Building a digital ecosystem strategy around customers — The What, How and Where

Q2 2020 hedge fund letters, conferences and more

Gartner predicts that “By 2030, 80 percent of heritage financial services firms will go out of business, become commoditized or exist only formally but not competing effectively.”The Age of Assistance, a term made popular by Google, is turning the financial services industry on its head. Consumers today live in micro-moments, with ease of access and exposure to a large and diverse set of digital services; customers are no longer satisfied with just getting what they want. Today’s consumer demands flexibility in how and where they engage financial services to get what they want. Banks that take advantage of this shift will outpace their customers and seize a new generation of customers across a multitude of channels. Banks that fail to adapt risk extinction.

Technology is evolving faster than ever. It is critical that financial services companies learn to adapt to the new digital ecosystem that has risen from this rapid digital transformation. Digital transformation is not solely about having your brand visible and present everywhere. That is an impossible, futile journey with a very high capital requirement. I believe the true power of a digital transformation initiative is when banks understand the power of invisibility — by partnering, leveraging customer trust, and building an ecosystem centered around the customer, the banks can be more relevant by building an invisibility fabric around the customer. Banks need to focus on leveraging digital to make their services simple, seamless, and invisible so that their customers do not face any complexities.

This new digital ecosystem provides many opportunities for banks to integrate with other products and services to offer these to customers in their moment of ask. The customer is looking to make decisions in their micro-moments.

Banks need to build out the following four invisibility capabilities:

- Build on Core-Asset, Consumer Trust — This is the biggest asset banks have today, and the winners are those who can capitalize on their trust. Trust has helped banks build data around customer behaviors, know your customers, and leverage data and analytics. The consumer of today is quite comfortable trusting non-banking entities with the same trust equation. What that means is that the data which the banks thought they have on customers is now being tracked and leveraged by other parties. So the battle is on for banks to retain not only customer trust but also the data they allow to share with the banks.

- Partnership Model — Success will come from the bank’s ability to power products and use distribution networks via your own and other marketplaces. Banks such as Goldman Sachs and JPMorgan Chase are already powering products for Apple and Amazon. Why waste a fortune on great user experience when you could power finance for the millions of captive consumers on another’s platform or acquire customers via their marketplace? Successful banks will determine which products they need to embed and distribute via multiple channels. This will require a willingness to have the bank brand concealed and the ability to co-create and design products aligned to the host platform’s purpose and brand — that may compete directly with your B2C brand.

- Customer Centricity — The old adage ‘If you build it, they will come’ is no longer the core of how customers operate today. Today, you have to take your service to where the customer is, personalized, in the moment, and frictionless experience for customers.

- Leveraging the right Technology Strategies — With no dearth of technology solutions today, banks have to have the right ecosystem design in mind and leverage the right set of technology tools — from Cloud platforms, legacy data management capabilities, API Management, to AI and Analytics to create quick, flexible customer service experiences.

Consumers today want simplicity, easy functionally, transparency, all of that coupled with the same experience they have with other digital-savvy industries and in the context of when they need those specific services. Most people understand that technology is evolving faster than ever before, but largely overlooked is the importance of companies in the financial sector evolving with the technology. So in what ways has the digital ecosystem shifted over recent years? Banks on a journey to digital transformation have focused on promoting their brand as the brand of choice for customers and building capabilities and services around their brand. Omnichannel strategies and platforms focus on providing existing products and services through ‘captive-branded’ mobile, digital experiences for existing customers. A core component has been building back end operations and data capabilities to extract data out from legacy applications, but delivery and distribution have been through banks' own branded channels. Any fintech integration or investments are all to enhance the ‘captive branded’ experience.

Financial Companies need to think ‘Outside the App’ in the new digital ecosystem and have their customer at the center of their strategy. Citi’s, Gavin Michel, summarizes the digital transformations the banks need to focus on, “Customers think about banking while they’re doing other things, like shopping, making travel plans, and talking to their friends.”The customer of today’s bank expects experiences they have from non-financial industries to be replicated by all their service providers’ banks or no banks. Brand and Trust for financial services are still their key assets but the banks have to be present in these micro-moments when customers are not doing banking but doing things such as shopping, making travel plans and engaged in non-banking activities.

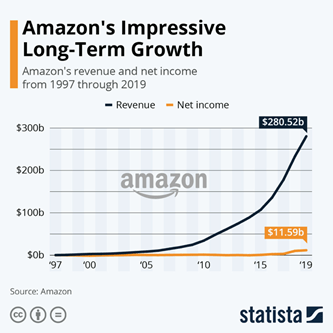

Amazon has, through its drive for customer obsession, become the platform of commerce and continues to do so by allowing third parties to participate in their ecosystem, from e-commerce services to Cloud-based platforms — AWS capabilities. Today more than 50% of their revenue comes from being a platform to sell services from third parties, the ease of experience, the customer focus has provided Amazon platform an incredible trust equation with their customers.

