COVID-19’s exposure of the limitations of current credit and default models is not news to many. Forecasters continue to struggle with developing methodologies to link a new economic paradigm with existing models that cannot easily be trained on double-digital unemployment rates and more than four million mortgage loans in forbearance. Traditional models are no longer working, and new solutions are in short supply.

Q3 2020 hedge fund letters, conferences and more

Lack Of Innovation In The Mortgage And Structured Credit Markets

It’s time for a systematic upgrade. With new technologies that provide faster analytics, access to “alternative data” and more robust risk management, it’s time for a digital transformation of the credit analytics ecosystem. The economic impact of COVID-19 has amplified the need to adopt new modeling methods that are more flexible and can incorporate new data. This is particularly evident in the mortgage and structured credit markets where tech and innovation have lagged behind other industries.

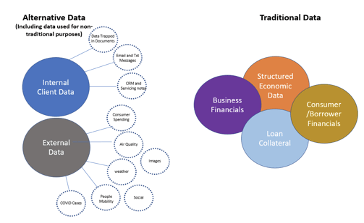

In many areas of capital markets, alternative data is mainstream as buy-side firms seek to use new sources of insight to find alpha and boost returns. New data sources have grown exponentially over the past decade and coupled with machine learning algorithms and cloud computing, a new standard for analytics is needed. Broadly speaking, alternative data includes any data used in a non-traditional way for investment or risk management purposes. Such data can include sources of structured and unstructured data that are repurposed to gain investment insight or an early warning signal for events leading to credit deterioration, default or bankruptcy.

Current models and associated macro-economic forecasts rely on traditional data sources that often have embedded latency of weeks or months, leaving the analyst to rely on stale information. Further, macro-economic forecasts are often available only at a national level which is problematic when evaluating mortgage and structured credit assets, as granular evaluation is paramount. Analysts must evaluate the loan collateral, the borrower’s financial status and have a robust view of the regional or local economic outlook. Therefore national averages don’t cut it and can skew results for particular loans or securities. In contrast, alternative data offers the opportunity to augment current models and supplement forecasts with near real-time information.

The Need For New Modeling Solutions

The COVID pandemic has heightened the need for new modeling solutions. Sustained levels of COVID cases and prolonged closures will inevitably lead to more shuttered businesses, and ultimately loss of jobs. However, the impact will likely vary across all states and industries. Recent data from the Department of Labor found that Massachusetts had the highest unemployment rate in June, 17.4 percent, followed by New Jersey, 16.6 percent, and New York, 15.7 percent – all setting record highs. Kentucky, on the other hand, had the lowest unemployment rate in June, 4.3 percent.

Right now, we’re in uncharted waters and the push for quicker analysis that incorporates current (and closer to real-time) data is a growing need. Understanding the vast amount of content available, selecting the most impactful data sources and embedding them in grounded forecasts is challenging. Further, understanding the impact on industries, regions and ultimately borrowers and probability of default and linking real-time forecasts to loan level analysis adds additional complexity. Consuming and making sense of such volume and sources of data can only be solved through the use of new modeling techniques including machine learning.

By leveraging emerging technologies, companies can unlock the power of data including new alternative data sources. Coupled with cloud analytics platforms, we now have access to a wealth of tools, algorithms and pre-trained models to integrate and analyze large alternate datasets. These platforms pave the way for new insights and smarter conversations with technology and analytics that introduce scenarios and data-driven forecasts. The next generation of analytics leveraging alternative data is here. Leading firms are creating a massive competitive advantage and those that don’t jump onboard the opportunity to embrace the digital change will quickly fall behind.