Whitney Tilson’s email to investors discussing one of the year’s worst short bets, GSX Techedu Inc (NYSE:GSX), defies scathing reports and an SEC investigation; Nikola Corporation (NASDAQ:NKLA) races to convince investors of value before share lock-up ends; Loop Industries Inc (NASDAQ:LOOP): ‘Recycled’ smoke and mirrors show.

Q3 2020 hedge fund letters, conferences and more

GSX Techedu Defies Scathing Reports And An SEC Investigation

1) On Monday, the Wall Street Journal published an article about the tug-of-war between short-sellers and Chinese online education provider, GSX Techedu (GSX): One of the Year's Worst Short Bets Defies Scathing Reports and an SEC Investigation. Excerpt:

No stock has been more heavily attacked by activist short sellers this year than GSX Techedu, a New York-listed Chinese tutoring company.

So far, GSX has come out on top. After quintupling this year, it is one of the world's most valuable education businesses, with a market capitalization of $27.3 billion.

"Shorting this, it has been just a nightmare," said Richard Smatt, a mathematics professor at Flagler College in St. Augustine, Fla., who said he is sitting on tens of thousands of dollars in unrealized losses on GSX.

Short sellers have made killings on stocks such as Nikola and Luckin Coffee. But in these volatile and speculative markets, the playbook has also flopped.

One of the best known activist short-sellers, Carson Block of Muddy Waters Research, called the company a "near-total fraud" in a report he published back in May.

So far, he's been very wrong. At the time, GSX shares were trading around $33 – and then proceeded to soar to more than $130 in early August, before settling back to today's level around $115.

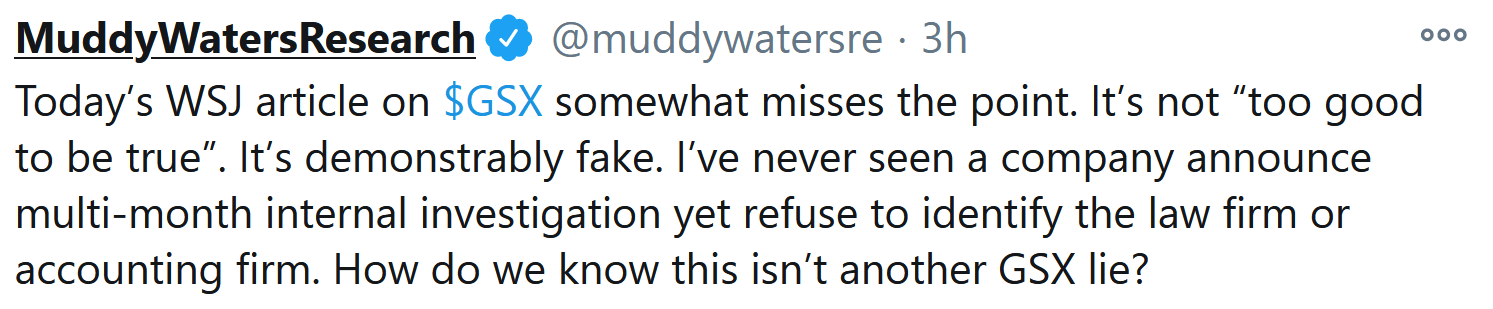

While Carson has taken a lot of pain on this short, he still thinks he'll be proven right. On Monday, he tweeted:

I continue to believe that Block will be proven right here...

2) Speaking of dicey promotions, here's an article in the Financial Times about electric-vehicle developer Nikola (NKLA): Nikola races to convince investors of value before share lock-up ends. Excerpt:

Nikola is in a race. A month since detailed and wide-ranging fraud allegations were levied against it, the electric truck start-up is fighting to convince investors of its true value.

On Thursday its efforts will step up a gear. A showcase of the company's hydrogen technology at a key industry conference will, Nikola hopes, begin to win over sceptics.

