Crescat Capital‘s research letter for the month of November, titled, “A Vicious Debt Spiral.”

Q3 2020 hedge fund letters, conferences and more

The structure of the global economy today is built on the incessant yet tenuous reliance on monetary and fiscal stimulus. To put it bluntly, policy makers are in a pickle. In accommodating struggling enterprises at large by piling new debt onto them, they have traded off future organic growth for economic zombification. At the same time, their persistent monetary easing to prolong the expansion of the business cycle has led to historic imbalances in valuations that pose serious destabilizing risks. But leverage and multiples cannot grow to the sky forever. The days of risk parity strategies where investors pile into levered long bond portfolios alongside broad equity portfolios are numbered.

There is an entire disruptor asset class that spoils the risk parity party. Gold is the great mitigator, the monetary metal that for centuries has been the antidote to the poison of ever-growing debt and fiat money. In 2020, central bank asset growth has inflected upward to surpass the $28 trillion mark.

The Great Disconnect

Artificially low interest rates are needed to sustain debt extremes, but they also encourage speculation. Today, we have a universe of overvalued assets in the US financial market. Overhyped markets are typical of a late-cycle mindset. Corporate earnings and the economy have already turned down, but stock prices at large have been diverging higher due to faith in monetary stimulus. Those who believe central banks have the ability to levitate risky financial assets ever higher are, in our view, playing a dangerous game.

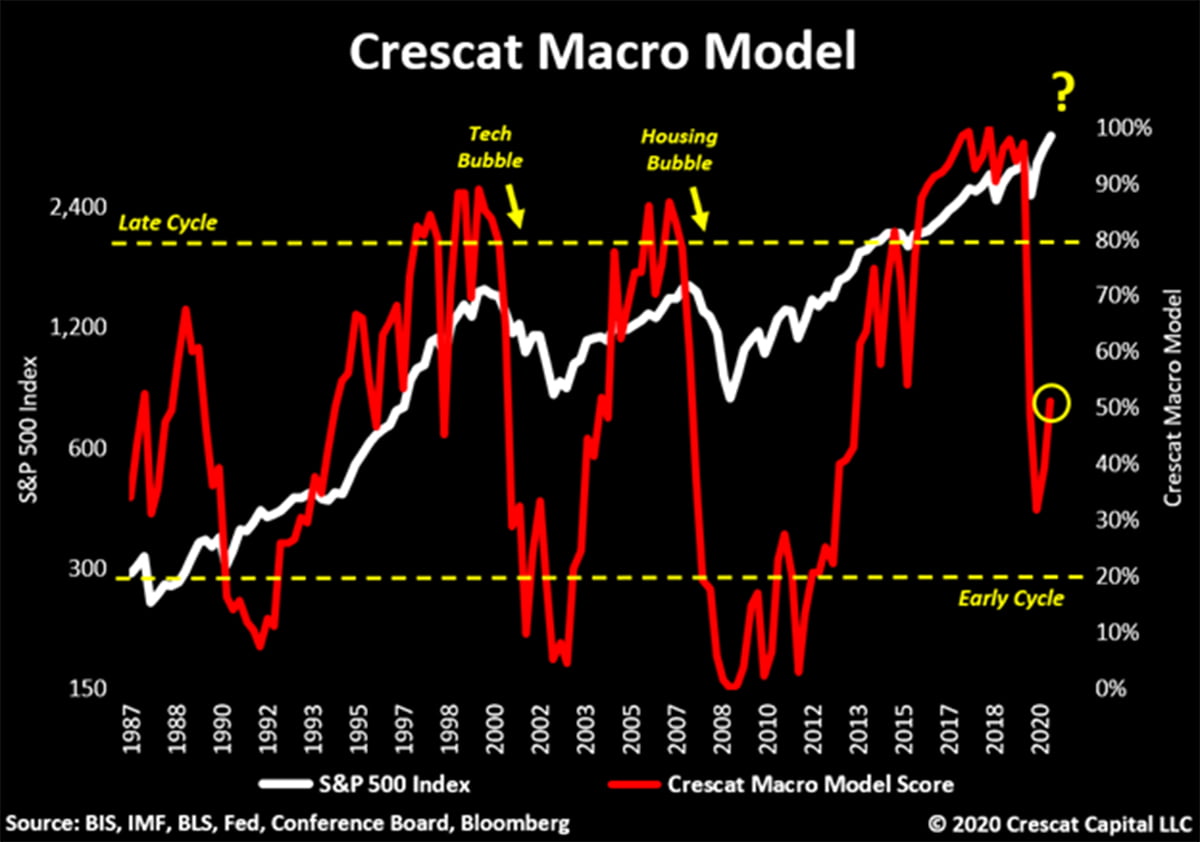

Crescat’s 16-factor macro model helps us identify what stage of the business cycle we are in as it naturally swings between expansion and contraction tied to swings in asset valuations and credit availability. Our recently plunging macro model score from an extreme is signaling a major disconnect with current stock prices warning of much further downside ahead for equities before we can have confidence to say that we have seen the worst of the current recession and are set up for a new bull market and economic expansion.

