Our study Perceptions and Understanding of Money — 2020 reveals what you may already have sensed: Americans are racked with uncertainty, and money (as usual) is at their heart of their concerns. One specific worry Americans have is that their dollar will continue to buy less and less, and it’s a fair concern given historical trends and recent economic events.

Q2 2020 hedge fund letters, conferences and more

While most Americans remain generally confident that rates of hyperinflation seen in Weimar Germany in the 1920s, Yugoslavia in the 1990s, and Zimbabwe in the 2000s will not occur in the States, the threat of inflation is very much real. Amidst economic uncertainty, the weakening of the dollar, scarcity of jobs, and endless pumping of fiat currency into the economy has left many wondering: what is next?

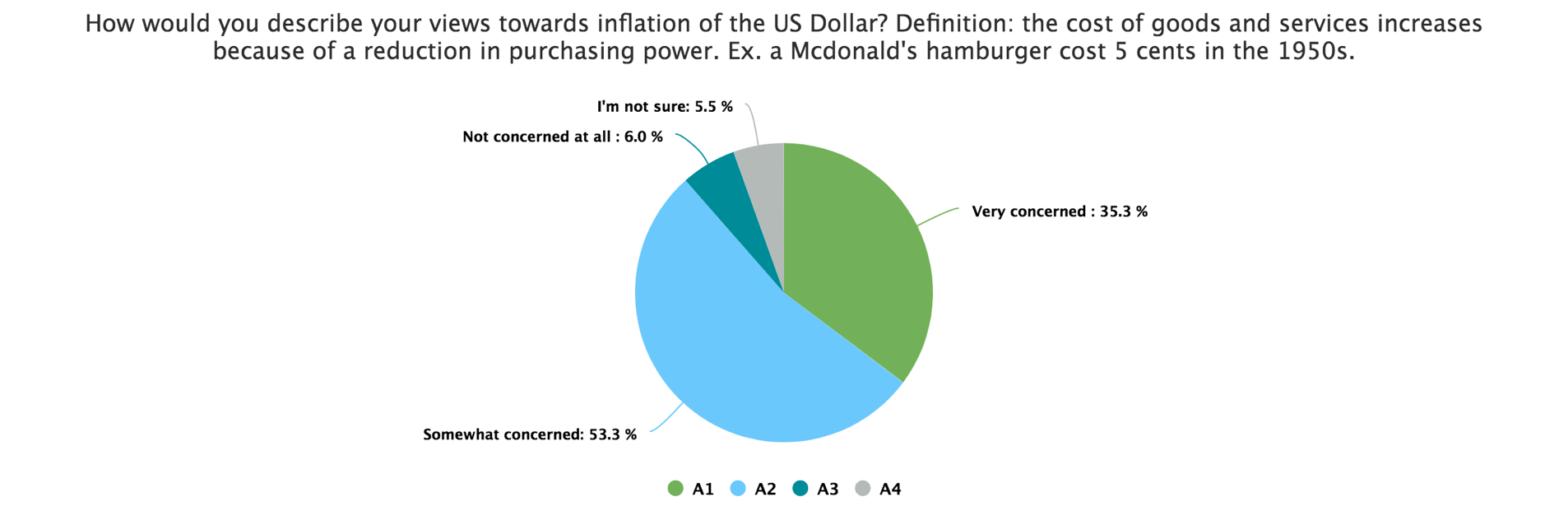

What Are Your Views On Inflation And The Dollar’s Purchasing Power?

88.6% of our respondents were concerned about inflation, split between “somewhat concerned” (53.3%) and “very concerned” (35.3%).

How can this be, considering that Reuters reports falling consumer prices (one measure of inflation) during the earliest months of the COVID-19 pandemic in the United States?

Worries about inflation may reflect several anxieties that Americans have, both perceived and real. For one, Americans with even a loose grasp of history understand that, in the long-run, the dollar’s purchasing power has declined substantially.

