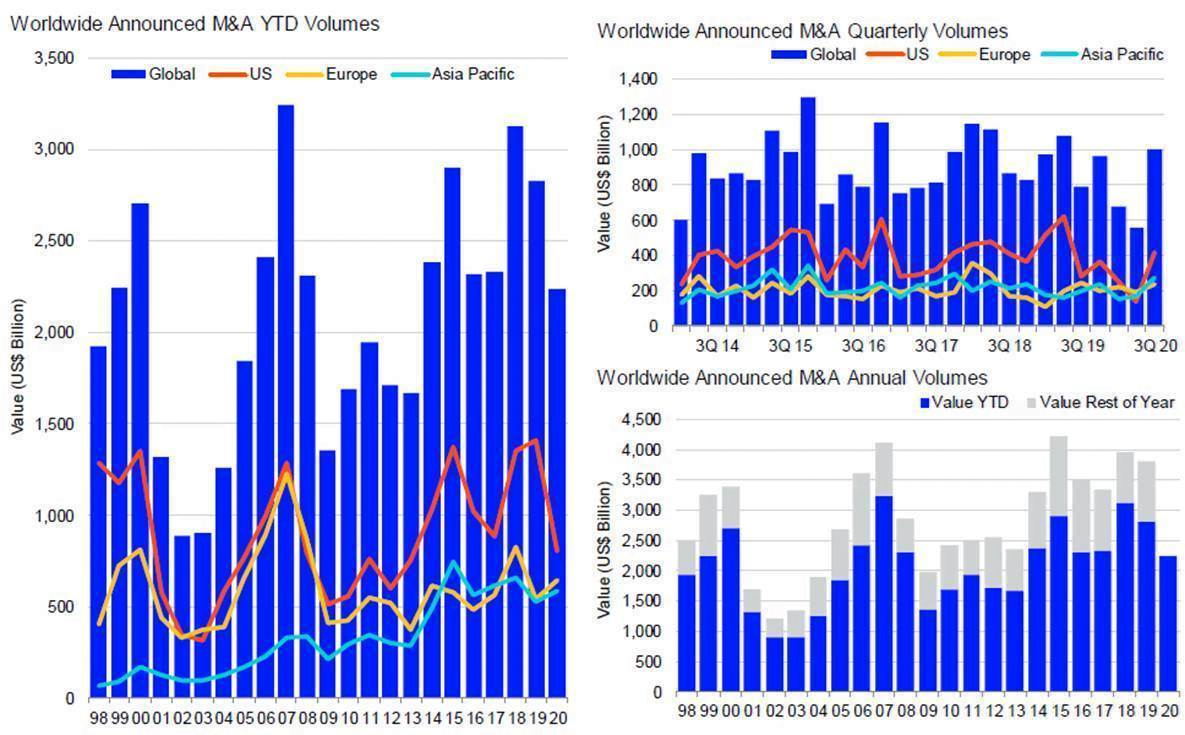

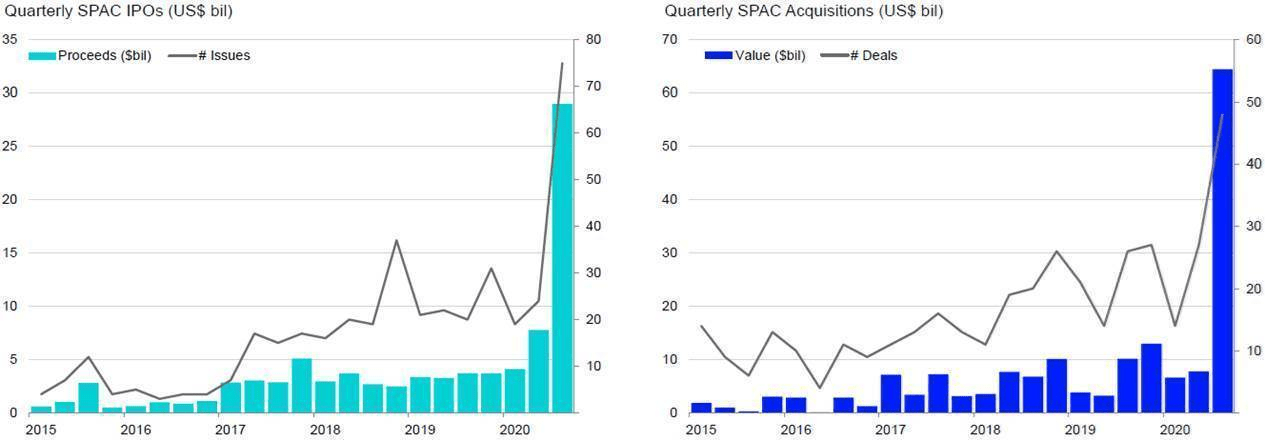

“In the face of the global COVID-19 pandemic and economic lockdown, for just the eleventh time over the past 40 years, quarterly merger activity has surpassed $1 trillion during the third quarter of 2020. Whether it’s delayed merger announcements held over from this past Spring, the arrival of opportunistic strategic buyers or private equity buyers flush with cash and friendly credit markets or the desire to strike deals before the results of the upcoming US presidential election, there’s no question that deal making strongly rebounded far earlier than expectations. The pace of deals, coupled with record levels of equity and debt capital raising, the resurgence of SPAC IPOs and the re-emergence of direct listings, illustrates that investment bankers have likely never been more in demand. Corporations around the world are evaluating their post-pandemic game plans and it’s fair to say that M&A and Capital Raising will play a pivotal role in how those game plans become reality,” summarizes, Matt Toole, Director of Deals Intelligence, Refinitiv.

Q2 2020 hedge fund letters, conferences and more

Record Start to Q3 M&A by Number & by Value of Deals