The revenue-less business was briefly this year valued more highly than Ford. But Nikola's valuation has plummeted from its giddy heights of $30bn to about $10bn now and cornerstone shareholders have watched profits from their investment slide, unable to trade.

Loop Industries: 'Recycled' Smoke And Mirrors Show

3) And speaking of Nikola, Nate Anderson of Hindenburg Research – who wrote the report that exposed the electric-truck developer's deception – released another short report yesterday on plastics recycler Loop Industries (LOOP), which crashed the stock by 33%. Here's a link to it: Loop Industries: Former Employees and Plastics Experts Blow the Whistle on This "Recycled" Smoke and Mirrors Show. Excerpt:

- Loop Industries has never generated revenue, yet calls itself a technology innovator with a "proven" solution that is "leading the sustainable plastic revolution." Our research indicates that Loop is smoke and mirrors with no viable technology.

- As part of our investigation, we interviewed former employees, competitors, industry experts, and company partners. We also reviewed extensive company documentation and litigation records.

- Former employees revealed that Loop operated two labs: one reserved for the company's two twenty-something lead scientist brothers and their father, where incredible results were achieved, and a separate lab where rank-and-file employees were unable to replicate the supposedly breakthrough results.

- The two brothers who act as lead scientists for Loop and who co-invented Loop's recycling process appear to have no post-graduate education in chemistry and list no work experience other than Loop.

- A former Loop Industries employee told us that Loop's scientists, under pressure from CEO Daniel Solomita, were tacitly encouraged to lie about the results of the company's process internally. We have obtained internal documents and photographs to support their claims.

- Loop Industries focuses on recycling a common form of plastic called "PET." According to a former employee, Loop's previous claims of breaking PET down to its base chemicals at a recovery rate of 100% were "technically and industrially impossible." The same employee told us the company's claims of producing "industrial grade purity" base chemicals from PET were false.

- According to litigation records, Loop's CEO, Daniel Solomita hired a convict, who had previously pled guilty to stock manipulation, to help raise Loop's startup capital. That convict introduced Solomita to another convict who facilitated Loop's first investment.

- Solomita has no apparent formal science education but has a history of stock promotion at another publicly traded company that subsequently imploded.

- Executives from a division of key partner Thyssenkrupp, who Loop entered into a "global alliance agreement" with in December 2018, told us their partnership is on "indefinite" hold and that Loop Industries "underestimated" both costs and complexities of its process.

- We contacted Loop's other partners, including Coca-Cola and PepsiCo, most of whom refused to divulge whether any plastic had been recycled as part of their partnerships with Loop. Comments from Danone, owner of the Evian brand, suggested it had not bought any PET from Loop thus far. We suspect these partnerships have gone nowhere.

- Loop's JV with PET and chemical company Indorama, promoted frequently over the last two years as an imminent revenue stream, is "still being finalized," according to an employee, despite being announced in 2018. An Indorama employee told us no production has taken place thus far.

- We expect Loop Industries will never generate any meaningful revenue. With a market cap of ~$515 million, we see 100% downside to Loop once it burns through its ~$48 million in balance sheet cash.

- We have submitted our findings to regulators.

In response, Loop Industries issued this lame six-sentence press release:

Loop Industries (the "Company" or "Loop"), a leading sustainable plastics technology innovator, today commented on the report published by Hindenburg Research this morning, which contained factual inaccuracies.

Per the Hindenburg report, Hindenburg holds a short position in Loop Industries stock. Hindenburg Research has not engaged with Loop directly nor does Loop Industries believe Hindenburg Research has done the required due diligence for this report. The claims it makes are either unfounded, incorrect, or based on the first iteration of Loop's technology, known as Gen 1, which was in use between 2014 and 2017. In 2017, Loop reinvented its process and developed its Gen 2 technology, which is at the core of Loop's commercialization projects.

Loop's focus remains on commercializing its technology to meet growing global demand for infinitely recyclable PET plastic and polyester fiber made from 100% recycled content.

Best regards,

Whitney