Private fintech company financings surged during the third quarter as some companies played catch up during the second-quarter slowdown, so we’ve put together a list of the top 10 private fintech financings. Additionally, fundamentals throughout the sector have been strong due to the pandemic, which may be impacting how much fintech companies have been able to raise.

Q2 2020 hedge fund letters, conferences and more

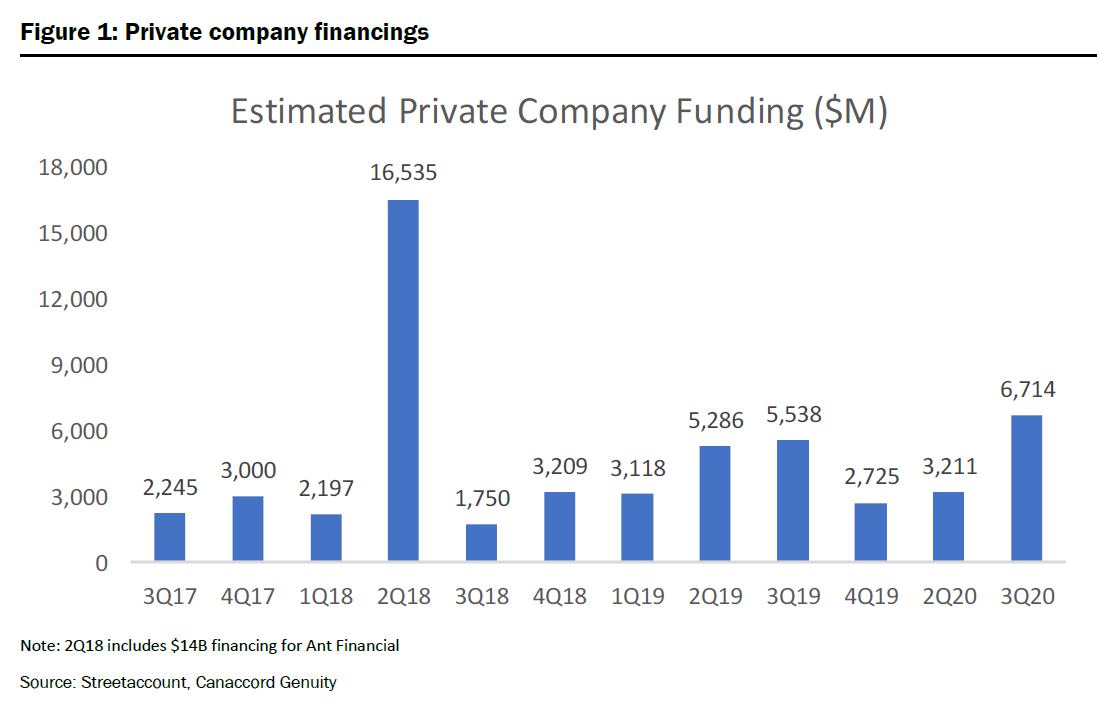

Canaccord Genuity analyst Joseph Vafi said in a report this week that COVID-19 has sped up the evolution and adoption of fintech, especially in e-commerce and the ongoing migration toward electronic payments. He estimates that private fintech companies raised a total of $6.7 billion during the third quarter, which is more than twice the amount they raised during the second quarter.

He also provided details on the top 10 private fintech financings during the third quarter. The number of large financings increased significantly during the quarter. Of note, this list of the top 10 private fintech financings does not include SPAC-driven transactions, which is becoming a bigger and bigger part of the capital markets backdrop for fintech.

Top 10 private fintech financings

Here are the top 10 biggest private fintech financings during the third quarter, according to data from Canaccord Genuity.

10. auxmoney

Number 10 on this list of the top 10 biggest private fintech financings is auxmoney, which raised €150 million ($176.6 million) in September. Centerbridge Partners led the financing round, and Foundation Capital, Index Ventures and Union Square Ventures also participated.

Auxmoney is the Eurozone's largest peer-to-peer loan marketplace, and it was founded by Raffael Johnen and Philipp Kriependorf in 2017. The company reports that it has delivered about 280,000 loans and seen its loan volume rise 20 times over the last five years. Over 50,000 lenders are on auxmoney's platform, which generates an auxmoney score to help them make lending decisions.

-

TruMid Holdings

This company raised $200 million in its most recent financing round, bringing its total raised to about $400 million. The most recent financing round valued TruMid Holdings at more than $1 billion. Among the investors that participated are TPG, T. Rowe Price, BlackRock, and Dragoneer Investment Group.

TruMid is a fixed income trading platform founded by Ronnie Mateo in 2014. The bond-trading platforms provides tools to provide and receive liquidity and negotiate and execute trades electronically. The company has 500 clients, including hedge funds, asset managers and banks. TruMid's trading volume exceeded $20 billion in five straight months ending in the second quarter. The company expects to generate $35 million to $50 million in revenue this year and is cash flow positive.

-

Greenlight Financial Technology

This company raised $215 million in its most recent financing round, bringing its total raised to about $300 million. The most recent funding round valued Greenlight at $1.2 billion. Among the investors in the latest financing round are Canapi Ventures, DST Global, Fin Ventures and others.

