Whether you’re a casual investor with a budding 401(k) or an experienced stock market player, you likely know that investing is a skill that you can never truly master. Even Alan Greenspan, the former chair of the Federal Reserve, has been quoted as saying financial education “is a process that should begin at an early age and continue throughout life.” When you’re starting out, or even as an intermediate investor it’s easy to see these learning opportunities everywhere.

Q2 2020 hedge fund letters, conferences and more

Beginner investors have hundreds, if not thousands, of decisions to make: how much to invest, the types of accounts to open, what your risk tolerance is, what stocks to buy and when, whether you’re more bullish or bearish, and more. And for as many questions as junior investors have, there are at least twice as many answers—there are no shortage of books, courses, articles, blogs and more from every established investor under the sun available to help you learn your own strategy and preferences as you’re setting up your portfolio.

But then, once you have your initial portfolio established, things can get a little more complicated. When you’ve been investing for a little while, it can suddenly become harder to find the materials you need in order to continue learning. By the time you’re well into your 40s or 50s, the usual tips are less like advice and more like reminders of things you’ve been practicing for years.

So where does the intermediate investors go for expert insight that actually helps? The advice is out there; it just takes a little bit of extra legwork to uncover.

Tips For Intermediate Investors

Let’s look at the challenges intermediate investors might be facing that are different than the obstacles you encountered when you were starting out, and some advice from successful billionaires that can help you navigate each scenario.

Learning When To Level Up

No matter who you listened to when you were shaping your strategy, you certainly learned that every good portfolio needs balance and diversity. But once you have that comprehensive portfolio bringing in a solid annual interest, how do you determine whether to leverage those assets to invest in something like a business, property, or venture opportunity?

Alice Walton, one of the billionaire heirs to the Walmart fortune, has a quote that can help investors navigate this particular crossroads: “One of the great responsibilities I have is to manage my assets wisely, so they create value.”

The key word in Alice’s quote is create. When you’re starting out, your priority is to protect your assets; you’re investing them in hopes that they will appreciate in value. But passively appreciating in value isn’t the same as creating it, and once you’re in a position where your assets are comfortably balanced, protected, and accruing worth, you should start looking at ways to leverage them to build new valuable opportunities.

Shifting Goals

Most people start investing via their employer-sponsored retirement accounts, so their priority is automatically to save for retirement. But depending on your particular situation, you may wake up one day and realize you’re safely prepared for a financially secure retirement. So what do you work toward next?

Consider McDonald’s founder and entrepreneur Ray Kroc’s famous quote: “If you’re green, you’re growing; as soon as you’re ripe, you start to rot.” If retirement is the only thing you’re working toward financially, you’ll become complacent once you’re in a position where you no longer need to worry about your finances post-career. And if you still don’t have any new goals once you actually do retire, you may find yourself depressed and aimless once you step back from your career if you don’t have a new purpose to drive you.

The answer? This is one problem for intermediate investors that can be solved with beginner advice: set both short and long term goals. But where that advice typically means to set varying financial timelines, older investors also need to have short and long term life goals in order to ensure their financial progress doesn’t peter out once they hit retirement. Domino’s Pizza founder Tom Monaghan sums it up well: “I have a lot of dreams, and I don’t think I’ll ever achieve them all. I hope not. I don’t like having to think about a day when I might stop having new ones.”

Defining An Ideal Scenario

Of course we would all like to have enough to give our family everything they’ve ever dreamed — who wouldn’t love to buy their parents a home or surprise their kids with a brand new car? But when we actually do have the ability to do these things, we’re faced with the reality that it might not be the best thing for those involved. Will your kids really be better off if you gift them everything they want in life? And if not, how do you determine where to draw the line?

The key here is to think of what you give to others not literally, but in terms of your legacy. What is it you want people — your family, kids, friends, coworkers, and community — to remember you for? As Eli Broad says, “Civilizations are not remembered by their business people, their bankers or lawyers. They’re remembered by the arts.” You can interpret this as an individual to understand that it’s not the items that matter; it’s the meaning and experience created with them that impacts people. Even if you can afford a brand new car for your son or daughter, you might find you can pass on even more value by working on a fixer-upper together instead.