- Q3 M&A Surpasses $1 trillion, Up 80% from Q2; Deals between $5-$10 billion up 24%; WW M&A Down 21% to Seven-Year Low

Source: Refinitiv

- U.S. Mergers and Acquisitions Decreases 43% to Seven-Year Low; Europe Deal Making Up 18%; Asia Pacific M&A Up 12%

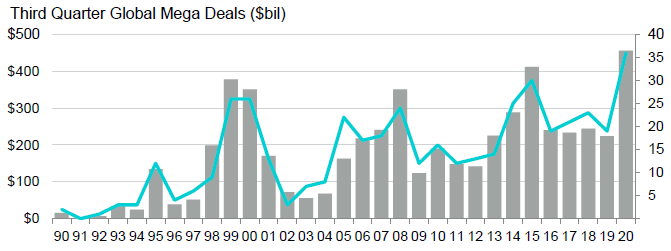

- 36 Mega Deals Announced Since the Start of H2, an All-Time Record to the Second Half; Combined Value of the Mega Deals, US$455.7bn, All-Time Record

Source: Refinitiv

- Technology, Financials, Energy & Power and Industrials Lead 2020 Deals

- PE-backed Buyouts Fall 6%; Highest Percentage of M&A Since 2007; Record Number of Deals

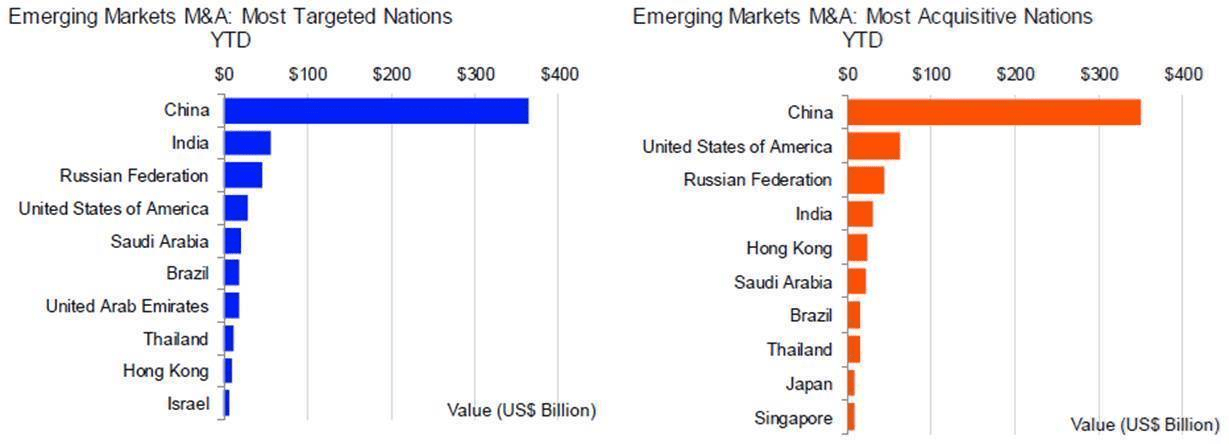

- Cross-Border Deal Making Down 2%; Emerging Markets M&A Down 6%

Source: Refinitiv

- Return of the SPAC: Record US$40.9bn Raised via 118 SPAC IPOs so far in 2020 - 4X more YoY; Q3 Funding Raised Totals US$29.0bn, All-Time Quarterly High; September Holds Record for Most Listings, 31; 48 SPAC Acquisitions with Combined Value of US$64.5bn Recorded in 20Q3, All-Time Quarterly High by Number & Value

Source: Refinitiv

- Goldman Sachs Maintains Top Spot for WW, US and European M&A; China International Capital Takes Top Spot in Asia Pacific

Attribution:

Data: “Refinitiv Deals Intelligence”

Commentary: “Matt Toole, Director of Deals Intelligence, Refinitiv”