Will there be a stock market crash ahead or will the FED (central banks globally) and the governments save the situation with their stimulus packages, low rates and asset purchases? Well, it doesn’t really matter because what matters is that you focus on fundamentals that increase your wealth over time and the key to watch is the risk and reward of the assets you own in your portfolio in relation to what is going on.

Q2 2020 hedge fund letters, conferences and more

However, to know the risk and reward you have to know what impact have the things that are going on - the news. The key factors are:

- the FED's policy where interest rates are kept at zero, this makes financial assets very attractive and stimulates the economy. They will also allow for inflation which is key for investments.

- fiscal stimulus - huge budget deficits give money directly to people and stimulate spending and investing

- global economy - the news is that things are better than expected and global economic growth will decline only 4.5% compared to the 6% expected in June 2020.

As for investing, in the current market situation, a crash is unlikely but you never know. The key is to balance well your risks and we show a few examples.

Stock Market Crash Ahead or FED/FISCAL BOOM?!?

Transcript

Stock Market Crash News

Good day fellow investors. Will the market crash? Will the Fed push it higher, higher and higher? What should we do? Well, in this video, we'll give you market overview economic overview, fiscal stimulus, what are the central bank's doing? And how is that impacting the markets, discuss the risks and rewards of investing in this current market, and then give you some random thoughts. To finish the video only know, I really want to give you as much value as I can show that you can make your own investment decisions. If you enjoyed that, please click like, subscribe to this channel. As we discuss investments, value investments, we make a lot of stock analysis, and we look for general long term investing trends that are low risk and high reward.

Stock Market Overview

So what happened to the market over the last year, we have seen the biggest economic crisis due to COVID lockdowns, but the market is where it was at the beginning of the year, year to date up 4% over the last year up 12%. But it peaked on September. Second. The joke on Wall Street is that on September 2, what happened? Why did stocks started going down crashing, because all the day traders, the app traders, Robin Hood investors, those that look for stocks below 15 bucks below five bucks, because they had to go back to school. So that's the reason for the crash, of course, let's continue. But this the run up was created to the Fed to fiscal stimulus, and we're going to discuss that too. All in all, the crash the 40 something percent crash was the shortest bear market in history, it took 126 trading days to recover the losses. That was what 30% of the earliest shortest recovery of 310 days in 66.

Now, when it comes to market overviews, you can always go to valuation. And if we look at the Shiller price to earnings ratio, the cyclically adjusted price to earnings ratio that takes into account average 10 year earnings, the price earnings ratio of the S&P 500 is at 30. The mean historical is around 16, minimum was four point 78, the 1920s, maximum 45. Now, from a valuation perspective, if the price earnings ratio is 30, you can expect the return around 3% plus a few percent of growth from inflation. And that's 5%. That's still good in this interest rate environment. But historically, when the price earnings ratio was so high at 30, the real returns were just above zero for the subsequent 15 years yearly returns. So okay, real returns, as I said, 3% to 3%, depending on inflation, depending on what's going on. And here we are, this is the ballpark to expect to be happy with. Of course, it can be also negative 4%. But it can also be a little bit more positive, positive, the maximum coming to 4%. But don't expect more in a zero interest rate environment. This is the market. Investment banks, of course, are telling you you should buy every possible dip out there stocks will continue go to go up forever. Well, that's their business. If they say no, don't do anything, stocks will crash. They don't get their commissions. So that's something to think about when JP Morgan says that stocks will go higher. But will stocks go higher or not? That's something we have to put into perspective because what are the forces driving the market except for the Robin Hood traders? They're not now back to school? The forces driving the market are the Fed fiscal stimulus and economic recovery that is better than expected. Let's look at the economy. What are central bank's doing globally? How it impacts currencies, stock market, real assets values, and then continue with our investment discussion.

Economy News

So the forecast was 6% that the global economy will decline 6% now it's already 4.5%, which is much better than expected. Even countries like China will not see an economic decline over 2020. That's really, really remarkable. And that gives you also insights on investing when it comes to investing. Companies exposed their commodities, perhaps etc. But it also shows the resilience China has and they're also doing stimulus like Everybody else, but they are stronger in this case, and they will emerge likely stronger in 2020. So that's very interesting. The hardest hit countries will be emerging markets India, Argentina, of course, Mexico, because they don't have the stimulus power that the US has Europe, China, Japan. And if you don't have that, then you are always on the margins of the financial world. And therefore you are hit the hardest. Unfortunately, as you can see here, the projections for GDP decline for India, Mexico, South Africa are even bigger than those were earlier in June. But China will likely grow almost 2%, the US will decline only 4%, the world also something like that euro area will decline a little bit more. UK, always the hardest hit the economy, because that's how their economy is set up for hire booms, when things go good, but big declines where things go bad, like in 2009.