The Sheer Magnitude of the Valuation Imbalance Today

The US equity market has never been so expensive relative to underlying fundamentals. Crescat’s 15-factor valuation model is at record levels with 11 out of 15 fundamental metrics in the 100th percentile historically.

The Low Rates Fallacy

In the US, the market value of both stocks and bonds are detached from the present value of their underlying cash flows. Investors appear to be confusing the risk-free rate of interest (the one managed by central banks) with the much higher required rate of return that they should be discounting future cash flows by. The latter is not the US Treasury rate but a higher one which takes risk into consideration. It is common for market pundits today to claim that low interest rates justify current high valuations. But today’s low interest rate economy is anything but low risk. It is marked by high debt and low growth. If we consider a discounted free cash flow valuation model, the key factors that matter are discount and growth rate. The fact is, we have record high levels of corporate debt to GDP which both elevates the discount rate and constricts growth.

Below are four different valuation metrics using median S&P 500 company data. Here we show empirically that today’s stock market multiples are the most extreme relative to interest rates in the last 25 years, significantly higher than during the tech bubble. While the regression lines show that a lower risk-free rate has in fact justified a higher multiple on average, it also shows that today’s multiples are at an extreme high relative to the mean for today’s rate. We believe a fair market multiple today is below the regression line not above it. In our view, stock prices have extraordinary downside risk today.

Large, Medium & Small Cap Stocks Record Overvalued

The broader equity market is also absurdly expensive. The aggregate P/E ratio for the Russell 3000 index is now higher than the tech bubble. One significant difference from prior peaks is the severity of the economic downturn that is unmatched by equity prices. For the first time in history, corporate earnings have been declining while stock prices have been elevating near all-time highs. We believe the stock price levitation is unsustainable while the weak corporate earnings environment is likely to persist.

EV to Free Cash Flow

Perhaps more than any other fundamental indicator, enterprise value compared to free cash flow illustrates the extreme valuation risks in today’s stock and corporate bond markets. In this case, we normalize cash flow by its three year average margin.

Dismal Capital Spending, a Drag on Economic Activity

The lack of capital spending by US corporations should continue to be a drag on economic activity. CAPEX estimates for the S&P 500 companies are now down 16% on a year over year basis, which only represents an improvement of 2.5% from their recent lows. As the virus keeps spreading, one would wonder how much monetary and fiscal stimulus would be necessary to restore growth.

Tech Bubble 2.0

In an economic environment of low to negative yields, investors have been crowding into high-flying tech stocks. These are perceived to be the only parts of the economy still growing fundamentally. The issue, however, is on the valuation side. We believe these companies are being priced for perfection. For those who claim that today’s price imbalances are not comparable with the excessive number of unprofitable business we had during the tech bubble, we urge you to dig a little deeper. On a median basis, rather than market weighted measurements, earnings yield for the tech sector is now almost as low as it was in March 2000.

In aggregate, the tech sector now represents 42% of the US economy. That is 26% higher than it was at the peak of the tech bubble in March 2000.

Gold & Silver Miners Turn Over a New Leaf

One of the few areas of the equity market that is meaningfully improving fundamentally is the precious metals mining industry. With gold & silver prices at their current levels, these companies are set to massively expand their margins. This is indeed a new phenomenon for the miners. After 25 years of constantly losing money and regrettably creating a long-standing reputation of being capital destroyers, this industry is becoming one of the most disciplined and profitable businesses in the global economy today. In fact, the median stock among top 50 largest gold & silver miners has had five straight quarters of positive free cash flow for the first time in the last three decades. We believe this is only the beginning. These stocks are becoming new cash flow machines with the strong support of precious metals prices moving higher. Gold & silver mining companies are the real beneficiaries of today’s macro environment with strong balance sheets, high growth, and still incredible undervaluation.

Risk Parity Exhaustion

Among all the demand drivers for gold, we view the lack of competing cheap assets being a major one. For the first time in history, junk bonds and stocks are record overvalued in tandem. We have only seen the exact opposite of this. That was in the Global Financial Crisis when US equities and corporate bonds both hit rock bottom. This time, we are on the other side of the coin. Both sides of the so-called risk parity strategy, stocks and bonds, are at extreme valuations. In a world of near zero to negative yields and frothy valuations across almost every risky asset, it will become imperative for investors to seek out undervalued assets that are true beneficiaries of the current macro environment. In our view, precious metals are poised to become the new core must-have asset for capital allocators. Gold & silver are risk-off alternatives to bonds in the portfolios of prudently minded investors in today’s market. At the same time, attractively priced, high-growth gold and silver mining companies serve to ignite the animal spirits of traders and investors looking for a risk-on alternative to overvalued, low-growth stocks at large.

