Based on our analysis, we are in a nascent and likely soon-to-be-explosive bull market for precious metals stocks underpinned by a macro set-up that includes:

Q2 2020 hedge fund letters, conferences and more

- Record debt-to-GDP globally that has been stifling economic growth

- A continuing structural global recession with rising permanent unemployment

- Historic speculative asset bubbles in US stocks, corporate credit, and Treasury bonds

- The likely re-ignition of a tactical bear market for US stocks

- US Treasury funding needs that virtually assure new record Fed debt monetization through 2021

- A central bank with a coordinated policy to increase the rate of inflation

Buying Undervalued Hard Monetary Assets

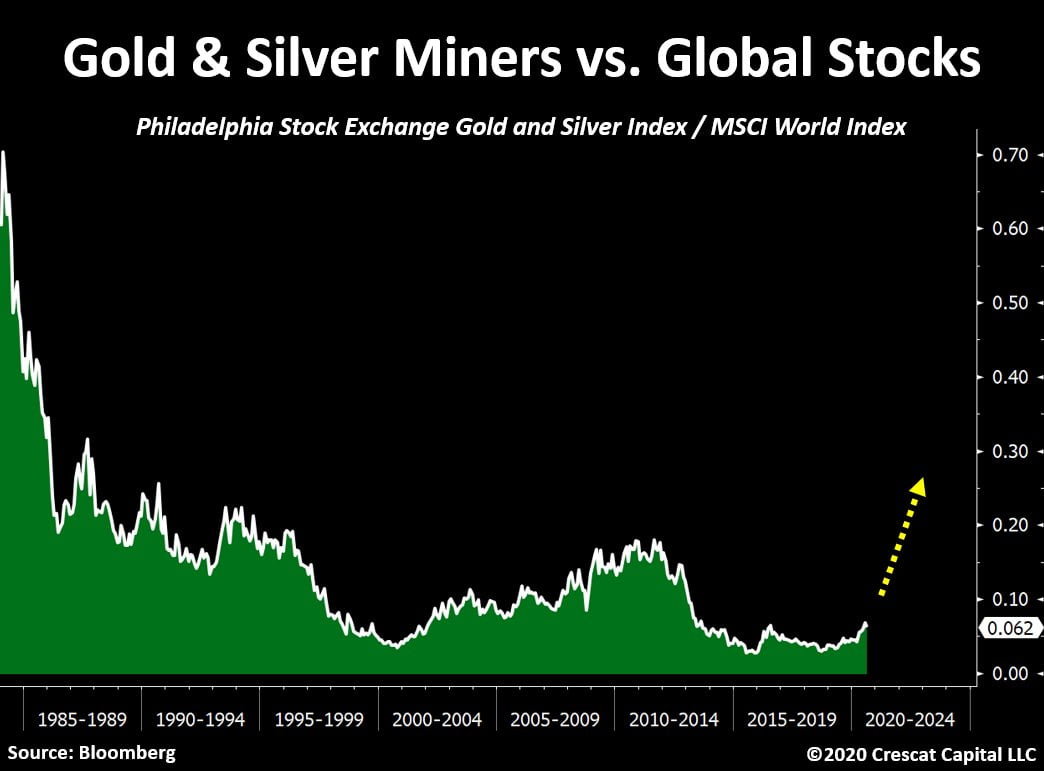

Investors are only beginning to wake up to the idea of selling overvalued stocks and bonds and buying undervalued hard monetary assets such as gold and silver and related mining companies to give themselves a fighting chance at protecting and growing wealth in the current macro environment. On the equity front, precious metals miners are one of the few if only industries with both deep value and strong intermediate-term fundamental growth prospects in the stock market today.

Imagine not seeing the above chart and calling for the end of the bull market in precious metals.

Crescat has been building a portfolio of the most prospective, large, new, high-grade gold and silver deposits in the viable mining jurisdictions across the planet. To date, we have acquired significant stakes in more than 30 of these companies in our hedge fund and precious metals strategies.

We are making friendly, activist investments in these firms with the help of internationally acclaimed exploration geologist, Quinton Hennigh, PhD, Crescat’s geologic and technical advisor. After a brutal ten-year bear market for the exploration-focused segment of the precious metals mining industry, there is an incredible value and growth investing opportunity today in support of our aggressive action plan. With Quinton’s expert guidance, Crescat is focused predominantly on deeply undervalued companies with outstanding mining claims and high-quality management and technical teams necessary to extract value from these assets.

Through Crescat’s funds, we are able to channel much needed exploration and development capital to these companies to help them build valuable mineral resources often investing at discounts to public market prices in deals that include valuable warrants and anti-dilution rights. We believe our activist precious metals portfolio will deliver substantial risk-adjusted outperformance (alpha) while also benefitting from the underlying long (beta) exposure to precious metals asset class.