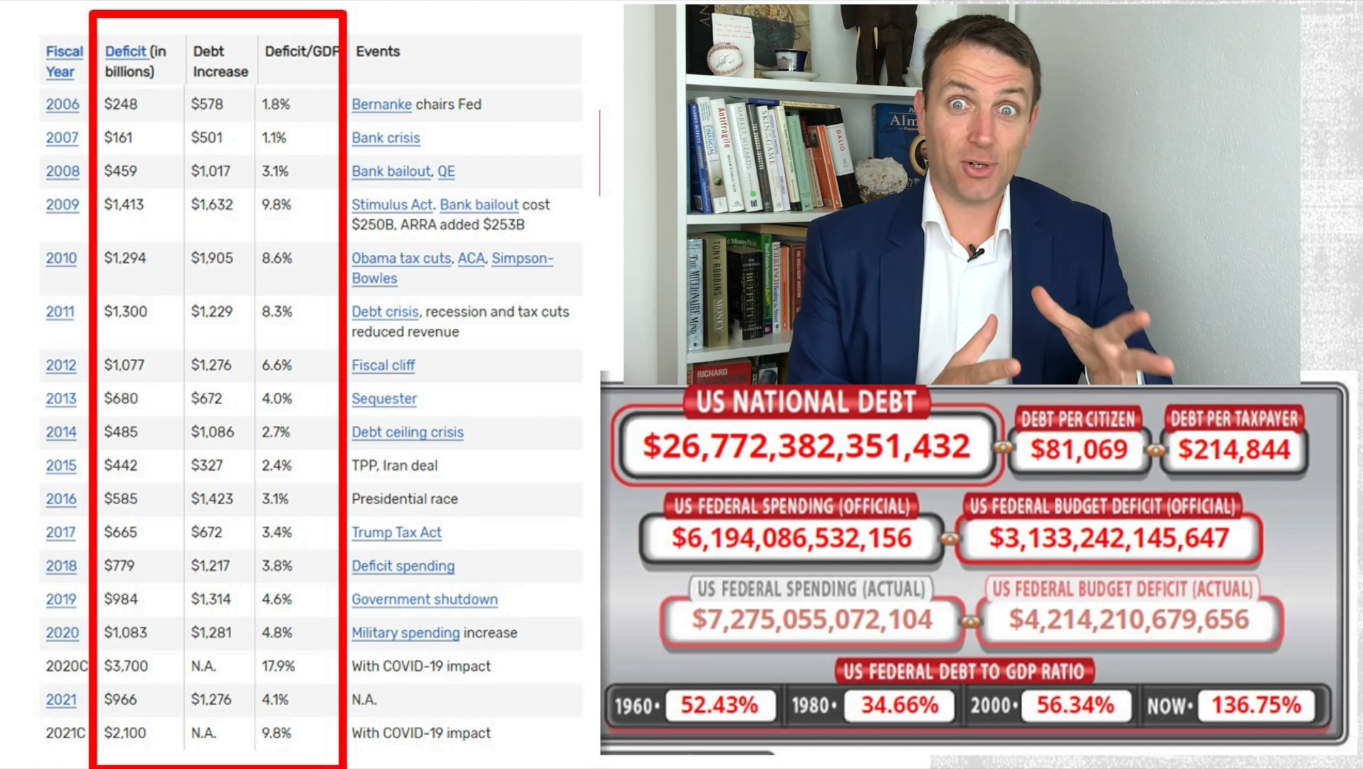

Unemployment rate is already down to 8.4%, the feds target is 4%. So still a lot to go. But if it continues like this, with the stimulus with everything, and the economy starts improving, we might see it sooner than expected, which is very positive also for the market. One of the reasons why the economists did so good is fiscal stimulus. And this is something very important to discuss, because there are different impacts of this, this is for Germany, and their deficits, deficit is expected to be a fixed 7.5% in 2020, as they spend more on stimulus, etc. But 7.5%, and their total debt to GDP ratio will be at 71%. So it's not just what central banks are doing, but also what governments are doing 71%. If we compare this to the US, the debt to GDP ratio is 136%. That's double what Germany has. And the deficit will be likely 17.9% more than double what Germany has, and then also 2021. So we have a conservative Germany, and a much less conservative us. And this also has repercussions on currencies, on economies on how the markets see what's going on. And perhaps not so much the feds activity we'll see later it's lower than Europe and other countries. But the stimulus, the fiscal stimulus and the mounting deficits, there might be the reason why the dollar is weakening. Now, the ECB will try to weaken also the Euro because a strong euro is not good for the economy. But that's the game they are playing. And we as investors also have to see how to work with debt.

Central Banks

The OECD said don't take off the stimulus. Because if you take off the stimulus, then the economies are going to crash. And that's also the thing. In 2018, when the Fed started increasing interest rates when the ECB started lowering asset purchases, everything started crashing, even before the COVID crisis. So we are now living in a world of fiscal and monetary stimulus. And that's that's it and that's something we have to get used to it and when investing we have to see how that works and what is the risk and reward. Now let's look at what are the central banks doing the Fed said they will do whatever they can, they will be very powerful and they will use all the tools as their disposition to lower unemployment to 4%. Reach price stability, leave inflation a little bit higher and improve the economic situation they will do whatever they can from a monetary policy perspective, but don't forget you also have the fiscal policy perspective where they are now fighting in the US how much stimulus should they give same in Europe. So, we will see how will their the coordination be because the monetary policy at some point, it can do much more because interest rates are already at zero. You can push more money into the system but if it doesn't trickle down to the economy, then you can't help much

Interest Rates

