Whitney Tilson’s email to investors discussing the highest expected return bet he has seen in a while pays off; margin of safety; I raised $17,750 for KIPP; Berkshire Hathaway’s third-quarter earnings; Biden’s ‘more predictable’ presidency; Biden’s day 1 agenda; Doug Kass’ amazing prediction.

Q3 2020 hedge fund letters, conferences and more

The Highest Expected Return Bet I've Seen In A While

1) In my recent e-mail on October 29 I wrote about...

The highest expected return bet I've seen in a while – an opportunity to make 54% in six days...

Just buy Joe Biden to win the election at $0.65 cents "per share" (meaning real-money bettors give Biden a 65% chance of victory) on betting website PredictIt here.

I wasn't making a political statement... I was simply following the best data I could find: namely, nearly every poll, which showed that Biden had huge leads in both the national popular vote as well as in numerous battleground states that would deliver him a win in the Electoral College.

It turns out that the polls were very wrong (for the second consecutive election!). For example, the polling consensus (based on FiveThirtyEight's model) was that Biden would win the popular vote by 8.4%. The actual margin will likely be only half that.

And many states were even further off. Biden was supposed to win Wisconsin by 8.3%, but the actual margin was less than 1%. He was seemingly up a healthy 2.5% in Florida, yet lost by 3.4%. Polls showed he was within a percentage point in Ohio, yet got blown out by more than 8%.

But here's the thing: the bet still paid off.

Why?

Because of the three most important words in investing: "margin of safety."

This term was first coined by legendary investor Benjamin Graham in his classic book, The Intelligent Investor. In Chapter 20, he wrote:

Confronted with a challenge to distill the secret of sound investment into three words, we venture the motto, MARGIN OF SAFETY.

Later, he continued:

The function of the margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future. If the margin is a large one, then it is enough to assume that future earnings will not fall far below those of the past in order for an investor to feel sufficiently protected against the vicissitudes of time.

Graham's best student, Berkshire Hathaway (BRK-B) CEO Warren Buffett, elaborates:

You have to have the knowledge to enable you to make a very general estimate about the value of the underlying business. But you do not cut it close. That is what Ben Graham meant by having a margin of safety. You don't try to buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it. And that same principle works in investing.

That's why I stuck my neck out and told my 100,000-plus readers that this was "the highest expected return bet I've seen in a while" – because I knew that even if the polls were very wrong, it was still likely to pay off. And that's exactly what happened...

As a result, I made a lot of money on PredictIt and, more important, raised $17,750 for my favorite charity, KIPP charter schools, thanks to my friendly wager for charity.

And readers of my Empire Investment Report newsletter are poised to make big gains... my team and I have outlined the exact stocks that should absolutely soar in the months ahead with the outcome of this election. You can find out more right here.

Berkshire Hathaway's Third-Quarter Earnings

2) Speaking of Berkshire Hathaway, my longtime friend and former partner, Glenn Tongue, is the axe on the company.

So, as I do every quarter, I asked if he'd share his thoughts on Berkshire's recent earnings report (here are links to the press release and 10-Q). Here's what Glenn sent me:

Berkshire Hathaway reported Q3 2020 earnings on Saturday morning. The results showed continued progress in most operations, rebounding from the sharp pandemic-driven decline in Q2.

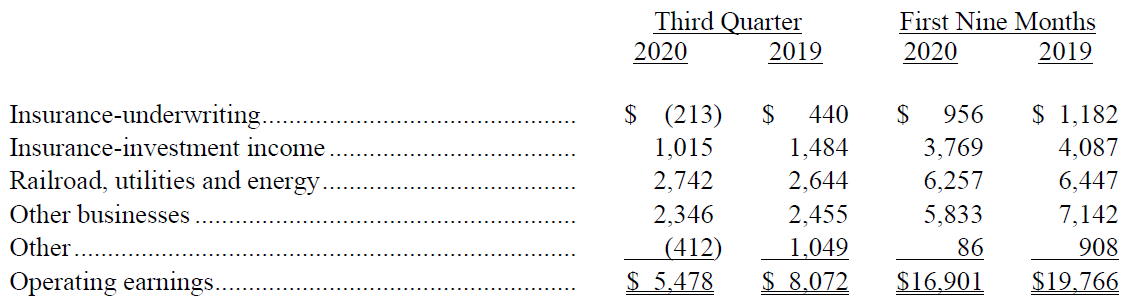

While not yet back to year-over-year growth, Berkshire's wide range of operating businesses reported flat earnings during the quarter. Meanwhile, its many insurance subsidiaries reported a $213 million loss (vs. a $440 million profit during the same quarter) due to the pandemic and hurricanes Laura and Sally in the third quarter. Insurance investment income declined by $470 million, largely due to the decline in interest rates and the sale of certain high-dividend-yielding stocks. Here is the breakdown by segment:

During the quarter, Buffett and his two successors on the investing side, Ted Weschler and Todd Combs, bought $17.6 billion of stocks (most notably $6 billion in a handful of Japanese trading companies), but also sold $12.8 billion, mostly repositioning the equity portfolio away from financials (especially banks). In addition, Buffett bought $9.7 billion of energy transmission assets from Dominion Energy (D), a midstream energy company.

