Africa Energy: One of the Largest Hydrocarbon Discoveries This Year Warrants Strong Investment Case

By Jan Martínek of CEC Partners

Q3 2020 hedge fund letters, conferences and more

Consortium run by French Total discovered one of the top five hydrocarbon deposits in the World this year. The most exciting segment of the consortium is Africa Energy from the Lundin Group. Africa Energy's share of the discovery has a value several times higher than its current market capitalization. Africa Energy management said they would look to sell the asset before development. The sale could happen within the next quarters. Africa Energy management intends to distribute any proceeds from the plot sale to its shareholders. Africa Energy has a unique derisked high return potential.

Africa Energy is listed in Stockholm (ticker AEC) and Canada (ticker:HPMCF), with a market capitalization of USD 260 million, no debt and net cash of approximately USD40 million.

In October 2020, Africa Energy and Total announced one of the top five hydrocarbon discoveries in the World this year.

Most junior oil exploration plays are a binary outcome play. They either find the hydrocarbons or not. Confirmation of one of the largest deposits in the World this year resolved the issue for Africa Energy. Based on the released information, the value of the deposit is multiple of the current share price of Africa Energy. Therefore the investment play is now only how much money you can make and how long will it take.

Introduction to Africa Energy

Africa Energy is an independent oil and gas exploration company. Lundin Group controls approximately 50% of Africa Energy capital.

The company has a market capitalization of USD 260 million with significant cash balance and no debt. The company is listed in Stockholm and Toronto. Stockholm is the primary listing.

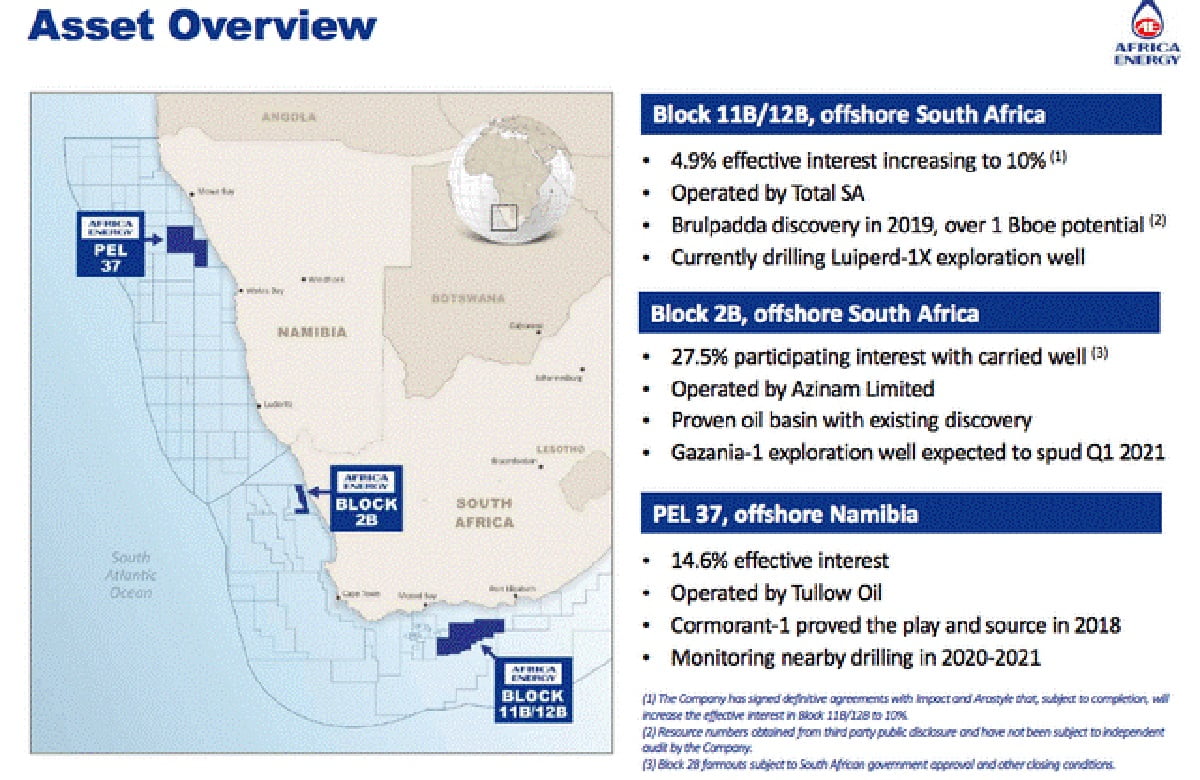

Africa Energy has three assets:

- Block 11B/12B in South Africa

- Block 2B in South Africa

- PEL 37 offshore Namibia

Source: Africa Energy

Africa Energy is not looking at any new opportunities; its goal is to de-risk the current fields, document the potential, sell the assets and distribute the proceeds to its shareholders.

