Is value investing, dead or alive, something for you? There is a plethora of articles and videos attacking value investing, discussing whether it is dead, detrimental, whether people like Buffett should change their strategies and embrace the new ways of investing?

Q3 2020 hedge fund letters, conferences and more

There is one certainty with such content; as Warren Buffett is a declared value investor, if you attack value investing you are sure to get a lot of attention and clicks.

But there are 2 key things most of these articles omit that are crucial for understanding and even just discussing value investing:

- Properly defining value investing is key to understanding it – many fail to grasp what value investing really is. (it is not just taking price to book or price to earnings)

- Then the key question, when you understand what is value investing, is whether value investing is something for you or not? (value investing is what it is, it is a different strategy than most have, so it can’t be dead; it can be for you, or it isn’t for you – it is as simple as that)

My passion is to look for low risk high reward investment opportunities with a long-term business owning like focus. I apply my accounting skills and investing experience in order to find the best businesses to own that offer the possibility to lead me towards my financial goals.

Value Investing Proper Definition - Is Value Investing For You?

Transcript

Value Investing

Good day fellow investors. My name is Sven Carlin. I'm a value investor. And I've even written a book about it, "Modern Value Investing." And I think we are the largest value investing channel on YouTube with more than 100,000 subscribers. And I think it's proper for me to give an answer to the question, what's value investing? Why is value investing struggling? Is value investing dead or not? I'll give an overview in a few slides. What value investing is, the key components of value investing, and those components will give you an answer to the most important questions you need to find an answer. So enjoy this video. Because the key question is, and investing is always personal. It's about you not about theories. It's about what best fits you. Let's start.

Being a Business Owner

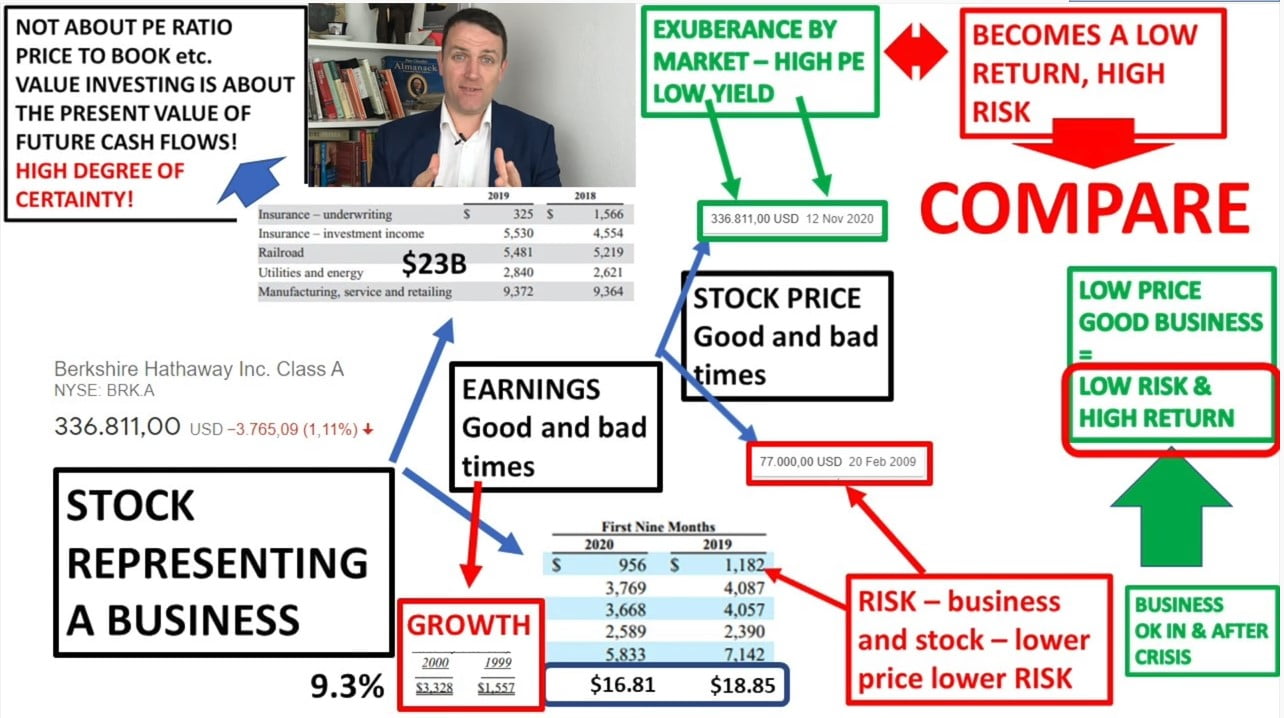

So the first premise of value investing is that the stock is not the stock that goes up and down in price is a stock that represent a business represents the business represents ownership, if you buy a stock of Berkshire Hathaway, for $336,000, you own a part of the company, you are a co-owner with Warren Buffett, Charlie Munger, and many other long term investors. And that's the first thing that I see value investing being different than many other strategies, momentum, this or that stock is going up or down. Value Investing is first and foremost about owning businesses.

