The Broad Market Index was up 1.23% last week and 70% of stocks out-performed the index.

Q2 2020 hedge fund letters, conferences and more

It was another very light week for SEC filings as we wait anxiously for the details of company performance from the second quarter. The concern is that broad decline in financial condition that appeared in the first quarter updates with only one month of virus impact. In the second quarter the virus effect is likely to be more negative.

Delta Air Lines, Inc. Now Dependent On Bailouts

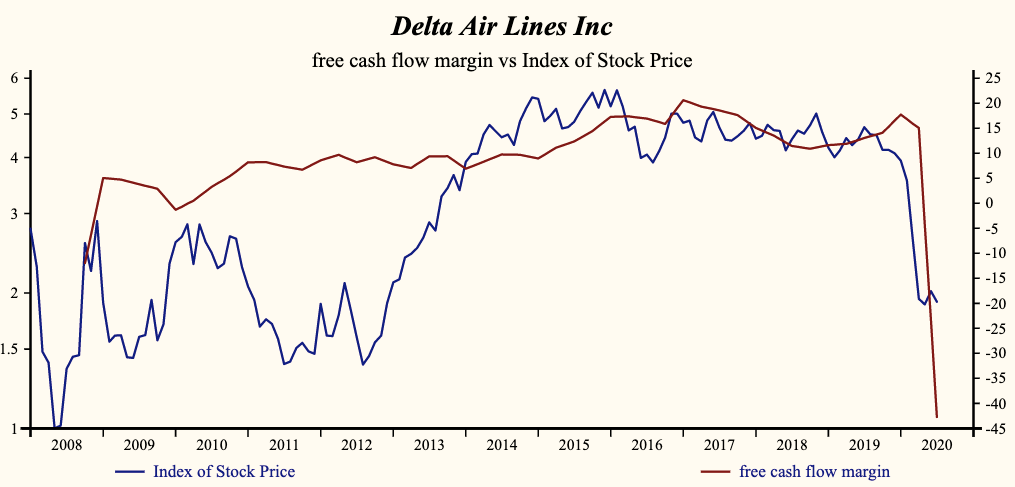

There are steep divisions between companies that are more exposed to the impact of the virus and those that are not. Sales growth at Delta Air Lines, Inc. (NYSE:DAL) has declined to -43% and profit margins are negative. The ability of companies to sustain solvency is critical to survival (or the urgency of a bailout). Cash from operating activities (ROI) fell steeply at Delta Air Lines and only remains positive due to the recognition of the bailout proceeds from the US Treasury under the Cares Act. Nevertheless, free cash flow margin took a big hit last quarter and has been 75% correlated with the share price.

Federal Reserve supporting the Bond Market

The extraordinary measures taken by the Federal Reserve to support the corporate bond market are reflected at Delta Air Lines where, despite negative cash flow and a ratings downgrade, the company raised over $9Billion from the sale of bonds during the second quarter. This is one of the biggest single quarter issuances of bonds in the company record and without a sharp rebound in air travel this only delays the cash flow crisis faced by the company.

Fastenal Company (FAST) $44.200 BUY this rich company getting better

Meanwhile a company such as Fastenal Company (NASDAQ:FAST) has a product range that includes PPE and sanitary products. The increase in sales from safety products used by government and other healthcare professionals offset the drop in sales from industrial and construction products producing a sales growth of 6.5%; up from the prior quarter.

The company is recording a falling gross profit margin. SG&A expenses are low in the record of the company and falling. SG&A expenses are being reduced at a more rapid rate than the gross margin producing a rising EBITD and Free Cash Flow margin.

The shares are trading at upper-end of the volatility range in a 35-month rising relative share price trend. The current indicated annual dividend produces a yield of 2.6%. Despite the recently extended share price the broad improvement in fundamentals forces a reversal of the Otos October 2019 sell decision.

Join our Free Online Seminar

A special invitation to experience your financial reality as FREEDOM AND EMPOWERMENT.

Bob Gay, Founder of Otos, in association with The FENG will be moderating a panel next Tuesday where they will discuss the evolving cash flow crisis from the economics, bond market and corporate cash flow points of view. The ability of the global central banks to "do whatever it takes" and the capacity of capital markets to provide the financing that companies will need as the Covid-19 crisis extends are essential to decisions.

Register now for next Tuesday July 28 at 8am Eastern:

|The State of Capital Markets - The Macro Picture|

Buy stocks of companies with sales growth up, rising gross profit margins, lower SG&A expense and good financial condition (Stable Golden Pot) and improving cash position or profitability (Green Crown of the MoneyTree). In other words, the more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.