Black Bear Value Fund letter to investors for the third quarter ended September 30, 2020, discussing their top 5 long positions.

“Half of the American people have never read a newspaper. Half never voted for President. One hopes it’s the same half.” – Gore Vidal

Q2 2020 hedge fund letters, conferences and more

To My Partners and Friends:

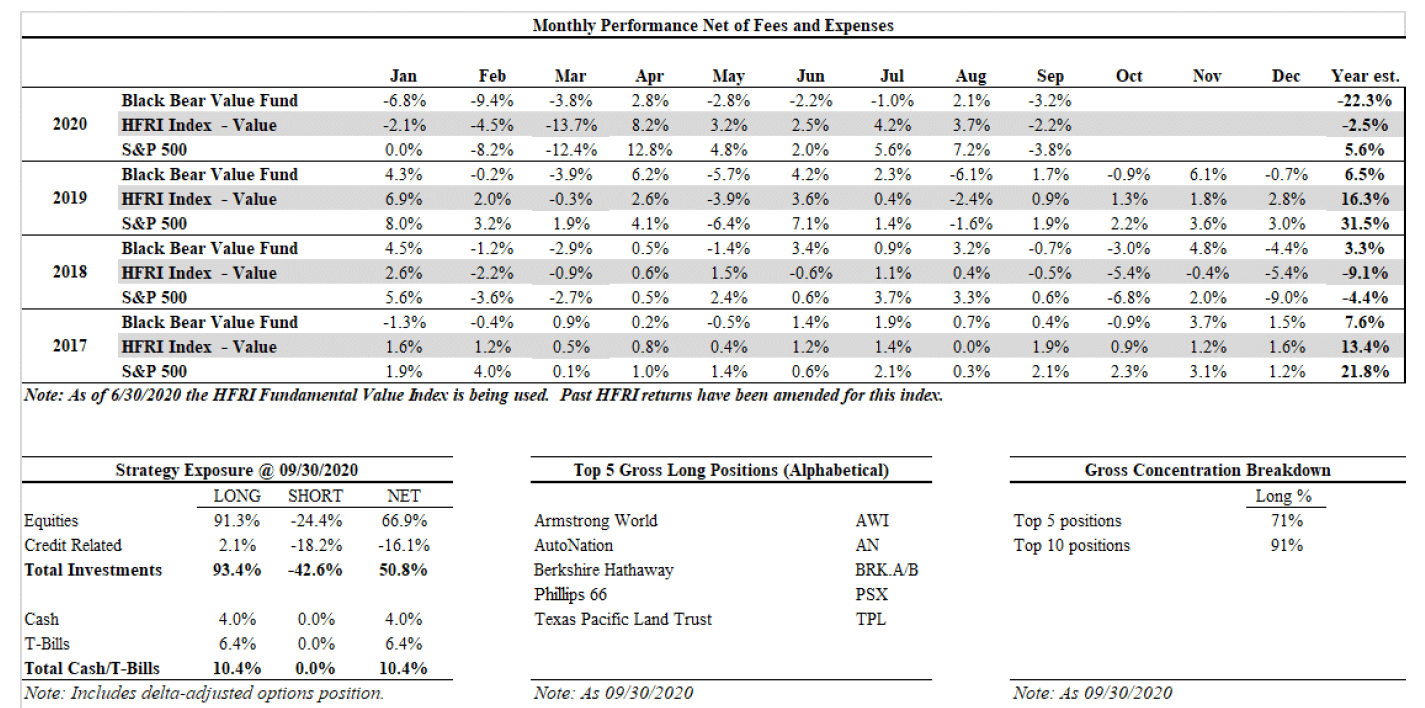

- Black Bear Value Fund, LP (the “Fund”) returned -22.3%, net, YTD.

- The S&P 500 returned 5.6% YTD while the HFRI index returned -2.5%.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

It can be cringe-worthy when someone describes an exciting investment opportunity, as most successful investing should not result in excitement. That said, the disparity in the prospects of what we own versus what is generally considered “the market” is the widest I’ve seen since I started the Fund. It’s anathema to say I’m excited so you’ll have to live with the statement that I am very pleased to be an owner of these businesses at these valuations. In 5 years, it seems likely we will look back and wonder why such good businesses were available to us at such cheap prices.

We have added new investments in smaller-capitalization/under-followed domestic and foreign companies with excellent balance sheets. In addition, 2 of our top 5 positions are now in the energy space. As capital continues to leave the energy sector it has become a smaller and smaller part of most investment portfolios (both passive and active). Most of the companies being sold were structurally doomed given high amounts of leverage. Our investments are either under-levered or in a net-cash position with idiosyncratic differences from the larger energy space. Year-to-date, we had very little overlap with the S&P 500 and now we will have less. This means that our performance will continue to have little correlation to the “market”.

Top 5 Long Positions We Own (alphabetical order)

Brief descriptions of our top 5 long positions follow comprising ~71% of the portfolio at quarter-end.