After 2011, the gold to risk parity ratio went through a precipitous downward trend that began to reverse in the fourth quarter of 2018. This ratio seems to have formed a double bottom and now, in our view, is poised to move significantly higher. We believe that in the next years investors will trade historically overvalued stocks and bonds for cheap macro assets such as precious metals.

US Fiscal Disorder

Even though most macro indicators have somewhat rebounded since the pandemic lows, the US fiscal deficit has done nothing but deteriorate further. The imbalance just reached its worst level in the last 70 years.

The swift fiscal response to Covid-19 has resulted in a global debt surge of $15 trillion since 2019 to $272 trillion through Q3 2020 based on IMF and BIS data. According to the Institute for International Finance, worldwide borrowing is on pace to hit $277 trillion by the end of 2020, a historic high 365% of world GDP. Just from the US government side, it took $4T of debt to get economic activity back to the worst levels of the great recession. This goes to show how macro conditions are still unbelievably depressed.

Gold Is Set to Replace Treasuries

Precious metals are likely to become a key alternative asset class to replace US Treasuries that are now yielding negative in real terms. Long decades of lack of fiscal and monetary discipline will, in our view, lead to a big shift in the way investors view gold & silver. For centuries, monetary metals have served as a perfect hedge for the constant devaluation of fiat currencies worldwide. In today’s macro scenario, these commodities have potential to massively outperform fixed income instruments. Meanwhile, the precious metals to US Treasuries ratio is still near all-time lows. We think gold & silver will gain significant market share from sovereign assets in the following years.

Monetary Dilution Has Created a Historic Opportunity for Undervalued Hard Assets

In such a fragile global economy, extreme monetary dilution becomes unavoidable. It’s bizarrely opportunistic, however, the fact that tangible assets have massively underperformed, particularly in the last year. The commodities to GDP ratio just reached a 60-year low! We view this as the best set up for hard assets in history. Monetary metals are poised to continue leading the way.

US banks lend now more to the government than to businesses or households. These financial institutions are now holding a record of $993B larger than commercial and industrial loans. The debt overhang is impacting the fluidity of stimulative policies like never before. Monetary debasement is the only way out. The cyclicality of the chart below shows how the political response for each prior recession became progressively bigger. It forced the banks to let go of an increasingly larger part of their business to fund the government. This time, however, they have taken it to a whole new level.

Debt Monetization

As noted in our prior letter, the Fed is already becoming the buyer of last resort of government debt. Foreign investors own the lowest percentage of marketable Treasuries in 20 years. In the meantime, the Fed continues to pick up the slack by significantly increasing its ownership of government securities, particularly this year. This trend appears irreversible. It all points back to gold.

The Second Wave

There is another major wave underway. That’s the second leg up in the Fed’s balance sheet expansion. By the end of 2021 about $8.5 trillion of US Treasuries will be maturing. The government is far from a position to clean up its balance sheet and, instead, it will likely be forced to roll out and re-issue a tsunami of government debt in the next 12 months. If foreign investors continue to progressively reduce their participation in this market, this development almost reassures the need for further monetary dilution to fund these Treasury purchases. Therefore, we believe the Fed’s balance sheet will increase again and provide further support for precious metals.

Negative Carry

Global negative yielding bonds are again breaking out. These instruments are now worth in aggregate a record of $17.5 trillion. From a portfolio management perspective, sovereign bonds now have a negative carry and, as a result, the risks for holding these fixed income assets is massively skewed to the upside. We expect that large capital allocators will be forced to seek other investment alternatives that offer larger appreciation potential. Gold, given its long history of serving as a resilient hedge against monetary debasement, will likely become a key macro asset for investors.

It All Leads to Gold

Central bank assets are the primary macro driver of gold prices. Measuring the level of monetary dilution worldwide is one way to value precious metals. These are moving targets as central banks expand or contract their balance sheets over time. Ultimately, we believe QE will drive flows out of overvalued stocks and fixed income securities and into precious metals. We are still early in the game.

The gold-to-silver ratio is starting to break down again. This is exactly the leadership one would expect in a healthy bull market for precious metals. We have seen this move twice this year and this could be signaling another significant upward move in precious metals ahead.

Performance of Crescat Strategies

Crescat’s strategies have performed well year to date across the firm. We believe there is much more to play out across our tactical themes we have laid out herein through year end and over the next year.

Sincerely,

Kevin C. Smith, CFA

Founder & CIO

Tavi Costa

Partner & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

Cassie Fischer

Client Service Associate

Linda Carleu Smith, CPA

Partner & COO

© 2020 Crescat Capital LLC