Hidden Value Stocks issue for the third quarter ended September 30, 2020, featuring Tollymore Partners’ stock picks Gym Group (LON:GYM) and Franklin Covey Co. (NYSE:FC).

Q2 2020 hedge fund letters, conferences and more

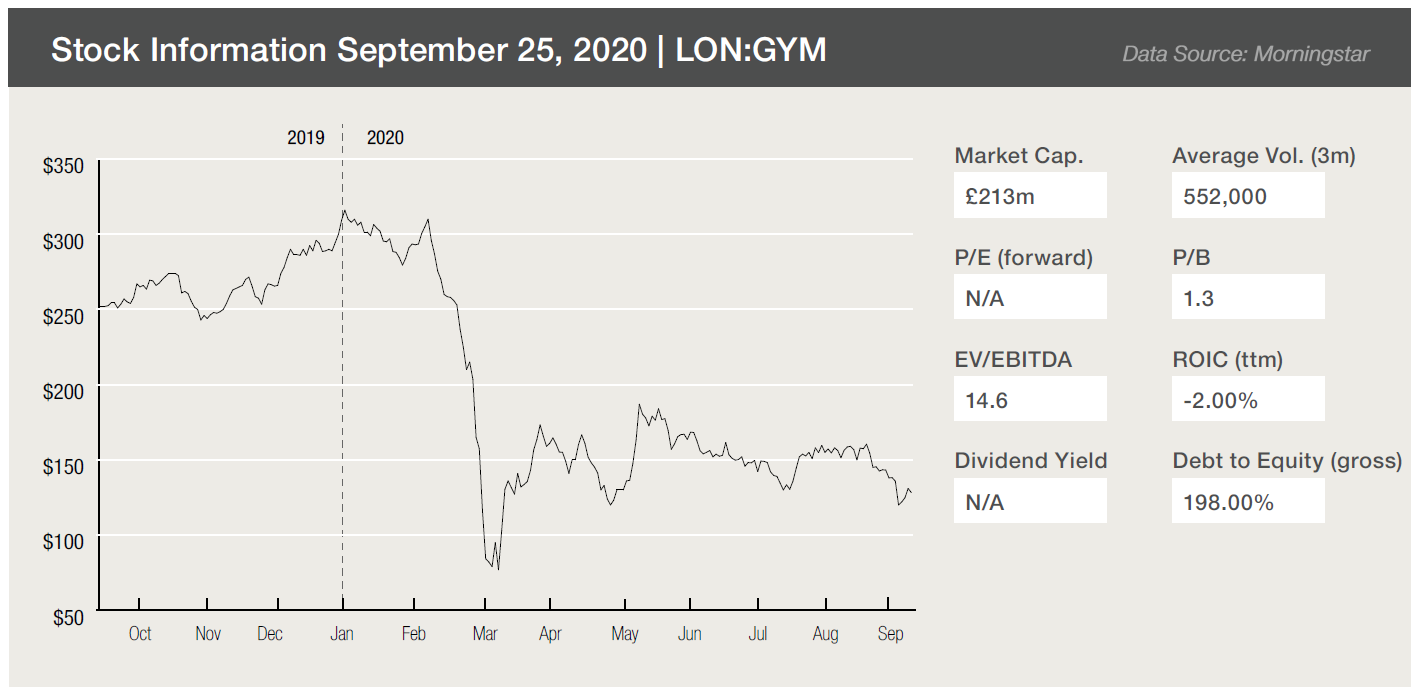

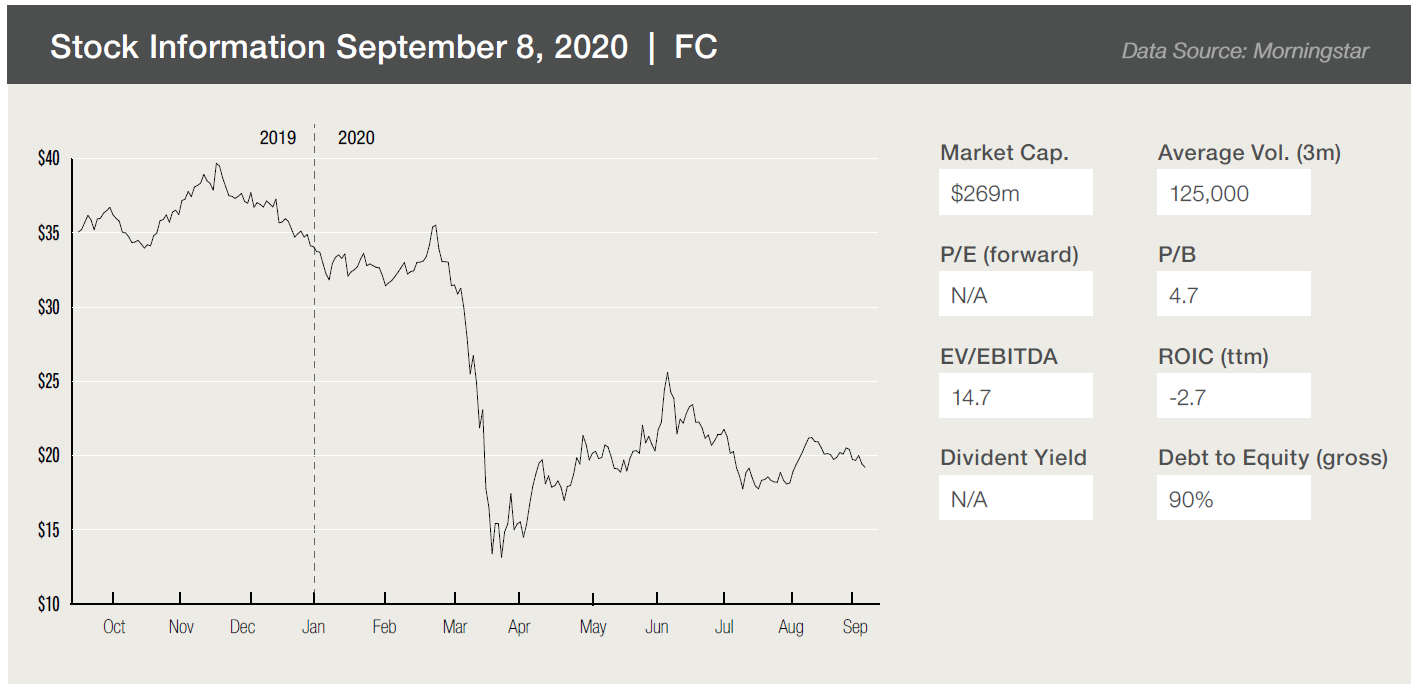

In the September 2019 issue of Hidden Value Stocks, Mark Walker, founder of Tollymore Partners picked out Gym Group (GYM) and Franklin Covey (FC) as his two undervalued small-cap picks. We recently caught up with Mark to see if he’s still bullish on these two firms.

Mark Walker: Gym Group Catch Up

How has the coronavirus pandemic affected the Gym Group, and do you still own the stock?

Gym Group's business was strongly adversely affected by the lockdown in the UK. Gyms were ordered to shut down and therefore earned no revenues from customers, none of whom are on contracts.

Gym Group froze all memberships for free. We, therefore, assumed 100% revenue loss in our ‘survive and thrive’ analysis. In addition, in March, we noted that two other factors would make this period challenging: (1) this is a business with high fixed costs, and (2) Gym will not enjoy pent up demand for its services. The market reacted swiftly in recognition of these challenges; Gym stock lost half its quoted value in the first quarter, enduring a peak to trough decline of 75% over a onemonth period.

The pandemic caused us to re-underwrite all our investments with a special focus on liquidity runway.

In our ‘survive and thrive’ analysis, we estimated how long each business could survive without revenues; protections mitigating revenue loss, such as contractual agreements; and what forms of cost relief may be available to our companies, due to the natural variable cost structure of the business, the curtailing of capital reinvestment, or government support. We compared the estimated cash burn to liquid assets and ranked our businesses according to those most likely to survive these extraordinary circumstances.