Earnings are Key

Then those businesses have earnings, those earnings can be good in good times. For example, 2019, Berkshire made 23 billion in earnings, then 8 billion not reported to stock ownerships. That's about 40 billion. And then the crisis came but still or Berkshire still is making and will likely make 18 to 20 billion in earnings in this year with the stock ownership 20 to 23 billion. So yes, earnings will decline 20%, let's say in a bad year. And then you have to see, okay, I'm owning this company. These are their earnings in a bad year, economies are always cyclical. These are their earnings in a good year. How does that fit me?

Growth is Value

Plus something very important for value investing. In my perspective, perhaps it's more modern value investing or real value investing. I have read Klarman, I have read all the books on value investing out there. And I disagree with the notion that it's price to earnings, it's price to book value, that's not value investing, how the big ones applied it, because then investing also includes growth, growth is an essential part of value. If we look at Berkshires earnings in 2000, so 2000, those were 3.3 billion. We look at Berkshires earnings in 2019. Those were 23 to 30 billion depending how you look on it. But let's take 18 billion, this from 3 billion to 18 billion implies 9.3% earnings growth per year, which is where Berkshires value has been derived where it came from in earnings growth. So when they say growth or value investing, I completely disagree. Growth is an essential part of value investing. And Warren Buffett's success over the last 20 years has been in growing earnings for 9.3%. But there is one big difference between growth investing and value growth investing.

Margin of safety

And that is that value investors look at certainty look at the margin of safety. Berkshire is a financial fortress. So there is a high degree of certainty that it will deliver that as the economy grows, as businesses develop, it will keep growing, you're still going to either know eat grain railroads, you're still going to use energy, Midwest energy. So all those businesses are going to keep growing keep adding earnings keep investing in good projects and with a high degree of certainty. So, you have growth, but based on a high degree of certainty. So growth when it comes to value investor is key, because value investing is not as I said about price earnings price to book ratios is about discounting future cash flows from today, as Buffett says to judgement day at the present value and then you know, okay, this is the value of the company.

Stock Price

Then you compare it to the stock price, which is there in good and bad times. And then you say all right, in this situation, my intrinsic value of the company is way above the stock price, which gives me another margin of safety another certainty that I'll do well that I'm buying great earnings at low cost. And then you are a value investor. Of course, the market doesn't like that. And in very good times, the stock price goes higher or higher and higher to for 346,000. Now for Berkshire, but in bad times it is very, very low. And in 2009, it was 77,000. Those are huge oscillations. And that's something that value investors take advantage of.

Value Investing and Risk

Then the next part is risk. So we want certainty, we want margin of safety, we want good businesses, good earnings, but we also focus and the first thing a value investor should do is focusing on risks, then investing doesn't like risk. And then you look okay, the lower the stock prices do lower is the risk that it will go even lower. If there is low business risk. If the business is a financial fortress, as I said, For Berkshire, it's good, it's strong, then you know, you have something with low risk from a stock perspective, and from a business perspective. And it's also important, okay, if a business can survive a credit crisis, or keep being profitable in a crisis like Berkshire has, and it's not liked by the market, that the stock price is below your intrinsic value, then and we'll come to how you calculate intrinsic value in a second, then you can find with a high degree of certainty, which is the key.

Low Risk High Return

And not risking, like, I don't know, Elon Musk said Tesla, yes, Tesla investors reached great returns. But Tesla, as he said, almost went bankrupt before the production of Model 3. That's not a margin of safety. That's high risk, high growth, but high risk, and it's something that many investors don't do, because we like certainty more. And we like low risk for high returns, not Tesla returns, perhaps somewhere, sometimes it happens. But constantly steady, low risk, good to high returns, and that is what value investing is. And that was make it different than anything else. But it's boring. It's ugly. Sometimes you buy I don't know, railroads like Berkshire, electric energy, or things like that insurance banking, something that it's not hot, it will not go 20x next year, like some other stocks, but that is the core of value investing, low risk, high return.

