The few who can understand the system will be either so interested in its profits, or so dependent on its favours, that there will be no opposition from that class, while, on the other hand, that great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burden without complaint and, perhaps, without even suspecting that the system is inimical to their interests. ~ The Rothschilds

Q2 2020 hedge fund letters, conferences and more

Housekeeping Note: Enrollment is opened this week to join our Collective. The sign-up period will close this coming Sunday. If you’d like to learn more about what the Collective is then go ahead and click this link below. Also, don’t hesitate to email me with any questions you may have.

Good morning!

In this week’s Dirty Dozen [CHART PACK] we talk CAPEX trends and the premium given to US earnings before diving into the fulcrum of global assets (real yields), what they mean for metals, growth stocks, and policy makers. We then discuss some pockets of the market that are seeing rampant speculation and finally end with a long semi pitch in the hopes we see some mean reversion, plus more.

Let’s dive in.

Tracking CAPEX trends

- According to the Levy-Kalecki equation, it’s net investment that drives aggregate profits — I’ve written about this here. This is why it’s important to track CAPEX trends, because one company’s spending (CAPEX) is another’s profits. Knowing this, it’s a good sign that GS’s proprietary CAPEX tracker has v-bottomed off its COVID lows and is back in positive territory.

- The premium given to US earnings relative to the rest-of-the-world is at levels that have only been seen a few other times over the last 60-years. If history is any guide, this rich value premium is unlikely to persist for much longer.

Plenty Of Room For Sentiment To Improve

- Sentiment and positioning is stretched in a few pockets of the market — some of which we’ll discuss below. But as these sentiment indicators from Nomura show, there’s still plenty of room for sentiment to improve before we can say things are exuberant (China being the exception).

- Real yields are the fulcrum of global markets as macro hedge fund manager Adam Fisher points out in this great interview on the Capital Allocators podcast (link here). The falling dollar, rising gold, and juggernaut trends in growth and momentum stocks all have falling real yields to thank for their moves. The inflation-adjusted UST 10yr yield hit an all-time record low. With yields fast approaching zero, we need to begin asking ourselves, is this as good as it can get?

- The hedge fund Bridgewater recently published a paper exploring this very question. It’s titled “Grappling with the New Reality of Zero Bond Yields Virtually Everywhere”, here’s the link. They point out that roughly 80% of all global local currency debt now yields below 1%.

Bridgewater: Managing The Monetary Base

- Bridgewater goes on to write about how managing the monetary base is likely to take the place of interest rate management (since yields can’t be lowered much further) in combating slower growth and falling inflation. Here’s a section from the report where they lay out what this will look like:

“ Zero nominal yields also create a unique linkage between real yields and inflation. Because there is an arbitrage between the breakeven inflation rate and actual inflation, a deflationary downturn that pushes breakeven inflation down is extra risky because the combination pushes real yields up as the economy contracts (because the real yield plus breakeven inflation must equal the nominal yield, and the nominal yield is relatively stable), i.e., you have a higher discount rate on cash flows as cash flows fall.

“On the other hand, if reflation is successful, central banks will likely delay the rise in nominal yields relative to inflation, forcing real yields to fall. And there is no lower limit to either real yields or breakeven inflation. As a result, a successful reflation can drive real yields much lower even if they start at low levels, and policy failure (i.e., deflation) will drive them higher.”

- This will be bad for the dollar but good for precious metals. A couple months ago I wrote about my strong conviction that gold will make new all-time highs within the next six months. Well, we got there last week. This long-term chart of the inflation-adjusted price of gold though shows that its still 30% below its 1980 peak and slightly below its 2011 high (see my framework for analyzing precious metals here).

- While I remain bullish on precious metals and silver in particular. There are a number of indicators suggesting both metals are due for a breather (retrace) before another leg up. This chart shows that speculative call buying in the main silver ETF hit levels last seen in 2011, which happened to mark the peak. With that said, the precious metals markets are prone to parabolic moves that defy the norms so it’s important we let the tape guide the way.