Armstrong World (similar summary as last quarter)

AWI is a 129-year old designer and manufacturer of commercial and residential ceiling, wall and suspension systems. 95% of their sales are for commercial use with the majority (70%) for repair and remodel (R&R). This translates to less sensitivity to new construction as R&R is a more stable revenue stream.

The US ceiling industry is consolidated with the top 3 companies controlling 98% of the market. AWI is the market leader with 65% market share. Because of a large previously installed base and exclusive distributor relationships, they’ve been able to increase pricing in the 5+% range annually.

On the 2nd quarter earnings call management reiterated their medium-term targets of high single digit revenue growth and free cash flow growth of 10+% annually. I underwrite slower growth and still come up with a security price that is significantly higher than where it trades today. With low leverage and steady cash production there are opportunities for them to both buy-in their stock and make bolt-on acquisitions.

AWI should be able to generate $4-$5 in annual free cash flow which implies a current yield of 6-8% that should be able to grow 5-7% per year over the long-run. This is an excellent business at a cheap price.

AutoNation

Despite COVID, AutoNation and the auto dealer industry are experiencing a record year. The 2nd quarter was the best earnings performance in the company’s history. While new and used car volumes are down, dealers have been able to increase profit margins due to a variable cost operating model and lower inventories.

Auto dealers have a large variable component to their expense base as they can reduce headcount, ad spending and other costs when business slows. We saw evidence of this in 2008 which repeated in the 1st half of 2020. Their ability to reduce costs was far in excess of what I had thought which was a pleasant surprise.

AutoNation has been testing used car supercenters called AutoNation USA over the last 2 years. Given its’ success they are investing an incremental $200MM to open another 20 over the coming 3 years. This is another potential area of growth for the company.

There is a lot of focus on online car shopping disintermediating traditional retailers like AutoNation in the used car market. Note that most traditional dealers have pivoted to online fulfillment. The legacy dealers have an inherent advantage both in terms of sourcing cheap cars from trade in and scale/density of existing dealerships to transport cars. Additionally, the cash produced by the parts and service business allow AN to reinvest in other methods of customer fulfillment whether they be online, in person, or omnichannel.

The 1-2 lot dealers will likely be the ones to suffer as they lack scale and density. The short-term disruptions to the business from COVID will accelerate changes and benefit those who have (AN) and hurt those who do not (smaller dealers).

AutoNation can generate a range of $4.00-$7.00 in free cash flow per year. This implies an 8-13% yield to us presuming limited growth. My expectations for AutoNation’s prospects have gradually improved as I see them effectively addressing costs and reinvesting in areas of growth.

Berkshire Hathaway

For more discussion on Berkshire I would refer you to past letters as we have discussed it at length.

In the 2nd quarter of 2020 Berkshire bought $5.1BB of stock, which is the most ever in a single period. Despite this, their cash holdings rose to $140BB in total. They have since deployed some of this cash in the 3rd quarter. It remains to be seen if they continued to buyback their stock in Q3. We will find out in the coming month.

Net-net I like owning Berkshire for similar reasons as before. It is very cheap for such high-quality businesses. While some punish the valuation for the cash holdings, prudence seems to be an unrewarded virtue at present.

Stock prices can go anywhere and be disconnected from underlying business performance. The collection of businesses at Berkshire (GEICO, BNSF railroad, BH Energy etc.) will continue to perform and expand their moats over time. This is a safe compounder which will prove it’s worth over the long-haul.

Phillips 66 (PSX)

PSX has been a top 5 position in years past. Its long-term value is similar to when we last owned it but is down 50+% in price in sympathy with broader energy concerns.

PSX is an integrated energy company with 4 central divisions: refining, chemicals, midstream (pipelines etc.) and marketing (gas stations). Due to downstream demand destruction, the refining businesses is taking it on the chin. This could persist for the remainder of 2020 and into 2021. As in years past, a lot of focus is given to the refining business as it has historically been the lion’s share of the value for PSX. Management has invested in the non-refining businesses who now make up most of the value of the company.

Management is extremely thoughtful with capital allocation and has focused on a healthy balance sheet with opportunistic share repurchases. They do not spend capex on projects unless they meet a healthy margin of safety for returns.

PSX should be able to generate substantial amounts of cash in the coming years and generate a 15+% free cash flow yield on quarter-end pricing. If the stock remains low management will be buying in a lot of stock.

Texas Pacific Land Trust (TPL)

TPL is a publicly traded land trust that is one of the largest landowners in Texas and one of the oldest listings on the NYSE, having been formed in 1888 and listed in 1927. Most have not heard about TPL as they are not in passive indices due to their corporate structure (they are a trust with unique corporate governance).

TPL is a royalty company with 100% of their acreage located in the Texas Permian Basin. In a nutshell they make money when drilling activity occurs but DO NOT have the capital needs as they simply provide access to land. Think of them as a franchisor of fast-food energy and the drillers and/or midstream as the actual restaurants.

If you drill oil on their royalty-land you pay a portion to TPL. Need a road to drive to the site? You pay a fee/easement. Need water? Need a pipeline? Need electricity transmission lines? I think you get the picture. If you want access to the assets underneath the ground or to travel on top (oil/natural gas/water) you must pay TPL.