Long Precious Metals Stocks' Exposure

In addition to the long precious metals’ exposure, both our global macro and long/short hedge funds remain significantly short a portfolio of absurdly over-valued stocks according to our fundamental equity model. For investors, who share our views, in these two hedge funds, we are determined to profit from the highly likely resumption of the bear market environment that surfaced in March of this year. We intend to capitalize on an impending valuation implosion not unlike the 1929-32 Great Depression and the 2000-02 tech bust. In our analysis, asset bubbles always burst and the current one is on borrowed time. We foresee a big downturn in stocks. At the same time, we believe undervalued gold mining stocks are setting up to diverge to the upside like historical analogs in 1930-32, 1973-74, and 2000-02. We intend to exploit these two big macro themes in our hedge funds.

Crescat Global Macro Fund has a third big theme, our China currency crisis theme, the third leg of our Macro Trade of the Century. We maintain a significant short position in the Chinese yuan and Hong Kong dollar today via long US dollar call options with large US bank counterparties versus those currencies. Our macro analysis continues to show that China has the largest banking imbalances of any country in history. The sheer, impossible size of China’s reported banking assets, reveals a huge, unrecognized non-performing loan problem. Such a large accounting misstatement is truly unprecedented in the history of global financial markets. In our strong view, money printing, bank recapitalizations, and currency devaluation are the only viable release valves to deal with the severe economic distress and social unrest that China will be facing during its inevitable reckoning. With the current global recession, trade wars, and new cold war between China and the US, there are abundant current catalysts for a Chinese currency crisis.

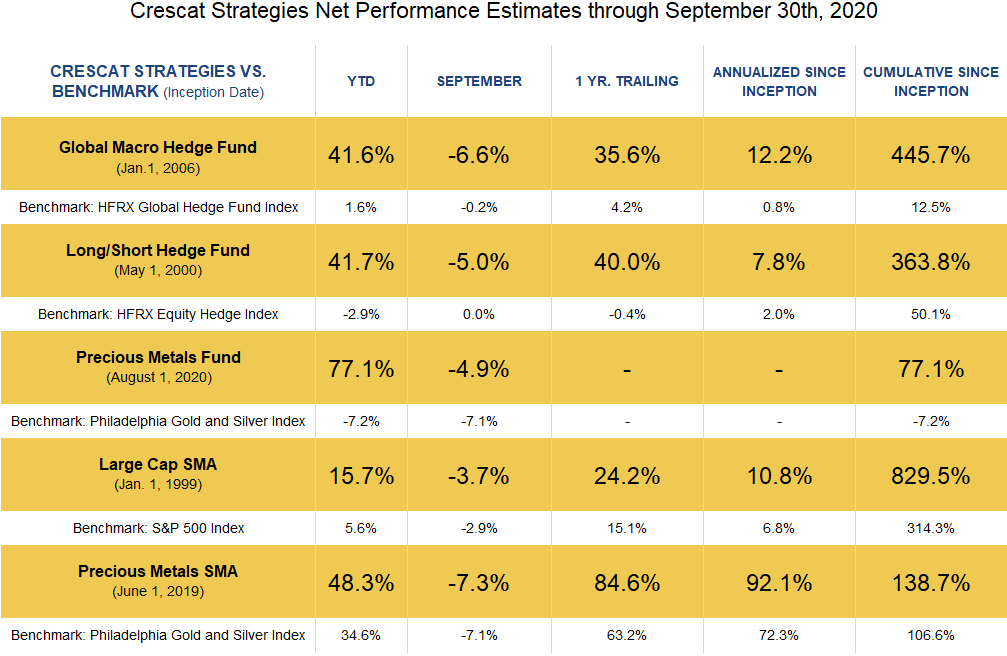

Crescat has performed well year to date across all strategies in what has been a challenging year for money managers and investors at large. Our pullback in September was attributed primarily to our long precious metals exposure across all our strategies today. The Philadelphia Gold and Silver Index (XAU Index) was down 7.1% in the month. Silver was down 17.5%. The industry-wide pullback was not only natural but healthy in our view. Since the March selloff in stocks, precious metals miners had been the number one performing industry in the market. Crescat made the right macro call in that respect across the firm. We also delivered strong outperformance relative to the XAU Index since that time via our stock-picking. We believe it is only the early stages of a new precious metals bull market for the many macro reasons we have laid out in our recent writings and macro chart presentations. Corrections are necessary to shake out the weak hands and prepare the way for the next macro and fundamentally driven advance.

Strong outperformance over complete business cycles remains Crescat’s goal. We are particularly excited about our potential to perform in the near and intermediate term because of our research supporting our current trifecta of macro investment themes and positioning, including a new secular bull market for precious metals, tactical bear market for stocks, and Chinese currency crisis.

Sincerely,

Kevin C. Smith, CFA

Founder & CIO

Tavi Costa

Partner & Portfolio Manager

Crescat Capital LLC