Mergermarket has released its Global M&A market roundup for the first half (H1) of 2020, including its financial advisors league tables.

Q2 2020 hedge fund letters, conferences and more

Key Findings

A couple key findings include:

- Contrasting 1H20 to 1H19, deal volume fell 32% (6,938 vs 10,155 transactions), while deal values declined 52.7% (USD 901.6bn compared to USD 1.9tn). Such activity levels were most evocative of 2008 and 2009. And while the Global Financial Crisis remains the best historical comparison, COVID-19 has generated its own unique brand of mayhem.

- The US M&A market was hit hard by the Covid-19 pandemic and associated social distancing measures. As site visits and in-person meetings were put off between March and April, M&A markets faced logistical hurdles slowing down processes. As a result, deal activity declined to levels lower than that of the 2008 Global Financial Crisis. Despite the bleak environment in which dealmakers have been operating, M&A markets appear to be thawing, with the Technology sector showing early indications of a rebound.

- Activity through 1H20, (2139 deals worth USD 274.5bn), fell 72.4% by value with over 1000 fewer deals compared to the same period last year (3174 deals worth USD 996bn in 1H19). Higher value deals were particularly effected – in 1H19 there were 126 deals worth at least USD 1bn, in 1H20 that number fell to 56. Activity by count dwindled, while the average disclosed deal value in the US declined over 50% compared to last year (USD 385m in 1H20 vs USD 826m in 1H19).

- Despite declines across all sizes of deals, large deals suffered the most so far in 2020. Transactions of USD 2bn or greater declined nearly two-thirds quarter on quarter in 2Q20 - 18 deals compared to 54 in 1Q20. Several high-profile deals fell victim to the downturn, such as Xerox’s [NYSE:XRX] USD 35.5bn bid for HP [NYSE:HPQ], Walmart’s [NYSE:WMT] divestment of a majority interest in UK-based Asda, and France-based Covea Mutual Insurance’s USD 9.05bn offer for PartnerRe [NYSE:PRE], the Bermuda-based reinsurer from Italy’s Exor [BIT:EXO].