And this is the feds idea. They have zero interest rates and they plan to keep it up till 2020 for longer term increase it but for the next one to four For years, we can expect to have zero interest rates, which means cheap money free money. Also something to take into consideration when it comes to investing. Of course, this is what they project if I just show you what they were projecting it not even two years ago, it's completely different. So they project but they know they can be very wrong. So in 2018, their projection was the interest rates were higher that in 2020, will have interest rates just close to 3%. Every dot here is the committee, individual projection of a person in the feds committee. But 2.9 are we at 2.9? Have we've been at 2.9 in 2019? No, it already started declining prior to the current situation. So yes, longer run, they hope to get free percent, but you never know that they don't even know because you don't know what will happen. There are so many factors impacting this, that's impossible to project but of course, they are saying they will do this. So we can implement this into our analysis and discussions. But never take anything they say for granted because it has been different and it will be different than expected. So they said they will keep interest rates at zero until labour market conditions have reached levels that they expect 4% inflation has risen to 2% on average. So even higher than 2%, let it exceed 2% for sometime. Not to make the 2018-19 mistake, where they slow down the economy and it was not necessary.

So here you see the target for 20 24% unemployment rate, inflation, longer run 2% target, they are buying mortgage securities, and treasuries. But what does this mean we have interest rates at their zero, hopefully inflation higher than two free percent, which means that the real interest rates will be negative. So the savers pension funds, insurance companies will all be the losers. Also something to keep in mind when it comes to investing. But what the Fed has been doing, but probably mostly what the governments with the fiscal deficits have been working on has led to a significant weakening of the US dollar. But this might also reverse because other countries, European, Japan, UK, Switzerland, and others might change their policies in relation to their strength and currency. So it's all a currency game. And you never know who will win for now there are a lot of people shorting the dollar show. So we might even see a short squeeze when the dollar starts going up. If, when it starts going up, it will definitely start going up sometimes, because currencies are always volatile.

And the fact is that other countries are doing the same as the fed, a little bit less fiscal stimulus, but that will likely come now that they have started with that there is no going back, the ECB started buying again, we have seen over the last five years, they put more than 3 trillion, 2.8 trillion euros, 3 trillion euros at the end of August into the system. And despite debt, given Germans fiscal conservative deepness, the Euro has strength that against the dollar in this crisis time, but it's just where it was in 2018. So nothing miraculous there this is normal now they're strengthening weakening etc, and depends on the actions later, which will go higher or lower. But look at this, this is the Bank of Japan, in proportion to GDP hones 135% of assets of GDP, and the Fed owns the least. So if you look from a monetary policy, the United States Fed has done the least of other banks, which again signals how more fiscal stimulus, less monetary stimulus, still the room to do more and more and more.