Amazon has implemented a consumer-centric business model that provides the customers with an experience such that they get what they want, the product, and how (ordering online) and where (to their own homes) they want it. The modern-day consumer is much more likely to turn to Amazon over other competitors for the same product due to this enhanced experience.

Over the last few years, we have witnessed this enhanced experience become the new norm, and companies who provide the same product, but without this experience, are struggling to stay in business. Additionally, the sellers on Amazon benefit from their trusted platform and large customer base. This is important as both the companies involved must have something to offer for this integration to work.

Many banks still operate in a manner that is well fit for the old digital ecosystem. Banks are unique in that they have an extensive and trusting customer base. Nearly everyone has a bank account and trusts their bank to manage their money. This means that banks have something incredibly valuable to offer to prospective digital ecosystem partners. Going back to the Amazon example, we can see what a highly trusted company with a large customer base has been able to accomplish by embracing this shift in the digital ecosystem.

How are Banks Adapting to this New Digital Ecosystem Shift

Several banks are already taking advantage of the opportunities provided by the new digital ecosystem. Goldman Sachs is a true leader where they have built their platform from the ground up and have built around it an ecosystem to plug and play the right partnership model. Their acquisition strategy also seems to be around enhancing its platform capabilities and services.

Banks have also realized that the strategy around ‘embedded finance’ or invisibility is key to their future. What is ‘embedded finance’? It refers to the finance capabilities — services and products which banks offer available through multiple platforms for the customers at their time of ask. It is also a frictionless experience like when you hail a cab ride with Uber. The money transaction associated with your Uber ride is seamless. It happens all as part of your experience of the ride and not as a separate banking transaction. The actual traction is ‘invisible’ to the customer in some ways, and uber focuses on the experience.

Banks can also leverage embedded finance as another opportunity to partner with other products and services in the new digital ecosystem. Banks can team up with various tech companies to integrate digital payment options into those platforms. This gives the banks another avenue to reach customers exactly how and where they want to be reached while also giving the other companies a way to set themselves apart. More importantly, this provides a seamless experience for customers.

PNC Bank’s cooperation with OnDeck’s ODX Platform Service is an example of two companies’ mutual benefit while making the loan application process seamless for customers. Not only does this provide great value to the customers, but it also creates a competitive advantage for both of these companies.

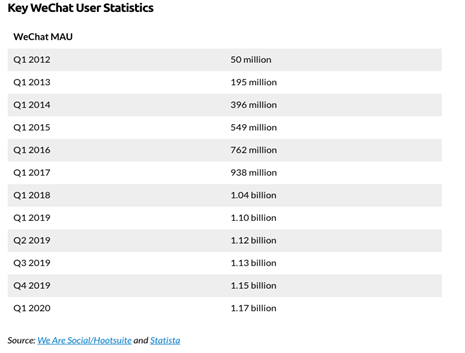

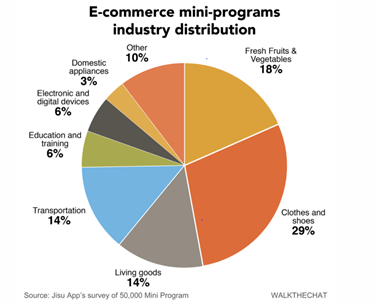

China's e-commerce platforms are great examples of banking services putting on the invisibility cloak. WeChat is an example for banks to look at as a company that has integrated messaging and finance. WeChat has optimized the user experience by combining online payment with communication. By doing this, they have set themselves apart from their competitors and provided a platform that customers can use for a diverse set of financial transactions at the highest level of convenience, it is no surprise WeChat has surpassed a billion active users.

https://www.businessofapps.com/data/wechat-statistics/

https://www.businessofapps.com/data/wechat-statistics/

As companies in the financial sector are making these adaptations, the elevated customer experience is becoming the new norm. Companies that can be on the cutting edge of this will have the opportunity to get a large amount of business from customers who demand this level of service and will not settle for less. Companies that do not adapt will lose out on those customers. Over time, the majority of consumers in the market will fit this description.

Leveraging the Right Technology Strategies

With no dearth of technology solutions today, banks have to have the right ecosystem design in mind and leverage the right set of technology tools — from Cloud platforms, legacy data management capabilities, API Management, to AI and Analytics to create quick, flexible customer service experiences. For platforms and partnerships to be invisible, several crucial technology strategies are needed across Cloud, API Management, AI and Analytics, and

Customer Experience

Banks are slowly adapting to the cloud model as large cloud platform providers continue to put strong guardrails around data, privacy around their offerings and build strong security posture around the cloud in line with banking regulatory requirements. For example, JPMorgan Chase is taking advantage of its API management system and customer analytics to help implement its partnership with Plaid. JPMorgan’s API connection is assisting consumers to share information in a faster and more secure manner.

