When you run an equity portfolio which is concentrated in 25-30 common stock selections, there are usually three stocks which stick out as particularly attractive at any given time. It is tempting to cherry pick and buy those outside of our strategy. As of the end of October 2020, there are more than ten of our stocks which appear to be worthy of extra attention and affection.

Q3 2020 hedge fund letters, conferences and more

Tempting To Cherry Pick

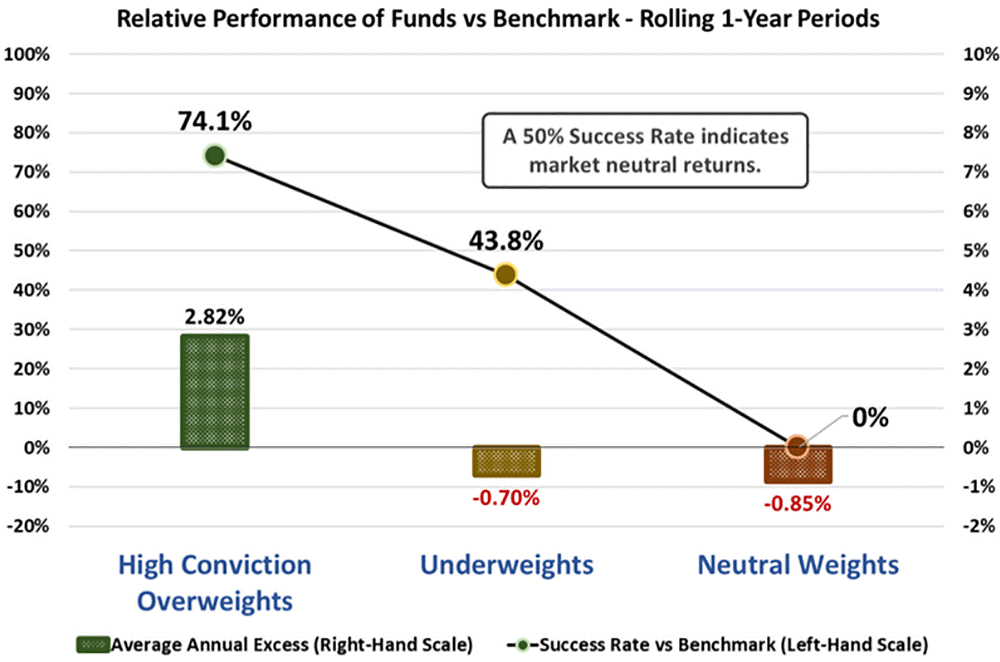

Before we go further, there are a few things to know about us at Smead Capital Management which block any attempt to guess which of our holdings will be the best to own over the coming years. First, we believe in holding our winners to a fault, because all the stocks that go up five-to-ten times the original purchase price had to double and triple in price to make the mark. Therefore, our leading alpha producers are held for a long time. The beauty of the stock market is that if you pay cash, your limit is losing the original investment and the upside of being correct is unlimited. Here is the academic evidence for holding winners:

114 managers with 85bps fees from 2014 to 2019. The performance data presented represents rolling one-year data (daily step), which was evaluated to capture the percent of rolling periods where each sub-portfolio was able to outperform the corresponding benchmark (Success Rate), and the average excess (or negative) relative return.

Second, studies have shown that you get over 90% of the benefit of diversification in the first 20 stocks owned. Thanks to our concentration, winning long-term performers add alpha. Third, our eight criteria for stock selection normally reduces the choices substantially. Lastly, we personally own our stocks side-by-side with our clients via our strategy and don’t do any cherry picking. This brings us to today.

We have rarely seen so many of our 28 holdings look as mouth-watering as they do today. The concentration of capital in today’s vast combinations (Amazon, Google, Facebook, Microsoft, Apple, Netflix, etc.) and over-the-top popularity of finding the next great tech companies, has pigged up all the money. On top of it all has been the voracious appetite to own COVID-19 quarantine beneficiaries. Simultaneously, it has starved value investors of capital, who are trying to buy the most future success for the least amount of money.

Now that we are past the preface, let’s look at some wonderful companies which are deeply out of favor and appear tempting.