Global M&A Market

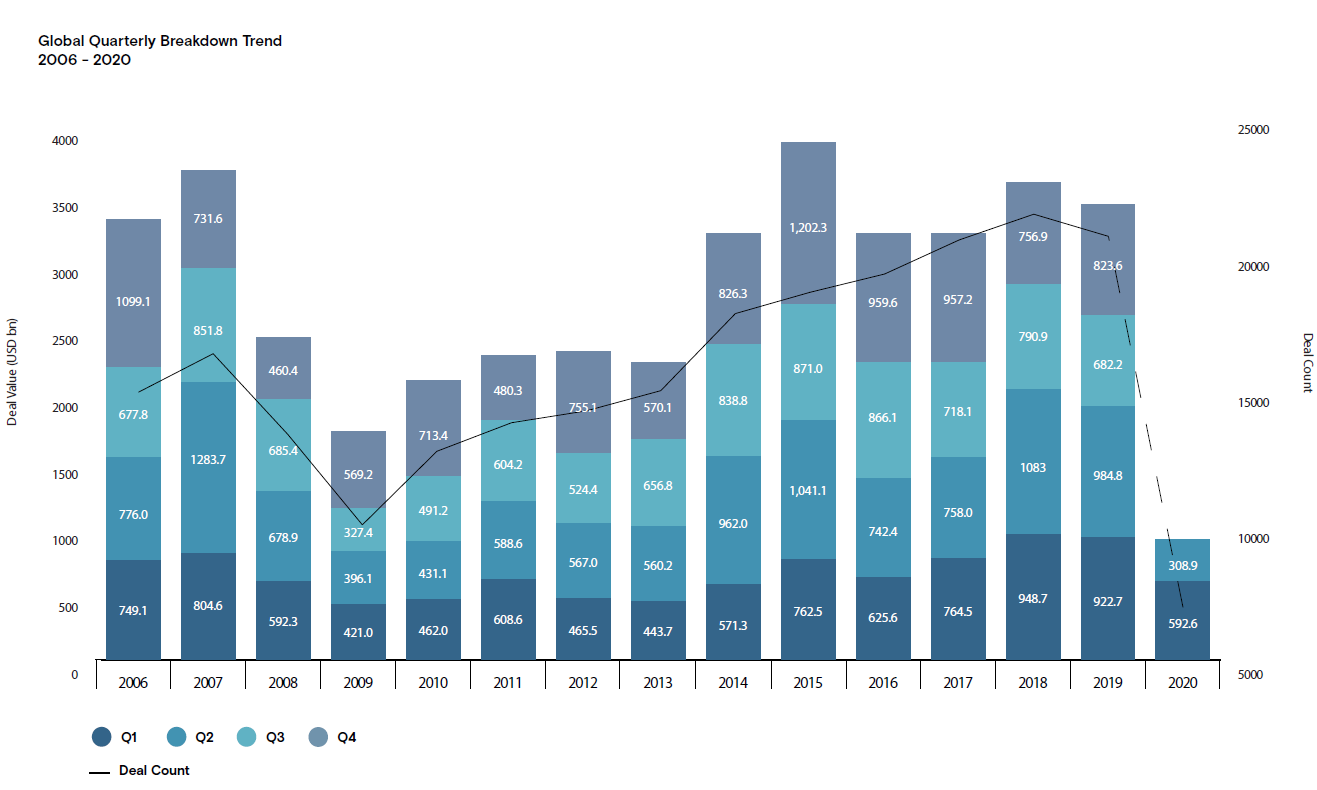

As 1Q20 came to a close, the initial effects of COVID-19 were only beginning to be felt across the global economy. Its full impact manifested in the second quarter, however. Deal volume dropped from 4,308 deals in 1Q20 to 2,630 in 2Q20 and deal values plummeted to USD 308.9bn from USD 592.6bn in the previous quarter.

Contrasting 1H20 to 1H19, deal volume fell 32% (6,938 vs 10,155 transactions), while deal values declined 52.7% (USD 901.6bn compared to USD 1.9tn). Such activity levels were most evocative of 2008 and 2009. And while the Global Financial Crisis remains the best historical comparison, COVID-19 has generated its own unique brand of mayhem.

Debt and Equity Capital markets. Although M&A struggled, debt and equity fundraising had a strong pulse. After markets pulled back in March, they came back with a vengeance in many regions.

Globally, leveraged loans and high yield bond issuance reached more than USD 1trn globally in the first half of the 2020, with more than nearly 44% taking place in 2Q20, according to figures by Mergermarket sister publication Debtwire. In equity capital markets, May was the busiest months for equity issuances in the US since January 2019, according to sister company Dealogic. Regional disparities have created near global parity.

As the virus spread in waves around the globe, its impact was felt differently across various regions of the world. First to be impacted by the virus, China saw the least impact on its global buying activity. Year-over-year, the north Asian country saw deal count fall by just 7% (down to 713 from 770), and deal values down 20.1% (USD 108.3bn vs USD 135.6bn). China experienced the earliest onset of - and recovery from - the virus, providing a hopeful note that as other countries and regions recover, they too will show an improving deal environment. Resurgences of COVID-19 could constrain the upside, however.

The Americas, dominated by the US, was the biggest decliner. Its share of global M&A by value declined to 33.4% Year-to-date 2020 compared to 52.8% in 2019. Not only did the lockdown impact economic productivity, but also the US is facing high levels of political uncertainty from the looming presidential election and widespread, large-scale demonstrations and protests. With the falloff in US activity, the rest of the world saw their global market share increase. Europe (with a 32.3% market share) slightly edged out Asia (27.7%) in seeing the largest market share gains.

Article by Merger Market, see the full report here.