Welcome to the first update of U.S. company financial statements for the new (third) quarter. First to report is a small population of companies with fiscal quarters ended August. It will not be until the end of October, early November, before financial statements that just ended in September will be filed. This is a prime time to empower your sock selection decisions with dynamic quantitative tools.

Q2 2020 hedge fund letters, conferences and more

The first sign of a recovery from the current growth decline will be an increase in the frequency of rising sales growth companies. In the second quarter update, only 25% of companies (accounting for 40% of market capital) achieved an improvement in sales growth. We expect that improvement frequency to fall again in the third quarter and the average sales growth rate to drop from the current 5%.

As a comparison, during the Financial Crisis the frequency of rising sales growth was 14% of companies (accounting for 8% of market capital) in the first quarter of 2009. That marked the worst quarter of the financial crisis from 2007 to 2009. The Tech Bubble low frequency was 31% of companies (accounting for 28% of market capital) in the third quarter of 2001. That marked the worst quarter of the Tech Bubble growth decline from 1999 to 2002.

Gross Profit Margins Hit 20-Year Low

It is the direction of the market or average gross profit margin that will determine the strength of a recovery. Efficiency gains are extended and exhausted with the gross profit margin falling at 44% of companies accounting for 40% of market capital. That is the smallest proportion of market cap accounted for by rising gross profit margin companies in the 20-year data record.

We suspect that the sharp decline was the result of slower layoffs encouraged by federal subsidies. Now that those subsidies are expired, layoffs have resumed. That reduces labor costs and lifts the gross profit margin. As companies cut costs more aggressively in the face of lower sales, the gross profit margin might improve. That is why the profit margin is the most important factor to follow.

As we wait for new numbers, review your portfolio holdings keeping only the healthiest with solid vital attributes. PETS is demonstrating a quality growth pattern with strong fundamentals. Visit Otos.io for more information on how Otos communicates changing fundamentals attributes with the MoneyTree avatar (See PETS ’s MoneyTree below).

PetMed Express $30.390 BUY this rich company getting better

Petmed Express Inc (NASDAQ:PETS) has been an exceptionally profitable company with persistently high cash return on total capital of 24.6% on average over the past 7 years. Over the long term the shares of PetMed Express have advanced by 70% relative to the broad market index.