Greenlight Financial Technology was founded in 2014 by Johnson Cook and Tim Sheehan, and it offers kid-friendly bank accounts and debit cards. Since it launched its debit card for children in 2017, over 2 million parents have created accounts.

The Greenlight app includes chore management, sets allowance on autopilot and supports direct deposit and instant transfer to kids' cards. The app also supports spending control specific to stores and ATM parental control. The cards are enabled for Google Pay and Apple Pay, and the company charges $4.99 per month for a family with up to five children.

-

Next Insurance

Next Insurance raised $250 million in September, bringing its total raised to $631 million so far. The most recent financing round valued it at more than $2 billion. CapitalG, Global Founders Capital, Munich RE, American Express and others participated in the most recent financing round.

Next insurance is a digital insurtech company that provides insurance to micro and small businesses. It offers business, general liability, workers compensation, professional liability and commercial auto insurance to small businesses in a variety of industries. More than 100,000 small businesses use its insurance products.

-

Neon Pagamentos

Neon Pagamentos raised $300 million in September and has raised about $420 million in total financing so far. General Atlantic led the most recent funding round, and Vulcan Capital, PayPal Ventures, Endeavor Catalyst and BlackRock also participated.

Neon is a Brazilian neo bank founded by Pedro Conrade in 2016. It offers credit cards, personal loans and investment products. Data from Crunchbase indicates that the company has over 9.4 million customer accounts. The pandemic has been driving an increase in its user base as it has seen a 26% increase in new users since March, according to Pulse 2.0.

-

Chime

Chime's most recent financing was $485 million, which brings its total financing raised to $1.5 billion. The most recent round of financing valued it at $14.5 billion. Tiger Global, Coatue, Access Technology Ventures and Whale Rock Capital are among those that participated in the funding round.

The company is a top challenger in the bank, and it was founded by Ryan King and Chris Britt in 2013. Among the services offered is instant transfers to friends without hidden fees. China has more than tripled its transaction volume and revenue this year, according to CNBC. Chime's approach to banking allows its users to avoid fees, automatically save money and manage their finances efficiently. The company's CEO said they will be ready for an initial public offering in the next 12 months.

-

Affirm

Affirm raised $500 million in its most recent financing round, bringing its total financing to $1.3 billion raised. Among the investors in this company are Thrive Capital, Fidelity, Spark Capital, GIC, Lightspeed Venture Partners and Founders Fund.

Affirm is a micro-lending company founded by Max Levchin, Jeffrey Kaditz and Nathan Gettings. The company offers installment loans at the point of sale to finance a purchase. It serves over 5.6 million customers in the U.S. and Canada and has partnered with more than 6,000 merchants, including Walmart, Peloton and others. Affirm's loan volume exceeded $2 billion in 2018.

-

Bright Health

This company raised $500 million in its most recent round, earning it a spot on the list of the top 10 biggest private fintech financings. So far, Bright Health has raised more than $1.5 billion in equity financing. Tiger Global, T. Rowe Price and Blackstone led the company's most recent financing round.

Bright Health is a next-generation healthcare company founded by Bob Sheehy, Kyle Rolfing and Tom Valdivia in 2016. The company integrates financing, care delivery and technology. It leverages its technology platform to connect consumers, payers and providers in a way that lowers costs and provides a better experience. Bright Health operates in 43 markets and 13 U.S. states and delivers benefits coverage to over 200,000 customers and clinical care to over 120,000 customers. The company said in a recent press release that it generates over $1.2 billion in annual net revenue.

-

Klarna

This company raised $650 million in its latest round of financing, bringing its total financing to about $2 billion. The most recent financing round valued Klarna at about $11 billion. Among the investors that participated in the latest financing round are Silver Lake, BlackRock, Ant Financial, Sequoia and Visa.

Klarna is a global payments provider and fully licensed bank founded in Sweden in 2005 by Niklas Adalberth, Sebastian Siemiatkowski and Victor Jacobson. The company provides online customers the option to buy now and pay later or over time. It works with 200,000 merchants, including Peloton, Adidas, Sephora, IKEA, Expedia and many others.

Klarna is also one of the largest banks in Europe, providing payment solutions to more than 60 million consumers. The company has over 90 million customers, including 9 million in the U.S. Its app has more than 12 million monthly active users globally.

Number one on the top 10 private fintech financings: Robinhood

Number one on this list of the top 10 biggest private fintech financings is Robinhood with a $660 million financing. The company has raised $2.2 billion in financing so far, and its most recent round valued it at about $11.7 billion. D1 Capital, Andreessen Horowitz, Kleiner Perkins, Sequoia and several others joined the latest round of financing.

Robinhood is a brokerage firm that was founded by Vladimir Tenev and Baiju Bhatt in 2013. It offers commission-free trading in U.S.-listed stocks, exchange-traded funds, options and cryptocurrencies for individuals. For $5 a month, investors can get access to the Robinhood Gold product, which provides access to professional research reports, trades on margin and the ability to make larger instant deposits. In August 2020, the New York Times reported that the company had 13 million user accounts.