Today, Symmetry Invest participated in Contrarian Investing Talks where they shared their view on Gaming Innovation Group (GIG).

Q3 2020 hedge fund letters, conferences and more

Underappreciated turn around - Gaming Innovation Group the cheapest stock in the Nordics?

- Gaming Innovation Group has undergone an impressive turnaround that has not been appreciated by the market.

- The company is strongly positioned in a highly attractive niche helping landbased casinos moving online. An asset-light structural growth business.

- GIG is valued at a fraction of their listed competitors due to prior mismanagement. As the new management has executed and completed their turn-around, we don’t see any reason for this big discount to continue.

- The new board of directors and management team has one target - to create shareholder value and have shown several times that they are willing to make hard decisions.

- If the market doesn’t close this huge valuation gap by itself, we think the board will initiate a structured sales process that would deliver a return of several times the current market cap. The M&A landscape in the industry is hot.

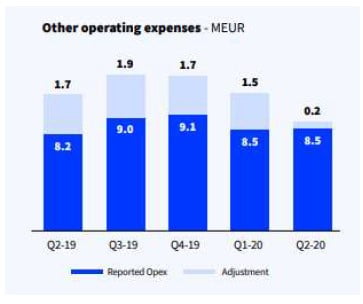

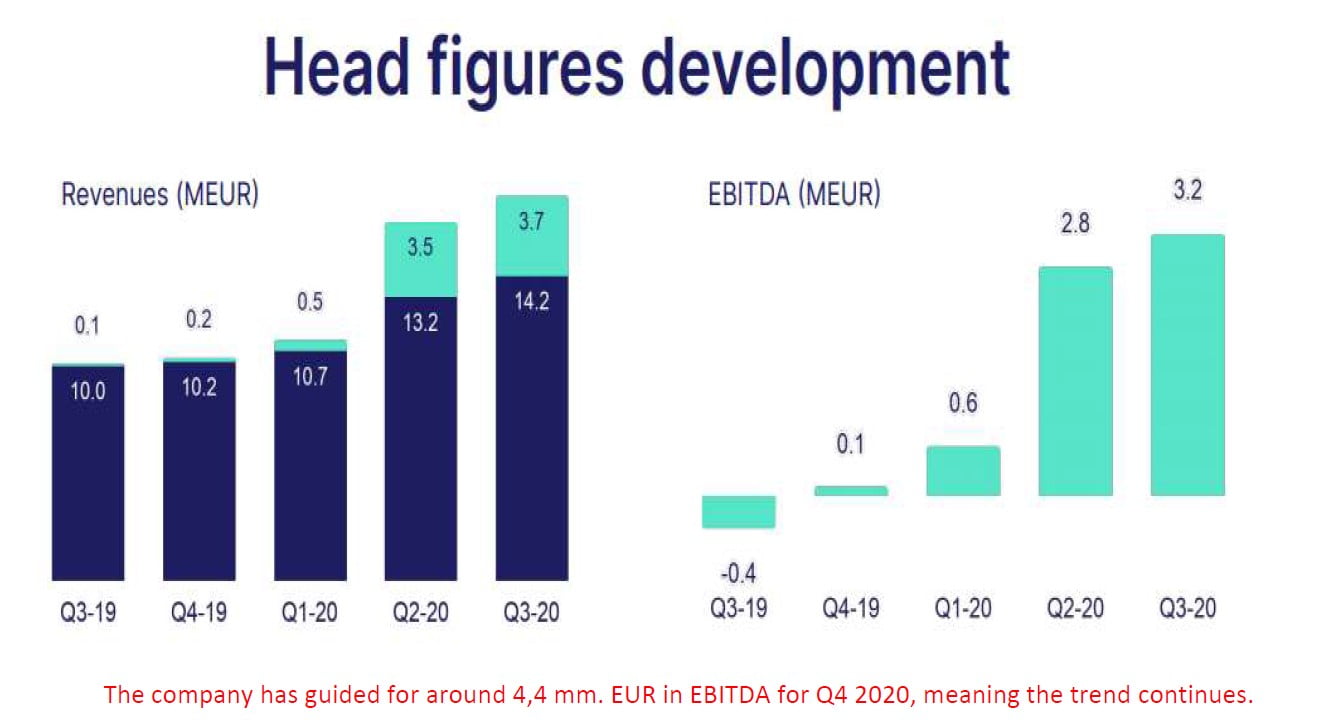

- Even though the reported numbers (below) show the impressive turn around the best is yet to come. A significant pipeline of signed operators is yet to go live and GIG just partnered with one of the biggest data providers in the world for their Sportsbook efforts.

We think the recent turnaround in Gaming Innovation Group is truly remarkable and extremely underappreciated. What Richard Brown has achieved in just 12 months since he became full time CEO is impressive and he has set the company up for great success going forward.

Because of some one-offs, selling pressure from old shareholders, and the bad history of the former management, the turnaround has been underappreciated. This has made Gaming Innovation Group the cheapest stock on the whole Scandinavian stock exchange based on the FCF yield on 2021 and 2022 earnings. The stock is valued as if bankruptcy was imminent, even though it’s an asset-light business with low debt levels and a clear path for double growth in FCF going forward.

In just 14 months since Richard Brown became the CEO in September 2019 he has:

1) Closed down the lossmaking Games studio

2) Reinvested money back into the Media business and turned it into a growth story again

3) Sold the B2C unit and repaid most of the debt and restored the balance sheet

4) Aligned the cost structure and company culture around new goals

5) Reorganized the loss-making Sports segment into a promising new Joint Venture

6) Completed heavy Tech development and product launches on the platform

7) Phased out the old risky white-label business