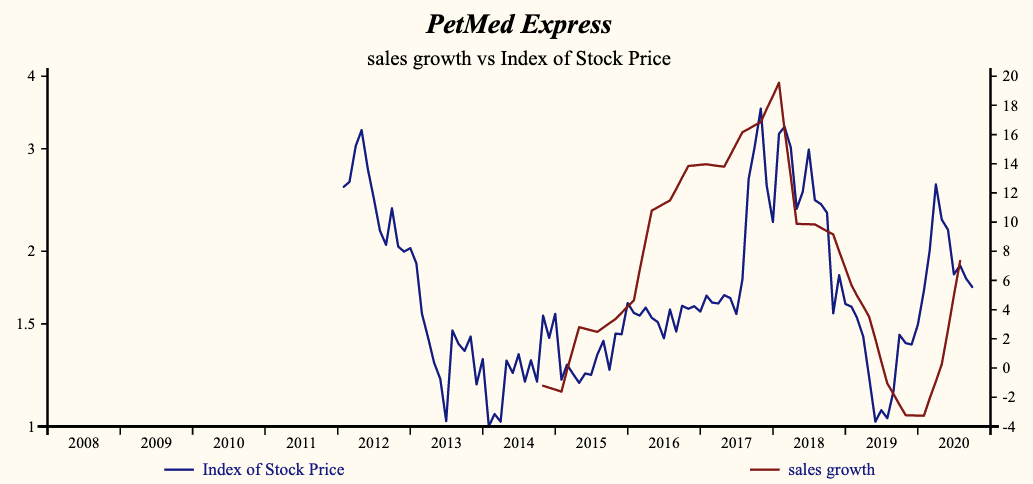

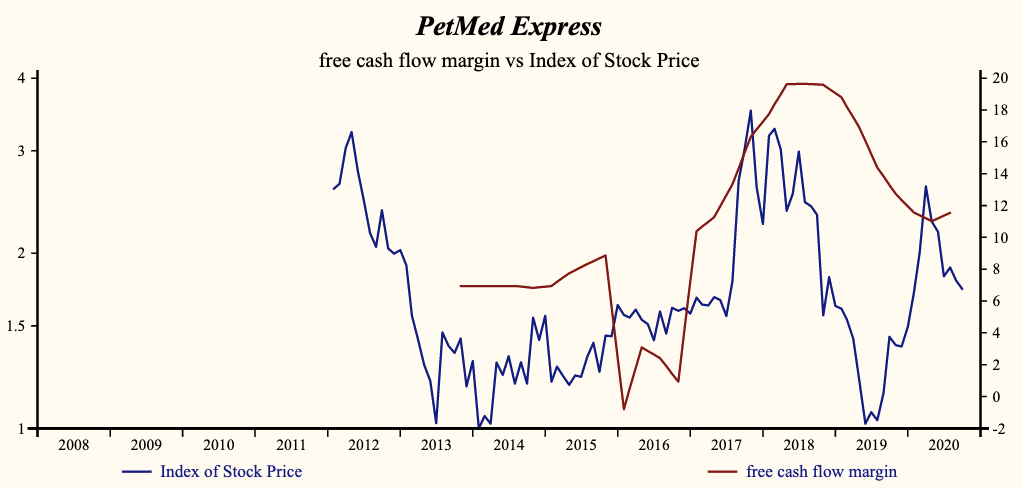

The shares have been highly correlated with trends in Growth Factors. A dominant factor in the Growth group is the free cashflow margin which has been highly correlated with the share price with a one quarter lead.

Currently, sales growth is 7.3% which is high in the record of the company and higher than last quarter.

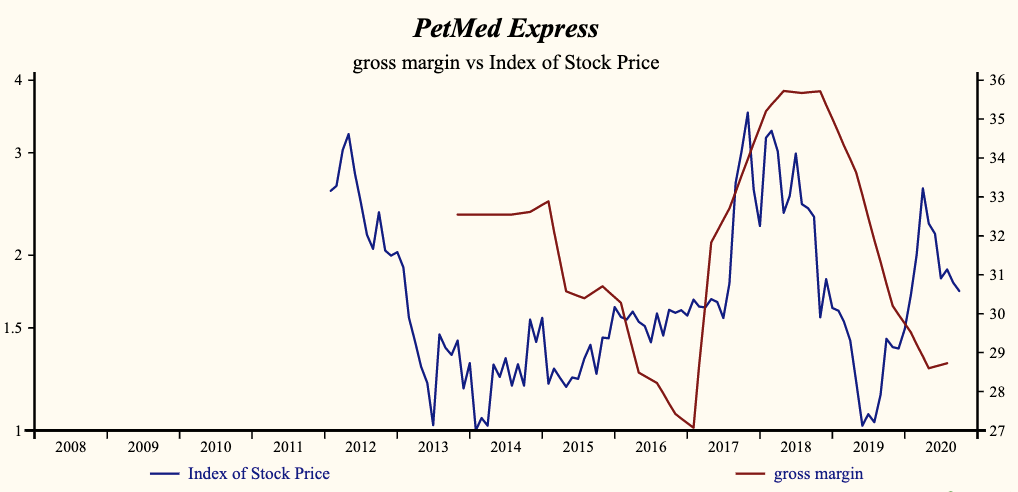

The company is recording a low and rising gross profit margin. Selling, General & Administration (SG&A) expenses are low in the record of the company but falling. Higher gross margins and lower SG&A are producing a leveraged acceleration in EBITDA (Earnings before Interest, Taxes & Depreciation, Amortisation) relative to sales and a rebound of free cash flow (EBITDA margin minus Capital Expenditures).

Yield of 3.6%

The current indicated annual dividend produces a yield of 3.69%. Five-year average dividend growth is 9.7%. Current trailing operating cash-flow coverage of the dividend is 1.8 times. More recently, the shares of PetMed Express have advanced by 68% since the May, 2019 low. The shares are trading at lower-end of the volatility range in a 16-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.