Intrinsic Value

And of course, the lower the stock price is like Berkshire 240,000 in March 2020. And then you compare that stock price to the intrinsic value. And how do you calculate that intrinsic value? You look at earnings, you look at likely growth, you discount that to the present value, using always the same discount rate. And then you compare I said, March 25, 2020, made a video that expected returns from Berkshire are 10%. And then you look okay, is Berkshire a safe business? Relatively, yes. Am I happy with 10%? Yes, how much? Would I allocate my portfolio into that? And then you simply wait for Berkshire stock to go higher, higher and higher? And yes, in March, Berkshire was a low risk, high return investment. Didn't go up five times. But it went up what is this 40% in 9 months, 8 months, which is a great value investing return because it's based on very low risk.

Risk a Function of Price

And as we value investors are focused on risk, we look at risk from a business perspective, the lowest the business risk, the better but also from a stock price perspective. Berkshire Hathaway went up 40%. Now the stock price is not giving a 10% likely future return, but 6-7 percent, which increases the risk as the high price earnings ratio leads to a lower earnings yield for the same business that it was a year ago, or 8 months ago. And that is also value investing. And then you always are careful because you want again, certainty, you don't want to bet on gold things going higher or higher and higher, slow and steady. When Jeff Bezos asked Warren Buffett, what's his secret? He says, Buffett said, "nobody wants to get rich slowly." That's the best definition of value investing.

Comparing

And then you always compare Berkshire now given 7%. is there something else that's giving more value or will there likely come Something in the future and then you always compare see, and I have discussed also in the last quarterly earnings on Berkshire how the return is lower, so you might want to check that video. And then on value investing, you always focus on the key elements of value investing that are of course owning a business, growth as an essential part of value, focus on risk, looking for low risk high return over time, compare all of that and always looking for a margin of safety. These are the key elements to summarise what is value investing.

Value Investing For You

And then we come to answering the key questions related to value investing. Is value investing dead? What is value investing? And is value investing something that will work for you? Because you either are a value investor, or you are not, if you are, welcome to the channel, if you are not, well, you will find other strategies that might also do very well for you. But it's about what best works for a certain person, not about what's best out there. Because the best out there was Simons with quantitative trading. And we can't all do that, or George Soros or something like that. We have to find what works for us, and then apply that we surely and certainly reach our financial goals with even a margin of safety that we don't bet our future financial lives on some crazy bets that's value investing. And value investing, as we said, in the form of discounting future cash flows, and buying when the price is low compared to the intrinsic value compared to the present value of those future cash flows with a margin of safety.

And the difference between value investor and all other investing strategies is that slowly and steadily, value investing works all the time. Because you'll always find, if you don't find low risk margin of safety investment, you don't do anything. And you're patiently wait for those opportunities to come. And those thanks to the market volatility and exuberance or panic on markets always done. So on answering the question, why value investing is always dead? Well, because there is always something that at that moment better than value investing, and there will always be something better than value investing.

Currently, tech stocks, biotech, all those fancy growth stocks from Beyond Meat, Canopy Growth. 2018 marijuana stocks were winning the field, best investment ever. And there will always be something that beats value investing in the short to medium term. But all those investments are high risk, high reward investments that at some point, turn into very bad investments with permanent capital losses, which is something that we value investors want to avoid at all costs over the long term. So Berkshire didn't beat the S&P 500 over the last, I don't know, 5-7 years. It did over the last 20-30 years. That's why Buffett is Buffett. But I would sign immediately that the s&p 500 makes 20% per year over the next 15 years, real returns and I make 50% I'm okay with that. Because I know that I'll keep doing well no matter what happens after year 15. And that is what value investing is it will always be dead, it will always be second grade to something, but it works. Always. And that's the beauty of it. Because it's margin of safety, low risk, high reward.

And then the key question is are you value investor? Do you want to get rich slowly? If yes, then you are a value investor. If you can watch all those other stocks go up 5-10 times. Some people saying oh, we did great. I don't hear any comments. Oh, I did so great on marijuana stocks. I hear Okay, we did great on other stocks that are hot now. But marijuana stocks 3D stocks were all those who did so great in those stocks in the last decade. And that's something you have to keep in mind over the long term. Yes, some will do great. Great, congratulations. I'm always happy when somebody makes a lot of money. And that's a great investment. But we are boring. We reinvest dividends, and those dividends bring us to our goals. Of course, investing also brings mistakes. I've made mistakes over the last few years that weren't value investments, especially related to YouTube channel to making something cool because when I would make a margin of safety Seth Klarman review video, YouTube would not promote it. And so I went into the hot stuff and things like that, which was a mistake, but I think now foward, I am strictly on the course of value investing because that's worked for me over the last 20 years, and I'm sure that it will work for me over the next 20 years. If you want to come with us on that journey over the next 20 years, value investing journey slow and steady, boring, low risk high return getting rich slowly. Please subscribe. If you have any questions ideas, leave them in the comments below. And I'll see you in the next video.