Brookfield Property Partners (BPY) and Brookfield Property REIT (BPYU) – The End of the Dividend And Negative Equity by Keith Dalrymple of RGICOUNCIL

Q2 2020 hedge fund letters, conferences and more

A Note on Structure:

Brookfield Property Partners is ~64% owned and externally managed by Brookfield Asset Management. Brookfield Property REIT is ~95% owned by Brookfield Property Partners and is externally managed by Brookfield Asset Management.

Brookfield Property Partners (BPY) and its publicly traded subsidiary Brookfield Property REIT (BPYU), (ex-GGP) and the second largest mall operator in the U.S, are not self-sustaining enterprises. In addition to retail, BPY owns office, hospitality, student housing, multifamily and logistics assets. Embedded incentives in the structure facilitate overleverage and cash extraction through fees and overpayment of distributions by the external manager, Brookfield Asset Management (BAM).

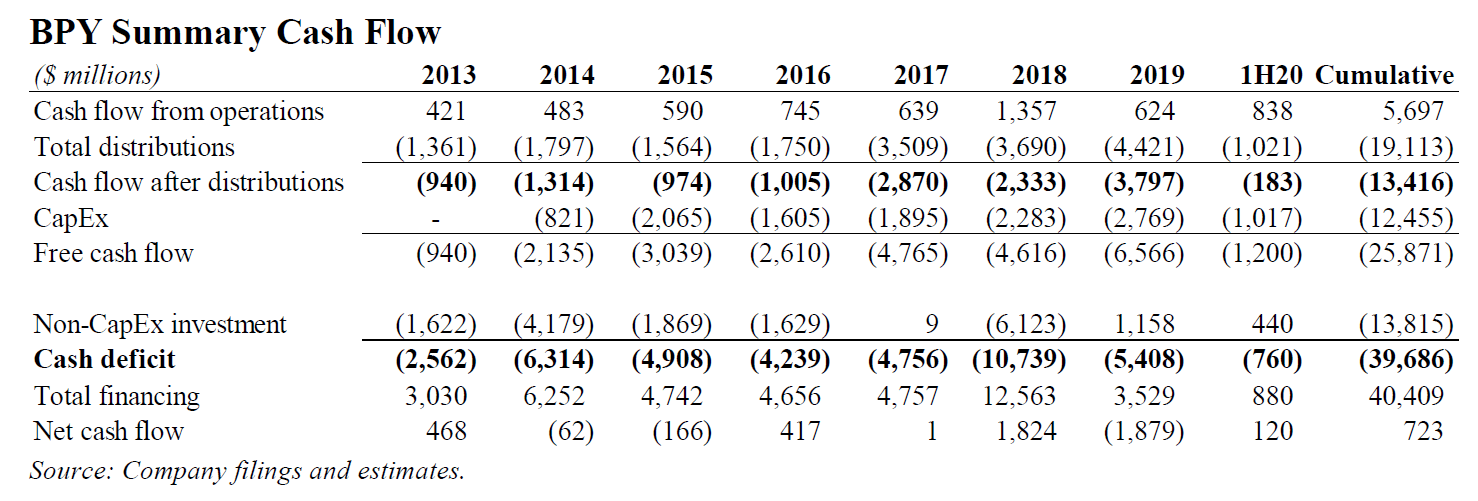

Historical cash deficits at BPY have been filled largely by adding leverage to the properties.

The strategy has become unstable in the current environment. We believe BPY and BPYU will cut their distributions.

Issues include:

- Overpayment of distributions – We estimate that BPY had annual cash flow deficits after distributions of approximately ($1B) before Covid that will grow in 2020.

- Cash cow no more – BPYU was the largest source of cash for BPY. In 2019, we estimate that $790M of cash upstreamed from BPYU amounted to 67% of BPY’s distributions paid. BPYU’s cash distributions to BPY declined to $0 in 1H20.

- Overstated NOI and operating metrics – BPYU’s steady q/q revenue and soaring accounts receivable in the face of collapsing cash flows suggests reported NOI and EBTIDA are overstated. We use reported figures, but adjusted operating metrics are likely 20% lower at BPYU and 10-15% lower at BPY.

