Whitney Tilson’s email to investors discussing Tesla surges to near-record high on mysterious new investor buying big; when Tesla joins the S&P 500, you know it’s game over; Elon Musk’s Twitter exchange with a Harvard Doctor re. rapid testing; Tesla sales in Germany.

Q3 2020 hedge fund letters, conferences and more

1) What a sign of the times… There is less than ZERO chance Buffett or his two investing successors, Todd Combs or Ted Weschler, are buying TSLA! Tesla (TSLA) surges to near-record high on mysterious new investor buying big – Electrek

When Tesla Joins the S&P 500, You Know It’s Game Over

2) A cautionary article by a Bloomberg columnist: When Tesla Joins the S&P 500, You Know It’s Game Over. Here are a friend’s comments on this article:

But Yahoo and AOL never had government policies that taxed their competitors, in order to subsidize Yahoo and AOL. More than 100% of Tesla's net profit this year comes from only one part (regulatory credits) of these subsidies (taxing the competition).

Maybe if Yahoo and AOL had been the beneficiaries of major government tax-and-subsidize programs, they too would have remained in the S&P 500 today.

Yes, I know, it's not "tax" in every instance -- it's often a "mandate" which can be offset by "credits", aka payments directly from one company to another, without first being sent to the government's coffers as the intermediary.

Imagine if the government had put a major tax (mandate) on a Google search, so that for every search made on the Google search engine, Google had to pay 25 cents to Yahoo and AOL. No doubt, Yahoo and AOL would be worth a lot more than without that kind of government subsidy.

Google might not have made it off the ground.

3) Fascinating article in Inc. magazine: After Testing Positive (and Negative) for Covid-19, Elon Musk Contacted a Harvard Doctor. The Response Is a Master Class in Emotional Intelligence. Here’s the full Twitter thread. And here’s Dr. Mina’s thread on a new paper comparing seven rapid tests.

Tesla Sales In Germany

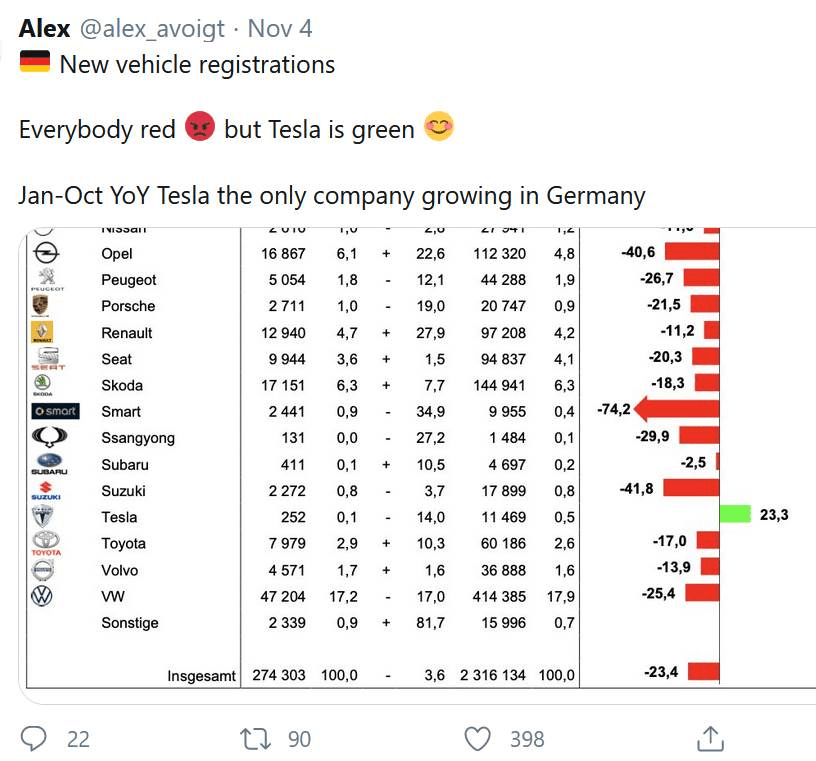

4) See my friend’s response below to this tweet about Tesla’s sales growing in Germany:

My friend wrote:

Let’s be clear as to what happened here. The German government reported that Tesla sold a whopping 252 cars in Germany in October 2020. No, that’s not a typo -- 252 cars in total, including Model 3, X and S.

Mind you, 274,303 cars were sold in Germany in October 2020. That means Tesla had a market share of less than 0.1%. Alfa Romeo sold more cars than Tesla, and the “other” category alone, which includes brands such as Lamborghini and Bentley -- was 2,339 units -- or ten times Tesla’s number.

In August and September, Tesla was selling approximately 2,800 Model 3 units per month in Germany: More than ten times as many as they sold in October.

Seriously, for Tesla to sell 252 cars in Germany in October, at less than 0.1% market share, down from around 2,800 per month in recent months, is hardly a good number -- to put it mildly. It's called being down around 90%. Granted, I understand that October is usually the weakest month of the quarter, but still… The number may be meaningless (in more ways than one), but once certainly can’t say anything good about it.

Mind you, Germany’s BEV sales overall -- all brands, models -- were up 365% in October. So if Tesla was up 14%, then Tesla lost 96% Battery-Electric Vehicle (BEV) market share in October.

In my opinion, for the supposed BEV leader to lose 96% market share in its own BEV category -- Tesla only sells BEVs -- is a Hindenburg-style fiasco. It’s like watching the wings coming off the AOL jumbo-jet juggernaut in year 2000, as it lost Internet connectivity market share to broadband. Not even AOL lost that much year-over-year market share, that quickly.

As things usually go with Tesla quarters, it will redeem itself to some degree during the last month of the quarter. I don’t expect Tesla to lose 96% BEV market share in Germany in December. Tesla’s market share losses will be less dramatic than they were in October. Perhaps it will only lose 50% of its BEV market share. A little closer to AOL.