Taleb Says It’s Time To Hedge Tail Risk

A few years ago, Nassim Taleb and I followed each other on Twitter, and he was even kind enough to offer his respects on my deadlift PR.

Q2 2020 hedge fund letters, conferences and more

Screen capture via Twitter.

Since then, like presumably hundreds of his other former correspondents, I have been blocked by Taleb. Fortunately, I have ValueWalk to keep me apprised of Taleb's pronouncements.

In a recent post, Michelle Jones noted that Taleb had warned that tail risk hedges were a necessity in the current market. Here's a simple way you can add a tail risk hedge to your portfolio. I'll use a $500,000 portfolio in this example, but you could use the same approach for a $50,000 or $5,000,000 portfolio.

Adding A Tail Risk Hedge To A $500,000 Portfolio

Here's a simple way of protecting a stock portfolio against market risk using optimal, or least expensive, puts on SPY. For the purposes of this example, I'll assume your portfolio is closely correlated with SPY, that you have enough diversification within it to protect against stock-specific risk, and that you can tolerate a decline of up to 20% over the next few months (if you have a smaller risk tolerance, you can use the same approach entering a smaller decline threshold; similarly, if you have a larger or smaller portfolio, you can adjust Step 1 accordingly).

Step 1

Divide $500,000 by the current price of SPY, which was $317.59 as of Friday's close, to get 1,574 (rounded).

Step 2

Scan for the optimal, or least expensive, puts to protect against a >20% decline in 1,574 shares of SPY over your desired time frame. Here, I've used Portfolio Armor's default setting, which is to scan for optimal hedges expiring in approximately six months.

Note the cost here: $19,455, or 3.89% of portfolio value, which was calculated conservatively, using the ask price of the puts (in practice, you can often buy options at some price between the bid and ask prices). That worked out to an annualized cost as a percentage of portfolio value of 7.6%.

Step 3

Round up the number of SPY shares to the nearest 100 and repeat step 2.

Note that, in this case, it was cheaper to hedge rounding up to the nearest round lot: The cost was $15,536, calculated conservatively again, at the ask. That's about 3.12% of a $500,000 portfolio, or 6.13% annualized.

Wrapping Up: A Drawback Of This Approach

You may recall that in the second, less expensive, example, the annualized cost is 6.13%. A drawback of this approach is that this cost will act as a drag on your portfolio's returns if the market keeps going up. If your portfolio is closely correlated with SPY, you can expect to lag it by approximately 6.13% over the next 12 months, assuming the market goes up over that time frame, you add new hedges of similar time to expiration just before these expire, and the cost is similar to what you paid here.

An Alternate Approach

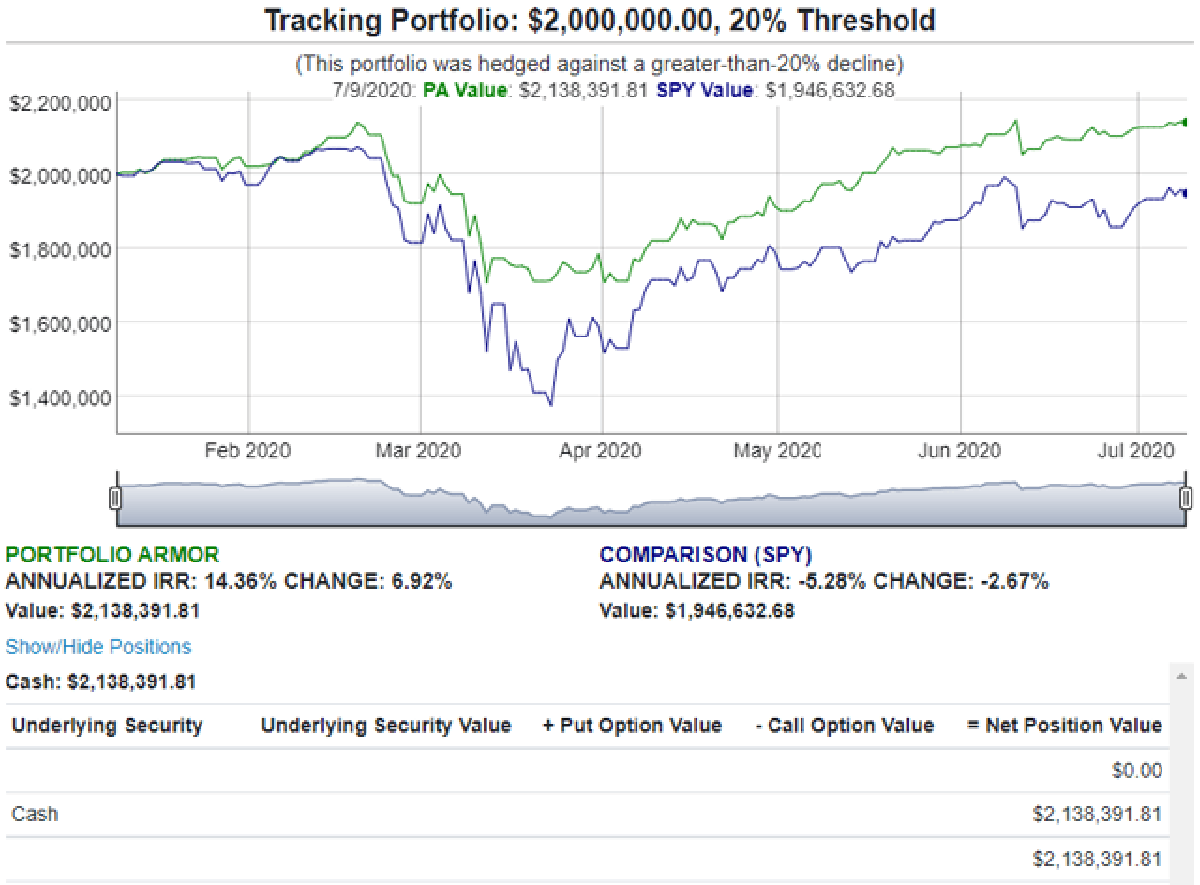

An approach to hedging that offers a chance of beating the market if it goes up, or only declines a little bit is the hedged portfolio method. In that approach, you buy and hedge a handful of names that have a shot at market-beating returns and are also inexpensive to hedge. Below is the performance of the most recent portfolio hedged against a >20% decline to finish its 6-month lifespan.