Per The Balance, you would need $2,529 in 2018 to purchase what $100 did in 1913. Even more concerning is the increasingly rapid rate of inflation since the 1970s, a rate which shows no signs of slowing. If you don’t find statistics compelling, find the nearest octogenarian and ask them how much a bottle of Coke or a cheeseburger cost when they were a kid.

Americans with an understanding of the Federal Reserve system know that, too often, the answer to financial problems (see: The Big Bank Bailout of 2008 and beyond) is to print money like it’s going out of style. In simple terms, the more money the Fed prints, the less each dollar is worth, as scarcity declines with each new bill.

Americans are not imagining that their dollars are losing pop at the register with each passing year, and many do not believe that their wages will keep up with rising prices caused by an ever-weakening U.S. dollar.

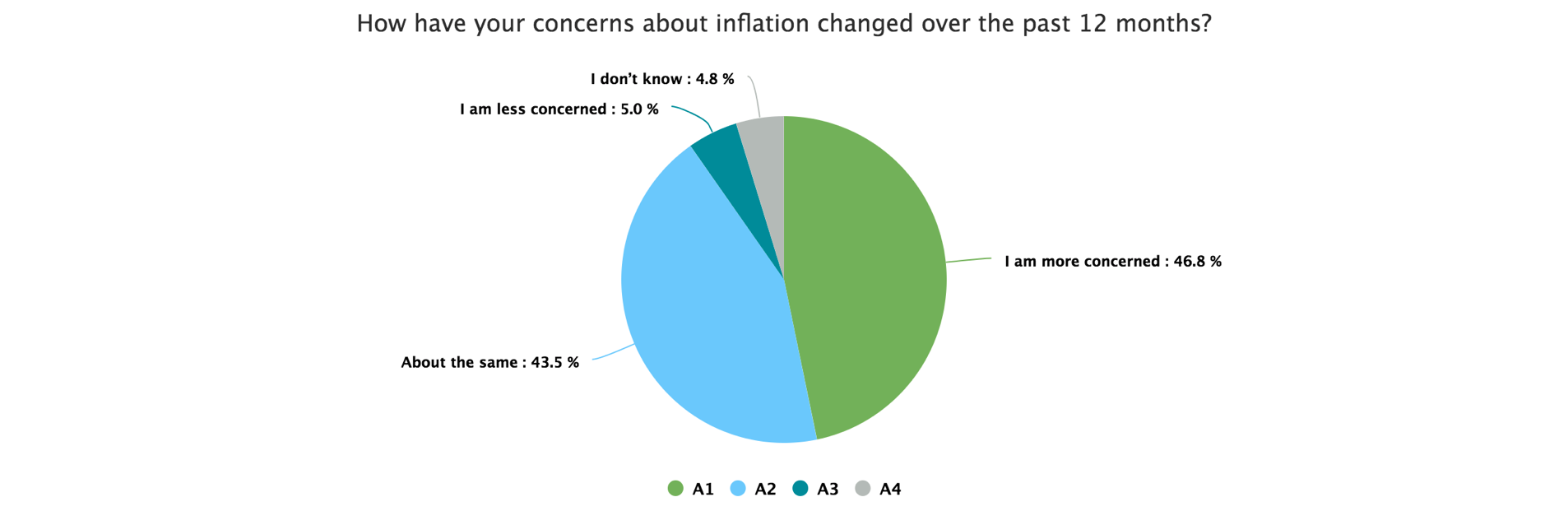

How Have Your Concerns About Inflation Changed In The Past Year?

A significant number of respondents (46.8%) to our Perceptions and Understanding of Money — 2020 survey have become more worried about inflation in the previous 12 months, and it’s not difficult to understand why.

We should first note that some level of inflation is generally expected, and the Federal Reserve aims for a 2% inflation rate in the long run. This rate is considered necessary to maximize employment and maintain some measure of price stability.

Moderate inflation is of little to no harm, so long as wages can keep pace with rising prices, and this is where the turmoil of recent months comes into play.

The response to the pandemic has employees uncertain that they will collect a wage at all (only 48% of the 22+ million jobs lost during early pandemic months have returned, per MarketWatch). Many Americans may be skeptical of finding employment at all—the idea that they could hope for a wage that rises in concert with inflation may seem like a pipe dream.