- Insurmountable debt – BPY and BPYU both have extremely high levels of debt. Debt/EBTIDA of 15.4x and 14.3x, respectively, are twice the peer group average of 7.4x. Interest expense is 61% and 182% of adjusted cash flow for BPY and BPYU, respectively, compared to 30% for high-quality peers.

- Debt defaults and consequences – BPYU is in default on $1.2B of mortgage debt across 12 properties and has approximately $4.9B coming due by the end of 2021. We believe continued debt defaults may lead to a collapsing of the corporate holding structure, putting assets across BPY at risk.

- Distribution cuts are coming – All mall REITs (except BPYU) and 36% of all REITs have cut or suspended dividends. BPY’s excessive leverage, high exposure to retail, poor cash generation and costly external management make distributions unsustainable. The distribution will have to be scaled down.

- Bailouts for now – BAM has engineered bailout programs through various strategies for the organizations, including funding tenants, direct cash infusions and stock buy-backs, using both corporate cash and private equity funds, in what we view as deeply conflicted transactions. BAM committed nearly $2.4B to the entities in 1H20.

- Watchful investors and lenders - Will BAM’s private equity clients watch while their cash is used to bailout BAM’s failing public entities? Will lenders accept ring-fenced, asset specific, defaults where partial and/or implied guarantees exist while the parent, BPY, continues to upstream ~$800M annually in fees and distributions to BAM?

- The units are worthless – Using EV/EBITDA metrics from the peer group indicates that BPY’s units have negative equity.

The Endgame: Insolvency is Here

- Historical substandard cash flows exacerbated by Covid-19

- BPY’s largest source of cash disintegrates

- Revenue recognition policy appears to overstate operating metrics

- Excessive leverage and debt defaults

Brookfield Property Partners (BPY) is not a viable entity as it does not generate enough cash to sustain the enterprise. Further, it has negative real equity after years of asset stripping through a conflict-ridden incentive system by BAM (Brookfield Asset Management). Bankruptcy could be imminent given the defaults of $1.2B of property debt, which could prompt CBMS investors to test the collapse of the SPE structures as happened during GGP’s bankruptcy.

Cash flow deficits have plagued BPY since its inception (see below). We are now at the point in the cycle where declining cash flows and asset values are bringing financial mismanagement to the fore. In our analysis, BPY is teetering on the edge of insolvency.

We estimate that LP-level cash deficits after distributions were approximately ($1B) pre-Covid-19, filled largely by increasing asset-level debt. Both cash-out refinancings and asset sales are significantly more difficult in the current environment than in the past, limiting deficit-financing options.

BAM took actions to relieve the financial stress at BPY and its subsidiary BPYU in May 2020 with the announcement of Brookfield’s ‘Retail Revitalization Program’. Since then, assistance has grown to include direct cash infusions and support of stock prices.

Brookfield management pointed out that while it does not specifically target Brookfield tenants with the Retail Revitalization Program, it’s an opportunity to “utilize the knowledge, the relationships and the understanding of these tenants that we have in the real estate business through our relationships with these tenants, and bring some capital to bear on this and earn investment returns”.

In July 2020, both BPY and BPYU announced substantial issuer bids totaling $1B, though neither entity had the cash. BAM disclosed that the tender offer for BPY would be funded 50% from BAM capital and 50% from managed accounts from private equity clients. It is unclear whether this is separately raised capital from institutional investors or part of existing private equity funds.

Both the tender offer and the Retail Revitalization Programs use private equity funds in conflicted transactions to support BAM’s ailing publicly traded investment vehicles. BAM is a direct beneficiary as it earns capitalization-based fees and receives distributions on its ownership stake.

In August 2020, BPY approved certain subsidiaries as borrowers on a $500M credit facility, which is guaranteed by BAM. Additionally, BAM is also providing a liquidity facility of $500M directly to BPY’s retail subsidiary BPYU. Altogether, BAM and BAM-managed entities committed approximately $2.4B of support in 2Q20-3Q20.

