Mercom Capital Group Releases Fact Sheet on Solar Funding and M&A for 1H and Q3 2020

Q3 2020 hedge fund letters, conferences and more

Mercom Capital Group has put together this fact sheet on Solar Funding and M&A activity for 9M and Q3 2020. It contains funding information on the solar sector with quarter-over-quarter comparisons, funding breakdowns by technology, and information on the top deals, top investors, and top acquirers.

Table of Contents

Show

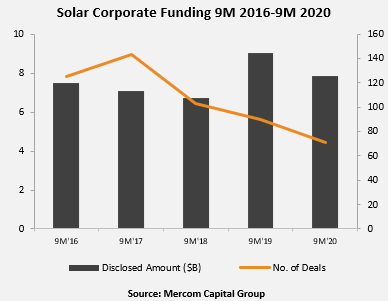

Total Corporate Funding (includes VC funding, debt financing and public market financing)

- Q3 2020 - $3.2 billion in 35 deals

- Q2 2020 - $2.3 billion in 19 deals

- Q1 2020 - $2.3 billion in 17 deals

- Q4 2019 - $2.7 billion in 27 deals

- Q3 2019 - $3 billion in 26 deals

- 9M 2020 - $7.9 billion in 71 deals

- 9M 2019 - $9 billion in 90 deals

- 9M 2018 - $6.7 billion in 103 deals

- 9M 2017 - $7.1 billion in 143 deals

- 9M 2016 - $7.5 billion in 125 deals

VC Funding

- Q3 2020 - $183 million in 15 deals

- Q2 2020 - $65 million in 5 deals

- Q1 2020 - $145 million in 9 deals

- Q4 2019 - $350 million in 13 deals

- Q3 2019 - $208 million in 11 deals

- 9M 2020 - $394 million in 29 deals

- 9M 2019 - $1 billion in 40 deals

- 9M 2018 - $889 million in 49 deals

- 9M 2017 - $985 million in 69 deals

- 9M 2016 - $925 million in 56 deals

Top VC Funded Companies in Q3 2020

- Ecoppia, a provider of automation and robotics solutions for large-scale solar projects, secured a $40 million strategic investment from CIM Group.

- Lumos, a provider of high-quality solar home systems, has secured $35 million in new financing from the U.S. International Development Finance Corporation (DFC), a new agency created by the merger of Overseas Private Investment Corporation and the Development Credit Authority.

- Renewable Properties, a developer and investor of small-scale utility and community solar energy projects throughout the U.S., raised $30 million from funds managed by CarVal Investors, an alternative investment fund manager.

- Technique Solaire, a France based company engaged in the design, development, installation, and operation of solar PV projects, raised $29 million equity financing from its partners Bpifrance and Credit Agricole Group.

Debt Financing

- Q3 2020 - $1.8 billion in 16 deals

- Q2 2020 - $1.5 billion in 9 deals

- Q1 2020 - $2.2 billion in 7 deals

- Q4 2019 - $2 billion in 9 deals

- Q3 2019 - $1.5 billion in 10 deals

- 9M 2020 - $5.4 billion in 32 deals

- 9M 2019 - $5.8 billion in 37 deals

- 9M 2018 - $4 billion in 40 deals

- 9M 2017 - $5.1 billion in 51 deals

- 9M 2016 - $5.4 billion in 55 deals

Public Market Financing

- Q3 2020 - $1.3 billion in 4 deals

- Q2 2020 - $737 million in 5 deals

- Q1 2020 - $22 million in 1 deal

- Q4 2019 - $259 million in 5 deals

- Q3 2019 - $1.3 billion in 5 deals

- 9M 2020 - $2.1 billion in 10 deals

- 9M 2019 - $2.6 billion in 13 deals

- 9M 2018 - $1.8 billion in 14 deals

- 9M 2017 - $1 billion in 23 deals

- 9M 2016 - $1.1 million in 14 deals

Announced Large-Scale Project Funding

- Q3 2020 - $5.6 billion in 52 deals

- Q2 2020 - $4.8 billion in 38 deals

- Q1 2020 - $2.7 billion in 31 deals

- Q4 2019 - $3.1 billion in 32 deals

- Q3 2019 - $4 billion in 44 deals

- 9M 2020 - $13.1 billion in 121 deals

- 9M 2019 - $13 billion in 120 deals

- 9M 2018 - $11.2 billion in 137 deals

- 9M 2017 - $10.2 billion in 118 deals

- 9M 2016 - $6.5 billion in 96 deals

Top Large-Scale Project Funding Deals in Q3 2020 by Dollar Amount

- sPower, a renewable energy Independent Power Producer (IPP), closed $700 million construction/term loan financing for 620 MW Spotsylvania Solar Energy Center in Spotsylvania County, Virginia. HSBC was the sole coordinating lead arranger, while La Caixa, CIBC, National Bank of Canada, Citibank, Societe Generale, Landesbank and Banco de Sabadell were mandated, lead arrangers.

- Mainstream Renewable Power, a developer of wind and solar power projects, completed the financial closure of $620 million in debt funding for the second phase of its wholly-owned and fully-contracted 1.3 GW of Andes Renovables wind and solar generation platform in Chile. A consortium of five banks provided the Senior financing: IDB Invest, KfW IPEX-Bank, DNB, CaixaBank and MUFG, and a sixth bank, Santander, provided a VAT facility.

- Atlantica Sustainable Infrastructure, a sustainable infrastructure company that owns a diversified portfolio of contracted assets in the energy and environment sectors, entered into a non-recourse, project debt financing for approximately $384 million in Helios solar projects with a total installed capacity of 100 MW.