Though the Federal Reserve has the power to print more money on little more than a whim, the average American does not. So while crisp dollars come off the presses, the dollar’s purchasing power declines and inflation continues, millions of Americans have no stable income to pay the rising price of goods and services.

Yeah, I’d say that is fair justification for inflation-related concern.

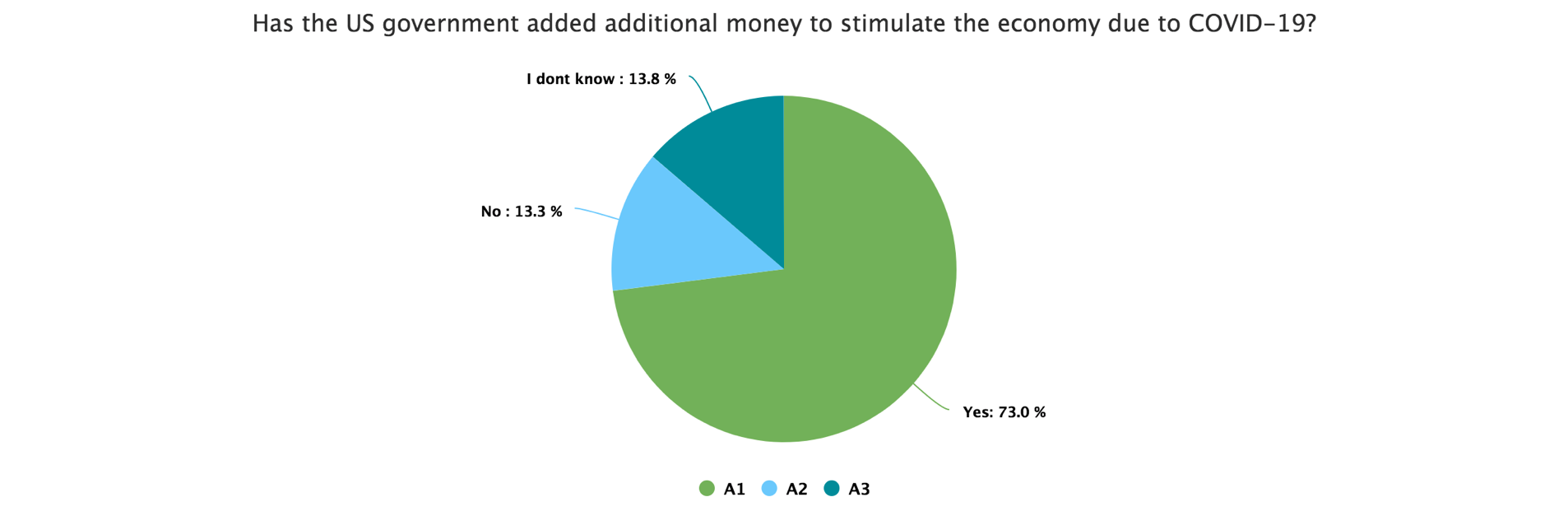

Has The U.S. Government Printed Money To Stimulate The COVID-19 Economy?

73% of our respondents said yes, and they are technically correct. The federal government has spent $8.3 billion attempting to “treat and prevent the spread of COVID-19” (though the public may not have noticed, considering continued uncertainty surrounding the virus and the state of the economy). This is in addition to hundreds of billions of dollars printed under the guise of bills related to coronavirus relief

These bills inevitably require the printing of an obscene amount of money, the further decline of your dollar’s value, and even greater uncertainty about inflation and the long-term future of the dollar.

But hey, you’re getting $1,200! What’s the worry?

About the Author

Marco Streng is the CEO and co-founder of Genesis Group and Genesis Mining, one of the largest crypto mining companies in the world. Prior to co-founding Genesis in 2013 and becoming an impassioned advocate for blockchain technology and cryptocurrencies, Marco studied mathematics at the Ludwig-Maximilian University of Munich.