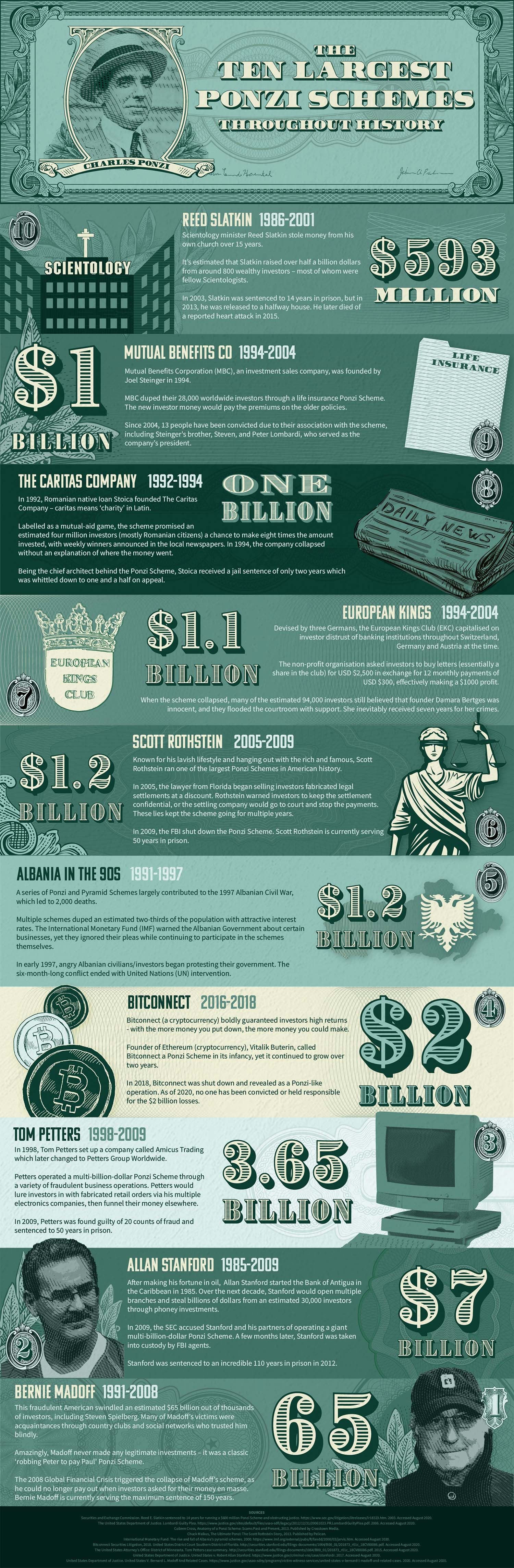

The 10 Largest Ponzi Schemes

To mark the anniversary of the deceptive investment fraud, comparethemarket.com.au created an infographic that counts down the 10 largest Ponzi Schemes by the amount of money scammed.

The largest Ponzi Scheme on the list involves Bernie Madoff swindling $65 billion[1] from thousands of investors, which makes up most of the roughly $80 billion total that was accumulated across all ten of the largest schemes. During the 90s and early 00s, Madoff would accept money from private investors and deposit it into a private bank account. When an investor asked for their money, he would withdraw it from the same account having never made any legitimate investments. Madoff is currently serving a 150-year sentence in a North Carolina prison.

The anniversary comes at a time where people’s fear of Ponzi Schemes is higher than it has been in the past. Following 2018 where statistics indicate the lowest number of Ponzi Schemes in a decade (47 schemes), 2019 saw a sudden surge where figures were the largest within that same decade (60 schemes).[2]

Despite the concerning leap in scheme discoveries, the increased figures may actually suggest an improvement in scheme identification as opposed to an actual rise in schemes themselves.[3] Strong financial markets make it harder for these fraudulent investments to go unnoticed, as was the case prior to the Global Financial Crisis in the late 2000s.

A List Of Warning Signs

In an effort to help consumers identify fraudulent investment schemes, Compare The Market also compiled a list of warning signs that suggest a Ponzi Scheme could be at play.

High return claims, including wording such as ‘guaranteed returns’ and ‘no-risk’ are a red flag. If it seems too good to be true, it likely is.

Consistent positive returns can be a bad sign. It’s natural for investments to fluctuate over time.

Vague details. If the terms of the investment are not crystal clear, it may be worth reconsidering your involvement. Vague information is a common sign of Ponzi Schemes.

Complicated business models are often intentional, so the investor can’t quite figure out the full picture. If you don’t understand the model, then don’t invest in it.

Unregistered investments should be avoided. Ensure any investments you proceed with are registered with government-backed state regulators.

Unlicensed sellers and unregistered companies are another red flag. Take the time to check credentials with the relevant authorities. Many countries have a database of registered and licensed countries where members of the public can check credentials – make the most of such resources.

You can find the list of the top 10 Ponzi Schemes of all time at Compare The Market, where you’ll also learn how Ponzi Schemes work in depth and how to avoid getting caught up in one.

About comparethemarket.com.au

Comparethemarket.com.au is a comparison service that takes the hard work out of shopping around. We make it Simples for Australians to quickly and easily compare and buy insurance, energy, travel and personal finance products from a wide range of providers. Our easy-to-use comparison tool enables consumers to find products that best suit their needs and back pocket.

[1] United States Department of Justice – United States V. Bernard L. Madoff And Related Cases: https://www.justice.gov/usao-sdny/programs/victim-witness-services/united-states-v-bernard-l-madoff-and-related-cases [2] Ponzitracker – Ponzi Schemes Surge In 2019 – Coincidence Or Cause For Concern?: https://www.ponzitracker.com/home/ponzi-schemes-surge-in-2019-anomaly-or-cause-for-alarm#:~:text=According%20to%20Ponzitracker's%20research%2C%2060,%243.245%20billion%20in%20investor%20funds.&text=Collectively%2C%20the%2060%20schemes%20represented,higher%20than%20the%202018%20figure. [3] Ibid.