Stock Market Investing

Now, when it comes to investing, how to position yourself I think each one of us has to look at all the possible assets, be it gold, real estate, stocks, whatever you own, whatever you base your financial future on. And then look at from a risk reward perspective, the quality of your of what you have in relation to what's coming, more fiscal stimulus, more monetary stimulus, more recessions, ups and downs. They can try to financially engineer a lot of things. But you never know how will that work. Some say budget deficits are not important anymore. Some say those are important. Some says they will be a crash. But the fact is that nobody knows because we are as always in uncharted territory. For now we know there's plenty of money, there is a lot of liquidity coming into the market. So we have to see how that liquidity at what price fits best your portfolio depending also in on the country where you are in. So I have made just a little chart here. If we look at risk, high risk, low risk quality of an investment, just to give you an example, you'll see what best fits you. We said inflation will hopefully be a 2% but not the average and financial assets might go might go even higher, real, returns are negative, nominal might be close to zero, and then risk what is risk is just volatility or business long term risk. Let's discuss this a little bit and see how an investment fits your portfolio.

So if we go we start with US Treasuries, I think that the risk is very high. Because I am, there is no risk. Actually, there is no risk, I am sure that if I put my money into the 10 year Treasury, I lose it because of nominal low nominal rates, which means negative real rate, so the quality is low, and the risk is high. For something like this, you can bet on treasuries, that rate will go even lower. But that's betting that's not investing. Then we discussed Barrick Gold, you might want to see how that fits. That's a medium risk, medium quality, it has a 5% yield, then we discussed Apple a little bit more quality, high cash flow. So we can say low risk from a business perspective, but more risk from a volatility from Mark, get perspective, because the price earnings ratio is above 30. But 3% yield is still better than zero point 69. So these are the things you have to see. Okay, will this lead to my financial goals or not? That's the most important question. We discussed some Australian shares, likely five to six 7% returns there. But then there are currency issues that increase a little bit the risk of this, there is stimulus depending on how air traffic recovers there. So Intel is another interesting stock that has higher cash flows now, but depends on how they will manage to fight for their market share. And then also real estate, given the cost of money, likely inflation ahead, it might be a low risk opportunity now if you structure it well and really good quality. So you have to see how these investments fit your portfolios. Don't ask me which of these stocks will go up? Because that's just the bad thing. That's not investing. We are buying real assets here with real returns. And those real returns compound over time, and we become wealthier, wealthier so that we are well off in 10 to 2030 years betting Yes, you win some you lose some you don't go far ahead, built on real assets. And that's the best answer I can give you. Because that works in any environment.

Random Long-Term Trends

Just some random, when I was reading the news and preparing this just some random thoughts. So investment, foreign direct investment into the US from China and from the US into China, up to 2017. Really high good growing, and now declining, declining, declining. So nobody is a winner. There is never a winner in any kind of war. That's the unfortunate truth and the consequence of this, instead of both the Chinese and the US being richer, thanks to collaboration, they are both poorer now, thanks to what they are doing. Now, the rebound will come for emerging markets with the delay always compared to developed markets. But we see here how bonds people already started buying higher yield bonds there. So this will likely if things keep looking The overtime also spill over to other assets. So it might be again good time to look at emerging markets. And this is something very interesting. Coal really destroyed from renewables, the energy shift in the US. So really declining consumption of coal and increasing of renewable energy. So also be careful with this long term trends, headwinds, tailwinds, and try to invest in tailwinds, not in headwinds, if you don't really know what you are doing.

So the conclusion is manage your risks weather when it comes to investing will stocks crash will not? We don't know what we can do is know what we will do in case if this this or that happens. And how is our portfolio structured from a risk reward perspective? Prepare for probabilities, if I would have to answer I would say 76%, the market will be pushed higher from the Fed, it is tailwind pushing all things higher. So we should be invested. But 24% perhaps even less, that it will be all doom and gloom or I'm sure it will be volatility, let's say 20% volatility occurred. No return over the next 10 years no real return and a 5% 4% of a real doom and gloom chance this would be my thinking when it comes to investing. So buy the dips. Yes, but think long term and think how it fits your portfolio.