Pharma/Biotech

Amgen (AMGN), Merck (MRK) and Pfizer (PFE) look very cheap to us regardless of who wins the White House. The pandemic has reduced doctor visits and prescriptions, but these companies are making very good money until then. Value Line estimates 2021 earnings for AMGN of $17.25 per share, for MRK $6.30 and for PFE $2.90. This means that AMGN trades at 12.50 times forward earnings, MRK 11.89 times and PFE at 12.18 times. This is in a market trading at 19.24 times 2021 earnings. These are superior companies trading at 30-40% discounts to the average S&P 500 Index stock. Did we mention their copious dividend yields?

Oil and Gas

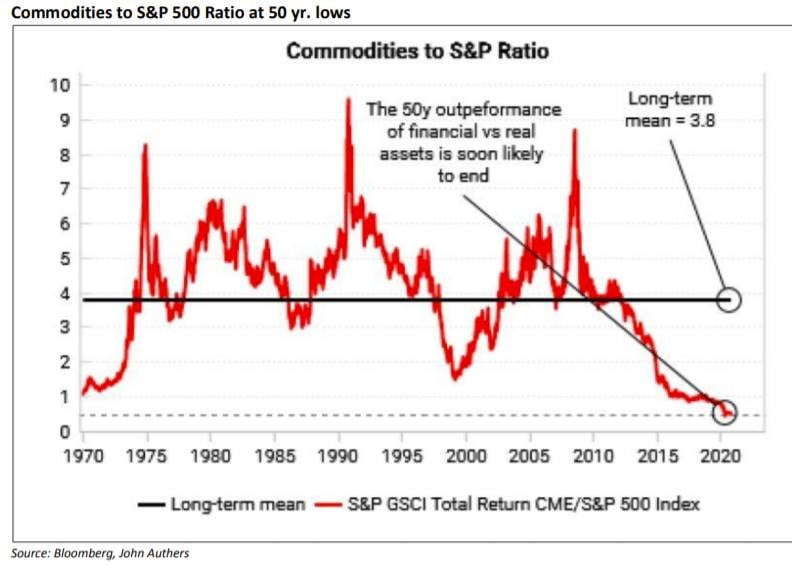

Oil and gas companies are the furthest out of favor they have been since 1999 when oil traded for $11 per barrel. You can buy proven reserves cheaper right now than at any time in my career on the New York Stock Exchange. We like Chevron (CVX) and Continental Resources (CLR). Chevron offers generous dividends while we wait. We are on the lookout for other oil and gas companies which meet our eight criteria.

Real Estate

Physical assets and labor are very undervalued. We like the mall REITs for their very attractive physical property in many of the most popular towns in America. Simon Properties (SPG) and Macerich (MAC) look like they are worth more dead than alive. Did we mention that they pay copious dividends?

Broken Growth Stocks

We own some luscious-looking broken former growth stocks. EBay (EBAY) has been hated everyday we’ve owned it since 2008. It trades for 12 times the Value Line 2021 earnings estimate of $4.00. Discovery Inc. (DISCA) provides the nation’s most popular unscripted television shows across cable and streaming platforms and is the Rodney Dangerfield of media companies (“I don’t get any respect!”). It trades for 9.4 times its 2021 Value Line estimate and is predicted by Value Line to grow earnings at 15% per year going out four years.

Banks

JPMorgan (JPM) and Bank of America (BAC) trade for about 11 times Value Line 2021 estimates for earnings. With COVID-19’s vaccine not yet out of the hopper and interest rates being slow to gravitate back to anything close to historical norms, investors have been wisely avoiding these bank shares. JPM yields 3.67% and BAC provides a 3.04% dividend.

Two of our favorite quotes come from stock pickers, Warren Buffett and Roger Engemann. When interviewed in Forbes in late 1974, Buffett, when eyeing all the bargains said, “I feel like an over-sexed man in a harem.” In 1991, Roger Engemann was quoted in Outstanding Investor Digest saying, “I feel like a one-eyed cat in a fish store!”

Overall, this is representative of how cheap our portfolio looks in comparison to the S&P 500 Index and to growth investing methodologies. It is tempting to cherry pick these ideas, but the history of our strategy is that our ability to write about this many ideas, which stick out as deeply undervalued, has spoken well for our overall portfolio. The last time we had this many stocks stick out like this was 2009-2010. As they say, the rest is history.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management's opinions and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2020 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.