DXY 14-day RSI Hit Its Lowest Level

- The dollar’s (DXY) 14-day RSI hit its lowest level in over a decade last week. Its 10-day moving average (blue line) is showing oversold conditions that have typically marked or preceded short-to-intermediate-term bottoms.

- Have investors in the FAAMG stocks built a bridge too far? Speculation marked by Put/Call ratios shows that investors in the stocks are the most bullish and most complacent of a drawdown than at any other time in the group’s history.

- Semiconductors are seeing their best profit growth relative to the Nasdaq in nearly three years.

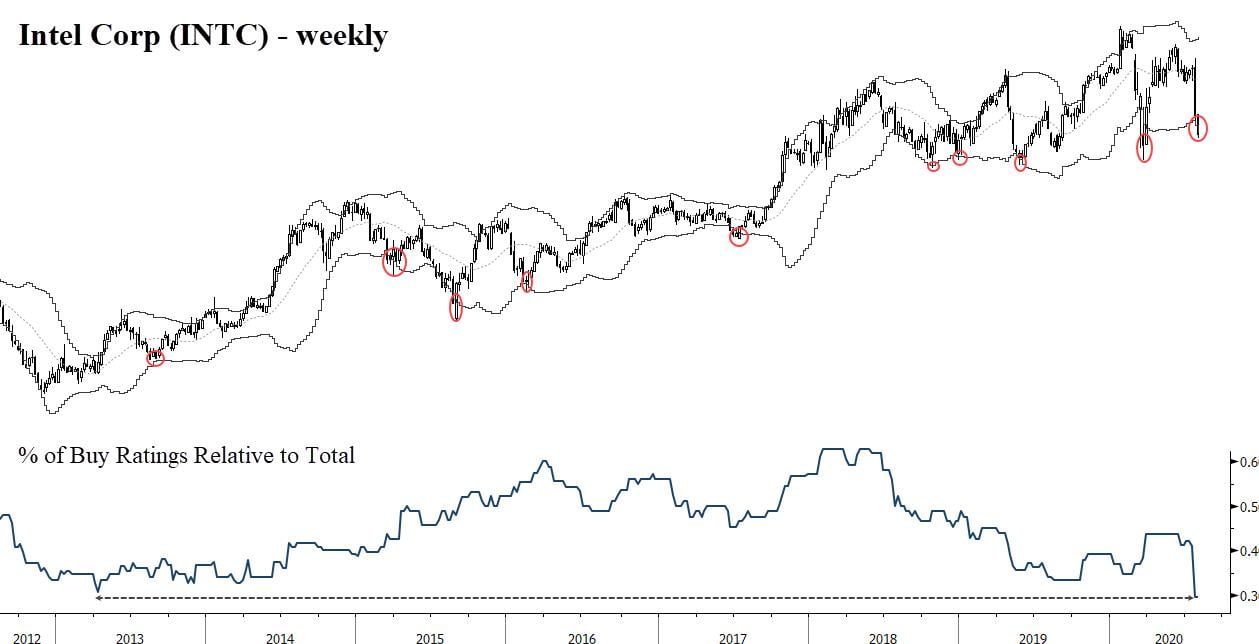

Intel Corporation (INTC)'s Underperformance

- There’s plenty of strong charts in the semi space. One of the laggards though is Intel Corporation (NASDAQ:INTC). Now, there’s obvious fundamental reasons for this underperformance. But with the stock at its lower weekly Bollinger Band and the number of buy ratings as a percent of the total near a decade+ low, INTC might be worth thinking about a reversion to the mean / catch up play here. Note, the last time analysts were anywhere close to this bearish on the INTC stock was in 2013, which happened to coincide with a major bullish breakout from a long-term base.

CLICK HERE TO LEARN MORE ABOUT OUR COLLECTIVE

Stay safe out there and keep your head on a swivel.

Alex Barrow

Co-Founder of Macro Ops. Alex is a former US Government Counterintelligence Professional, U.S. Army Interrogator, and USMC Scout Sniper. He’s an independent trader with over 10-years in markets.