Read more

This capacity to survive massive revenue disruption formed one part of our analysis. The second step involved a consideration of the opportunities to flourish at the other end of this period. Do the restrictions placed on populations in quarantine aid or inhibit our companies’ ability to serve their customers? Do our companies sell products or services which have replacement characteristics, or for which demand is likely to build up over time, leading to lumpier rather than measurably lower cash inflows? Assuming ample liquidity runway, does the operating leverage in the business work in our favor when revenues pick up again? Does the business benefit from structural trends that may be accelerated by customers’ behavior confined to their homes? Do the cost and capital structures of competitors increase the potential for competitive rationality or consolidation?

The first two steps of this survive and thrive analysis were insufficient to help inform sensible portfolio management decisions. We changed our holdings’ weightings in the small number of situations in which our expectations for the company’s staying power and ability to flourish in more normal times were at odds with those implied by the quoted price change.

In Gym Group's case, we lowered our cost basis very meaningfully, where we determined this to be in the overwhelming interests of our partners. For Gym this necessitated the ability to purchase more shares of a smaller, less liquid company where we believed non-fundamental selling pressures were exaggerating the stock price decline. Capacity constraints are an essential safeguard against permanent capital erosion; they facilitate the ability to exploit mispricings and safeguard against being a bystander, a costly but common sin of many investment managers. The paucity of appropriate capacity constraints is a function of widespread greed, something we were excited to exploit.

The company has raised money from investors to strengthen its balance sheet. Is the balance sheet now robust enough to fund the group’s recovery?

Gym Group is now the best-capitalized player in the industry. Management articulated a clear intention to acquire distressed operators and new sites at lower rent. Prime real estate opportunities are now on the table, previously ruled out on the grounds of adequate economic return. All this suggests potentially improving unit economics and addressable market potential. And near term, the clear price gap between Gym and the next lowest price gym may allow some price increases. This, together with the unwinding of deferred revenues, should support near term profitability, while the long-term potential to deploy capital into value-accretive projects seems at least as rich as it ever was.

Has the pandemic enhanced or damaged the group’s competitive positioning?

We see several opportunities to thrive now that gyms have reopened. The transition from mid-tier to low cost may accelerate if recessionary conditions follow. Smaller-scale, more levered and less financially sound independent gyms may close. In the UK, DW Fitness

has shuttered and Xercise4Less has been permanently closing gyms, some near Gym Group sites. 24 Hour Fitness and Gold’s have filed for Chapter 11, the latter’s Germany branches

acquired by McFit. In the UK, one-third of local authority gyms have still not reopened, and the government’s funding crisis may result in a prolonged period of underdeveloped assets and an overpriced proposition.

Last time we spoke, you noted that for every £1 of owner earnings invested, the Gym group created £2 of value. Have these economics changed over the past six months, and how have the changes impacted your valuation?

Given the operating leverage and off-balance sheet financing in the business model, our original research on the company presented scenario analyses that stress-tested the point at which Gym Group could no longer service its maintenance Capex and operating lease commitments.

Read more

We did not go far enough; we did not envisage a circumstance in which Gym Group would lose 100% of its revenues overnight.

We tweaked our original assumptions as part of the re-underwriting of our ownership of Gym Group shares. Assuming the company continued to earn no revenue, ceased all maintenance capital investment programs, and obtained business rates and furloughed staff relief from the UK government, we estimated the firm could fund its rate of cash burn for five months, or 10 months should it draw on its existing credit facility.

This gave no credit for Gym Group’s ability to renegotiate rental agreements with landlords to obtain deferrals or discounts, despite this being likely due to the paucity of creditworthy tenant alternatives. This has indeed proven to be the case. It was also our contention that access to low-cost health and fitness for all is a mission the UK government is likely to support. In short, we thought the business had adequate liquidity to survive.

More so than any other stock we own, we moved aggressively to purchase many more shares, substantially reducing our ownership cost.

