Alluvial Fund commentary for the third quarter ended September 2020, dicussing the largest contributor to their portfolio, P10 Holdings Inc.

Q3 2020 hedge fund letters, conferences and more

Dear Partners,

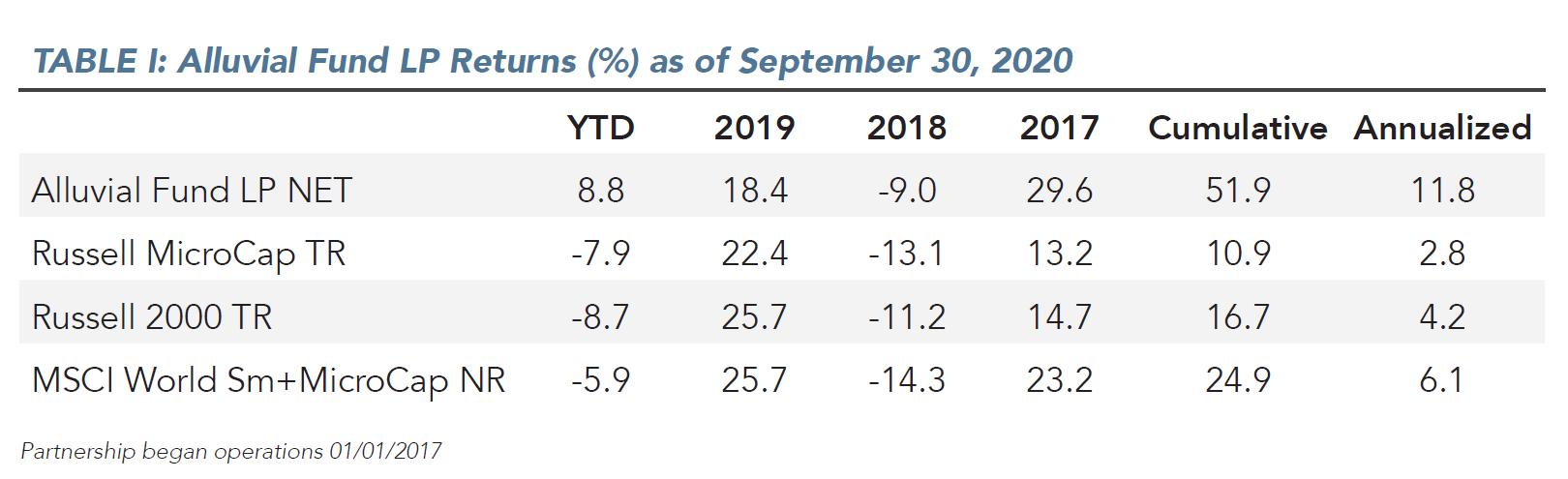

I am pleased to report that Alluvial Fund enjoyed a very strong quarter, rising 15.1% and outpacing all relevant benchmarks. The fund has recovered all of its 2020 losses and is now in solidly positive territory. The fund remains solidly ahead of small-cap and micro-cap domestic and global benchmarks since inception. To say I did not expect this rapid recovery is putting it mildly. The outlook was downright bleak at the end of March. However, the pandemic has not slowed most of our portfolio companies down, and the market has rewarded them accordingly.

My job feels a lot more fun now than it did just a few months back. The first quarter of this year was not enjoyable in the slightest, but it was a good reminder that markets aren’t always in rally mode. Volatility is often the price of admission for those hoping to above-market long-term returns. I am happy we are enjoying a relatively good year, but well aware that a year means little in the greater context. Our portfolio is and has always been idiosyncratic to the extreme, looking nothing like any other fund or index I have encountered. This differentiation has contributed to our returns thus far and I believe it will continue to do so, but it comes at a cost. From time to time, our portfolio will be wildly out-of-favor and shunned by the market.

