Hedge funds return to form; up 8.4% for Q2 2020 as investors prepare for phase two

Q2 2020 hedge fund letters, conferences and more

Hedge Fund Performance

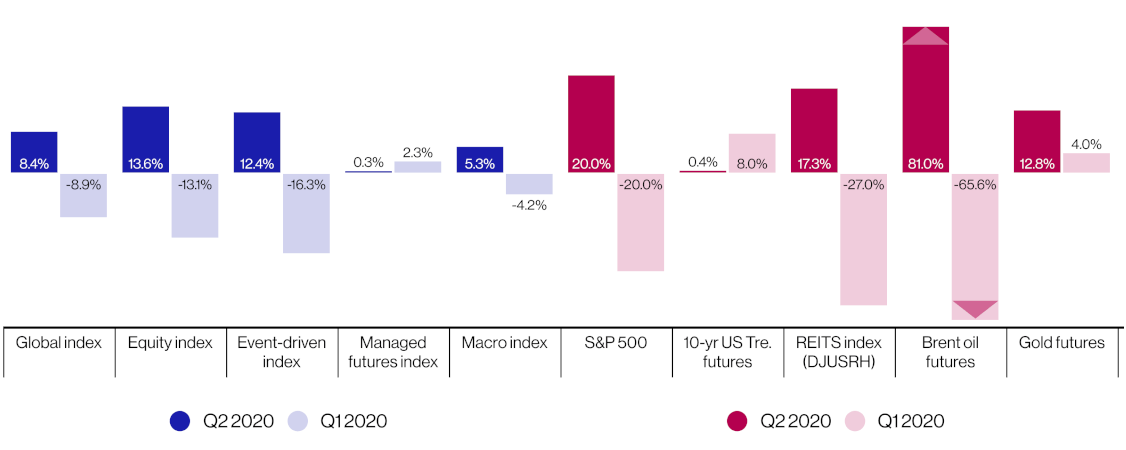

Speedy recovery overshadowed by record lag to the S&P 500: The HFM global composite index recovered from a dismal Q1 to achieve a near-term record gain in Q2, up 8.4% as global stock markets rebounded and end-of-quarter macro data indicated a faster than expected global recovery. However, with the global benchmark trailing the S&P 500 by almost 12 percentage points – the biggest quarterly lag to date – there was cause for only restrained celebration. Equity hedge funds led the way, gaining 13.6% off the back of the equity market bounce, followed closely by event-driven peers, up 12.4%. Both strategies needed the boost, having been major casualties in Q1. And though macro performance was more muted than other top-level strategies, many macro traders were able to make gains through pinning rates, buying Fed Funds contracts then entering into the options market and trading strikes. Despite the recovery, equity long/short strategies face an uncertain future as managers rue a lack of quality shorting opportunities and investors eye alternative options for their equity market outperformance.

Ex. 1: Hedge fund performance versus selected benchmarks, Q2 2020

Billion Dollar Club

Largest managers rebound whereas smaller shops surge: The top five performing Billion Dollar Club (BDC) hedge funds were down in Q1 before staging double-digit turnarounds in Q2, according to HFM data. Equity shops dominate the list, having taken advantage of rising global stock markets. Despite these eye-catching returns, the BDC as a whole failed to keep pace with its smaller peers (5% vs 7.3%). Only larger event-driven funds outperformed sub-billion-dollar equivalents, although larger and smaller firms alike rebounded strongly after a poor Q1. Managed futures funds, which had proved a relative bright spot for hedge fund strategies overall and for the BDC in Q1, faltered in Q2 with countertrend strategies hauling the benchmark underwater. With the economic recovery gathering pace into Q3, particularly in the Asia-Pacific region, BDC funds well-positioned for this upturn will enjoy continued gains as the year progresses. A pivotal quarter lies ahead: funds that can build on Q2 performance with a solid Q3 will have a compelling narrative to tell investors. Those that cannot will face an uncertain year-end.

