FPA Crescent Fund commentary for the third quarter ended September 2020, discussing that more than half of the stocks in the ACWI and S&P have declined in value this year.

Q3 2020 hedge fund letters, conferences and more

H/T Dataroma

Dear Shareholders:

Overview

The FPA Crescent Fund (“Fund” or “Crescent”) gained 3.80% for the third quarter and declined -5.12% for the first nine months of 2020.1

The global MSCI ACWI Index (“ACWI”) advanced 8.13% in the third quarter, while the domestic S&P 500 Index (“S&P”) increased 8.93%. Year-to-date through September, the ACWI and S&P returned 1.37% and 5.57%, respectively.

Stocks In The ACWI And S&P Have Declined In Value

Guided by the incredible performance of a few large growth companies, these indices have recovered from being deeply in the red following the global onset of COVID-19. Stock market breadth is as narrow as we’ve ever seen it. Notably, more than half of the stocks in the ACWI and S&P have declined in value this year, which helps explain the negative year-to-date performance of the ACWI and S&P when measured on an equal-weighted basis. The largest 10 companies delivered all of the performance (and then some).

In last quarter’s letter, we pointed out that the Fund’s long equity portfolio, for trailing twelve month and forward periods, was cheaper on a price-to-earnings and price-to-book basis than the S&P and ACWI, and had higher 3-year historic and forecasted earnings-per-share growth than the indices, although you wouldn’t know it from its price performance.3 On average, it appears investors are placing much greater weight on what earnings might look like in the (sometime distant) future, rather than what they are in the here and now. Joel Greenblatt, in a recent Bloomberg podcast, pointed out that, “If you bought every company that lost money in 2019 that had a market cap over $1 billion…you’d be up 65% so far this year.”4

Long equities held by the Fund returned 4.43% and -11.32% in the third quarter and nine months, respectively, underperforming the ACWI and S&P in both periods.5 Including some minor risk assets and cash held, the Fund generated 51.88% of the market’s return in the quarter (where “market” is the average of the 2020 third quarter returns for the ACWI and S&P). The Fund underperformed its own risk exposure of 78.9%, on average, during the quarter.6 Growth continues to outperform value for the year on a global basis, as illustrated by the MSCI ACWI Growth Index Q3 and YTD return of 12.00% and 18.13%, respectively, versus its value counterpart, MSCI ACWI Value Index, returns of 3.97% and -14.54%, respectively, for the same period.

Portfolio discussion

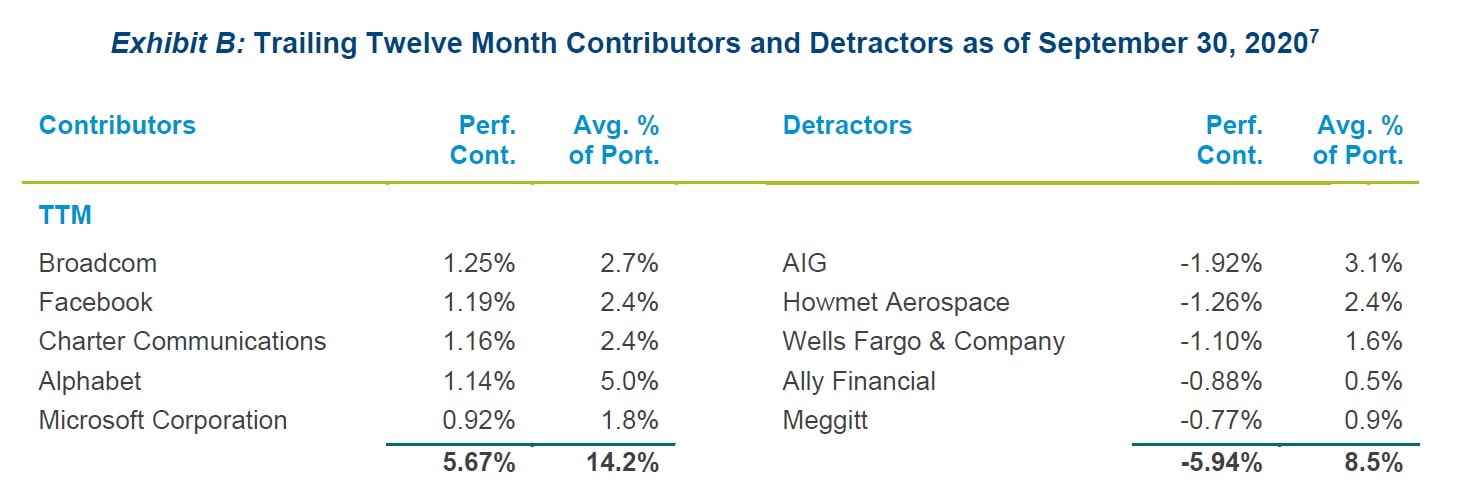

Contributors to and detractors from the Fund’s trailing 12-month returns are listed below.

