In our recent writing on the energy transition, one of the themes we have touched on is the need to increase investment in two types of firms: transitioning companies and enabling companies. These are businesses that either make goods to enable a transition or businesses that produce economically critical goods that need to transition their processes to lower carbon outputs.

Q3 2020 hedge fund letters, conferences and more

Innovation In Cleantech Companies

Enablers may spring from existing firms or emerge as new businesses. The opportunities range from carbon capture technology to grid-scale battery storage. Despite the promise, there are substantial barriers to deep decarbonization in many industries, and some might go so far as to say that energy innovation is fundamentally different from innovation in other sectors of the economy.

Energy or cleantech companies typically face significant up-front capital requirements, very long development timelines, and heavily regulated markets. As was recently noted in Energizing America: A Roadmap to Launch a National Energy Innovation Mission:

"New energy technologies often seek to eke out efficiencies near the limits of physics and thermodynamics, and they must meet daunting performance and cost demand from customers and regulators. Energy innovation cannot match the rapid cadence of product development and commercial diffusion achieved by software startups. New energy technologies often take decades of development and billions of dollars of investment before achieving commercial traction."

Thus, it is unsurprising that little progress has been made decarbonizing certain sectors of the economy; after all, the above description does not paint an overly rosy picture of the potential for success. The execution challenges, unfortunately, beget funding challenges, and the funding challenges prevent progress.

Climate Change As An Innovation Problem

Climate change can be looked at as an innovation problem. We must innovate across multiple disciplines, multiple technologies, and numerous business models to shift our economy's mode of operation from a high carbon footprint to a low carbon footprint. The centrality of innovation to solving the problem immediately brings to mind, in many, Silicon Valley and venture capital. Unfortunately, venture capital has a checkered history when it comes to energy innovation and cleantech, succeeding in some cases with software related startups but generally failing when it comes to the innovations necessary to promote change.

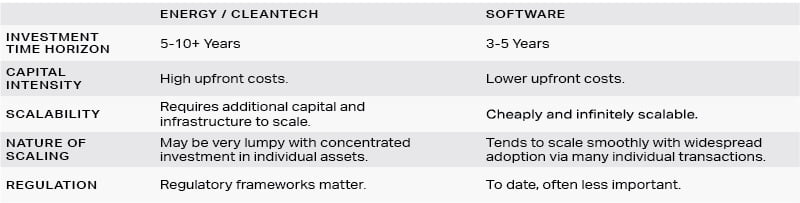

Between 2006 and 2011, VC investors plowed roughly $25 billion into the cleantech sector and lost nearly half of it. Although VC investing levels in cleantech have bounced back from the dismal post-2011 washout, they are only now approaching the 2006-2011 highs. One of the important lessons learned from that period is that energy and cleantech investing is fundamentally different from software:

In a world that has grown accustomed to the next great thing arriving speedily to their phone, the disconnect between the risk and reward profiles of the typical VC investment and those needed to finance the energy transition are somewhat concerning. At Massif Capital, we rarely jump on a recent market mania as an opportunity, let alone posit it as a possible solution to a pressing issue, but given the inherent risk-reward disconnect between VCs and Energy/Cleantech we think it worth contemplating the possibility that SPACs represent an effective medium through which to finance essential energy-related innovation.

We are not suggesting that investors pile into the current deluge of cleantech/energy-related SPACs. We find little interest in the current energy slate of SPACs. Still, with at least 12 cleantech/energy-related SPACS coming to market this year, there does appear to be an appetite for the types of investments necessary to make a go at charting a new course in the energy world. By our count, electric vehicles are currently dominating the market (Nikola, Canoo, Hyliion, Lordstown, Fisker, XL Fleet, Hyliion), but battery technology suppliers (Eos, Romeo, Quantumscape), electric vehicle charging (ChargePoint), and even rare earth mining (MP Materials) are catching a bid. According to Bloomberg, only one of the clean energy SPACS has meaningful commercial revenue, and five have no revenue. Some companies are likely struggling to raise more private capital and their fatigued investors need to find an escape route through the SPAC frenzy. Some may indeed prove revolutionary and are simply in search of a better path to public markets.

Issues With SPACs

SPACs are not without their problems. The most pressing being that the traditional structure often results in the SPAC sponsors collecting an easy 20% of the business at the expense of shareholders. Furthermore, given the unique capital formation process, it’s challenging to understand where incentives ultimately lie. Preferred stock, warrants, dilution, private placement offers below the market price … the SPAC offering documents are littered with cross currents of incentives that can challenge even an astute reader.

For cleantech companies however, SPAC’s may be critical as an option for capital formation. The time horizon for a SPAC is limited only by capital and market patience, which can be very long indeed (see Plug Power and Bloom Energy for examples of the market’s patience with clean energy technology). Investors can enter and exit at any time, so management need not worry about having anxious investors looking for the door. Most importantly, the capital commitment may be an order of magnitutde larger.

SPAC’s are another financing tool to provide liquidity options to employees and early shareholders. Bio-tech investors start planning for an IPO after a Series A or B round is raised. What happens if energy technology investors can plan the same way? We may see more ‘moonshot’ companies, solving difficult problems as the SPAC structure makes it easer to extend the financing horizon beyond private markets. Reid Hoffman recently framed his SPAC as “venture capital at scale”, seeking to fill the void to be a long term financial co-founder as opposed to offering a onetime service of going public.

The capital scale is critical as most cleantech and energy investments that are ready to be integrated into business models are in the development and demonstration stage. The demonstration stage is particularly important for energy and cleantech. A large-scale demonstration is critical to commercializing physical products with precise performance and cost expectations from demanding business customers. SPACs do not address or solve all the cleantech/energy world's funding problems, but they certainly are an interesting financing mechanism worth contemplating. With the SPAC market now ~55x the size it was just six years ago, its easy to write off the trend as pure speculative behavior that ensures a future bust. We’re not ready to make that call yet. We recommend watching this space for cleantech companies.