Whitney Tilson’s email to investors discussing BP says the era of oil-demand growth is over; is ExxonMobil still a classic value trap?

BP: The Era Of Oil-Demand Growth Is Over

1) Today, global energy giant BP (BP) wrapped up its three-day investor event, in which it "said the relentless growth of oil demand is over, becoming the first supermajor to call the end of an era many thought would last another decade or more."

This is a big deal, as this Bloomberg article highlights: BP Says the Era of Oil-Demand Growth Is Over. Excerpt:

Oil consumption may never return to levels seen before the coronavirus crisis took hold, BP said in a report on Monday. Even its most bullish scenario sees demand no better than "broadly flat" for the next two decades as the energy transition shifts the world away from fossil fuels.

BP is making a profound break from orthodoxy. From the bosses of corporate energy giants to ministers from OPEC states, senior figures from the industry have insisted that oil consumption will see decades of growth. Time and again, they have described it as the only commodity that can satisfy the demands of an increasing global population and expanding middle class.

Here's the key chart:

ExxonMobil: A Classic Value Trap

2) BP's forecast led me to revisit my February 3 e-mail, in which I warned my readers that fellow oil titan ExxonMobil (XOM) was "a classic value trap."

After reporting earnings on Friday morning, energy giant ExxonMobil fell 4% and is now trading at a nearly 10-year low.

Buying the stocks of blue-chip companies when they've fallen out of favor has been one of my most profitable investment strategies over the past two decades: Berkshire Hathaway (BRK-B), McDonald's (MCD), Apple (AAPL), Home Depot (HD)... the list goes on and on.

I then analyzed ExxonMobil's financials, exposed its misleading disclosures to investors (a frantic attempt to put lipstick on a pig), and concluded:

In short, ExxonMobil looks like a classic value trap – a melting ice cube that doesn't come within a country mile of covering its dividend, which it will likely eventually be forced to cut (though not for a few years I suspect)...

With the stock down another 40% since then and having recently (and ignominiously) been booted from the Dow Jones Industrial Average after more than a century, I decided to take another look.

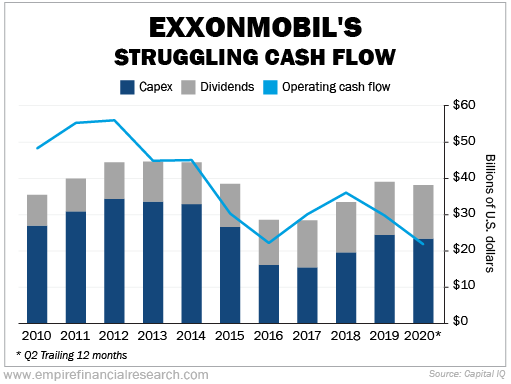

It didn't take me long to see that things have gone from bad to worse. The chart below shows how the company's operating cash flow over the past decade has deteriorated so much that it has gone from comfortably covering capital expenditures plus the dividend, to not covering both, to over the past year, not even covering capital expenditures ("capex") alone!

How has ExxonMobil funded these deficits? By taking on more and more debt, as you can see in this chart:

In conclusion, my message to investors hasn't changed: ExxonMobil's stock is a classic value trap. Don't be tempted by the high dividend yield (currently 9.6%) – the company doesn't come within a country mile of generating the cash flow to cover it, so it will eventually be forced to cut it.

Further below are additional articles about ExxonMobil and the industry...