1. BPYU: Loss of the Key Cash Generator as Malls Disintegrate

BPYU (ex GGP) is the key to the BPY’s dividend viability. Between 2013 and August 2018, BPY owned 29-34% of GGP. In that time, GGP’s dividends increased significantly and the company was a key source of cash dividends paid to BPY. In 2017, GGP accounted for 65% of all cash upstreamed from equity accounted investments. Purchasing the 66% of GGP BPY did not already own in 2018 allowed it to extract more cash by both relevering and selling assets.

As part of the acquisition, GGP paid a $9.8B dividend prior to the deal’s close. It was funded

largely with $7B of refinancing debt and $3B in asset sales. However, asset stripping became

problematic in 2019 as the retail apocalypse took hold, as shown in BPYU’s summary cash flow for 2019.

The REIT paid a total of $912M of distributions with only $428M of cash flow. Including investing cash flow, the total cash deficit for the year was $1.8B. We estimate that BPY received approximately $681M of total distributions paid in 2019.

BPYU financed the deficit by raising approximately $1.9B in additional mortgage debt.

BPYU has a complex share structure. The publicly traded security is the Class A shares, which receive a distribution equal to BPY’s. BPY owns several non-traded share classes, two of which have cumulative dividends. In 1H19, the Class B and Series B preferred shares paid a total of $659M to BPY. As shown in the table below, the figure has collapsed to $0 in 1H20.

The publicly traded Class A shares pay a distribution identical to BPY’s declared distribution as part of the so-called economic equivalency of the entities. Class A distributions were $39.6M in 1H20. Thus, distributions to the outside shareholders have been maintained, but distributions to BPY have been cut to $0. The key source of cash for the limited partnership appears to have been shut-down.

BPYU’s financial performance was suffering prior to Covid-19; it has gotten a lot worse. The firm’s 10-Q states that 2Q20 collections were only 30% of rents, though the collection rate improved going into and subsequent to quarter’s end.

BPYU’s revenue declined only -3% q/q compared to -20% for peers while accounts receivable increased significantly more than comparable companies. The discrepancies suggest that BPYU continues to book revenue and accrue it in accounts receivable where peers are writing-off a portion as uncollectable. Continuing to book revenue in accounts receivable boosts reported NOI, EBITDA and FFO, which makes operating metrics at both BPYU and BPY appear more stable than those of competitors.

The operational metrics make it impossible for BPYU to continue its distributions to BPY at previous levels. Further, the devastating retail environment makes asset sales and debt increases on the asset level a virtual impossibility.

2. The Insurmountable Debt Problem – BPY & BPYU

We show comparative leverage statistics for both BPY and BPYU in the accompanying table.

BPY as a whole and BPYU as the retail subsidiary are both substantially more levered than peers. The table below shows how the leverage flows through to operating statistics.

At the BPYU level, interest expenses for 1H20 was 182%, a higher ratio than BPYU’s predecessor company’s leverage in 2008 just prior to filing bankruptcy, and significantly higher than contemporary peers, particularly the more prudently financed SPG, with whom BPYU’s assets are most often compared.

Operating statistics at the BPY level are likewise significantly higher than those of peers.

The downturn across the real estate industry has caused many REITs to down-size their dividends to reflect the current environment. Recent research by Hoya Capital notes that all mall REITs with the exception of BPYU and 36% of all REITs have cut dividends. Of companies noted, SGP and VNO have cut dividends; BXP, the most stable and least levered of the group, has maintained its dividend.

BPY’s combination of income mix with 65% of net operating income derived from retail and risky LP investments, and excessive leverage, create an extremely high-risk financial profile. While many other REITs have opted to cut payouts in the face of financial uncertainty, BPY’s external management has elected continue with unsustainable payouts. However, in our view, the bailouts will end and the BPY’s distribution will have to be eliminated.

Collapsing Cash Flow Leads to Debt Default

Unlike BPY’s IFRS statements with vague language regarding ‘suspension of payment’ of debt, BPYU’s US GAAP statements speak quite plainly regarding the REIT’s debt problems. The 2Q20 10-Q states that “the company stopped making payments on 12 property level mortgages resulting in them being in default.” The company has a total of $1.2B of mortgages in default on properties with a carrying value of $1.1B.” BPYU’s defaults represent 4% of the total debt outstanding. We show the companies consolidated debt along with its proportion of equity accounted debt below.

Read the full report here.