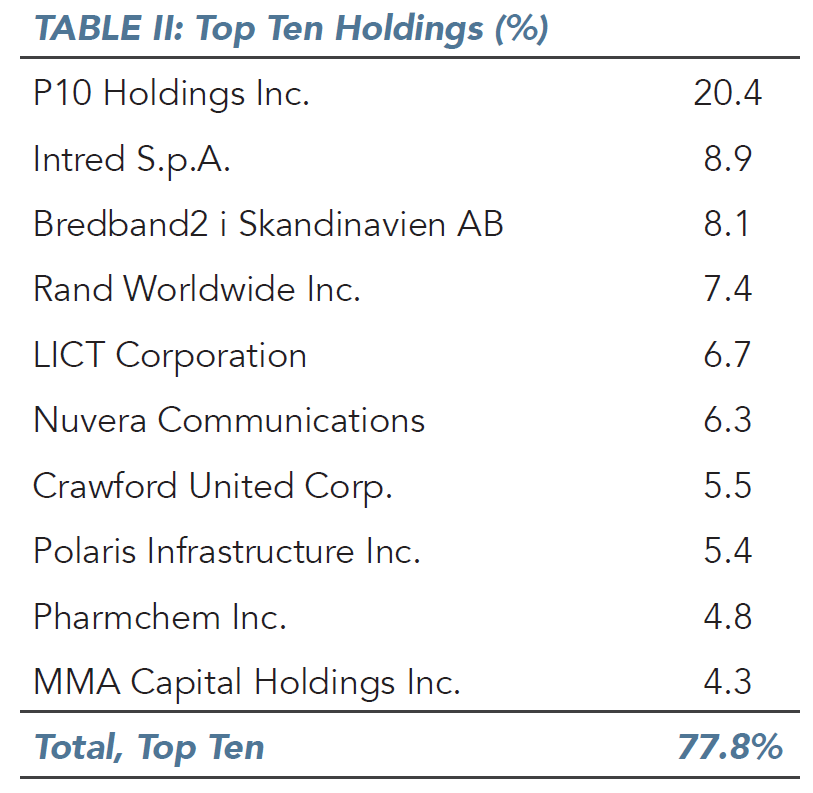

Small company stocks and especially so-called “value” stocks on the whole have experienced a years-long shunning, so any reversion to the mean could benefit Alluvial Fund. Thankfully, these headwinds have not kept the market from recognizing the value creation going on in such firms as P10 Holdings Inc, Intred S.p.A, Rand Worldwide, and many others, to the benefit of our portfolio’s returns.

P10 Holdings Inc: The Largest Contributor To Portfolio Gains

P10 Holdings Inc (OTCMKTS:PIOE) is by far the largest contributor to our portfolio’s gains this year. I have written about P10 before, so I won’t go into great detail here on the company’s strategy or operations. Suffice to say, the company continues to execute, adding another asset manager to its stable this quarter. In August, P10 Holdings Inc announced it would acquire TrueBridge Capital Partners, a venture capital manager. The deal closed in early October. With the addition of TrueBridge, P10 now offers a spectrum of alternative investment solutions, from traditional private equity to private credit and now, venture capital. The deal was creatively financed, preserving substantial upside for both P10 and the sellers. P10 now expects annual pre-tax, unlevered cash flow of $55 million or so. P10 Holdings Inc will convert an extraordinary percentage of this $55 million to free cash flow because the firm has a large tax shield and requires essentially zero capital expenditures.

Shares of P10 Holdings Inc have soared from a low of $1.25 amidst the COVID-19 panic to over $4.00 today. Despite the move, P10 shares still trade for only 12x my estimate of 2021 free cash flow. That’s incredibly reasonable for a firm of P10’s predictability and asset efficiency. Setting aside all growth from future acquisitions (and there will be more) it won’t take much for P10 Holdings Inc to grow its free cash flow per share at an 8-10% rate or more for years to come. Growing assets under management/committed capital at just 5% annually, plus benefiting modestly from operating leverage and debt amortization would accomplish the goal. In the nearterm, P10 Holdings Inc could experience a wave of new attention and a corresponding increase in valuation when the firm becomes an SEC reporting company and up-lists to a major exchange, likely within the next year.

P10 Holdings Inc was an ideal scenario for Alluvial Fund: a little-known company that had recently gone through a major corporate transition (bankruptcy and recapitalization) before completing a transformative acquisition. It took the market many months to discover P10’s new economics and strategy, which allowed us to build a sizable position at very attractive prices. As satisfying as our investment has been to this point, I think P10’s best days and returns are still ahead of us. Not every investment Alluvial Fund makes is one it will hold for years and years. Most companies are not worthy of that. But when I find a company like P10 Holdings Inc that has a high chance of multiplying shareholder wealth several times over, I won’t hesitate to make it a material portion of our portfolio.