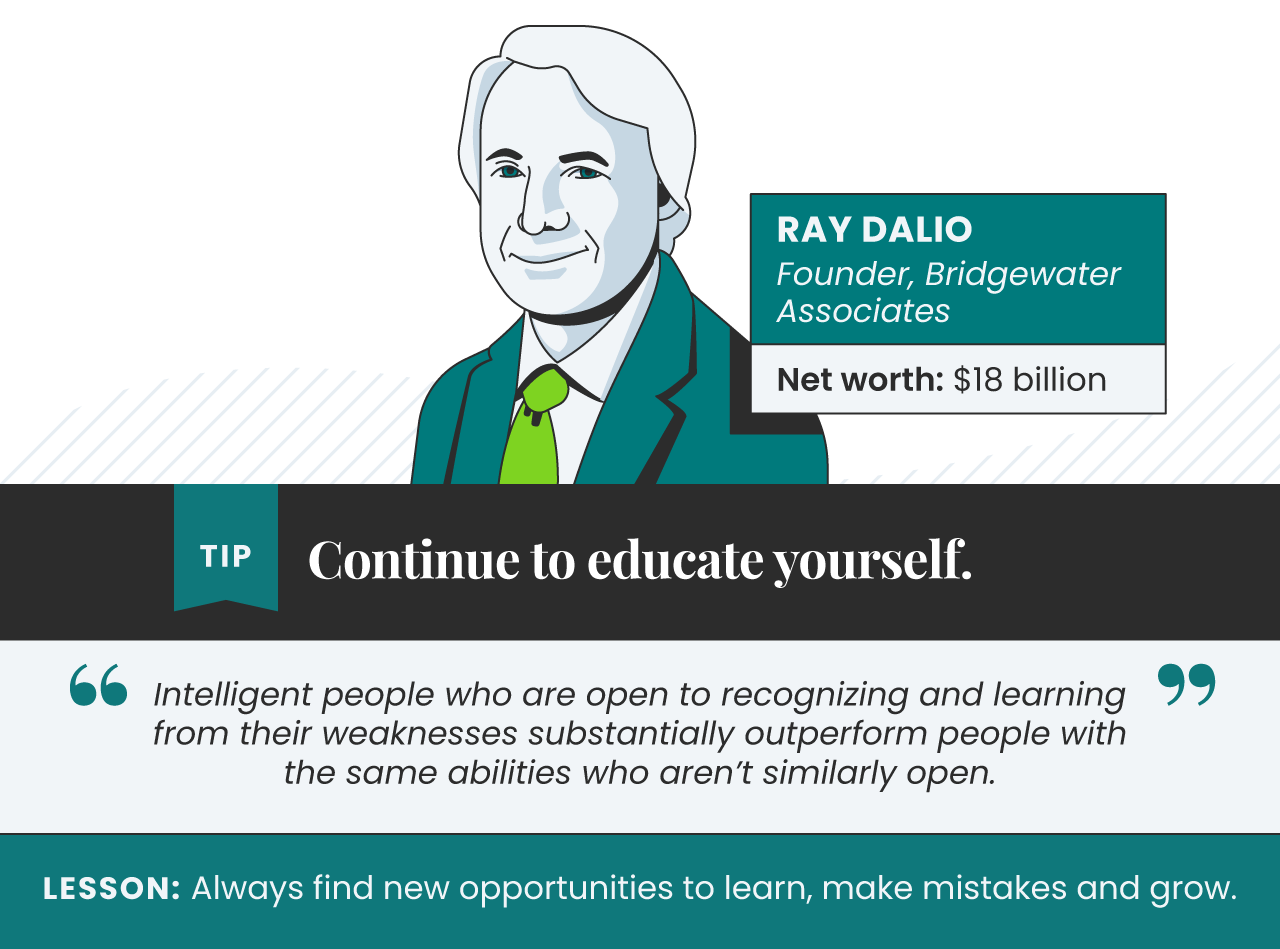

As you continue to navigate the uncharted waters of life, your investments and your financial strategy will need to evolve along with you. Many of the lessons you learn will continue to apply throughout life, while others may arrive when the time is right. The important thing is to remember that learning is a lifelong process, especially when it comes to investing. The most successful investors are those who maintain an open mind, a humble attitude, and pursue knowledge continuously as a lifelong student of the world.