8) Signed a significant amount of new platform deals with good future potential

Based on our estimates, GIG currently trades at only 4,4 and 2,5 times FCF for 2021 and 2022. This implies a free cash flow yield of 23 - 39 %. This despite the fact that the company should be able to grow FCF at least at high single-digit rates for the foreseeable future Based on the annualized run-rate on the Q4 2020 guidance and the huge pipeline of signed deals, we think those targets are achievable

Why believe? Our iGaming track record?

We believe we have one of the best track records investing in iGaming stocks.

To invest successfully in iGaming, not only do you need to be able to find the long-term winners but also be able to constantly adapt to changing environments. We made a lot of money early on in Bet-at-home and XL media when they benefitted from expanding online penetration in their countries. We benefitted from GAN due to the listing change from AIM to Nasdaq and around Catena Medias fundraise. We have also had our finger on the pulse and exited our positions when the thesis changed. When we lost confidence in prior management in XLM and GIG we quickly sold shares which saved us a lot of money when the shares subsequently depreciated.

We have also been good at riding long-term winners like Kambi and EVO as they benefit from structural changes.

Why have we been able to deliver such a strong track record?

1) We have been following the industry for a long time and built deep connections with clever people who understand trends there

2) Symmetry Invest A/S is seeded by the founders of Better Collective A/S who have great knowledge about the space

3) Our portfolio manager Henrik Abrahamsson has worked in the industry for +10 years in different positions.

History of GIG:

Most companies in the iGaming sector are either affiliate businesses, operators, game suppliers, odds suppliers, or technology providers. In 2015 GIG went public intending to collapse the value chain in iGaming by taking all services in-house. The strategy made sense on paper but came with a huge execution risk. GIG grew a lot between 2015 and 2017 through vertical expansion, organic growth, and M&A. Everything looked good.

But with increased regulatory pressure, especially in Sweden and the UK, and a huge lack of focus and execution the results turned downwards. Different verticals lacked the scale and focus they needed to be finished and become competitive, and instead of having synergies between segments, it became a distraction.

During this period, the company took on a big amount of debt for M&A. It also took money from cash flow generative segments and threw it into loss-making venture investments. As the segments with positive cash flow were starved for reinvestments their results also started to decline.