While the other two blocks are quite valuable, for simplicity, I concentrate only on the main assets - block 11B/12B.

Block 11B/12B

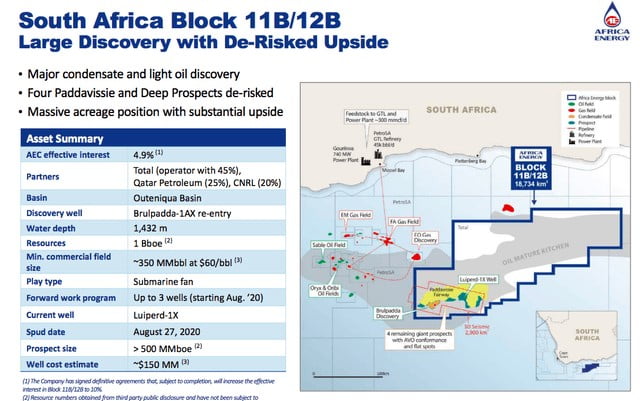

Block 11B/12B is Africa Energy's primary asset with an area of the 19,000 km2 located offshore South Africa.

The asset is operated by French Total that has 45% interest. Africa Energy has 10% effective share following a recently announced series of transactions.

In February 2019 Total and Africa Energy discovered oil in a prospect called Brulpadda, that has an area of approximately 70 km2 within 11B/12B. Total estimated the Brulpadda discovery size at 1 billion barrels of oil equivalents.

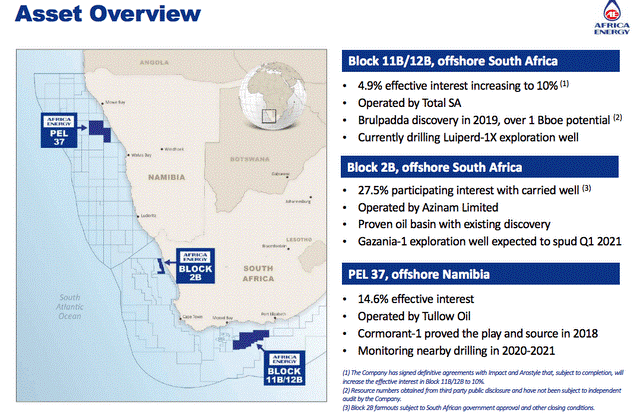

The market does not fully appreciate that Brulpadda was a "double" discovery. In the first target, Total discovered 34 meters of net gas condensate pay plus several meters of oil pay. Below that Total found another 23 meters of net gas condensate in a secondary target.

The market does not appreciate there was oil too. It will be very relevant for the further evaluation of the Luiperd discovery. Brulpadda double discovery is described in the slide below.

