500 US companies file for bankruptcy and more expected, says GlobalData

Q2 2020 hedge fund letters, conferences and more

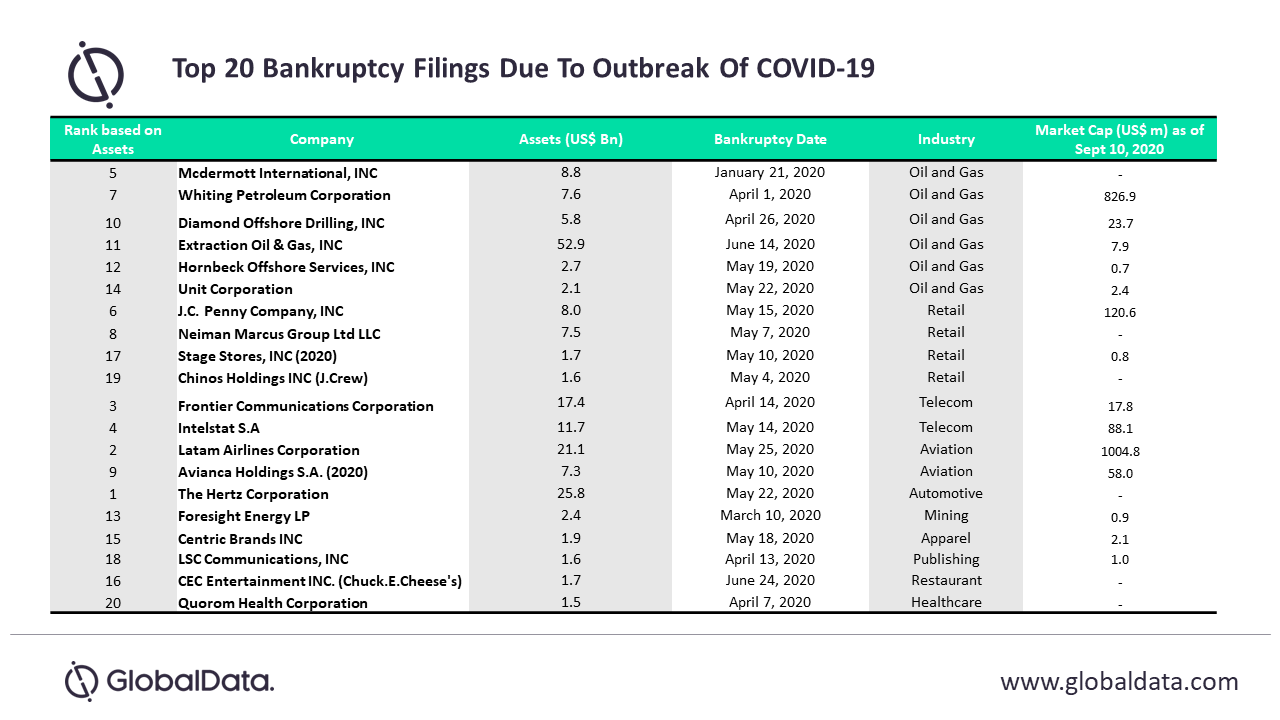

Amid the financial and economic crisis triggered by COVID-19, around 500 businesses have filed for bankruptcy since March 2020 and the trend is only set to persist in the coming months, says GlobalData, a leading data analytics company.

Slowdown In Recovery Is Shutting Down Businesses

Bindi Patel, Economic Research Analyst at GlobalData, says: “An increasing number of US companies are filing for bankruptcy. Various businesses continue to be disrupted, and all companies - whether big, small or medium-sized enterprises – are feeling the strain. Despite the government’s stimulus measures, and the US economy experiencing a further slowdown in recovery, many of these businesses are likely to permanently shut shop.

“With businesses shutting down and consequently job growth showing a slowdown, on top of a stoppage of unemployment benefits, consumer spending is bound to be heavily impacted in the months to follow.”

Companies That Filed For Bankruptcy

Some of the largest companies that went bankrupt in the US are JC Penny, which filed for Chapter 11 bankruptcy on May 15 stating it would close 30% of its store base; Gym chain 24 Hour Fitness filed for Chapter 11 bankruptcy on June 14, stating it would permanently close down more than 130 gyms; and WorldStrides, a travel company that helps organize educational trips for around thousands of students, which filed for Chapter 11 bankruptcy on July 20.

Patel concludes: “Although the US Government’s stimulus measures may be helpful to a certain extent, it might not be enough to prevent further bankruptcy filings in the near future. Although the government has eased down on lockdowns and certain social distancing measures, many Americans are still hesitant to go to malls or restaurants in the fear of contracting the virus.

“If the pandemic is not controlled, it will not only continue to dampen the US economy as a whole, but the filing of increasing number of bankruptcy cases, revival of businesses and increase in consumer spending will be huge challenges to address for the months to come.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make timelier and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.