Over the years, I have spent a lot of time talking about “inflection investments,” but have never really given a playbook for how to approach this genre of investments. Given the number of questions I have received about various investments, clearly, I should have put out some guidance to invest by.

Q2 2020 hedge fund letters, conferences and more

Inflection Investing

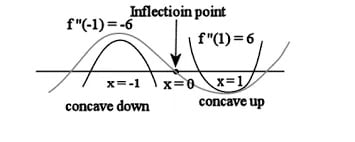

What is an inflection investment? This is a situation where some dynamic piece of news has changed the economics of the business, but the shares have yet to recognize it. This can be anything from a new product to new management or in the situations that I prefer, it relates to a change in the sector itself—often due to increased pricing power. The clearest such example is a commodity company where the price of the commodity increases, leading to increased earnings. Simple enough, right?

Now, here’s the hard part; often there are false dawns. You see, commodity prices can spike and retrace, new products can have competitors. Business is competitive and unpredictable. As an inflection investor, your task is to identify the inflection, whatever it is, before anyone else. It is at this point where the shares have yet to respond much, that you take the least risk. By the time the shares have started moving, you’re going to be taking on a lot more risk; defined in my mind as the appreciation that has already occurred over the unadjusted price, in case you’re wrong. Now, I realize that many people like to buy “strong charts” making new highs, but that’s simply toxic in this sort of investing as you never know when or if the trend will sputter out and reverse.

When I look at an inflection, the first question I ask myself is; has the market figured it out yet. I want to see a stock that has stopped making new lows and is even showing a bit of strength; “boring charts” that are getting stronger are the best. That is indicative that other investors are starting to catch onto what I see. At the same time, it should be obvious that I have missed the opportunity if the shares are already up substantially. I realize this is a nuanced line to tread—you want to buy strength, but if it’s gone too far, you’re taking on too much risk. With that in mind, since I have spoken so frequently about tankers, let’s explore them within an inflection framework.

Macro Thesis

To start with, what’s my macro thesis? I believe that the skinniest order book in two decades, compounded with an aging fleet will lead to a tight market going forward. This is then compounded by various environmental regulations which make older vessels prohibitively more expensive to operate, forcing scrapping and further tightening the market. The immediate catalyst that I identified was the IMO 2020 sulfur regulation which kicked in on the first day of 2020. However, I wanted to time my buying with underlying charter rate strength. Too often, a thesis sounds good on paper, but there’s no follow-through in the real world—I want that validation before pulling the trigger. In early 2019, rates started increasing during a seasonally weak period and that was my cue to get long.

Looking back on it now, I’m rather proud of myself as I effectively caught the bottom of a decade-long bear market, after having stalked it quietly for years. A year later, I also called the super-contango inflection in March of 2020, which is one of my proudest moments as a contrarian equity prognosticator, as I correctly called out the extreme earnings that would occur at a time when most global businesses were bleeding capital due to COVID. While neither of these analytical wins have been reflected in today’s share prices, getting the macro right (especially when most of the world disagrees) is all you can hope for as an equity analyst. We have now had 5 sequential quarters where rates have increased quarter over quarter and while the third quarter of 2020 will not show quarterly increases, realized rates are still above 2019 levels—indicative of a powerful bull market. Unfortunately, the fourth quarter will likely be soft, but these rate progressions are rarely linear. Additionally, while it’s easy to look at specific events and attribute higher charter rates to them (scrubber off-hire, COSCO sanctions, Venezuela sanctions, Hin Leong Bankruptcy, the Saudi Armada, COVID contango, Panama Canal bottlenecks, etc.), rates only spiked because the market was tight to begin with. While reduced COVID oil demand has postponed the next period of excess profits by a few quarters, nothing much has changed in my big picture thesis.

At the same time, in a highly cyclical industry, short-term traders will extrapolate recent trends and often cause securities to overshoot to the upside and downside, particularly in a sector like tankers with such extreme financial and operating leverage. You can use that volatility to your advantage and trade around your position within the bull market or you can ignore it and play the big picture trend you’ve identified. I’ve done a bit of each, while keeping a core long position. I’ve added on the big dips like February 2020 and March 2020 when super-contango showed up. I’ve also cut some back on the big upside moves (January 2020 and April 2020). Most of my position cutting was mechanical and based on tanker stocks appreciating to the point where they became over-weighted in my portfolio—you don’t realize the necessity of having rules to de-gross an overweight sector until something like COVID comes along and makes you thankful for staying disciplined. I’ve also tried to be pragmatic. When implied volatility spiked in April, I mostly preferred to sell out of the money calls to reduce my exposure, instead of selling shares—allowing me to take a healthy percentage of my cost basis off the table, while staying long.