As value investors, we aim to understand the value of a business and purchase it at a price that offers both a margin of safety and the opportunity for a good longer-term rate of return. Sometimes, a company captures the imagination of investors right away and that return comes quickly, but often the exact opposite may occur. Four of the contributors in the Fund over the trailing twelve months are technology companies, and the fifth is a cable company that offers the broadband delivery system for new technology (streaming). The contributors have either been beneficiaries of COVID-19 (e.g., more streaming and thus more demand for broadband) or haven’t experienced much of a negative impact on their businesses due to the pandemic. The detractors are aerospace or financial companies, whose businesses have been harmed to various degrees and their stock prices reflect these changes. However, in most cases, when COVID-19 recedes, we believe these businesses will rebound and incite investor interest that could lead to higher stock prices.

The need for return has most investors feeling the tension between current income and capital appreciation. Finding yield in this environment has caused investors to either accept lower yields or move out on the risk curve to capture yields that are only marginally higher and generally don’t appreciate the inherent risk in many of those credits. That has accrued to the benefit of the equity markets in recent months where total return is being sought in its stead.

No one has ever lived through the grand monetary experiment that central bankers and government treasuries are cooking up. These are unproven and untested theories where the outcome is not yet clear. However, if one has a long-term time horizon, choosing between investments in cash (no return), fixed income (low return), and equities (likely higher return), equities would be the logical choice.

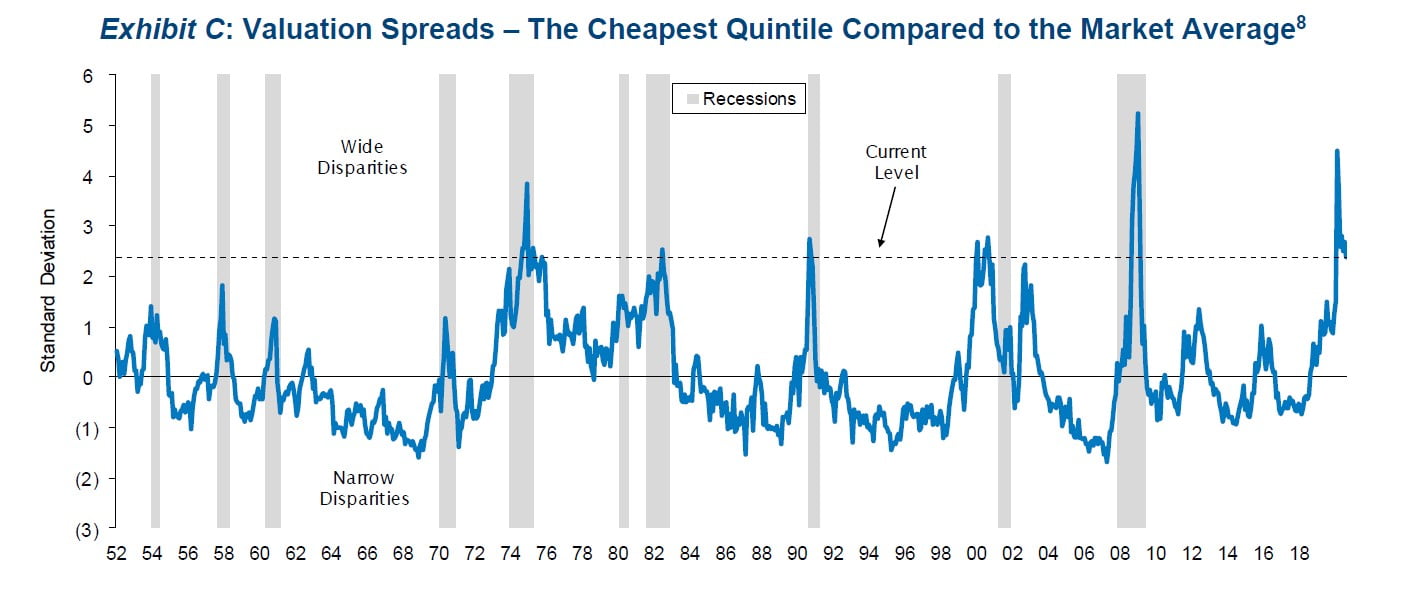

Only A Matter Of Time Before The Valuation Gap Narrows

We therefore continue to maintain the Fund’s net risk exposure at ~78.3%, but with less than average exposure to low-yielding, sub-investment grade corporate debt, the Fund’s equity exposure has crept up to 70.4%. We believe the more value-oriented names in our portfolio continue to offer good value, both on absolute and relative terms. Should these companies continue to execute well, we believe it is only a matter of time before the valuation gap narrows between them, the stock market, and certainly the expensive, large-cap stocks.

We alluded in the second quarter to central bank policies widening the societal gap between the Haves and the Have-nots. Within the equity market, a similar valuation gap between the Haves and Have-nots is about as wide as we’ve ever seen it.

Low multiples are certainly justified for those businesses that face existential risk.

We have largely avoided the secularly challenged industries over the last decade: including brick and mortar retail; mall real estate; oil and gas; and broadcasting. However, there are many good businesses in sectors that are cyclically challenged and have not performed well of late: such as aerospace; property and casualty insurance; and cement.

If the companies in our portfolio grow at the same rate as the stock market (they’ve actually been growing faster), while trading at lower valuations, then it stands to reason that our portfolio should perform well in the future. Though we wish it might be sooner, we expect business performance will eventually be recognized in stock prices.

Respectfully submitted,

Steven Romick

Co-Portfolio Manager