Unfortunately, because we conducted the above calculations swiftly, we purchased more shares too readily; we would have served our partners better by waiting. But frankly, we could not have anticipated the market would present the outstanding opportunity it did in the middle of March.

When we finished averaging down at 76p, the stock was trading at an owner earnings yield of 35%. The opportunity and intention to invest substantially all these owner earnings into new site development yielding cash on cash aftertax returns of c.20% remains.

We expect these final purchases to generate an annual investment return of c.60% to 70% for our investment partners.

Does Tollymore still own Franklin Covey Co.?

Yes, Franklin Covey remains a core position in the portfolio. Franklin lost almost two-thirds of its value in a month, implying an enterprise value of 85% of sales included billed and unbilled deferred revenues. We lowered our cost of ownership, consistent with our risk mitigation framework.

The company’s most recent results showed a massive drop off in demand for its services due to the pandemic. Do you think this is a temporary or more structural factor?

Five years into the business model transition, Franklin is better positioned to weather event-driven macro crises such as these. More than half of revenues are now subscriptions. This subscription model provides clients with the ability to access Franklin’s content and solutions across a wide variety of delivery channels, including digital and live online, allowing the group to help clients who are now working remotely.

Do you think there has been a structural change in the education/training market due to the pandemic?

The goals of improving leadership performance, execution, trust, and productivity have been enduring business objectives regardless of time, geography, or industry. And the human behavioral flaws at the root of these challenges seem equally perpetual in nature.

The goal of achieving permanent human behavioral change is a long-lasting one likely to need ongoing, multi-year support. A typical AAP subscription is in the region of $200 pa per employee. It really doesn’t take much in the way of employee productivity improvement for an investment to be worthwhile at this price point.

This low cost/high utility proposition makes switching unlikely once a client chooses to partner with Franklin; the company’s techniques and processes are deeply integrated with the way that clients conduct their business. High retention rates are evidence of this.

Based on the above, how long do you think it will take before Franklin’s revenue and profitability return to pre-Covid levels?

While customers have delayed the renewal of contracts, slowing new sales and depressing margins, this operating leverage will work in reverse as Franklin benefits from clients getting their bearings.

It took four months after the Global Financial Crisis for the pace of bookings to return to normal levels. Franklin suffered from clients postponing purchase decisions, but the company did not lose significant business – training and consultancy revenues declined 17% in 2009 when there was no subscription product. This time round, more than 100% of the revenue decline was due to clients rescheduling training due to take place onsite.

The subscription business’s strong progress is not reflected on the income statement but on and off the balance sheet as billed and unbilled deferred revenue. This was 20% higher than the prior-year in the last reported quarter. i.e., bookings are not slowing down, but the transfer of booked business onto the balance sheet has been impeded by the inability to deliver training onsite. This deferred revenue will be released as high margin subscription sales.

Is management making changes to stay ahead of the market and competitors?

Management has offered digital delivery of Franklin’s services for a long time, but clients have typically preferred in person, onsite, delivery. In fact, the firm’s online coaching capabilities were developed more than a decade ago, post-SARS. Covid has caused clients to try out the remote onboarding option when it became apparent that the virus was not going away anytime soon.

The net promoter scores for digital delivery are even higher than Live Online. The revenue and margins for Franklin of Live Online are similar, but this is cheaper for the client, as there are no travel costs for Franklin to train the client’s staff onsite. This may make it more appealing for clients to expand the number of AAPs they purchase.

Is its balance sheet strong enough to manage the recovery?

We estimated that Franklin could fund its monthly cash burn for over a year, even if all non-recurring income stopped immediately.

Read more

In our first interview, you said, “Ideally, I want to own Franklin Covey for a very long time.” Do you still hold this view?

Yes. The value proposition of AAP remains compelling and clients have been consolidating providers. Franklin’s new logo sales are on a par with prior years; there seems to be no signs that the company is less relevant to its customers today. Covid has paused the reported profitability of the business; this justifies an NPV reduction of 50% only through the lens of short-term investment programmes.