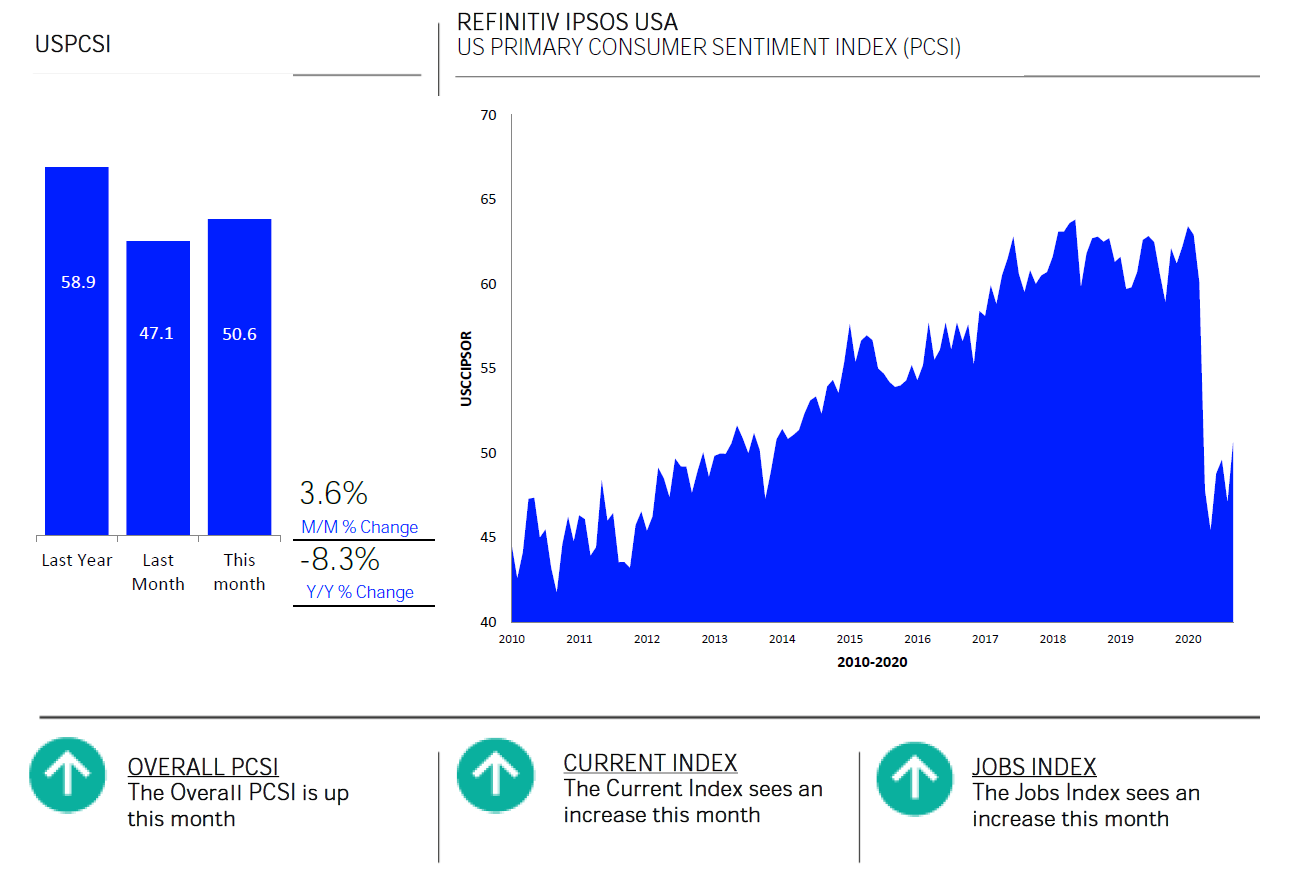

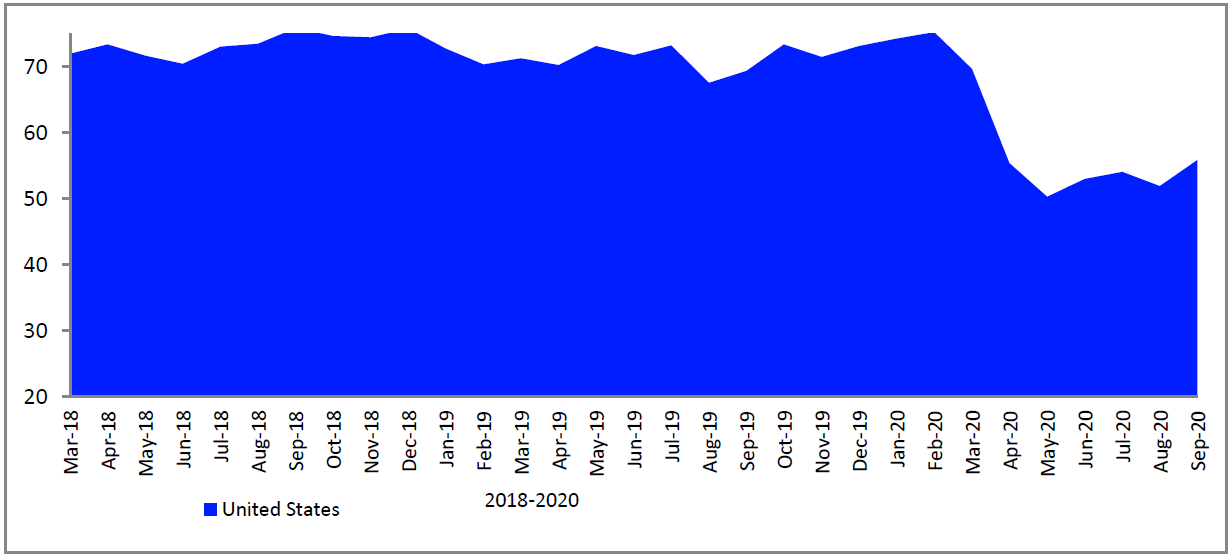

WASHINGTON, DC — Americans’ consumer confidence, as measured by the Refinitiv/Ipsos Primary Consumer Sentiment Index, is at 50.6 for the month of September 2020, up 3.6 points from last month (47.1).

[activistivnesting]Q2 2020 hedge fund letters, conferences and more

Erasing a 2.5 loss observed the month prior, the Index is showing signs that, despite month to month volatility, consumers are generally beginning to feel more confident in their personal situations and the economy overall. All sub indices showed significant improvement this month with the Current, Investment, and Jobs index at their highest marks since March of this year.

“American consumer confidence continues to climb despite instability on a per month basis.

As the unemployment rate improves and people continue to embrace their situations, overall confidence is improving,” notes Chris Jackson of Ipsos. “Despite the coronavirus