Third Point Partners’ Dan Loeb penned a letter to The Walt Disney Company CEO Robert Chapek, urging him to permanently end the company’s $3 billion annual dividend and instead spend it on Disney+.

Q3 2020 hedge fund letters, conferences and more

While activist investors are not known for demanding companies return less money to shareholders, Loeb believes Disney+ to be at an inflection point. "By reallocating a dividend of a few dollars per share, Disney could more than double its Disney+ original content budget," Loeb wrote in the letter to Chapek, which was obtained by Activist Insight Online.

The letter comes days after Disney announced it would lay off 28,000 workers at its amusement parks due to the COVID-19 pandemic. Despite the company’s struggles, Disney+ has attracted over 60 million paying subscribers since its launch in November last year.

To arrange an online demonstration of Activist Insight Online email us at [email protected].

What We'll Be Watching For This Week

- Which of the investment ideas pitched at the Active-Passive Investor Summit will catch a takeover bid first?

- How will Calfrac Well Services shareholders vote regarding a takeover by Wilks Brothers at the meeting on Friday, after the company warned it would trigger insolvency?

- Will the threat of legal action from the Securities and Exchange Commission continue General Electric’s share price’s downward spiral?

FuelCell Energy shares tumbled 16% last Monday as short seller Night Market Research alleged the power company failed to properly disclose the cancellation of two contracts worth hundreds of millions of dollars. "We found that [the two cancelled contracts] represented approximately $636mn in future revenue," Night Market said in a Monday October 5 report. However, FuelCell dismissed the allegations, saying the short report contains "misleading" claims and "factual inaccuracies."

FuelCell’s projects appear to have been scuttled by the 2019 Climate Leadership and Community Protection Act passed by New York state, which changed the definition of “renewable energy systems” to exclude fuel cells powered by fossil fuels. Though FuelCell mentioned this legislation in the footnotes of slide decks in 2019 and 2020, it has not appeared in any of the company’s Securities and Exchange Commission filings. Night Market said the nondisclosures could force the company to cancel or reprice its secondary offering which grossed $105.5 million and closed last week.

To arrange an online demonstration of Activist Insight Shorts, email [email protected] or view our product brochure to find out more.

Chart Of The Week

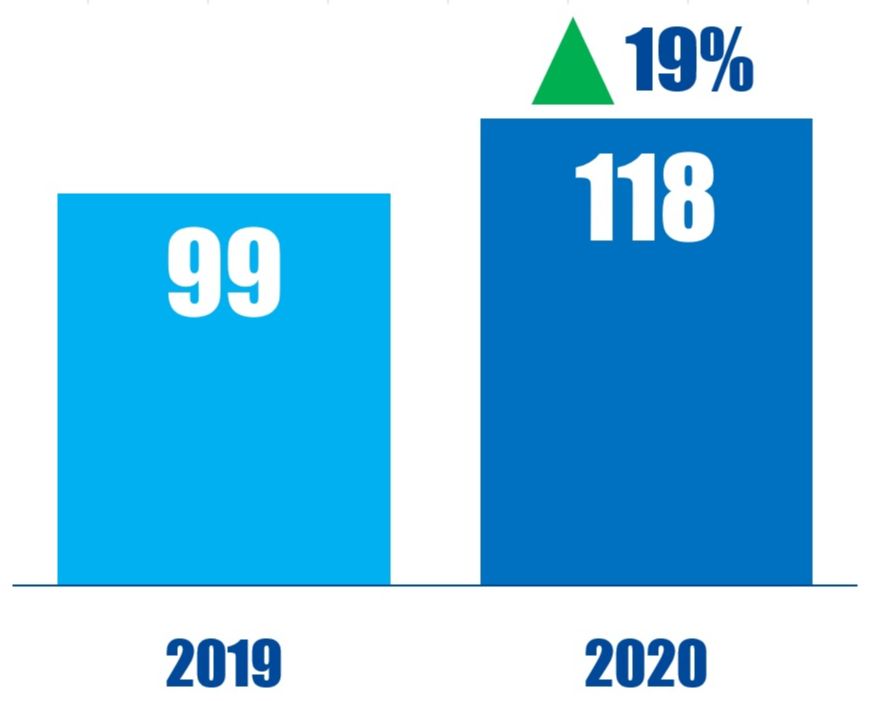

The number of board-related activist demands made at Asia-based companies between January 01 and September 30 in respective years.