Ex. 2: BDC funds versus non-BDC funds performance, Q2 2020 and Ex. 3: Selected BDC funds performance, Q2 2020 versus Q1 2020

Industry Assets

Hedge fund AuM dips below $3trn for first time since 2016: Hedge fund industry assets fell 8.3% in the first five months of 2020, sinking below $3trn for the first time since 2016. Just over half of this drop was attributable to investor outflows, which totalled $144bn during the period. Anecdotally, funds of hedge funds (FoHFs) were among the first to the door, as they scrambled to meet their own investor redemption requests – a repeat of 2008. The mood among institutional investors such as pension funds was also subdued as some weighed partial or full exits from hedge fund investments. While many investors were highly critical of negative top-level hedge fund performance in Q1, others were heartened by the industry’s relative outperformance when compared to widely followed equity benchmarks such as the S&P 500. These allocators have used the pandemic as an opportunity to take stock and examine the opportunity set in front of them. With industry performance on the up through June, and a raft of new mandates announced by investors in Q2, industry AuM will not be below $3trn for long.

Ex. 4: Total hedge fund industry assets by region, 2015–2020

Investor Mandates

Funds lean on pre-existing relationships and consultants: Despite the hedge fund industry’s negative performance in Q1, investors were heartened by its relative outperformance of global equity markets, with the number of new and potential hedge fund searches increasing as wider searches fell. Just over a third of these were for global macro strategies. Managers interviewed by HFM said allocations had come from new and existing investors, although the inability to meet face to face had seen them lean more heavily on pre-existing relationships. Investment consultants also proved a rich source of new capital. Managers that have already been through IDD and ODD with gatekeepers would do well to exploit these connections as institutions continue to reassess their portfolios. Flexibility around the customisation of products and strategies will also prove key, according to hedge fund IRs, with interest in SMAs and bespoke portfolios on the up. As investors continue to insist on virtual meetings, IR and marketing professionals will need to leverage online events and existing networks to the fullest in order to drive new business.

Ex. 5: All hedge fund mandates tracked by Fundmap in Q2 2020 and Ex. 6: All new/potential mandates tracked by Fundmap in Q2 2020

Theme Spotlight: Covid-19 Crash Generated Investor Interest For A Third Of Funds

No doubt the Covid-19 pandemic has had a devastating effect on the global economy. But for most hedge fund businesses, the short-term impact has been mixed if not manageable. Although half of the managers surveyed by HFM in June said the pandemic had, unsurprisingly caused them to miss out on an investor meeting, and 15% an allocation, more than one-third said it had resulted in new investor interest. In terms of the wider business, 5% had made staff redundant and 4% furloughed staff. Only 5% said it made them question the viability of the business. Furthermore, around 70% of managers said that the impact on fund performance had been no worse than expected, including a significant majority of credit and fixed income specialists, which said recent performance had been better than expected. No one is resting on their laurels. But if the initial shock was short and sharp, and the journey out likely long and painful, an elongated period of uncertainty could give investors a new appreciation of certain hedge fund strategies.

Ex. 7: Selected consequences of the Covid-19 pandemic Ex. 21: Impact of the Covid-19 pandemic on hedge fund performance

Asset Flows From Eurekahedge

The Eurekahedge Hedge Fund Index was up 1.38% in June, supported by the strong performance of the global equity market as represented by the MSCI ACWI IMI (Local), which returned 2.70% over the same month. The resumption of the economic activity of most countries, particularly in Europe and the US combined with an upbeat macroeconomic data, boosted market optimism towards a faster-than-expected recovery of the global economy from the crisis, which provided support to the performance of risk assets. Final asset flow figures for May showed that hedge fund managers recorded performance-based gains totalling US$27.3 billion and net investor allocations of US$0.3 billion throughout the month. Preliminary data for June estimated that the global hedge fund industry witnessed US$2.2 billion of performance-driven gains offset by US$6.6 billion of net investor outflows. The AuM of the global hedge fund industry stood at US$2,104.6 billion as of end-June 2020. On an annual basis, the industry had seen US$105.5 billion of performance decline and US$92.6 billion of investor redemptions over the first half of 2020. Find out more.

Ex. 8: Summary monthly asset flow data since January 2013

About HFM

HFM provides hedge fund professionals with an unparalleled blend of business essential data, exclusive industry intel and market-leading events. Combining 22 years of industry heritage with a cutting-edge platform, to create true business intelligence; the intelligence needed to raise assets, allocate funds or source new business opportunities.