Finding Opportunities In The World's Tiniest Public Companies

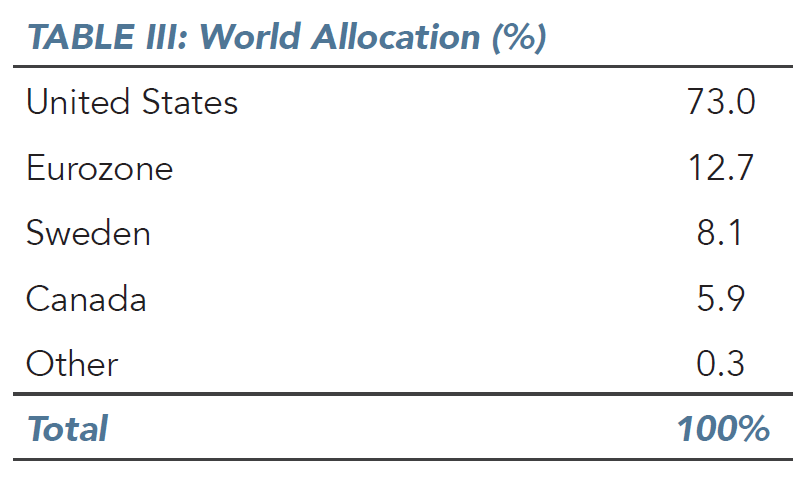

Alluvial Fund is heavily focused on finding opportunities in the world’s tiniest public companies. And I do mean tiny. While most of our investments are valued at <$100 million at the time of our initial investment, some of the fund’s recent purchases are shares of companies with market capitalizations of less than $1 million. Clearly, opportunities like these will not comprise a material portion of our portfolio, at least at cost. There are simply not enough shares to buy. But the opportunities are too good to pass up entirely. The bottom of the capitalization spectrum often offers incredible value.

That is not to say tiny companies make attractive investments as a rule. In fact, the opposite is true. The small-cap and micro-cap market segments offer a dizzying variety of companies to evaluate, but I am here to tell you the large majority are total garbage. I completely understand why so many investors avoid small companies entirely. Still, there is a lot of money to be made in identifying rare treasures amidst the detritus.

When evaluating a small-cap or micro-cap company for investment, investors can avoid a lot of potential heartache by answering a single question: why is this company so small? There are good reasons for a company to be small. It could be fairly new, or it could have started from a very small base of revenues and assets. Perhaps it was spun off from a larger entity, or it operates in a niche industry.

Then there are the bad reasons. Many companies are small because they are at best marginal operations. They really shouldn’t exist, and eventually they will not. Others are small because of continued malinvestment or strategic missteps by management, or because their industry is so challenged that profitable growth is all but impossible. I rarely find promising investments in this second, much larger group.

Companies that are small for good reasons often begin to grow larger over time, enriching shareholders in the process. They introduce new products and services, perform smart acquisitions, and adapt to changing business environments. Companies that are small for bad reasons tend to stay small. They muddle along, failing to earn their cost of capital year after year, they recommit to ineffective strategies and fall farther behind competitors, or they fight a hopeless war against dire industry trends.

This is not to say investors cannot make money in fundamentally flawed or challenged businesses. At a certain price, virtually anything can be cheap. However, I have found it much easier and less psychologically stressful to make money by committing capital to high-quality small companies with motivated, well-incentivized management, sound strategies, and growing end markets. The best part is getting this quality for free! Buying the highest perceived quality large companies almost always meaning paying a steep premium. Investors aren’t stupid. But the market routinely overlooks or ignores high quality tiny companies, which allows me to pay single digit multiples for cash flow streams growing at 15%, 20%, or more, backed by strong balance sheets and quality leadership.

Favorite Over-Achiever: EACO Corporation

Investors sometimes labor under the impression that in order for a business to generate excellent returns for shareholders, it must invent some revolutionary product or process or otherwise upend an existing industry or business model. Certainly, many of today’s tech darlings have done so. But there is another path, one that gets fewer headlines but the same outcome. This path is to pursue a conventional business model, offering a product or service that already exists, but do it better. I don’t mean to sound trite. It’s easy to say, very difficult to do. But over time, firms that figure out how to deliver a better customer experience, be it price, convenience, service, or any other factor that customers value, will tend to take market share from competitors and build customer goodwill.