still being far from under control, millions of Americans unemployed, and civil rights protests sweeping the nation, disrupting many, Americans are finding a way to feel confident again.”

Jharonne Martis, Director of Consumer Research at Refinitiv, said, “As the second quarter earnings season comes to an end, over 70% of retailers beat earnings and revenue expectations. The Refinitiv Retail and Restaurant Earnings Index showed that while overall Q2 growth was anemic it could’ve been a lot worse. Moreover, the latest retail earnings reports suggests that Q3 spending is off to a less poor start with an estimated earnings decline of 31.8%, an improvement from the 43% drop in Q2 earnings.”

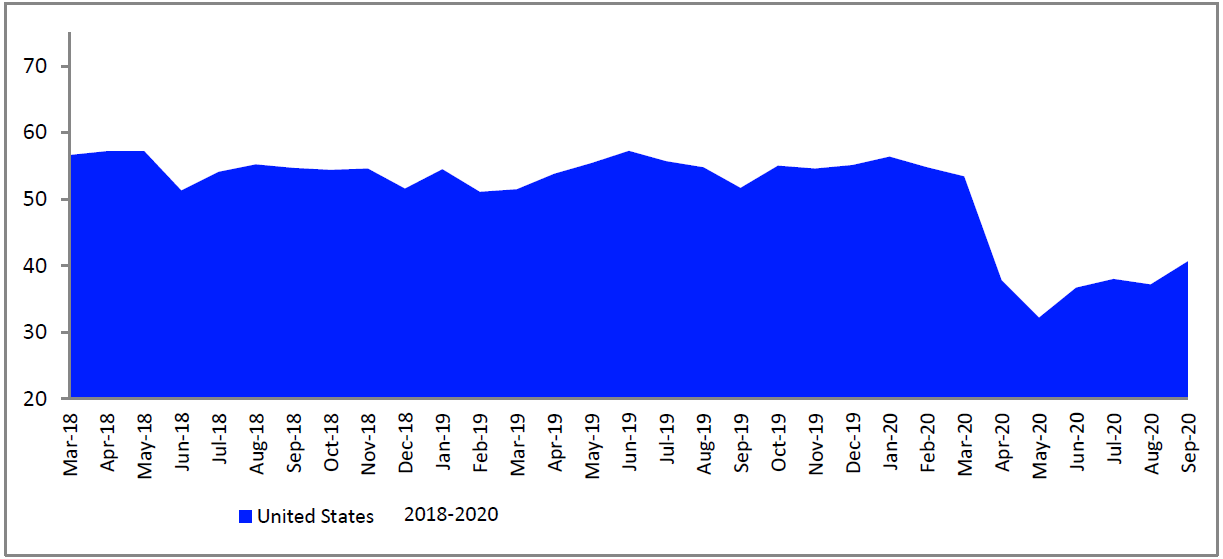

Current

The PCSI Current Condition Index, currently at 40.7, is up from last month (37.2). American sentiment has been growing or holding steady since May of this year; this is the first time since March that the index has surpassed 40 points.

