Crescat Capital performance update for the month ended October 31, 2020, discussing financial asset bubbles.

Q3 2020 hedge fund letters, conferences and more

Dear Investors:

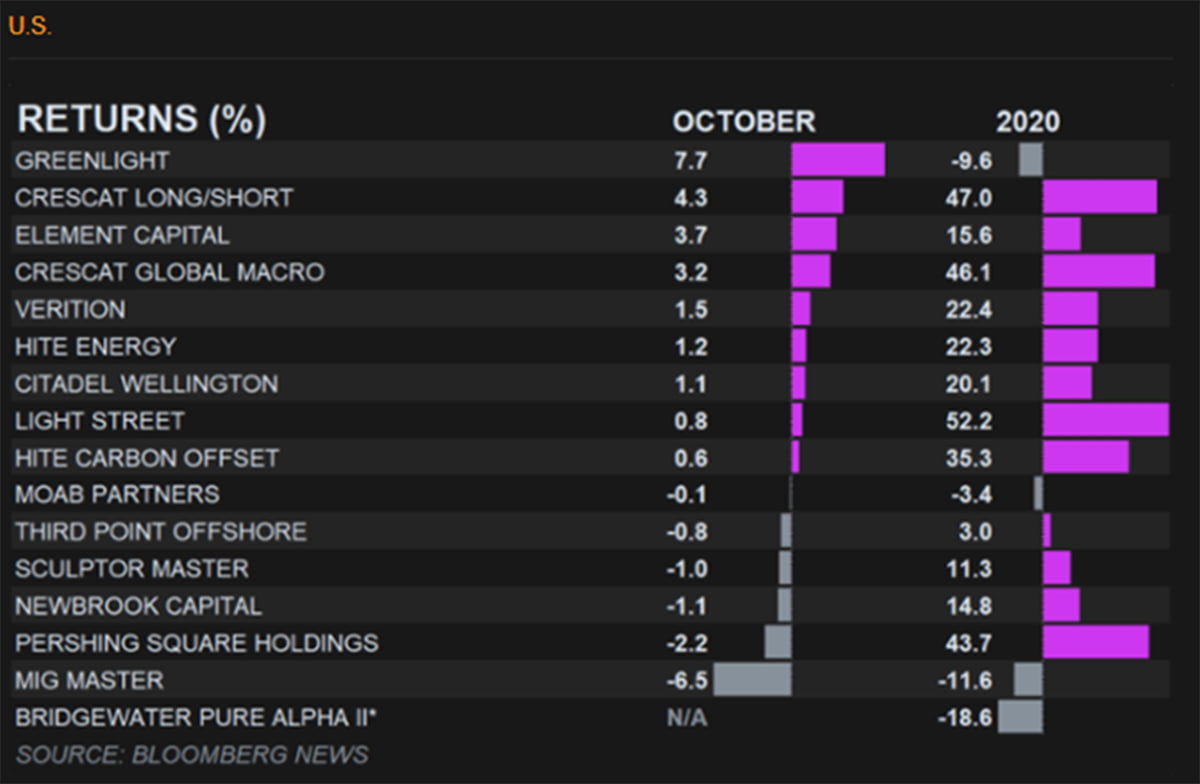

Crescat’s three hedge funds surged in October to maintain their year-to-date performance leadership within the universe of managers. The S&P 500 declined 2.4% in the same month as US election day neared. All five of the firm’s investment strategies substantially outperformed their benchmarks net of fees in 2020 and since inception. Collectively, the Crescat strategies encompass three business cycles going back to 1999, including the same number of recessions.

Getting The Macro Right

Crescat is a tactically oriented global macro asset management firm. Our mission is to grow and protect client wealth over the long term. Our goal is industry leading absolute and risk-adjusted returns over complete business cycles. The firm’s edge is its ability to develop and profit from investment themes that arise from our proprietary, value-driven equity and macro models. At Crescat, it is not just about getting the macro right. It is also about getting the security selection correct within our thematic buckets. We believe this is what differentiates Crescat substantially from other macro managers in our ability to generate high risk-adjusted returns over time.