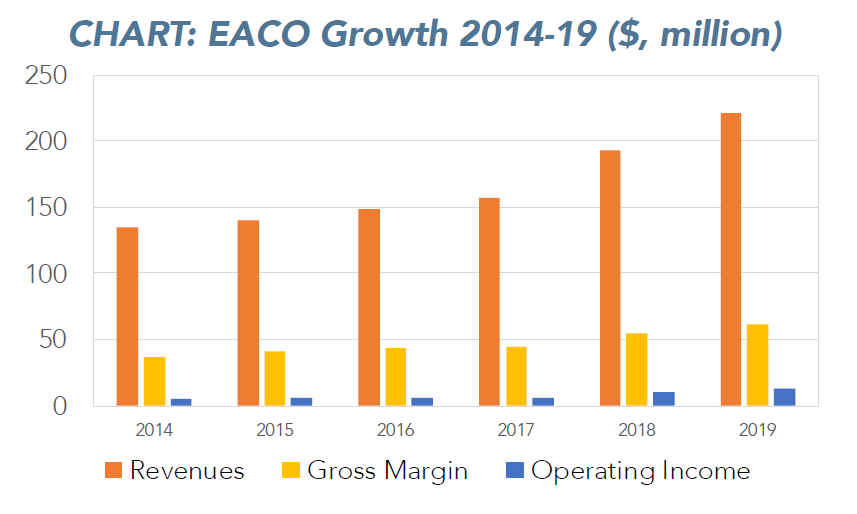

The Alluvial Fund portfolio includes a few shining examples. One of my favorite little over-achievers is EACO Corporation. Via its subsidiary Bisco Industries, EACO is a distributor of fasteners and electrical components. Bisco distributes nearly 4 million different parts and components, operating from 49 locations in 33 states and 3 Canadian provinces. Bisco was founded by EACO CEO Glen Ceiley in 1973 and was the 20th largest US electronics distributor as of 2015.

Distributors perform a critical function, serving as middleman for components producers and end users and reducing search costs and inventory investment for each. Distributors earn low margins per dollar of revenue but turn over their assets multiple times yearly. A good distributor can earn a very healthy return on its equity capital, and EACO (again, through Bisco Industries) is a very, very good distributor.

From 2014 to 2019, EACO grew its revenues by 64%, its gross margin by 65%, and its operating income by 168%. The firm largely avoids debt and often has net balance sheet cash, but still routinely earns returns on equity of at least 20%. Despite its steady growth and strong balance sheet, EACO shares have nearly always been available for purchase at a single digit multiple of earnings. At $18, shares trade for 10x normalized fiscal 2019 earnings. The COVID-19 pandemic and the resulting industrial slowdown have caused EACO’s 2020 results to decline, but the firm is optimistic and reported stronger bookings and a sales backlog 16% higher than the previous year at May 31, 2020.

So why is a high-quality company like EACO with a history of profitable growth trading at 10x last year’s earnings? The biggest reason is the shockingly low number of shares available to investors. Of EACO’s 4,861,590 shares outstanding, Mr. Ceiley owns 4,704,864, leaving precisely 156,726 shares worth just $2.8 million for the public. That is scarcely enough to enable an informed two-sided market. I am happy to take advantage of this illiquidity discount and acquire shares whenever possible. EACO can easily double its revenues this decade and profits should grow at least as quickly. What’s more, EACO would make an excellent acquisition for any its competitors.

Growing Without Sacrificing The Ability To Invest

Thank you once again for investing in Alluvial Fund. I am pleased with what we have accomplishedand more excited than ever for what future years will bring. I continue to wake up excited each day to find more and better opportunities, wherever and whatever they may be. The wide world of obscure and over-looked securities always offers rewards to whomever is diligent enough to find them. The fund’s net assets are again in excess of $25 million, a level that leaves considerable room to grow without sacrificing the ability to invest in the most profitable niches. I do endeavor to grow Alluvial Fund, not only to more fully exploit the opportunities I see now, but also to gain access to new ones. As the fund grows, we gain access to new geographies and markets. Fresh hunting grounds!

Our address has changed! We didn’t go far. Just 10 miles down the Ohio River. Alluvial Fund, LP and Alluvial Capital Management, LLC now reside at:

816 Thorn Street

Sewickley, PA 15143

Our e-mail and phone information remain the same.

Many thanks to my wife, Kayleigh, for enabling me to maintain a nearly normal work schedule throughout the moving process. Thanks also to my associate, Tom Kapfer, for his help in editing this letter, creating charts and graphics, and generally making it far more presentable that I am capable of doing.

I am always available for questions and discussion. Please don’t hesitate to reach out. I hope that you and your families are well, and I look forward to reporting to you again after the close of the year.

Best Regards,

Dave Waters, CFA

Alluvial Capital Management, LLC