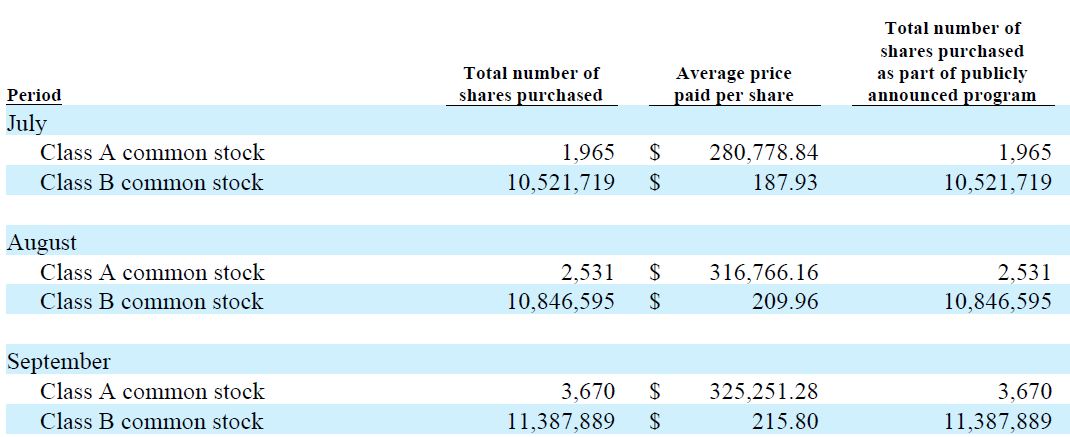

As we have been suggesting for quite some time, the stock seems undervalued (see below for details). Increasingly, it appears that CEO Warren Buffett and Vice Chairman Charlie Munger agree with us, as the company bought back stock consistently throughout the quarter at a record rate of approximately $3 billion per month (and continued this pace in October). The $9 billion spent on repurchases during the quarter was more than Berkshire has ever spent in a full year. At this rate, Berkshire would retire 7%-8% of its shares annually.

Interestingly, the buybacks accelerated even as the stock price rose during the quarter, as you can see from the table in the 10-Q:

The increasingly large repurchases likely reflect a combination of the attractiveness of Berkshire's stock, the company's enormous cash balances, and the dearth of opportunities to invest it.

At Friday's close of $313,885 per A-share, Berkshire's stock is down 8% for the year. Using the methodology we developed nearly two decades ago, outlined in your July 16 e-mail, I estimate that its intrinsic value today is just over $420,000, 34% above today's level. No wonder Buffett is buying it back aggressively!

Thank you, Glenn!

Biden's 'More Predictable' Presidency

3) Stocks are ripping today due largely to the incredible news from pharma giant Pfizer (PFE) and German drugmaker BioNTech (BNTX) that their coronavirus vaccine was "more than 90% effective in preventing the disease among trial volunteers who had no evidence of prior coronavirus infection."

But a secondary factor is that the markets are continuing to react favorably – stocks had their best week since April last week – to the news of a Biden win, plus the likelihood that Republicans will retain control of the Senate.

Here's an insightful article in the Wall Street Journal explaining why: For Business, Biden Bodes a Less Hospitable but More Predictable Presidency. Excerpt:

The election looks like it may yield a dream scenario for business: a moderate Democratic president whose more aggressive plans can't pass the Senate, but who eschews the unpredictability that has often marked the Trump administration.

President-elect Joe Biden ran on one of the most progressive Democratic platforms in decades. It envisions increased taxes on investors and businesses, a public health insurance option for Obamacare, lower prices on drugs and bold plans to confront climate change and empower unions.

Biden's Day 1 Agenda

4) And here's Andrew Ross Sorkin in the New York Times DealBook with a summary of Biden's Day 1 Agenda. Excerpt:

Although the current resident is not going quietly, Joe Biden is preparing for his move to the White House. His transition team has announced four priorities for his first days in office: COVID-19, economic recovery, racial equity and climate change. But his room to maneuver on these and other issues will be limited by a (potentially) Republican-controlled Senate, divisions within the Democratic Party and a fragile economy.

Here are some of the biggest challenges President-elect Biden faces:

- Divisions among Democrats.

- Gridlock with Republicans.

- Balance the cabinet.

- Raise taxes.

- Stimulate the economy.

- Cool down trade tensions.

- Reimpose financial regulations.

- Take on Big Tech.

- Make energy cleaner.

- Defend Obamacare.

- Boost jobs.

Best regards,

Whitney