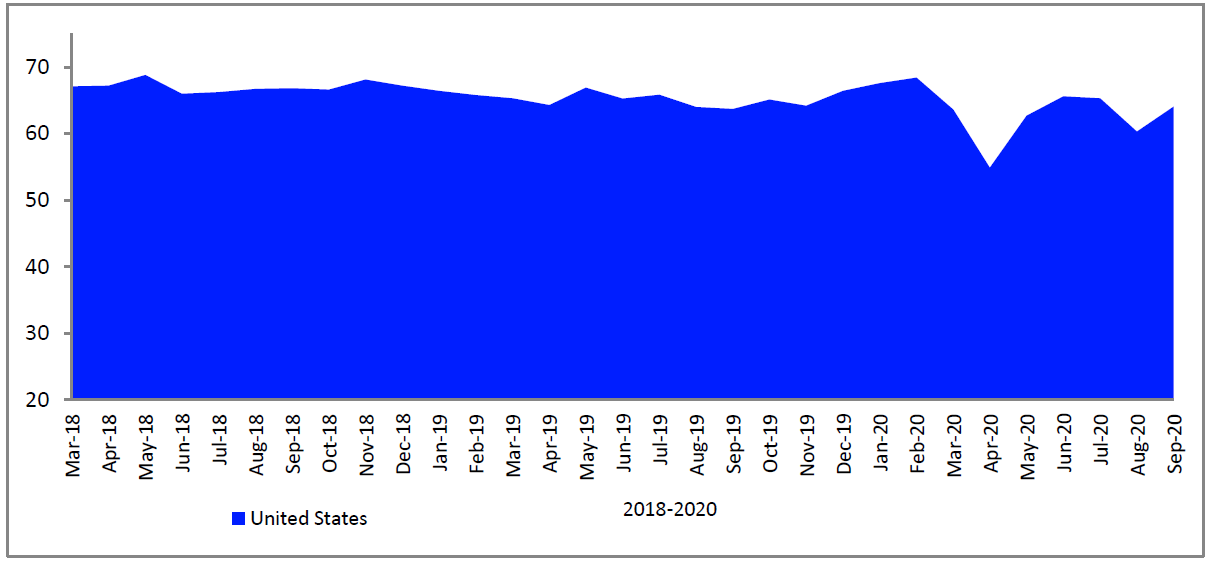

Expectations

The PCSI Expectations Index is up 3.7 points, standing at 64.1. Bouncing back from a near 5 point drop recorded last month, Americans’ confidence about the economy’s impact on their personal finances and job security is on the rise again, aligning much closer to what was seen July (65.3) and June (65.6).

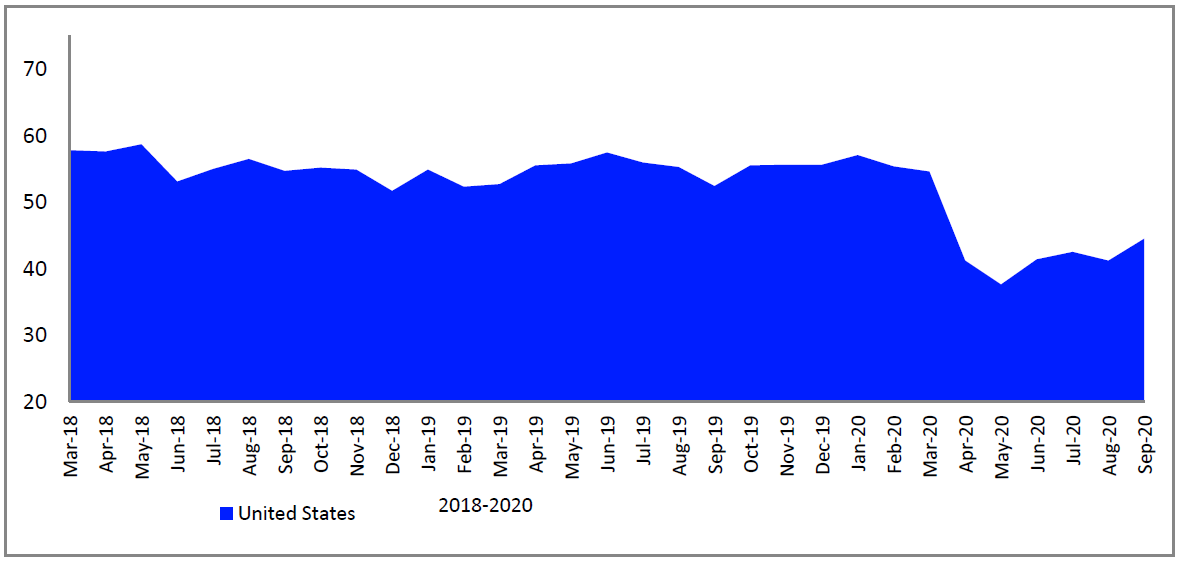

Investment

The PCSI Investment index, indicative of Americans’ confidence in their ability to invest in their future, is up significantly this month. At 44.5, the index gained 3.3 points this month. Similarly to the Current Condition Index, this is the highest recorded level since March 2020.

Jobs

As the unemployment stats continue to decline (11.1% in June, 10.2% in July, and most recently reported at 8.4% in August), Americans’ confidence regarding their job security and future employment expectations is increasing.