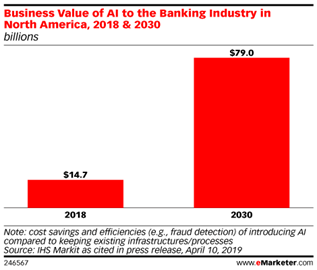

Additionally, the value that AI can bring to the financial sector provides many opportunities that should not be overlooked.

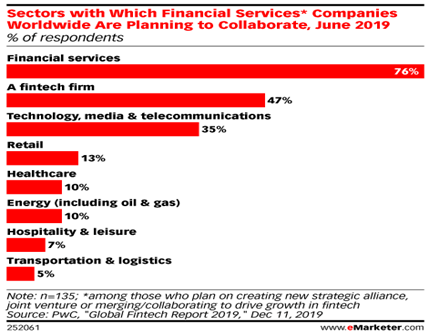

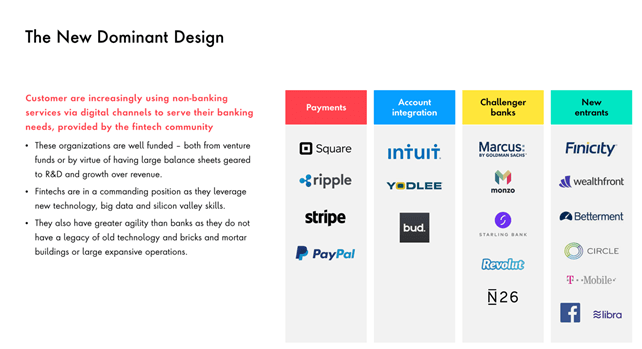

Partnership Ecosystem — Understanding the Importance of the Shift Banks, who fail to adapt to the new digital ecosystem, will lose business to competitors. What may be less evident, although still critical, is that these competitors consist of more than just other banks. Companies that traditionally operated outside of the financial sector are noticing the opportunities provided by new technologies and a shift in behavior.

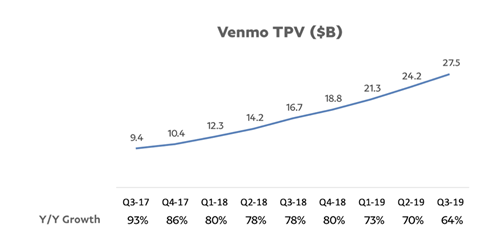

Banks may benefit from building their digital payment platforms or partnering with other companies with existing platforms. Cash App and Venmo are prime examples of digital payment platforms potentially taking business away from banks. These companies have inserted themselves in transactions that are ultimately between two bank accounts, and taking a piece of the pie. Banks should be asking themselves why consumers are choosing to introduce a third party to participate in these transactions. The answer may very well lie in how and where discussed above. Consumers are not satisfied with just any method of transferring money from one bank account to another. They want to do it exactly in the manner they prefer most.

Perhaps an even more significant threat than digital payment platforms is the increasing number of large tech companies like Facebook attempting to provide banking services. Gartner Vice President of Research, Avivah Litan, stated that “All of these mega-companies and brands are vying for consumer wallet share. Apple, Amazon, Google, and other online networks will also want this market, as they have forayed into payments themselves and will likely get into cryptocurrency if Facebook succeeds.” This is particularly dangerous for banks who refuse to adapt as, much like the banks, these large tech companies also have enormous customer bases that they can leverage to take advantage of opportunities in the new digital ecosystem. Banks who wait too long to adapt will not only be filtered out of the market by other banks, but also by these tech companies.

Conclusion

Between rising consumer demands and technology shifts that make it possible to meet these demands, there is no question that the standard for convenience is at an all-time high in today’s Age of Assistance. This provides an amazing opportunity for banks willing to embrace this change and risk a scary downfall for those who refuse to do so. The banks that fail in the new era will likely not fail due to an inability to adapt, but rather due to an unwillingness to adapt. Not only do these banks have the capability of adapting, but they also have the opportunity to grow tremendously if they capitalize on their situation. Banks have to be ready to compete in specific areas in an operating environment shaped by technology, open finance, and higher consumer expectations. This is banking you don’t have to think about. You tap to pay. You drive, and your car pays the parking fees, You buy your groceries and walk out of the store, and your groceries are paid for ( not in the future but happening today with Amazon Go stores).

In five years, banking will be behind the scenes, embedded in everyday activities—time to get your invisibility superpower on.