What Real Estate Insiders REALLY Think About This Market: RCLCO Sentiment Survey Has Answers

[reit]Q2 2020 hedge fund letters, conferences and more

What The Real Estate Industry Insiders Are Expecting

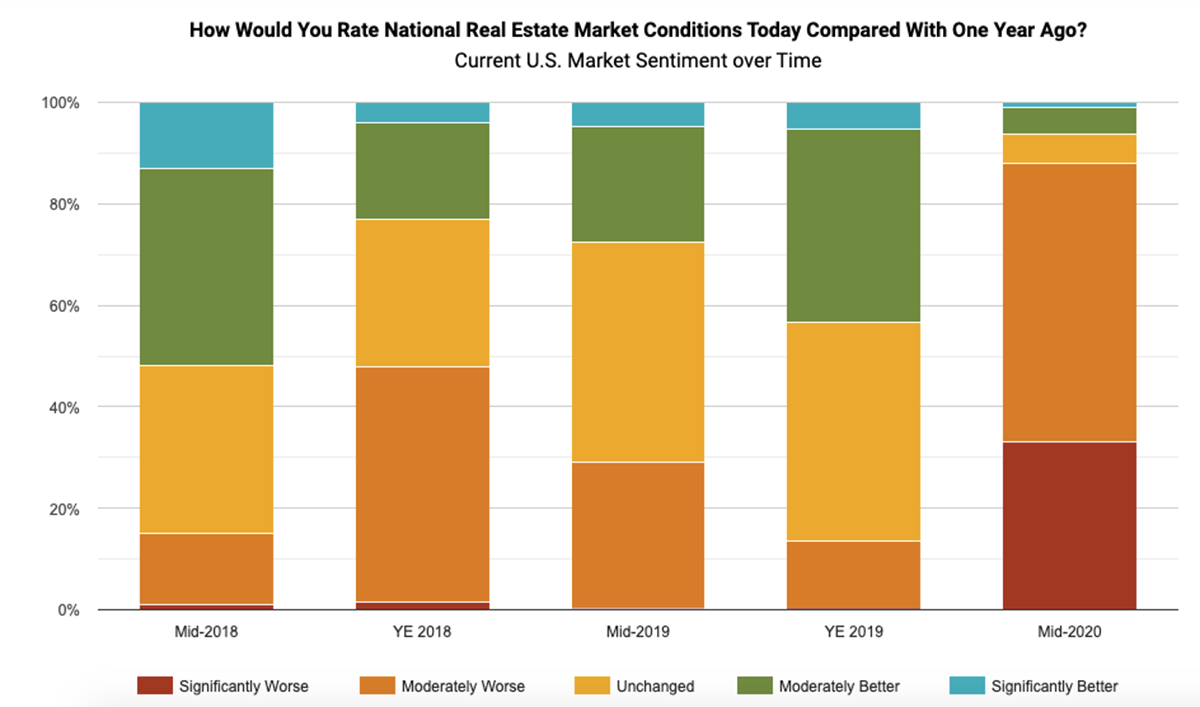

The RCLCO’s 2020 Mid-Year Sentiment Survey provides an invaluable look at what the real estate industry insiders are expecting to see in commercial and residential real estate for the next year. Twice a year, RCLCO polls its extensive network of knowledgeable contacts, including hundreds of C-suite executives and other experienced leaders in various sectors of real estate, to ask them what they think about the current and future state of the real estate industry. Upon analyzing the responses, the results are used to construct the RMI which expresses sentiment about current conditions by sector, as well as the outlook one year from now.

As you can imagine, this mid-year index is particularly illuminating this year, as we all struggle to understand how the continuing impacts of the COVID-19 pandemic are playing out across multiple market segments in ways we don’t fully understand. Brad Hunter, Managing Director at RCLCO and one of the authors of the report, says “this isn’t a ‘cycle’ that we’re in — it was a sudden stop. Many sectors of real estate leapfrogged entire stages of the normal real estate cycle and went straight to the bottom. The good part about that is, as they say, you can’t fall off the floor. The real estate executives and developers that responded in this survey feel that the worst is behind us, at least for many sectors of real estate.”

Key Takeaways

Some of the key takeaways include:

- Industry leaders see the severe declines as being behind us, but some sectors still face a moderate downside.

- Only a relatively small percentage (less than 16%) believe the markets will be significantly worse over the next 12 months;

- The pandemic has provided a boost to the industrial space market due to increased demand for deliveries during lockdowns.

- Not surprisingly, the mid-year RMI showed an absolute free fall to the bottom. Of note, certain sectors, including hotels, are expected to begin recovery within the next twelve months.

- The sectors respondents expect to be most impacted are Retail-Regional Malls, Hospitality, and Big Box Retail.

- The sectors they expect to suffer minimal impact include Industrial, Healthcare/Medical and Rental Apartments.