Source: Africa Energy

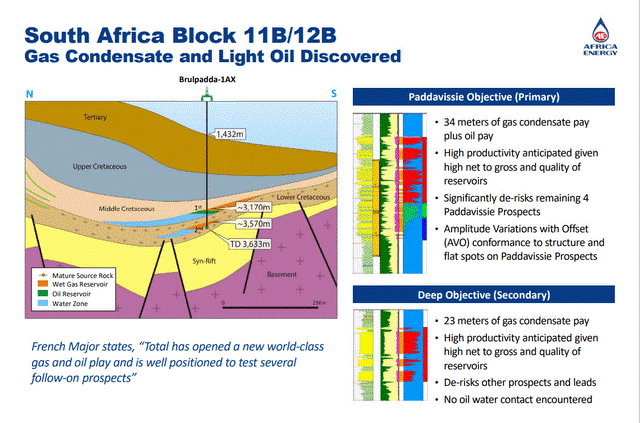

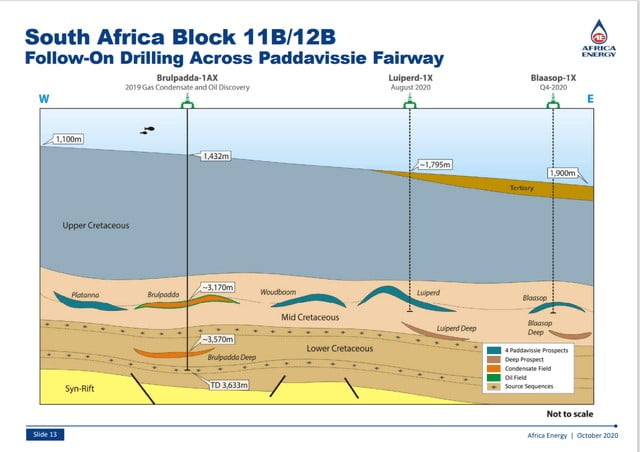

On 28 October 2020 Total and Africa Energy announced gas condensate discovery on the Luiperd prospect. The Luiperd prospect is 110 km2, which is approximately 50% larger than Brulpadda plot of 75 km2. The deposit discovered was 73 meters of net pay, which is almost double the Brulpadda pay at the primary target.

Africa Energy estimated that the Luiperd deposit is about 50% bigger than Brulpadda. If Brulpadda is 1 billion boe (barrel of oil equivalent), then Luiperd should be 1.5 billion boe. Therefore the two discovered deposits should be around 2.5 billion boe.

In Brulpadda Total drilled deeper after the gas condensate discovery and below that Total discovered an oil rim and the water contact at the main target. In Luiperd they did not drill deeper and did not encounter the water contact.

Jan Mayer, Africa Energy Vice President for exploration described that it was always the plan not to drill deeper because the well location was optimized for testing flow rates at the main targeet and was not ideal for assessing the resource potential of the secondary target.

Jan Mayer also said, that they have correlated the 3D geology in Luiperd and Brulpadda and based on this Africa Energy team has a high conviction that there could be an oil leg down-dip of the Luiperd location. That assumption is also visible from the slide above. This is not fully appreciated by the market. Market perception is that there is only high-quality gas condensate in Luperd and no oil.

What is also not appreciated by the market that there are 3 other remaining giant prospects with similar geology. Those prospects have been derisked significantly. Africa Energy's CEO Garrett Soden told Energy Voice. " ... This has also derisked the other prospects in the fairway, such as Blaasop, which now has a 95% chance of success."

Source: Africa Energy

Retail sell-off creates attractive entry price

To the surprise of all the insiders, the Africa Energy sold off after the announcement. The share price decreased from SEK 3.5 to as low as SEK2.2 and then stabilized around SEK 2.6. I am using the Stockholm Stock Exchange prices as the stock has the most liquidity. In my view there were several reasons for the sell-off:

- Africa Energy has a large retail investor base. Retail stocks tend to be more volatile. Retail does not have access to detailed information and analysis and therefore, often reacts more to speculations and perceptions than facts. Based on my conversations with local brokers, it was mainly retail who was selling on the news, as many bought the shares at much lower prices and wanted to lock their profits. This is a classic example of buying the rumour before drilling results and sell on the news.

- Before the market opened, Pareto Securities, one of the largest Scandinavian brokers, issued a positive analyst report, that set the price target at SEK 4.0. The Swedish business paper misquoted in their translation to Swedish announcing that the Pareto downgraded price target from SEK4.2 to SEK2.5. That may have initiated the panic selling. Pareto went to press to correct it, but it was too late.

- The market was hoping for oil discovery, but the company delivered high-quality condensate, that is very valuable. When I spoke to local analysts, they never estimated 100% oil; they assumed a combination of oil and gas. When they calculated the average price, it was not much different from the value of condensate. Despite that, the retail investor's view was that the high-quality condensate is a disappointment because they confused it with dry gas that is typically standard offshore Africa. Please note that in Brulpadda they found oil only near the water contact, which Total did not target at Luiperd. As described above, Africa Energy management has a high conviction that there could be oil downdip at Luiperd.

- The final reason for the sell-off was Total's decision not to proceed with further drilling of a well on Blaasop, a prospect near Luiperd. Total announced that the Luiperd discovery is better than expected and sufficiently large to proceed to commercialization. Before proceeding, they want to finalize the terms with the South African government. That may be a rational decision from Total's point of view, as they own 45% of block 11B/12B, but Africa Energy would have preferred to drill Blaasop as well to further certify the size of the discovery.

Ideal location for gas sale

South Africa is very supportive of the oil and gas industries. It currently uses coal for 80% of its electricity generation and is interested in replacing it with more ESG friendly gas. South Africa has one of the lowest royalties rates and very good infrastructure.

