Investing makes it easier to create a more financially secure future — which is more important than ever during these turbulent times. Money you’ve invested earns interest, which in turn can be reinvested to earn interest of its own. If you have learned about investing you know that this is called compound interest, and it makes building wealth much easier. Over the long term, that interest adds up, making it easier to save for retirement or another significant expense.

Q3 2020 hedge fund letters, conferences and more

While investing can be an important way to build wealth over time, a new survey conducted by FinanceBuzz revealed some big differences between how men and women invest. But the good news is, around 71% of Americans are investing their money.

These differences in investing styles show how men and women learn about which assets to buy, the key features that individuals of each gender consider when choosing their investments, and more.

Here are three of the biggest differences between men versus women when it comes to how they invest.

1. Learning how to invest

Understanding how to choose investments and developing a sound investing strategy can make a difference in how successfully your investments perform. Unfortunately, more women than men don't know how investing works, with 23% of women admitting their confusion on this important topic compared with 16% of men.

Statistics Of How Both Genders Learned About Investing

One possible reason men are more informed is they receive more financial education early. While 15% of men said they learned about investing in high school or college, just 9% of women reported receiving this type of education.

Men are also more likely than women to teach themselves about investing using either books or the internet. Thirty-seven percent of men said they taught themselves about investing online, while only 17% of women said the same. And while just 8% of women learned about investing from books, three times as many men — 23% — read about the subject.

However, when it comes to learning about investing from either parents or financial advisors, the gender gap is smaller. Twenty-two percent of men and 20% of women learned about investing from a financial advisor, and 18% of men and 17% of women learned how to invest from their parents.

2. Choosing where to invest money

There are vast differences not just in how men and women acquire investing knowledge but also in how they decide where to put their money.

When considering where to invest, both men and women care most about the types of accounts offered. Forty-six percent of women and 43% of men reported this is an important feature.

And affordability is also important to both. However, low management fees/expense ratios were of the utmost importance to 43% of women. At the same time, men focus more on commission-free trades, with 41% citing commission-free trades as a priority feature.

Women placed a higher priority than men on both an easy-to-use app and strong customer service, with 39% of women saying a good app is one of their top five features and 38% stressing the importance of customer service. And while 32% of women listed the availability of human advisors as one of their top five features when deciding where to invest, only 28% of men agreed.

3. Reviewing investment portfolios

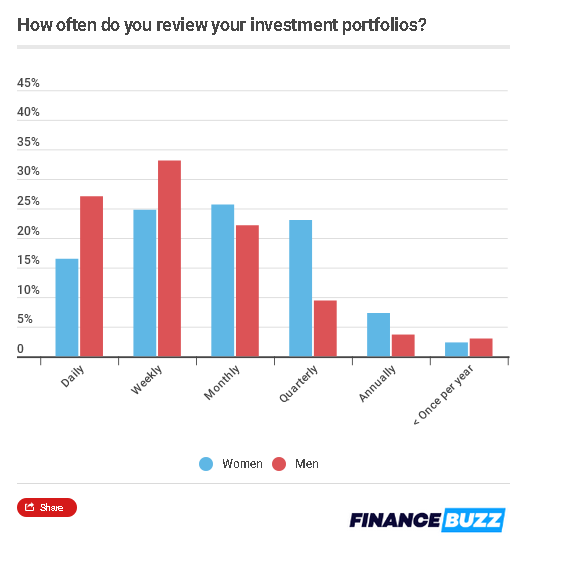

Finally, men were much more likely than women to keep a close eye on their portfolios. In fact, 27% of men said they review their accounts daily compared with just 17% of women. Men were also more likely than women to review accounts weekly, with 33% of men checking in once per week, while just 25% of women do the same.

Women, on the other hand, tend to let more time pass before reviewing their investments. Twenty-six percent of women check their accounts monthly, 23% quarterly, and 7% annually. By comparison, 22% of men reported checking on their investments once a month; 9% indicated they do a quarterly check; and 4% only review their investments once a year.

Experts recommend checking your investment portfolio no more than once per quarter, as doing so more often can lead to making shortsighted decisions.

Americans of every gender should be investing

Regardless of your gender, it's essential to learn about investing so you can put money aside for your future in a smart way. The good news is, it's easy to get started. If your employer offers a 401(k), you can sign up at work and have contributions taken directly from your paycheck. Your employer may even provide matching funds, which are free money.

If you don't have a workplace 401(k), investment apps such as Stash make it easy to get your money into the market. Or, if you prefer a more hands-off approach to investing, you can opt for a robo-advisor, which picks investments for you based on your answers to a few simple questions. With so many options out there, everyone can find an investment option that works. And everyone should, because if this year has taught us anything, it's that life is uncertain, and it's important to be prepared for whatever comes your way. Having a hefty nest egg can help you to do just that.