Teekay Tankers: Most Value But Worst Trade

Now, when you make a sector bet, the individual names don’t tend to move in unison. For some odd reason, Teekay Tankers Ltd. (NYSE:TNK) has traded the worst lately, despite earning the largest percentage of its market cap, locking in a third of its fleet for the next year at peak rates and selling older vessels at premiums to assumed vessel values. In summary, Teekay Tankers created the most value, but traded the worst. As a result, I have continued to add to Teekay Tankers on the way down, but to fund it, I’ve sold down other positions like Euronav NV (NYSE:EURN) which has barely pulled back while paying copious dividends along the way. In addition, when Scorpio Tankers Inc. (NYSE:STNG) reported Q2 charter guidance and I realized how poorly they had performed, I jettisoned most of my position (I sold the rest a few weeks ago). I have used the proceeds to add to my position in Dorian LPG Ltd (NYSE:LPG) as Very Large Gas Carrier rates remain elevated and Dorian continues to earn excess profits at a time when economic conditions are still weak—imagine how they’ll do when Asian propane demand fully recovers. By knowing the companies in the sector, I’ve been able to continue pivoting around within the tanker universe over the past seven quarters, using the volatility in share prices and charter rates to pick up some extra Alpha while staying long—which is the beauty of a sector bet in the first place.

Despite having made some modest money in tankers thus far, I remain frustrated. From a fundamental standpoint, I got this one spectacularly right, unfortunately, I have not really succeeded in getting myself paid (yet) for my foresight. 2020 has been the best year for NAV accretion in a decade. 2019 was pretty good as well and I called this inflection at a time when the entire industry expected continuous waves of bankruptcies and dilutive capital raises. Instead, many of my companies have earned disproportionate percentages of their entire market caps since I got long. If the market doesn’t want to appreciate that fact, that’s just how the game is played in the year 2020, though it is somewhat offset by those occasional times that I’ve make money despite getting the thesis wrong.

With that nuanced victory lap out of the way, I wanted to show that while an equal-weighted basket of tanker names is roughly unchanged (including dividends) since I began writing about them, you can still make decent money in inflection investing—even when the sector does not hit escape velocity—as long as you manage your exposures appropriately. While I’m frustrated that tankers have under-performed many parts of my portfolio, while tying up quite a lot of my capital, they also gave two clear opportunities to realize a double on my investment, while positioning myself for a potential home run. Just as importantly, I still have a lot of exposure to the sector and am closely watching to pounce on the eventual recovery in rates—whenever that may be. If the US is going to produce less oil as shale trails off, we’re going to be importing more and that is the next catalyst for my tankers. In the interim, I expect new ordering to be anemic while a lot of older vessels will get scrapped.

Summary

In summary, I hope you have a better feel for how inflection investing should be thought of. You want to stalk these themes and be ready to capture the precise inflection moment. You want to show up with your capital at the least risky time, just as the shares are showing strength, and you want to manage the position over time as the thesis evolves. Remember, most inflection plays fail to reach escape velocity—there’s a short period of improvement and then it turns out that nothing has really changed. Other times, there’s a pause in the bigger bull market and traders panic sell—often back to the inflection level itself. Fortunately, if you bought at the inflection, it doesn’t hurt much when that happens—particularly if you’ve scaled out a bit on the way up. Instead, it just gives you another opportunity to add more.

On a final note, please, do yourself a favor and stop thinking of inflection companies through a compounder lens. Compounders gain value every day as they retain earnings and reinvest capital at high rates of return, which is why you don’t have to monitor them very closely—inflection stocks can destroy surprising amounts of capital during bear markets in their respective sectors. Inflection stocks are meant as tools in creating outperformance, as escape velocity is often measured in multiples of the purchase price—as a result, you also need to work for that gain, because the mistakes will hurt.

Given how explosive the returns can be, I intend to continue writing about these inflection sectors, however, you’re on your own in terms of the weaving and bobbing. With this longer than normal posting, you should now have a better understanding of how to play inflections.

Disclosure: Funds that I control are long Dorian LPG and Teekay Tankers.