The slide above shows that there is a gas to liquids plant on the shore of Mossel bay, some 175 km from Luiperd. The gas to liquids plant is running now on 30% capacity and running out of feedstock, as the currently supplying fields are at the end of their production life. Therefore there is a nearby customer for the gas paying an attractive rate of USD7/mcf.

There is also a Gorikwa power plant nearby that is using diesel and would like to switch to gas.

11B/12B should be sold within the next year or so

In my view, the sell-off made the opportunity much more attractive. I have increased our position in the sell-off significantly. The play has been derisked by the second discovery. It is not a binary play now - it is not whether Africa Energy would find hydrocarbons or not. They did, and the thesis is derisked. Africa Energy say they want to document the size of the deposit, sell it, and distribute the cash to its investors.

The next drilling will happen in 2021 or 2022 when 3-4 wells are expected to be drilled. Africa Energy has approximately USD40 million in cash, which would cover at least two wells. The company demonstrated that they could raise capital of that size, but still it is more likely that they would sell before the next drilling campaign.

Africa Energy's stake in 11B/12B has multiple times higher value then its full capitalization

The current market capitalization of Africa Energy is USD260 million. The company has USD 40 million in cash, so the current enterprise value is about USD220 million.

Africa Energy currently has 884 million shares. As stated above the company will be issuing new shares in exchange for doubling its stake in Block 11B/12B. After the transaction, the number of shares will increase to 1,457 million. Therefore the adjusted market capitalization would increase to USD430 million, and the adjusted enterprise value would be USD390 million.

The valuation of the deposit is relatively simple - you estimate the size of the deposit, and you take a net present value per boe that a buyer would use, and you get the value.

The largest gas condensate discovery this year

As described above the discovered deposits at Luiperd and Brulpadda have total deposit size estimated 2.5 billion of boe.

Africa Energy presentation slide above shows that there are three other plots with similar 3D geography, which Africa Energy CEO estimates that there is a 95% chance of success. We do not know the size of the deposits. If they had a Brulpadda size, that could mean an additional 3 billion of boe. If they had Luperd size, that could mean an additional 4.5 billion of boe. So the total deposit size could be anywhere between 2.5 billion boe to 7 billion boe. For conservative purposes, let's assume 3.0 billion as a base case. The table below shows the materiality of the upside under this assumption.

Multiple

I spoke to two analysts from large Scandinavian brokerage houses. They both view that the such deposits at this stage would be valued between USD3-4 per boe. Both view this as conservative, good sale process could yield above USD5 per boe.

Significant value upside

As mentioned, Africa Energy will own 10% of the deposit. Below are the valuations of Africa Energy stake in USD millions at different deposit size and multiple assumptions (horizontal axis is the deposit size, vertical is multiple)

| 2 bil boe | 2,5 bil boe | 3.0 bil boe | 4.0 bil boe | 6.0 bil boe | 7.0 bil boe | |

| $3 per boe | $600 | $750 | $900 | $1 200 | $1 800 | $2 100 |

| $4 per boe | $800 | $1 000 | $1 200 | $1 600 | $2 400 | $2 800 |

Source: author calculations

The table above illustrates the point if you take just the current Brulppada and Luipered estimated deposit size, you get a value more then two times larger than current Africa Energy enterprise value.

Even if you assume only 75% of the size of Brulppada and Luiperd, the value still come at USD560-750, which is still significantly above the implied diluted enterprise value of USD390 million.

If you assume some additional deposits in the nearby prospects, the value gets substantially larger at several multiples of implied diluted enterprise value.

Please note that all the calculations above are only for one of the three assets Africa Energy owns. The other prospects are described in detail in my previous article.

Near-term catalysts

There are several catalysts for the story in the next four weeks:

- Africa Energy is scheduled to announce its Q3 results on November 10. That should bring further details and clarifications for the retail investors.

- Africa Energy stated that during November they will disclose the results of their Luiperd testing, that should help the analysts to revise their estimates of the deposit size.

- Africa Energy may organize another investor event to discuss the findings with investors, after the November announcement. Such events are usually accompanied with multiple press activities and interviews.

Africa Energy is a good risk return proposition

It is unusual for a company of Africa Energy's size to be included in such a major resource. I spoke to the management several times. They are one of the most impressive guys I have met in the industry.

The investment play has been derisked by the discovery. It is now only about the timing and the size of value creation by the plot disposal.

The Lundin Group owns 50% of Africa Energy. Lundins have a great track record in achieving value creation. They have a good motivation to reinforce their reputation further through this transaction.