- Sonnedix, an independent solar power producer (IPP), completed non-recourse financing for 13 solar PV projects in Spain, with a total installed capacity of 63 MW, at a value of $378 million. The six lenders' syndicate for the financing included CaixaBank, BNP Paribas, Bankia, Triodos Bank, Abanca and Liberbank.

- Climate ER, a UK based utility-scale renewable energy developer, focused on solar PV and distributed generation assets, secured funding to develop $322 million worth of utility-scale solar projects in the UK.

- Longroad Energy, a US-based renewable energy developer, owner, and operator, received $320 million for the construction of 331 MW Prospero 2 solar project located in Andrews County, Texas. U.S. Bank is the sole tax equity investor in the project. CIT led the construction and term lending group as the Coordinating Lead Arranger. Zions, Rabobank, HSBC, Commerzbank, Siemens Financial Services, and National Australia Bank also participated in the lending group.

Residential/Commercial Solar Project Funds (aka third-party financing/lease/loan)

- Q3 2020 - $400 million in 3 deals

- Q2 2020 - $1 billion in 7 deals

- Q1 2020 - $200 million in 1 deal

- Q4 2019 - No deals

- Q3 2019 - No deals

Corporate M&A Transactions

- Q3 2020 - $6.8 billion in 17 transactions (5 disclosed)

- Q2 2020 - $145 million in 13 transactions (4 disclosed)

- Q1 2020 - $39 million in 12 transactions (2 disclosed)

- Q4 2019 - $6.1 billion in 8 transactions (1 disclosed)

- Q3 2019 - $86 million in 20 transactions (4 disclosed)

- 9M 2020 - $7 billion in 42 transactions (11 disclosed)

- 9M 2019 - $600 million in 57 transactions (10 disclosed)

- 9M 2018 - $16 billion in 64 transactions (16 disclosed)

- 9M 2017 - $5.6 billion in 59 transactions (20 disclosed)

- 9M 2016 - $368 million in 48 transactions (10 disclosed)

Top Disclosed M&A Transaction in Q3 2020

- Sunrun, a provider of residential solar, battery storage and energy services, entered into an agreement to acquire Vivint Solar, a full-service residential solar provider in the U.S., in an all-stock transaction for $3.2 billion.

- Royal DSM, a Netherlands-based multinational corporation, reached an agreement to sell its Resins & Functional Materials and associated business, to Covestro for an equity value of $1886 million. The transaction includes all of its Resins & Functional Material businesses, including DSM Niaga, DSM Additive Manufacturing, and the coating activities of DSM Advanced Solar.

- Orix Corporation, a Japan-based financial services group, has signed a framework agreement with renewable energy project developer Greenko Energy, to acquire approximately 20% of its shares. Orix said that it would acquire over 20% of Greenko’s shares at a total value of around $980 million.

- DuPont has divested its trichlorosilane (TCS) business, the primary raw material used in producing the ultra-pure polysilicon HSC supplies to the semiconductor and solar industries, and its equity interest in the Hemlock Semiconductor joint venture to Hemlock for $725 million.

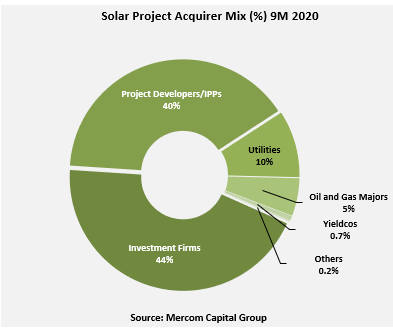

Announced Large-Scale Project Acquisitions

- Q3 2020 - $1.9 billion in 57 transactions

- Q2 2020 - $325 million in 36 transactions

- Q1 2020 - $4.1 billion in 55 transactions

- Q4 2019 - $314 million in 52 transactions

- Q3 2019 - $955 million in 35 transactions

- 9M 2020 - $6.3 billion in 148 transactions

- 9M 2019 - $3.7 billion in 140 transactions

- 9M 2018 - $6.6 billion in 166 transactions

- 9M 2017 - $4.6 billion in 161 transactions

- 9M 2016 - $4.4 billion in 146 transactions

Disclosed Acquisitions by Dollar Amount in Q3 2020

- Vortex Energy, a global renewable energy platform managed by Beaufort Investments, a subsidiary of the private equity arm of EFG Hermes, completed the sale of its controlling and managing stake in Vortex Solar (Vortex III), a 365 MW solar PV portfolio, to TNB International, a wholly-owned subsidiary of Tenaga Nasional Berhad (TNB) at an enterprise value of $647 million.

- UK-based investor Actis completed the acquisition of two solar projects with a total capacity of 400 MW from ACME Solar. The deal is expected to be valued at nearly $334 million. The projects have been acquired by Actis Lifelong Infrastructure Fund (ALLIF) and are located in the states of Andhra Pradesh and Madhya Pradesh, India.

- UK-based privately owned investment group United Green agreed to acquire a majority stake in a 300 MW Rodds Bay solar project from Australian renewable energy project developer Renew Estate. The overall investment in the project is expected to be $243 million.

- RattanIndia Group sold its entire 306 MW solar portfolio to infrastructure investment fund Global Infrastructure Partners (GIP) for a consideration of $223 million.

- Bluefield Solar Income Fund, an investment company focusing on large-scale agricultural and industrial solar assets, acquired a UK-based portfolio of 15 operational solar PV projects with a total installed capacity of 64.2 MW for an initial cash consideration $140 million.

- Amplus, the Indian arm of Petronas (Petroliam Nasional Bhd), a Malaysian government-owned oil and gas company, acquired 100 MW of solar project from ACME Solar at $109 million.