The stock price went from 60 NOK at its high to 3 NOK at its low and is today trading around 7,5 NOK. A shadow of its former self despite competitors in the industry setting new highs day after day.

The rescue:

In December 2018 a new board of directors was elected with former Unibet CEO Petter Nylander as the new chairman. The company initiated a strategic review of the business. The conclusion was that:

1) The company lacked focus

2) The debt was too high

3) The cost base was too high

In September 2019 the board took the hard decision to fire the founder and CEO Robin Reed. The board instead hired the former COO Richard Brown as the new CEO.

Richard was previously in charge of the Media department, the only profitable segment in the group at the time. In 2017 he was promoted to group COO where he also took charge of the B2C vertical. He quickly turned that around and made it profitable. When becoming the CEO in September 2019 he took charge of all segments with a mandate from the board to “clean up the company” and to focus on the segments where the company had a good strategic position.

Richard quickly went to work and over the last 14 months he has done an impressive job:

1) Closure of Gaming studio

Gaming Innovation Group had previously invested money in building their own in-house games studio developing slot games. The strategy made sense. By creating their own games GIG could distribute those to their own brands and B2B partners and in this way taking a larger share of the pie.

The problem is that it’s not easy to create good slot games and Gaming Innovation Group had big and focused competitors with much higher R&D budgets. At the same time, good game developers want to work for innovative startups or big companies with unlimited resources. They don’t want to work for a small game department inside a big “conglomerate”. The games GIG developed never got traction and the cost to keep it going was too high. Only a few weeks into the position, Richard quickly decided to close the loss-making studio.

Gaming Innovation Group would then focus on integrating their first-class platform with the best game developers in the world, such as. NetEnt and Evolution Gaming.

2) Reinvesting money back into the Media business

From 2015 to 2017 the media division, Gaming Innovation Group Media, was growing fast with high profits and cash flow, stemming both from organic growth and M&A. This was not unique to GIG, but was occurring all around the industry. Under the old CEO, GIG Media was mostly squeezing money out of mature Scandinavian and UK markets while using the money in other loss-making parts of the company. As the former person in charge of the Media division, Richard immediately understood the need of reinvesting the money into growing the Media division. He quickly hired new persons, changed the structure, invested in technology, and started to diversify the division away from mature Scandinavian markets into higher-growth markets.

After stagnating revenue in 2018 and declining revenue in 2019, this has started to pay off in 2020. The Media division is now setting new highs in revenue and profits and growing fast again with good future growth prospects ahead.

3) Sold the B2C unit to restore balance sheet

Another focus area for the company was to become a focused B2B player and move out of the B2C business. The B2C business has different characteristics than B2B as it has lower margins and more regulatory issues. At the same time, the company had a hard time selling its B2B products as the customers didn’t like that Gaming Innovation Group was competing with them on their own B2C solution.

After only 5 months in the job Richard managed to sell the B2C brands to Betsson:

https://www.gig.com/news/gaming-innovation-group-divesting-its-b2c-vertical-to-betsson-group/

The cash consideration was slightly lower than what I had hoped for, but GIG was stuck between a rock and hard place here, as all potential buyers knew GIG wanted to get rid of the assets and had a debt maturity coming up. Despite the slightly low cash consideration Richard managed to sign Betsson on a long-term platform deal strengthening the B2B business going forward.

After the completion of the sale in April 2020, GIG paid down their outstanding bond which significantly improved the debt situation as the remaining amount is due 2022.

4) Aligned the cost structure and culture

GIG was always known as a company with a quite lavish cost structure, related to their efforts in employing a “Silicon Valley” mentality.

Here is an example of the new 2017 headquarter with private chefs, baristas, etc.

The company throwing expensive parties with Steve Wozniak as a guest speaker:

This strategy seemed perfect in an environment with endless opportunities and a fight to attract talent. But the company never got the culture to be about executing on their goals, signing deals, and keeping development programs on budget and on time.

Richard quickly went to work to change the cost structure to the future need of the company:

Read the full report here.