The incremental amount of work on TPL’s part is minimal as the extraction and movement of the oil/natural gas is undertaken by others. They are merely a toll collector with Returns on Capital of 80+%.

TPL is undergoing a corporate structure change as the result of constructive activism from Horizon Kinetics. They will be converting to a corporation with modern corporate governance over the coming months. This could result in index inclusion which could provide a non-fundamental catalyst for the stock price to rise.

Longer term some of the cheapest to deliver hydrocarbons are in the Permian basin. Some are concerned that the long-term push towards renewable energy will harm them. I see it a bit differently. First, change takes time and while there are increasing amounts of electric vehicle (EV) or solar power discussions, it is going to take a while for it to become a large part of our everyday lives. Secondly, and probably more importantly, renewable products require commodities and/or compounds that need to be extracted and/or heated (Silicon, silver, copper, lithium etc.). Their production requires hydrocarbons. In order to get to a lower hydrocarbon long-term future, we will need hydrocarbons. The cheapest place to get these are in the land owned by TPL.

In an inflationary environment, businesses that have lower capital intensity both in capital assets and people stand to benefit. In other words, if oil goes up a lot, the incremental cost to TPL is close to 0 so it’s all incremental profit. This is a business that should benefit in a massive way if we were to see energy inflation. In the meantime, we likely own it at a 5-7% free cash flow yield with massive upside.

Shorts

We continue to have credit shorts, index shorts and 2 small equity shorts in our portfolio. I have made my thoughts on ETF’s well-known and will not belabor the point. Over the coming 6-12 months we will likely see actual defaults come thru the pipeline and I am curious to see how the bond market absorbs them.

Portfolio asymmetry and risk

Our portfolio is as asymmetric as I can ever recall. We do not need to have 100 great ideas. 5-10 is more than enough. From a risk perspective I am surprised we can buy the quality of companies we own at these prices. Some of it may be technical in nature as much of what we own is NOT represented in passive flows. From a long-term perspective we will make up a lot of ground when the winds change. We need to maintain our patience and analyze our decisions based on the underlying business performance, not in the auction/popularity contest that is the stock market.

Inflation and impacts of psychology

Investing in businesses with pricing power is of extreme importance. With record amounts of money being injected into the financial markets, inflation and pricing power are variables to strongly consider.

In simple terms inflation means a rise in price and associated decline in the purchasing power of your money. For the average consumer if the price of milk and eggs goes up, and wages do not move up in tandem, the consumer is worse off. Inflation can be a very subtle tax, but the power of compounding can make the impact devastating over longer periods of time. If you experienced 4-5% inflation for 4 years and your income stayed flat, you would be 15-20% poorer as your dollars could only buy 80-85% of what you used to consume.

What creates inflation? There is a big debate about the current state of US finances and whether a big inflation wave is coming. I tend to lean in the camp that several outcomes could produce a pretty steep rise in inflation in the coming decade. The 2 central reasons are the supply/demand of money and the psychology that can reinforce or even create inflationary behavior.

First, let’s presume tomorrow every American received $1MM in the mail. Let’s further presume that every middle-class person who gets this check wants to make a luxury purchase of a vehicle or something equivalent. If this check arrived with no warning, there would not be enough luxury goods to satisfy this stimulated demand, so prices go up (inflation). This is an extreme example but shows that more money chasing goods results in increased prices.

Second, let’s discuss how psychology can create or reinforce inflation. If you sell a good and are concerned that your input costs are going up…you will raise prices. Sometimes you may raise prices ahead out of fear that your costs will rise. It’s a very circular issue. In the case of homebuilding the wood manufacturer may raise prices for their lumber because of fear of their labor costs are going up. The homebuilder sees this and starts to price their homes higher to maintain margin. The homebuyer sees this and needs to pay a higher cost and demand higher wages to compensate them for the increased cost of living. The mere concern about inflation can create inflation.

Anyone who can accurately predict the way inflation behaves will get a cookie from me. I think it’s an impossible task and that the Fed is continuing down a very dangerous path and tempting fate by allowing inflation to “catch up”. We will see how things play out. In the meantime, I am focusing on businesses that have pricing power to limit some of the damage from an inflationary environment.

Upcoming election and positive wishes

We are weeks away from one of the more consequential elections in history. As a world we are going thru tumult caused by COVID-19 and dealing with the pain of racial injustice that has been perpetrated for as long as anyone can recall.

No matter your politics the one thing I hope for is calmness and civility. The divisiveness and polarity between those who disagree is alarming. The combination of a 24-hour news cycle and social media creates an echo chamber which entrenches people in their closely held views. If there was one word, I would preach…and I have mentioned it before…it’s empathy. If your candidate wins, be empathetic to those who lose. They believe as forcefully in their views as you do yours. Win with grace and surprise the losing side with an olive branch. We need each other.

Wishing everyone who reads this peace, good health and a little extra empathy for everyone around you,

Black Bear Value Partners, LP

www.blackbearfund.com