Cosmetics company Revlon’s fate is in Carl Icahn’s hands as it potentially faces bankruptcy if it is unable to restructure its debt. Revlon is pressuring bondholders to tender claims for a third of their face value, according to a press release from the company. Icahn, who owns a significant portion of the makeup company’s debt and could derail the proposed bond exchange, has so far stayed away from the swap. According to reports in the Wall Street Journal, the veteran activist believes the deal doesn’t return enough to the bondholders.

Q3 2020 hedge fund letters, conferences and more

Two Week Ultimatum For Revlon

Revlon has two weeks to complete a $343 million bond swap or otherwise eliminate the notes. If the company fails, it will trigger a $1 billion loan repayment it is unlikely to meet. That would either force Revlon’s owner Ronald Perelman to inject capital into the company or push Revlon into Chapter 11.

Mom and pop investors are also significant holders of Revlon’s bonds, leading the company to create a website urging bondholders to participate in the exchange or risk no repayment at all.

What We'll Be Watching For This Week

- How will AMP react to buyout shop Ares Management’s AU$1.85 per share conditional buyout offer?

- After Institutional Shareholder Services advised Apartment Investment and Management Company (Aimco) shareholders to push for a vote on the company’s planned split, will Glass Lewis follow suit?

- Will MG Capital be awarded board seats at Contura after recent engagement talks between the two?

Activist Shorts Update

Blue Orca placed a short bet on Australian online recruiting company Seek, alleging it is "significantly overvalued" and "dangerously over-levered." The short seller said the stock should trade at AU$7.20, the equivalent of a 69% fall to Wednesday’s close. Blue Orca said Seek’s Chinese recruiting platform Zhaopin, its most important business, is a "fading platform inundated with fake job postings and fake resumes."

The online recruiting platform bit back within days, deeming Blue Orca’s allegations "inaccurate" and "unsubstantiated." Seek noted that fake job postings occur on all platforms and that Blue Orca’s description of the platform being "inundated with zombie resumes and fake job postings," is "greatly exaggerated and misleading."

However, Blue Orca seemed unimpressed by Seek’s response, depicting it as "flimsy" and deeming its compelling evidence as the reason why the company does not want to meaningfully address its report. "Since our report, Zhaopin has removed 64 of the 66 employers on its platforms we identified as likely fake, which we believe is clear validation of our work," the short seller noted.

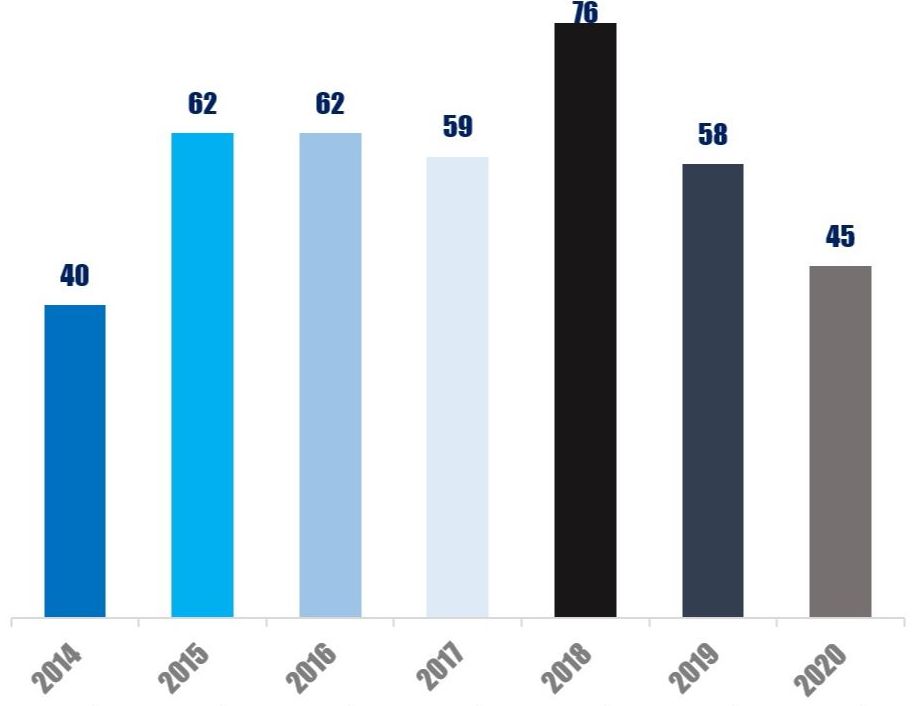

Chart Of The Week

The number of non-U.S.-based companies publicly subjected to U.S.-based activist demands, between January 01 and October 30.