As value-oriented investors with an exclusive like-minded client base, we are confident that the intrinsic worth of our portfolios is always substantially greater than their market price at any point in time. Conviction in our approach and alignment with our investors gives Crescat fortitude to embrace a moderate amount of risk to pursue strong benchmark-beating returns and unlock the true value presented by our models and themes.

Today, Crescat is a strong proponent of the hedged return stream that can be delivered by combining two key thematic buckets: buying undervalued precious metals mining companies while shorting a portfolio of excessively over-valued equities across multiple industries. These two themes are prominent in both our global macro and long/short funds today and have been working phenomenally well this year. In March, the two Crescat funds capitalized on the short side of the portfolio to deliver strong absolute returns while many of our peers faltered. Since that time, gold and silver mining stocks have been the leading industry group in the market to drive all Crescat’s strategies to new high-water marks. Through both the downturn and the runup in stocks at large this year, the combination of these two themes has propelled Crescat’s global macro and long/short funds to the top of the Bloomberg Brief table for monthly and year to date performance. Our activist precious metals fund that we launched in August could arguably be at the top of this table, up 90.3%, but it only has a three month history instead of a full 10-month year to date for comparison purposes.

With global debt to GDP as stretched as it has ever been, sovereign bonds, investment grade credit, and junk bonds collectively are the most over-valued in history in tandem with stocks.

With global debt to GDP as stretched as it has ever been, sovereign bonds, investment grade credit, and junk bonds collectively are the most over-valued in history in tandem with stocks.

Highest Financial Asset Bubbles Ever

The Federal Reserve and fiscal powers may appear for now to have come to the rescue during the Covid-19 recession, but they have only upped the ante on the imbalances and risks they have allowed to build in the first place. In this context, low interest rates equate to anything but low risk. From a valuation standpoint, in our analysis, the risks presented by US financial asset bubbles today are the highest they have ever been.

For long-oriented investors, the good news is that it is perhaps one of the greatest setups ever for precious metals, the forgotten asset class of the last decade. Gold is the one cheap asset that truly benefits from artificially manufactured low interest rates. We expect gold will increasingly become the new high demand asset for discerning allocators given its low correlation, undervaluation, and high absolute return potential compared to overvalued and overcrowded stocks and bonds at large. “Buy gold and sell stocks” is Crescat’s macro mantra today.

In an environment where many believe “the Fed has got your back”, it is not surprising to frequently hear that “valuation doesn’t matter” anymore. Years of easy monetary policy have led to the popularity of strategies like “risk parity” where bloated hedge funds and institutional investors crowd into leveraged long bond portfolios alongside record over-valued stock portfolios. We also get aberrations like short volatility strategies designed to manufacture yield in an ultra-low interest rate and perceived ever-lower risk environment. Such strategies are popular for the apparent steady return steams. Never mind their highly probable, ultimately inevitable, asymmetric total destruction like we caught a brief glimpse of in early 2018 during Volmageddon. Beyond index funds, another concern is hedge fund whales and Robinhood traders alike crowding into an over-abundance of large cap momentum disruptor stocks, largely in the tech sector, at ungodly multiples of sales, all disrupting each other’s profit margins and future revenue growth, most without any clear sustainable competitive advantage.

Here is the bottom line. Easy money creates financial asset bubbles. Bubbles burst. Such is the business cycle. Manias do not last. They lead to financial crises. There is one almost certainly in the making today. When there is very little value to be found on the long side of the market, there is much opportunity on the short side. We are determined to capitalize on it.

Please reach out to a Client Service Specialist, Marek Iwahashi at [email protected], or Cassie Fischer at [email protected], with questions or investment inquiries. We would like to thank you for your continued trust in Crescat Capital at this time and are looking forward to finishing out the year strong.

Sincerely,

Crescat Capital LLC

Kevin C. Smith, CFA

Founder & CIO

Tavi Costa

Partner & Portfolio Manager

For more information including how to invest, please contact a client service specialist:

Marek Iwahashi

303-271-9997

or

Cassie Fischer

303-350-4000

Linda Carleu Smith, CPA

Partner & COO

(303) 228-7371

© 2020 Crescat Capital LLC