Volkswagen subsidiary Traton is willing to increase its bid for truck manufacturer Navistar to $43 per share, as Carl Icahn and former protégé Mark Rachesky squabble over the price. Traton made a $35 per share takeover offer to purchase Navistar in January, and Rachesky reportedly told some of the company’s directors that he wanted more than $70 per share.

Q2 2020 hedge fund letters, conferences and more

Icahn and other directors racknowledge that a sweetened bid should be made but did not expect Traton to double it, sources cited by the New York Post said. Navistar and Traton were expected to hold talks later this month. Both Rachesky and Icahn hold board seats, as does Traton.

Q2 2020 hedge fund letters, conferences and more

What We'll Be Watching For This Week

- What will happen at Calfrac Well Services’ meeting on Thursday, when shareholders vote on its proposed recapitalization plan?

- Will D.E. Shaw approve of Weatherford International’s appointment of former GE top executive Girish Saligram as its next CEO, months after the activist investor removed three directors?

- How will Computer Task Group react to Wax Asset Management and Assurance Global Services’ calls for improved governance?

- Can New Mountain Vantage find a rival bid for Virtusa, after indicating it considers private equity firm Barings’ bid too low?

- How will Hindenburg Research’s short campaign at Nikola play out?

Activist Shorts Update

Hindenburg Research revealed a short bet on Nikola, alleging the electric truck maker is an "intricate fraud" built on "dozens of lies" by founder Trevor Milton. In a report published last week, the short seller said that Nikola has been misleading investors and partners by making false claims about its technology, including its hydrogen fuel cell batteries, which the short seller says never existed.

The report alleged that Nikola lied about a number of business aspects such as having 3.5 megawatts of solar panels on the roof of its headquarters and owning natural gas wells, which Hindenburg claims are fabrications. Hindenburg also said its investigation points to several bogus product presentations, including the company’s hydrogen-powered truck dubbed Nikola One.

Nikola refuted the allegations a day later, claiming Nathan Anderson’s short outfit is attempting to "profit from a manufactured decline in our stock price." The electric car maker accused Hindenburg of manipulating the market with "misleading information and salacious accusations directed at our founder and executive chairman," and said it has referred the matter to the U.S. Securities and Exchange Commission.

Chart Of The Week

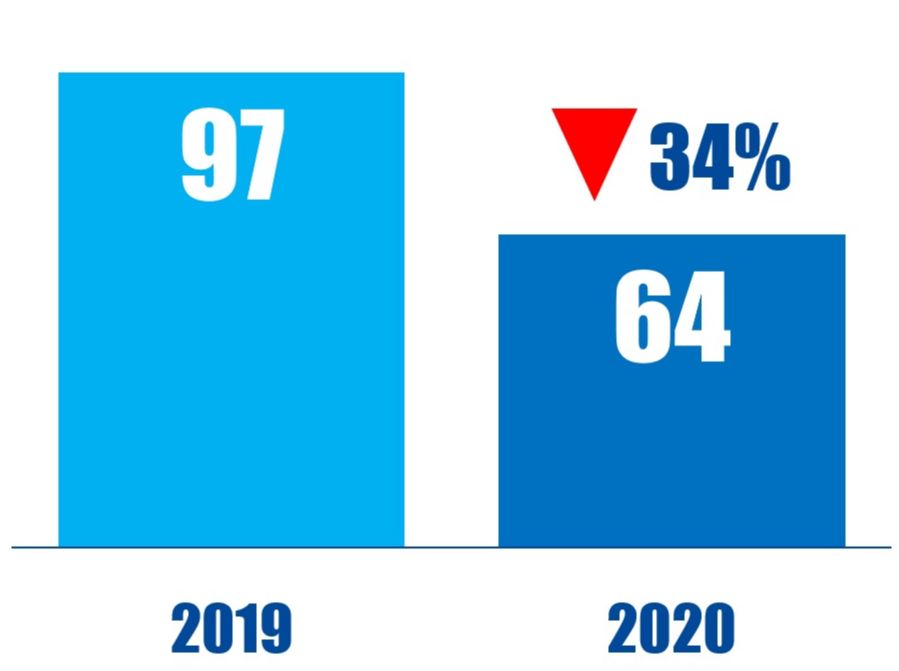

The number of U.S.-based activist investors that made public demands between January 01 and September 11, compared to the same period last year.