In what was already a record year for special purpose acquisition companies (SPACs), Jeffrey Smith’s Starboard Value is the latest activist to establish one, joining the likes of Bill Ackman’s Pershing Square Capital Management and Daniel Loeb’s Third Point Partners. Since the start of 2020, SPACs have raised $22.5 billion, a far cry from last year’s $13.6 billion, according to SPAC Research.

Q2 2020 hedge fund letters, conferences and more

Smith’s new entity, Starboard Value Acquisition Corp, will use the $300 million raised in an initial public offering to acquire "established businesses" that the activist sees as "fundamentally sound." The figure may rise to $345 million if underwriters choose to exercise an over-allotment option. Starboard will also consider "earlier stage companies that exhibit the potential to change the industries in which they participate, and which offer the potential of sustained high levels of revenue growth," a regulatory filing stated last week. Founder and CEO Smith will act as the blank check company’s chairman while M.J. McNulty, an executive at Starboard, will lead the vehicle as CEO.

A recently launched SPAC by Pershing Square attracted $4 billion from outside investors and is looking at private companies that are valued at more than $10 billion, including so-called "mature unicorns," private equity-owned firms, high-quality IPO candidates, and family-owned businesses.

What We'll Be Watching For This Week

- Will the recapitalisation plan at Just Energy get voted through at a special meeting today, leading to a board refreshment as promised by the company?

- How will shareholders react to CBL & Associates Properties' plans to seek bankruptcy protection?

- How will Leaf Group shareholders fare in their continuing pursuit of CEO Sean Moriarty’s resignation, after board member Charles Baker stepped down last week?

Spruce Point Capital Management Deem GFL Environmental Stock Worthlress

Spruce Point Capital Management released a scathing report on GFL Environmental last Tuesday, claiming the Canadian environmental solutions company is a "poorly organized and opaque" roll-up. Spruce Point, which deemed the stock "worthless", alleged the people running GFL Environmental have connections to "controversial" people, which, if true, makes the stock uninvestable to institutions, according to the short seller.

Spruce Point’s report noted that GFL Environmental acquired 143 companies over the past 13 years, and argued that most were marked by poor post-acquisition execution and continue to face operational or financial challenges. The short seller also claimed it had found evidence that GFL has minimized financial control issues and understated leverage through "aggressive" accounting practices, and that its CEO’s "side hobby... could distract him from running GFL Environmental." GFL’s stock fell more than 10% on the day of the report’s release.

Chart Of The Week

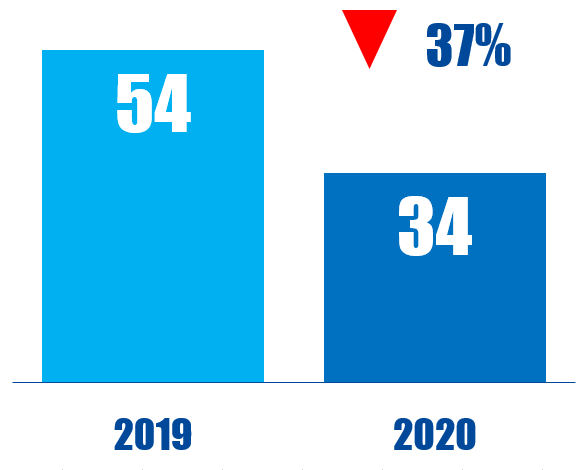

The number of investors that disclose activism as part of their investment strategy and have publicly subjected at least two companies to activist demands between January 01 and August 21, in respective years.